Aircraft Tires Market Share, Size, Trends, Industry Analysis Report,

By Type (Radial-Ply Tires, Bias-Ply Tires); By Aircraft Type; By Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft); By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 117

- Format: PDF

- Report ID: PM3198

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

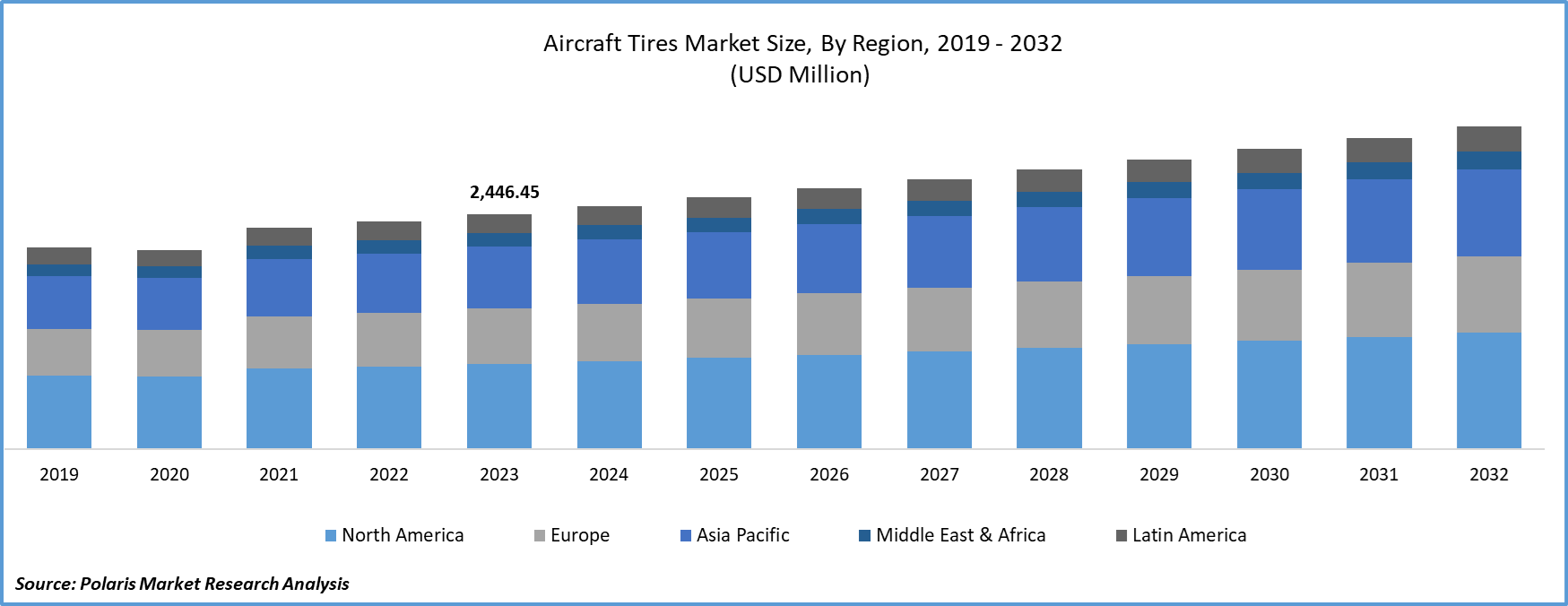

Aircraft Tires Market size was valued at USD 2,446.45 million in 2023. The market is anticipated to grow from USD 2,531.23 million in 2024 to USD 3,353.10 million by 2032, exhibiting the CAGR of 3.6% during the forecast period

Aircraft Tires Market Overview

The increasing number of low-cost carriers is influencing global market growth, particularly in emerging economies like China, India, South Korea, and Indonesia. In addition, the demand for MRO services for aircraft tires is also growing to ensure the safety of landings and take-offs. Aircraft tires are designed to support the full weight of that aircraft while on the ground, and the static and dynamic loads are generated during taxi, take-off, and landing. The tread patterns on aircraft tires are specially crafted to enhance stability during crosswind conditions, eliminate water accumulation to avoid hydroplaning, and improve braking efficiency. Aircraft tires have fusible plugs intended to melt at a certain temperature. Most aircraft tires are made per fixed standards and are governed by the Federal Aviation Administration (FAA).

