Agricultural Lubricants Market Share, Size, Trends, Industry Analysis Report,

By Lubricant Category (Bio-Based, Mineral Oil-Based and Synthetic Oil-Based); By Product Type; By Sales Channel; By Agricultural Equipment; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM4651

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

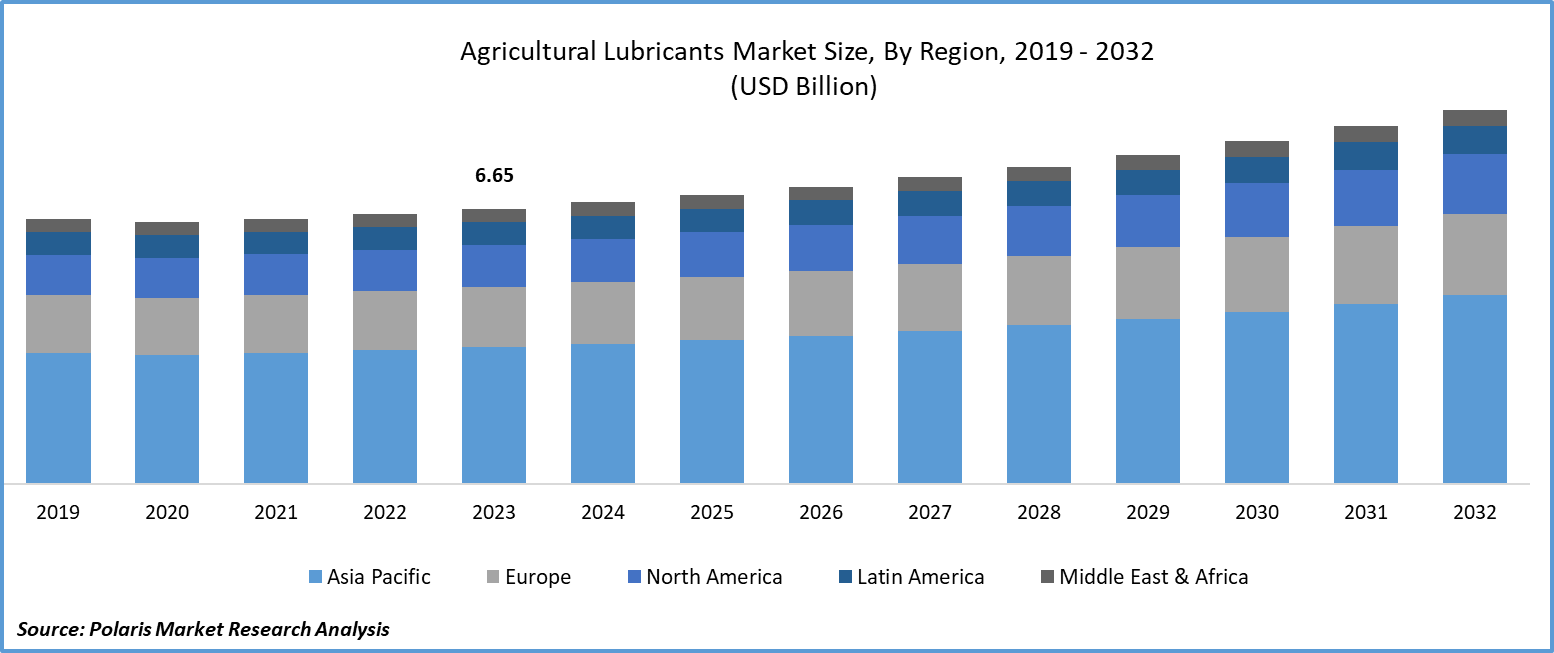

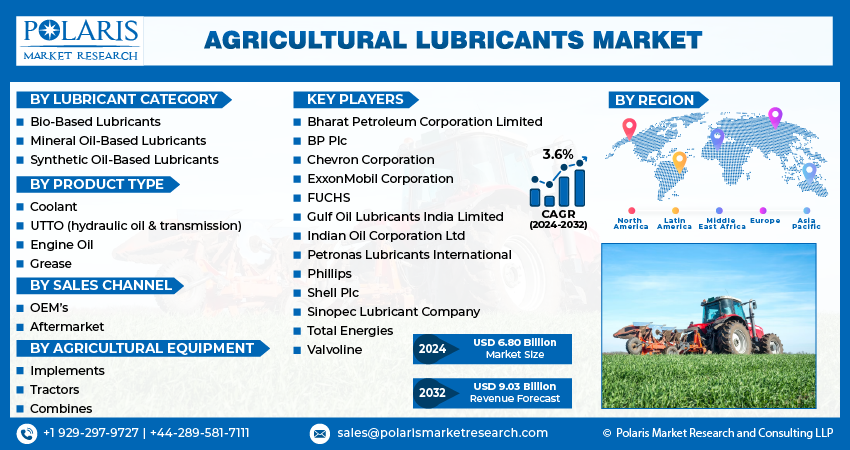

Agricultural lubricants Market size was valued at USD 6.65 billion in 2023. The market is anticipated to grow from USD 6.80 billion in 2024 to USD 9.03 billion by 2032, exhibiting the CAGR of 3.6% during the forecast period.

Agricultural Lubricants Market Overview

The agricultural lubricant market is experiencing growth driven by the industrial and agricultural sectors. In the industrial sphere, agricultural lubricants, especially engine oils, play a crucial role in preserving the performance and lifespan of heavy-duty farming equipment. In agriculture, these lubricants provide various advantages, such as enhanced equipment reliability, increased yield and profitability, and lower maintenance expenses. These benefits highlight the importance of agricultural lubricants in ensuring the smooth and effective operation of agricultural machinery, guaranteeing operational dependability, and maximizing equipment uptime, regardless of the weather or terrain conditions.

- For instance, in January 2024, BP and Sinopec agreed to a Memorandum of Understanding (MoU) to enhance collaboration in several areas, such as trading of oil & gas, fuel retailing, marine fuel sales and lubricant, and upstream operations.

To Understand More About this Research: Request a Free Sample Report

The use of modern agricultural equipment has increased, which is fueling the need for agricultural lubricants and even enabling businesses to go worldwide. Furthermore, the global development in farm mechanization is driving growth in the agricultural lubricants business.

The agricultural lubricants market was negatively affected by the recent coronavirus outbreak. Lockdowns in countries like China, which supply raw materials, disrupted the supply chain in the first half of 2020. However, the pandemic had little impact on the demand for agricultural lubricants, as agriculture was deemed an essential service in most countries. Raw material procurement was a challenge for market players in the first half of 2020. These factors are expected to influence the market's revenue trajectory in the forecast period. On a positive note, the market is expected to recover as regulatory bodies begin to ease restrictions.

