Agricultural Robots Market Share, Size, Trends, Industry Analysis Report,

By Type; By Component (Software, Hardware, Services); By Farming Environment; By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 117

- Format: PDF

- Report ID: PM1417

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

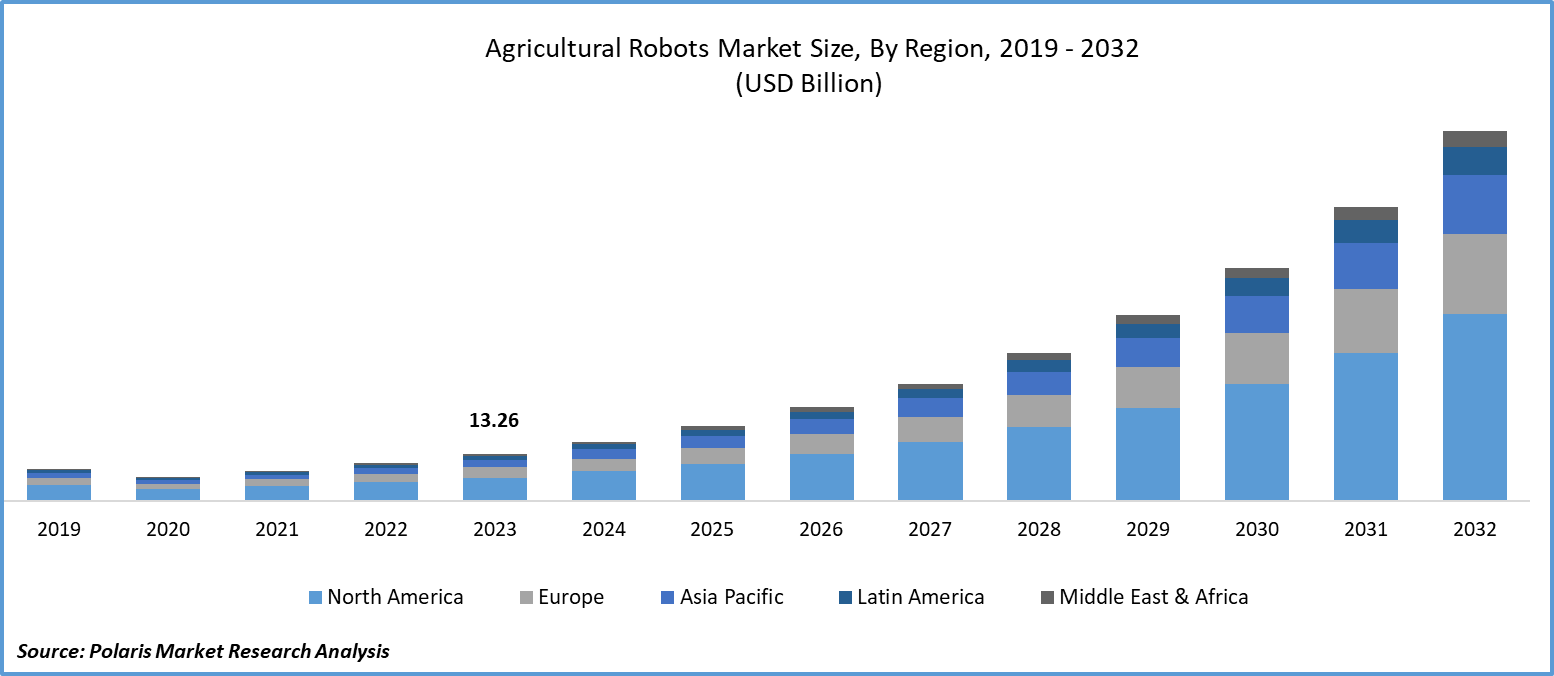

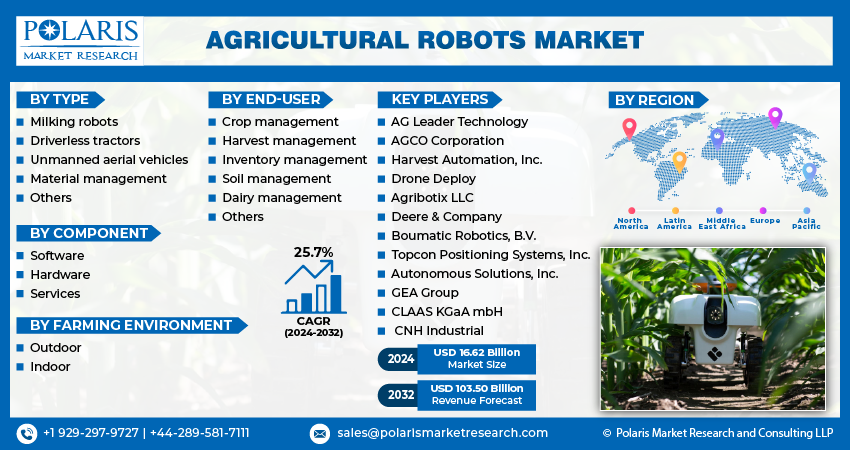

Agricultural Robots Market size was valued at USD 13.26 billion in 2023. The market is anticipated to grow from USD 16.62 billion in 2024 to USD 103.50 billion by 2032, exhibiting a CAGR of 25.7% during the forecast period.

Agricultural Robots Market Overview

The rising awareness for agricultural robots is due to the development of agricultural robots, such as the increasing need for precision farming, the adoption of environmentally conscious farming practices, and the need to solve the challenges posed by a lack of labor. The agricultural robotics industry is expected to grow as long as technology keeps developing. When these robots are implemented, they will offer innovative ways to improve production and satisfy the agricultural industry's always-evolving needs. Moreover, the government and NGOs are making a conscious effort towards the adoption of these agricultural robots in people.

For instance, in March 2024, Garuda will manufacture drones to meet the demand from fertilizer companies under the Drone Didi scheme, designed to support women and further the use of UAVs in India’s rapidly developing agricultural industry.

Moreover, the acceptance of several drone and robotic technologies has made farming easier. Agricultural technology, such as GPS navigation and vision systems for crop tillage and spraying, increases precision in farming. Traditional high-mass tractors are now expected to be replaced in the future by fleets of tiny, light robots.

To Understand More About this Research: Request a Free Sample Report

However, COVID-19 impacted the agricultural workforce, which highlighted the need for agricultural robots. To maintain food production continuity, farmers who were having trouble finding labor for important operations like planting and harvesting turned to automation. This change in viewpoint led to a rise in demand for agricultural robots and a quicker rate of deployment.

Agricultural Robots Market Dynamics

Market Drivers

Rise in Agricultural Automation