To Understand More About this Research:Request a Free Sample Report

- For instance, in April 2022, Goodyear Tires announced the production of military aircraft tires containing rubber made of dandelions by working with The US Department of Defence to develop tires from natural rubber. Likewise, the growing procurement of newer aircraft by the armed forces globally has increased demand for new and advanced aircraft tires.

In addition, there has been a significantly increasing demand for a newer generation of aircraft in military and commercial sectors, along with the extensive rise in R&D activities of innovative aircraft tires that offer high convenience and comfort to travelers, which are also expected to boost the growth of the aircraft tires market over the next coming years. The aircraft tire manufacturers invest significant resources in research and development to design and improve aircraft tires. They work closely with aviation experts, engineers, and regulatory authorities to understand the specific needs of different aircraft types and optimize tire performance. In conclusion, aircraft tire manufacturers play a critical role in designing, producing, and testing high-performance tires that cater to the unique demands of aviation.

Aircraft tire manufacturers produce these tires with strict adherence to industry standards and regulations, employing advanced materials and construction techniques to meet the stringent demands of aviation.

Further, the increasing adoption of urban air mobility and highly automated aircraft for transporting people and goods at low altitudes, along with the development of technology such as vertical take-off and landing aircraft, conventional helicopters, and uncrewed aerial vehicles, are driving the market's growth. The rapid emergence of coronavirus worldwide led to a decline in the overall production capacities of many aircraft tire manufacturers due to the raw material and components shortage.

Aircraft Tires Market Dynamics

Market Drivers

- Growing technological advancement in aviation industry

Growing technologically advanced infrastructure in the aviation industry has led to significant advancements in various components and systems, including aircraft tires. These essential components play a crucial role in ensuring aircraft safety, efficiency, and performance during takeoffs, landings, and taxiing. As airports worldwide strive to accommodate larger aircraft, handle increased air traffic, and improve operational efficiency, the demand for highly reliable and technologically advanced aircraft tires has seen a notable surge. The development of technologically advanced aircraft tires is the continuous push for enhanced safety in aviation operations. As aircraft sizes, weights, and speeds have increased, the demands on tires have grown significantly. Advanced tires must be engineered to withstand tremendous stresses during takeoffs and landings while providing excellent braking performance and traction on runways, especially during adverse weather conditions.

- Increasing use of urban air mobility (UAM) and highly automated aircraft

The increasing use of urban air mobility (UAM) and highly automated aircraft has transformed the aviation industry, impacting various components, including aircraft tires. As urban air mobility gains traction and autonomous aircraft become a reality, the demand for specialized and technologically advanced aircraft tires has surged. For instance, Volocopter and Safran Electrical & Power announced a partnership during the Paris Air Show in 2023, this partnership aimed to foster commercial and engineering alliances to advance sustainable and efficient electric propulsion technologies for the fast-developing urban air mobility industry.

Market Restraints

- High Cost of tires

The aircraft tires market has been impacted by the high cost of tires, presenting challenges and opportunities for manufacturers and airlines alike. Aircraft tires are specialized components designed to withstand the demanding conditions of takeoffs, landings, and taxiing. The cost of producing these tires is influenced by various factors, including advanced materials, engineering, and stringent safety standards, leading to higher prices compared to standard automobile tires.

Report Segmentation

The market is primarily segmented based on type, aircraft type, platform, end-user, and region.

|

By Type |

By Aircraft Type |

By Platform |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Aircraft Tires Market Segmental Analysis

By Type Analysis

- The radial-ply tires segment dominated the market and is projected to grow at a CAGR during the projected period, mainly driven by its growing demand in the aircraft tires market due to their superior performance and safety benefits. Radial-ply tires have cords that run perpendicular to the centreline of the tread, providing increased stability, improved grip, and a smoother ride. These features are particularly advantageous for aircraft, as precise control and performance are critical during landings, take offs, and taxiing. As the aviation industry prioritizes safety and efficiency, the demand for commercially viable radial-ply aircraft tires is expected to rise, further driving growth in the market.

Designing radial-ply aircraft tires involves complex calculations and considerations to meet safety, performance, and regulatory requirements. These innovative tires have shown promising results, and as the aviation industry continues to explore new tire technologies, radial-ply tires play a crucial role in enhancing aircraft performance, safety, and efficiency.

