Artificial Lift Market Share, Size, Trends, Industry Analysis Report,

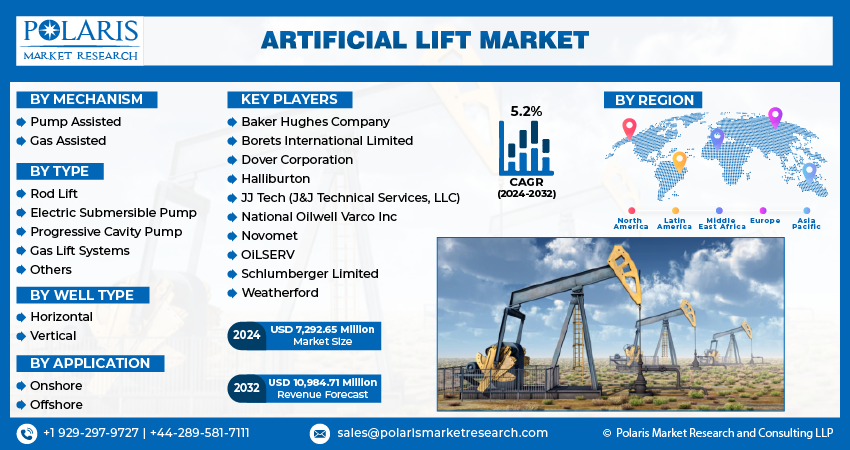

By Mechanism (Pump Assisted, Gas Assisted); By Type; By Well Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 118

- Format: PDF

- Report ID: PM2724

- Base Year: 2023

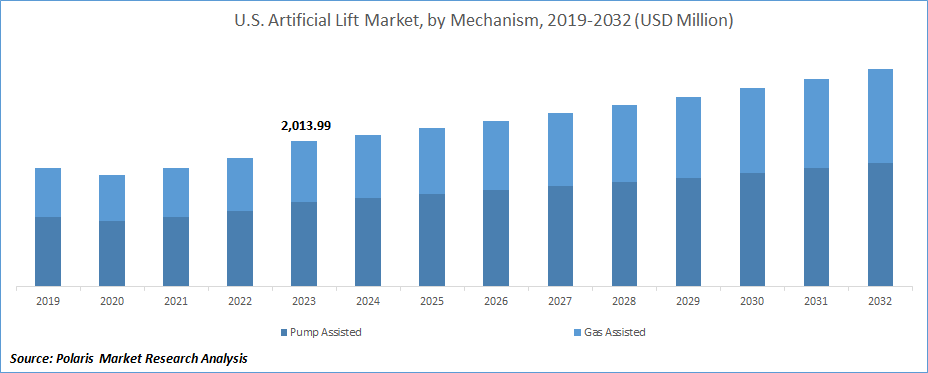

- Historical Data: 2019-2022

Report Outlook

Artificial lift market size was valued at USD 6,935.95 million in 2023. The market is anticipated to grow from USD 7,292.65 million in 2024 to USD 10,984.71 million by 2032, exhibiting the CAGR of 5.2% during the forecast period.

Industry Trends

Rising exploration and production of unconventional oil & gas resources and increasing shale gas production in emerging economies are responsible for the artificial lift market growth. The artificial lift method is used to decrease the bottom hole pressure in order to increase the production rate from a well. This is typically achieved by using a positive-displacement downhole pump, such as a progressive cavity pump or a beam pump, to reduce the flowing pressure at the pump intake. The reservoir's natural drive energy is insufficient to push the oil to the surface. So, to increase production, mechanical devices or other means are used. Artificial lift methods increase production and recovery by forcing the oil to reach the surface.

To Understand More About this Research: Request a Free Sample Report

The use of digital technologies and automation is becoming increasingly prevalent in artificial lift systems. These technologies can help optimize well performance, reduce downtime, and improve safety. Examples include the use of sensors and real-time monitoring to detect changes in well conditions, and the use of artificial intelligence (AI) and machine learning (ML) to optimize pump settings and predict equipment failures.

