Aircraft Hydraulic Systems Market Share, Size, Trends, Industry Analysis Report,

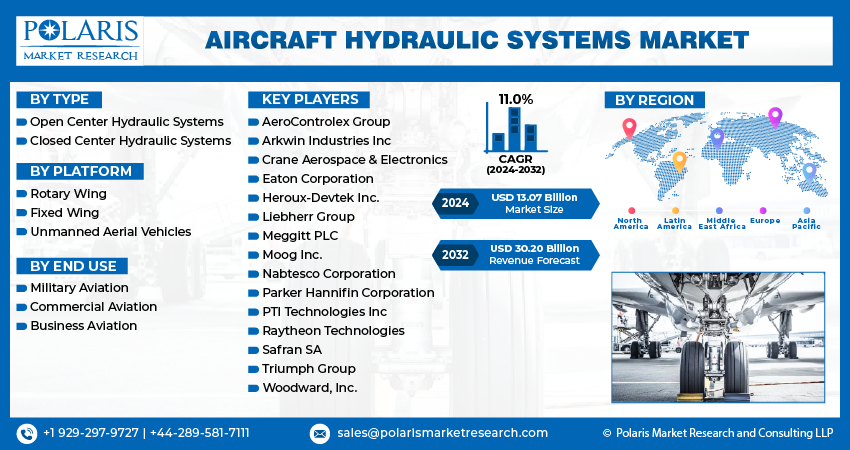

By Type (Open Center Hydraulic Systems, Closed Center Hydraulic Systems); By Platform; By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4374

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

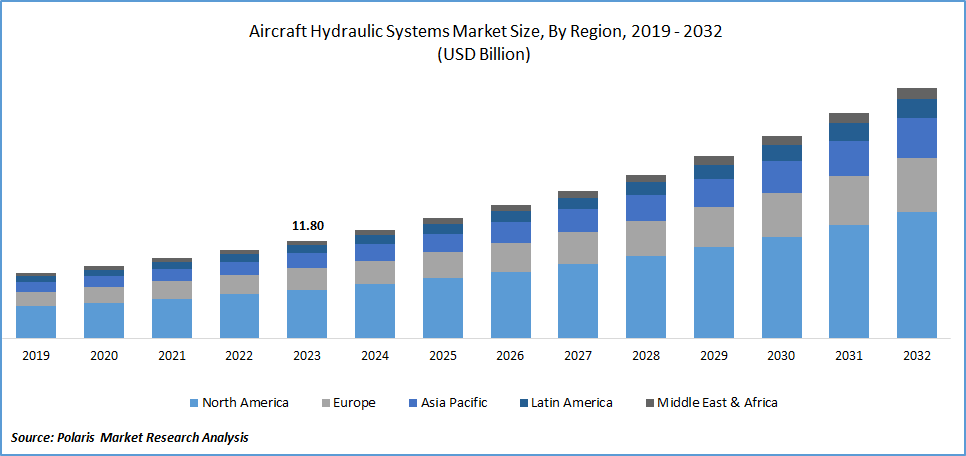

The global aircraft hydraulic systems market was valued at USD 11.80 billion in 2023 and is expected to grow at a CAGR of 11.0% during the forecast period.

The demand for air travel, GDP growth, and infrastructure investments are some macroeconomic variables that significantly influence the course of the aviation sector. The demand for aircraft is directly impacted by changes in the economy, leading to a rise in demand for sophisticated hydraulic systems that meet changing aviation requirements.

A non-negotiable feature of the aviation sector is adherence to the strict safety requirements enforced by aviation agencies like the FAA and EASA. Modern hydraulic technologies must be incorporated in order to comply with these regulations. This guarantees that aircraft hydraulic systems satisfy performance requirements and uphold the highest safety standards, enhancing the general dependability of air travel.