With the rising awareness of automation processes like planting, harvesting, and monitoring, agricultural robots provide a solution by lowering the need for human labor. Increased productivity, efficiency, and accuracy made possible by these robots result in better yields and lower manufacturing costs. Agricultural robot adoption is becoming more and more appealing due to its ability to solve labor shortages and maximize resource utilization, which will promote sustainable farming practices and drive agricultural robots market growth.

For instance, in November 2023, Aigen raised $ 12 million to develop solar-powered autonomous robots for crop management without chemicals or fossil fuels using ML, AI, and battery technology.

Shortage of Skilled Labours

As more and more agricultural practitioners are moving towards the adoption of automated agricultural technologies, there is a need for more skilled labours. This is due to the over-dependency on technological advancements rather than traditional agricultural practices. The agricultural robots can work around the clock, leading to no dependency on the labourer’s hence causing a shortage and leading to high daily wages.

Market Restraints

High Cost of Investment

These robots are quite expensive, which prevents many farmers, especially small and medium-sized ones, from adopting them despite their several advantages, such as improved productivity, accuracy, and decreased labour needs. Agricultural robots impose financial hurdles due to their initial investment and maintenance expenses, which prevent many farmers from accessing modern technology.

Report Segmentation

The agricultural robots market segmentation is primarily based on type, component, farming environment, end-user, and region.

|

By Type |

By Component |

By Farming Environment |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Agricultural Robots Market Segmental Analysis

By Type Analysis

- The milking robots segment dominated the market and is expected to continue dominating due to its ability to be done automatically, without the need for an operator. This makes the procedure flexible and enables the animals to deliver milk on their schedule. The demand for more milk production, the lack of workforce, and the emphasis on farm sustainability and animal welfare are some of the causes driving the agricultural robots market expansion.

- The unmanned aerial vehicles segment is anticipated to grow at the fastest CAGR due to their ability to offer significant benefits for a variety of agricultural tasks, including information gathering, air seeding, air spraying, and remote sensing detection. Drone research is, therefore, crucial to the advancement of precision agricultural.