Agricultural Lubricants Market Dynamics

Market Drivers

Introduction of subsidies by government agencies.

Government agencies in multiple countries are offering subsidies to farmers to help them buy agricultural equipment such as tractors, paddy transplanters, harvesters, power sprayers, threshers, and similar items. This initiative is driving the adoption of more advanced agricultural equipment, which in turn is increasing the demand for agricultural lubricants. The rising cost of farm labor is also expected to boost the growth of the agricultural lubricants market development. Furthermore, the growing popularity of high-performance synthetic lubricants is projected to enhance the agriculture lubricant market's growth further.

Adoption of mechanization in farming practices.

The increasing use of cutting-edge farming methods and equipment is leading to a greater need for lubricants to maintain and use agricultural machinery effectively. As the agricultural sector becomes more mechanized, there is a growing demand for high-performance lubricants, including engine oils. The increasing complexity of farming equipment drives the rise in demand. The strong development of the agricultural sector and the adoption of cutting-edge farming machinery are expected to drive the agricultural lubricant market demand, especially engine oils. These oils are crucial for engine longevity and smooth operation, as they reduce heat dissipation and prevent wear and tear despite the challenging conditions of agricultural work, such as exposure to dust, debris, and heavy loads. The agricultural lubricant market demand is also likely to be influenced by the increasing use of lubricants in various industries.

Market Restraints

Fluctuations in price of crude oil.

Because the manufacturing of lubricants is closely linked to the crude oil market, volatile crude oil prices are one of the main factors limiting the agricultural lubricant industry. Changes in the price of crude oil have a significant and instantaneous impact on production costs, which include base oil extraction, processing, and refining utilized in lubricant manufacturing. As a result, depending on how volatile crude oil prices are, the agricultural lubricant market may see changes in growth and valuation. These elements will impede the market development for agricultural lubricants from growing.