To Understand More About this Research: Request a Free Sample Report

Ongoing research and development initiatives are propelling technological enhancements within the aircraft hydraulic systems domain. Innovations encompass lightweight materials like composites, precision-engineered components, and improved system efficiency through smart hydraulics. These advancements address the industry's pursuit of heightened reliability, efficiency, and sustainability in hydraulic systems.

- For instance, in June 2023, Boom Supersonic unveiled notable progress in the development of Overture, its environmentally conscious supersonic aircraft. Overture is engineered to operate at double the speed of current airliners and is specifically designed to be powered entirely by sustainable aviation fuel (SAF). The schematics released by the company showcase crucial components within Overture, encompassing avionics, flight controls, hydraulics, fuel systems, and landing gear. Notably, the hydraulic systems, featuring a triple redundant setup, ensure dependable power delivery for both flight controls and mechanical systems, reinforcing the aircraft's reliability and sustainability.

Defense forces globally engage in continuous modernization efforts, impacting the demand for advanced hydraulic systems, particularly in military aircraft. The evolving nature of modern warfare necessitates robust and high-performance hydraulic components for critical applications, driving ongoing innovation and investment in military aviation hydraulic technologies.

Industry Dynamics

Growth Drivers

Aircraft production & fleet expansion, and retrofit and upgradation programs

The growth of aircraft fleets worldwide and manufacturing trends in the aerospace sector are closely linked to the need for aviation hydraulic systems. The need for sophisticated hydraulic systems is growing as a result of the rapid expansion of a number of sectors, notably defense, and commercial aviation, in order to accommodate the growing number and variety of aircraft going into service.

The demand for commercial aircraft is increased by the worldwide growth in air travel, which is driven by factors such as rising incomes, urbanization, and globalization. This increased demand highlights how important dependable and effective hydraulic systems are to maintaining the best possible operation of many aircraft systems, which enhances passenger safety and experience overall.

Airlines and military operators undertake significant modernization and retrofitting projects to increase the fleet's operating life and improve performance. Upgrading hydraulic systems is prioritized by this strategic approach, which creates an opportunity for retrofit solutions that comply with modern requirements and technological developments.

Report Segmentation

The market is primarily segmented based on type, platform, end use, and region.

|

By Type |

By Platform |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The closed center hydraulic systems segment accounted for a significant market share in 2023.

The closed center hydraulic systems segment accounted for a significant market share. Closed center aircraft hydraulic systems employ a closed-loop configuration, ensuring continuous circulation of hydraulic fluid for consistent performance. Maintaining a uniform pressure level is crucial for precise control of diverse components like landing gear and flaps. The variable displacement pump adapts output to meet specific demands. Directional control valves, whether manual or electronic, selectively route fluid to different systems. Safety is ensured through a pressure relief valve that prevents overpressure. An accumulator stores hydraulic energy, offering a temporary power source during critical scenarios. Filters maintain fluid cleanliness, and a reservoir manages the stable supply, making closed center systems reliable for modern aircraft.

By Platform Analysis

The fixed wing segment accounted for a significant market share in 2023.

The fixed wing segment accounted for a significant market revenue share in 2023. The escalating demand for fixed-wing aircraft stems from a dynamic commercial aviation expansion, emphasizing enhanced regional connectivity and military fleet modernization. Business aviation thrives as corporations seek flexible transportation options, while the focus on pilot training intensifies. Continuous technological innovations drive the demand for state-of-the-art features, and special mission aircraft cater to specific operational needs. Increasing global e-commerce and trade activities boost cargo aircraft orders. Emerging markets actively contribute to aviation growth, and environmental considerations prompt innovations in fuel-efficient and eco-friendly technologies. The post-pandemic industry recovery prompts airlines to adapt fleets to changing travel patterns, fostering a resilient demand surge.

By End Use Analysis

The commercial aviation segment accounted for a significant market share in 2023.