By Component Analysis

- The hardware segment has dominated the market share. This segment is essential to the agricultural robotics industry since it provides the foundation for these cutting-edge farming solutions. It includes hardware motors, batteries, and other mechanical parts that allow robots to carry out a variety of activities in agricultural environments. Due to their complexity, hardware components frequently call for sophisticated technical knowledge, exacting production procedures, and stringent quality control procedures.

- The software segment is expected to grow at the fastest growth rate over the next coming years due to rapid development of artificial intelligence (AI) and machine learning (ML) technologies. These innovations have completely changed the potential of agricultural robots, giving them the ability to evaluate enormous volumes of data, make judgments in real-time, and adjust to shifting circumstances.

By Farming Environment Analysis

- Outdoor farming has dominated the market as it is intensive farming, which is heavily automated and has significant financial incentives. Land that is cultivated without the support of a regulated environment is referred to as outdoor farming. It is entirely rain-fed agricultural; the farmer has no influence over the substrate (soil), temperature, or humidity.

- The indoor farming environment is anticipated to expand at the fastest rate as it can be practiced at any indoor space with controlled indoor cultivation settings, such as using growth media rather than soil, which reduces the risk of insect infections and genetic crop diseases.

By End-User Analysis

- Dairy management has dominated the market due to automated milking equipment, which lowers labour expenses while increasing milk output. This lessens the physical contact with the cows required, which lessens their stress and pain throughout the milking process. Moreover, agricultural robots can identify and treat any anomalies or health problems in the milk, improving the well-being of the cows by keeping an eye on the milking procedure using sensors and cameras.

- Harvest management is expected to grow at the fastest CAGR by providing more accurate, streamlined, and data-driven techniques to maximize agricultural yields and reduce losses. These advanced robots, which include sensors, artificial intelligence (AI), and imaging capabilities, are essential to the harvest season. They use drones to deliver real-time crop monitoring and assessment.

Agricultural Robots Market Regional Insights

The North America Dominated the Global Market

The North America region dominated the global market with the largest agricultural robots market share and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed to the rapidly increasing adoption of robotic agricultural farming practices with advanced techniques and technologies. The rising labour cost and shortage of skilled farmers are increasing this region’s growth. Moreover, the high per-capita disposable income is driving the adoption of advanced techniques.

For instance, in May 2023, Farm-ng, US-based company, demonstrated Amiga, its robot that can adapt to any farm’s cropping system. It can be personalized for a range of tasks, including lifting, planting, seeding, harvesting, and other activities that are unsuitable for costly tractors or dedicated implements.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing adoption of technological advancements for efficient agricultural methods is driving the expansion of population and growing worries about food security. Robots for Agricultural provide a solution by increasing crop yields and automating labour-intensive operations.

Competitive Landscape

The Agricultural robots market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global agricultural robots market include:

- AG Leader Technology

- AGCO Corporation

- Harvest Automation, Inc.

- Drone Deploy

- Agribotix LLC

- Deere & Company

- Boumatic Robotics, B.V.

- Topcon Positioning Systems, Inc.

- Autonomous Solutions, Inc.

- GEA Group

- CLAAS KGaA mbH

- CNH Industrial

Recent Developments

- In March 2024, the DigiAgro project received € 2.8 million in financial support from the European Commission to develop Agrobots, which are intended to make Agricultural more efficient and ensure that farmers can continue to earn money sustainably.

- In April 2024, AGCO Corporation and Trimble announced their joint venture to provide farmers with agricultural technologies that minimize the environmental impact.

- In December 2023, Solinftec launched Solix Robot in Agricultural to enhance its agricultural presence and production in the American Midwest and expand its manufacturing capacity in the United States.

Report Coverage

The agricultural robots market report emphasizes on key regions worldwide to provide users with a better understanding of the product. It also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis of various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, component, farming environment, end-users, and their futuristic growth opportunities.

Agricultural Robots Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 16.62 billion |

|

Revenue forecast in 2032 |

USD 103.50 billion |

|

CAGR |

25.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Component, By Farming Environment, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global agricultural robots market size is expected to reach USD 103.50 billion by 2032.

Key players in the market are Boumatic Robotics, B.V., Topcon Positioning Systems, Inc., Autonomous Solutions, Inc.

North America contributes notably towards the global agricultural robots market.

Agricultural robots market exhibited a CAGR of 25.7% during the forecast period

The key segments covered in the agricultural robots market report are type, component, farming environment, end-user, and region.