Report Segmentation

The market is primarily segmented based on lubricant category, product type, sales channel, agricultural equipment and region.

|

By Lubricant Category |

By Product Type |

By Sales Channel |

By Agricultural Equipment |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Agricultural Lubricants Market Segmental Analysis

By Lubricant Category Analysis

- The bio-based lubricants segment is projected to grow at a healthy CAGR over the agricultural lubricants market forecast period. This expansion is due to the superior lubrication provided by bio-based lubricants, which effectively reduce friction and wear on machinery parts. Their low friction coefficients also improve the efficiency of farming machinery. Bio-based lubricants have a low evaporation rate, ensuring consistent lubrication and reducing the need for frequent reapplication. Furthermore, as agricultural practices and equipment evolve, there is a growing need for lubricants that offer strong protection and reliable operation, which is driving the continued growth of bio-based lubricants in the agricultural lubricants market.

By Product Type Analysis

- The UTTO (universal tractor transmission oil) segment accounted for the largest market share in 2023 and is likely to retain its position throughout the market forecast period. High-performance lubricants are necessary for agricultural machinery because of its complex gear systems and transmissions, which guarantee maximum longevity and performance. Tight laws focusing on environmental sustainability have advanced technology in lubricant compositions, increasing their effectiveness and lowering their environmental impact. The need for specialized UTTO lubricants has significantly increased as farmers and agricultural businesses place a higher priority on the dependability and efficiency of their equipment. UTTO lubricants are the market leader in agricultural lubricants due to their dominance, which highlights the vital role these lubricants play in extending the lifespan and general performance of agricultural machinery.

By Sales Channel Analysis

- Based on sales channel analysis, the market has been segmented on the basis of OEMs and aftermarkets. The aftermarkets segment held a significant market share in revenue share in 2023 due to its dominance at offline distribution channels, driven by the increasing demand for lubricants essential for farm machinery and the preference for cost-effective and various mineral oil-based lubricants. Government initiatives and investments sustaining the agricultural sector also play a role in this segment's prominence. Essentially, the aftermarket's success hinges on distribution channels, demand, types of lubricants, and government measures.

Agricultural Lubricants Market Regional Insights

The Asia Pacific region dominated the global market with the largest market share in 2023

The Asia Pacific region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. Agriculture plays a significant role in the GDP of many Asia Pacific countries, providing income and jobs for a large portion of the population. The Asia Pacific, agricultural lubricants market, is expected to grow rapidly due to factors such as the high demand for food, significant agricultural sectors in countries like China and India, government initiatives, and the adoption of modern farming techniques contributing to the growth. The region's large population, with around half depending on agriculture, also fuels the demand for efficient lubricants.

The North America region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the agricultural sector in the region experiencing a rise in mechanization, leading to increased efficiency and productivity. This trend is driving the development of new and innovative products tailored to agricultural applications.

Competitive Landscape

The agricultural lubricants market development is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Bharat Petroleum Corporation Limited

- BP Plc

- Chevron Corporation

- ExxonMobil Corporation

- FUCHS

- Gulf Oil Lubricants India Limited

- Indian Oil Corporation Ltd

- Petronas Lubricants International

- Phillips

- Shell Plc

- Sinopec Lubricant Company

- Total Energies

- Valvoline

Recent Developments

- In March 2023, ExxonMobil intends to construct a lubricant production facility in India, marking the business's first greenfield venture there.

Report Coverage

The agricultural lubricants market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, lubricant category, product type, sales channel, agricultural equipment and their futuristic growth opportunities.

Agricultural Lubricants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.80 billion |

|

Revenue forecast in 2032 |

USD 9.03 billion |

|

CAGR |

3.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Lubricant Category, By Product Type, By Sales Channel, By Agricultural Equipment, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Agricultural Lubricants Market report covering key segments are lubricant category, product type, sales channel, agricultural equipment and region.

Agricultural Lubricants Market Size Worth $9.03 Billion By 2032

Agricultural lubricants Market exhibiting the CAGR of 3.6% during the forecast period.

Asia Pacific is leading the global market

key driving factors in Agricultural Lubricants Market are Adoption of mechanization in farming practices