The commercial aviation segment accounted for a significant market share. Aircraft hydraulic systems are pivotal in commercial aviation, powering crucial functions like landing gear operation, flight control surfaces, and braking systems. These systems facilitate controlled movements during takeoff, landing, and taxiing. Employed in steering mechanisms and thrust reversers, they enhance maneuverability and braking efficiency. High-pressure systems handle critical flight controls, while low-pressure systems manage auxiliary functions. Advanced materials and technologies contribute to system efficiency, with a focus on lightweight materials and environmental sustainability. Regular maintenance ensures reliability and ongoing research explores eco-friendly hydraulic solutions.

Regional Analysis

North America accounted for the largest revenue share in 2023

North America accounted for the largest revenue share of the market in 2023. The region's dynamic growth is influenced by the continuous expansion of the commercial aviation sector, significant military aircraft programs, and an emphasis on achieving enhanced fuel efficiency. Renowned as the headquarters for major commercial aircraft manufacturers, North America commands a substantial share in the demand for hydraulic systems. The market's trajectory is closely tied to the production and maintenance needs of both narrow-body and wide-body commercial jets. The region boasts a robust defense sector marked by ongoing military aircraft programs. Hydraulic systems are integral components for various functions in military aircraft, including the operation of landing gear, weapon systems, and flight controls. Major players in the aerospace and hydraulic system manufacturing sector, including industry giants like Parker Hannifin Corporation, Collins Aerospace (now part of Raytheon Technologies), and Eaton Corporation, have substantial influence in North America.

Asia-Pacific is expected to experience significant growth during the forecast period. Asia-Pacific's aircraft hydraulic systems market is propelled by a rise in air travel demand, particularly in commercial and military sectors. The region, a key hub for major aircraft manufacturing, experiences robust growth with a focus on technologically advanced hydraulic systems. Ongoing military fleet modernization initiatives contribute to the increasing demand. Governments' proactive investments in aerospace and a growing emphasis on sustainable aviation further shape the market.

Key Market Players & Competitive Insight

The market faces fierce rivalry, with companies leveraging cutting-edge technology, top-notch product offerings, and a robust brand reputation to propel revenue expansion. Key players employ diverse tactics, including dedicated research and development, strategic mergers and acquisitions, and continuous technological advancements. These strategic maneuvers are aimed at broadening their product ranges and sustaining a competitive advantage. The market dynamic is shaped by constant innovation and a commitment to delivering high-quality solutions, underscoring the importance of strategic initiatives in ensuring sustained competitiveness.

Some of the major players operating in the global market include:

- AeroControlex Group

- Arkwin Industries Inc

- Crane Aerospace & Electronics

- Eaton Corporation

- Heroux-Devtek Inc.

- Liebherr Group

- Meggitt PLC

- Moog Inc.

- Nabtesco Corporation

- Parker Hannifin Corporation

- PTI Technologies Inc

- Raytheon Technologies

- Safran SA

- Triumph Group

- Woodward, Inc.

Recent Developments

- In July 2023, Safran announced the acquisition of Collins Aerospace's crucial actuation and flight control operations, integral for both commercial and military aircraft as well as helicopters. The hydraulic and mechanical actuation expertise of Collins will be integrated with Safran's existing proficiency in electrical actuation and electronics. This strategic move positions the group effectively for upcoming aircraft programs, leveraging a comprehensive set of capabilities to enhance performance and innovation in the field of aviation.

Aircraft Hydraulic Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 13.07 billion |

|

Revenue forecast in 2032 |

USD 30.20 billion |

|

CAGR |

11.0% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Platform, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

AeroControlex Group, Arkwin Industries Inc, Eaton Corporation, Heroux-Devtek Inc., Parker Hannifin Corporation are the key companies in Aircraft Hydraulic Systems Market.

The global aircraft hydraulic systems market is expected to grow at a CAGR of 11.0% during the forecast period.

The Aircraft Hydraulic Systems Market report covering key segments are type, platform, end use, and region.

Aircraft production & fleet expansion are the key driving factors in Aircraft Hydraulic Systems Market.

The global aircraft hydraulic systems market size is expected to reach USD 30.20 billion by 2032.