By Aircraft Type Analysis

- The commercial aviation segment accounted for the largest market share and is anticipated to grow at the fastest CAGR owing to its demand for aircraft tires. As passenger flights increase, so does the need for reliable and durable tires for the aircraft fleet. Commercial aviation drives demand for various types of tires, including radial-ply and bias-ply tires, designed to meet the specific requirements of different aircraft models. The growth in commercial aviation results in higher orders for new aircraft, leading to increased demand for aircraft tires during production and fleet upgrades and replacements. The growth of commercial aviation in the aircraft tires market is influenced by factors like the rebound of passenger air travel post-COVID-19, leading to increased flight demand.

By Platform Analysis

- The fixed-wing aircraft segment dominated the market and is expected to grow at the fastest CAGR owing to an increase in international air travel and global air passenger traffic, due to higher demand for fixed-wing aircraft. Fixed-wing aircraft can conduct flight operations at high altitudes and over long distances without frequent refuelling, making them essential for long-haul flights. The rising demand for fixed-wing aircraft directly impacts the aircraft tire market. With more aircraft being utilized for commercial and cargo purposes, there is a greater need for aircraft tires to ensure safe and efficient operations. Consequently, aircraft tire manufacturers are witnessing a surge in orders from airlines and maintenance organizations. Additionally, the expansion of low-cost carriers has improved air travel accessibility for passengers worldwide has led to the introduction of more fuel-efficient and long-range fixed-wing aircraft.

Aircraft Tires Market Regional Insights

The North America region dominated the global market with the largest market share

The North America accounts for the largest market share in the aircraft tires industry due to the rapid growth and significant investments in the aerospace and aviation sector. Nations like the US and Canada, with their strong emphasis on passenger security and accessibility, contribute to the region's dominance in the market. North America's thriving aviation industry, extensive commercial and military aircraft fleet, and well-established manufacturing and technological base contribute to the significant demand for aircraft tires in the region. Furthermore, military aircraft modernization through defense procurement programs opens up new opportunities for aircraft tire manufacturers in North America. With the upgrade of military fleets, there is a demand for specialized, high-performance tires capable of withstanding the rigors of military operations.

The Europe region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing tourism activities within the countries which are responsible for the ring demand for regional aircraft tires. The European Union's statistical office, Eurostat, reported that between August 2021 and August 2022, commercial aviation in Europe increased by roughly 25%. In August 2022, 596,930 commercial flights were operating within the European Union, 14% fewer than in August 2019, when 695,912 commercial airlines were operating within the continent.

Competitive Landscape

The aircraft tires market is fragmented and is anticipated to witness competition due to several players' presence. Major players in the market are constantly adopting dynamic pricing strategies based on market demand, raw material costs to attract the consumers. These companies focus on upgrading their technologies including developing tires with improved fuel efficiency, weight reduction, enhanced durability to stay ahead of the competition and to ensure long term results. These players focus on mergers, acquisitions, partnership, product developments, and collaboration to gain a competitive edge over others to capture a significant market share.

Some of the major players operating in the global market include:

- Bridgestone Corporation

- Desser Aerospace Companies

- Dunlop Aircraft Tyres Ltd.

- Michelin

- Petlas

- Qingdao Sentury Tires Company Limited

- Specialty Tires of America, Inc.

- Stomil Poznan

- The Goodyear Tire & Rubber Company

- Wilkerson Aircraft Tires

Recent Developments

- In June 2023, Michelin Launched New ‘Lighter and Longer Lasting’ Aircraft Tire i.e. Air X SKY LIGHT that is 15 to 20% longer than its old-generation equivalent. With Air X Skylight, Michelin is launching at the 54th Paris Air Show, a new radial tire technology intended for commercial aviation, a world first. Lighter than previous generations, its weight has been reduced by 10-20%

- In May 2023, Petlas, a Turkish tire manufacturer, invested $360 million in a new facility to increase production capacity and boost exports.

Report Coverage

The aircraft tires market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, aircraft type, platform, end-user, and their futuristic growth opportunities.

Aircraft Tires Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2,531.23 million |

|

Revenue forecast in 2032 |

USD 3,353.10 million |

|

CAGR |

3.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Aircraft Type, By Platform, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Aircraft Tires Market Size Worth $ 3,353.10 Million By 2032.

Key players in the aircraft tires market are Bridgestone Corporation, Desser Aerospace Companies

North America contribute notably towards the global aircraft tires market.

The global aircraft tires market exhibiting the CAGR of 3.6% during the forecast period.

The aircraft tires market report covering key segments are type, aircraft type, platform, end-user, and region.