Artificial lift systems are also being used in conjunction with EOR techniques to increase oil recovery from mature fields. This includes the use of gas lift systems and ESPs to inject gas or water into the reservoir to increase pressure and improve oil recovery. With the increase in digitalization and automation, remote monitoring and control of artificial lift systems is becoming more prevalent. This allows operators to monitor and control wells from a central location, reducing the need for onsite personnel and improving safety.

Key Takeaways

- North America Dominated the Market And Contributed Over 33% Market Share Of The Artificial Lift Market size in 2023

- By mechanism category, the pump assisted segment dominated the global artificial lift market size in 2023

- By type category, the gas lift systems segment is projected to grow with a significant CAGR over the artificial lift market forecast period

What are the Market Drivers Driving the Demand for Market?

Increasing Drilling Activities

Artificial lift is a technique used in the oil and gas industry to increase the production of wells by creating artificial pressure that helps in lifting the hydrocarbons to the surface. The market for artificial lift systems is driven by a variety of factors, including increasing drilling activities. As drilling activities increase, more oil and gas wells are being drilled, and this creates a greater demand for artificial lift systems. The use of artificial lift systems can increase the efficiency and productivity of oil and gas wells, thereby reducing costs and increasing profits for oil and gas companies.

Moreover, the adoption of advanced technologies, such as automation, remote monitoring, and real-time data analysis, has significantly improved the performance and reliability of artificial lift systems, making them more attractive to oil and gas producers. Additionally, the growing demand for oil and gas in emerging economies and the need to optimize production from mature oil and gas fields are other factors that are driving the growth of the artificial lift market. Overall, the increasing drilling activities in the oil and gas industry are expected to continue to drive the demand for artificial lift systems in the coming years.

Which Factor is Restraining the Demand for the Market?

Sustained Low Oil & Gas Prices

From a peak price of USD 145.16 per barrel, to the previous lows, the fall of oil & gas prices has been dramatic and steep. Global oversupply and tepid demand growth have pulled down crude oil prices. Sustained low oil and gas prices can indeed present challenges for the artificial lift market. When oil and gas prices are low, oil and gas companies may reduce their capital expenditures, including investments in artificial lift systems. This can lead to a reduction in demand for artificial lift systems, which can impact the growth and profitability of companies that produce these systems.

Additionally, sustained low oil and gas prices can also lead to a decrease in production, which reduces the need for artificial lift systems. As a result, companies that produce artificial lift systems may have to compete for a smaller pool of potential customers, which can lead to pricing pressure and reduced profitability. Furthermore, sustained low oil and gas prices can also impact the adoption of new technologies in the artificial lift market. Companies may be hesitant to invest in new and more advanced systems when prices are low, leading to a slower adoption of these technologies.

Report Segmentation

The market is primarily segmented based on mechanism, type, well type, application, and region.

|

By Mechanism |

By Type |

By Well Type |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Mechanism Insights

Based on mechanism category analysis, the market has been segmented on the basis of pump assisted and gas assisted. Pump assisted is expected to be the largest shareholding segment during the forecast period, including both positive and dynamic displacement pumps, due to the increasing adoption of electric submersible and progressive cavity pumps. Various technological advancements across these pumps will further positively affect the growth of the pump-assisted mechanism segment.

The gas-assisted market is expected to grow at the highest CAGR. The fact that the gas lift requires less maintenance than a pump-type lift is the key factor contributing to the segment's growth. These gas lifts are also more affordable than pump lifts and are widely utilised in a variety of industries and end-user applications, including mining, oil & gas, and many more.

By Type Insights

Based on type category analysis, the market has been segmented on the basis of rod lift, electric submersible pump, progressive cavity pump, gas lift systems, and others. The gas lift systems segment is projected to witness a progressive growth rate in the forecasting years. Gas lift is an artificial lifting method, in which, compressed gas is injected into the production fluid to lower the density of the combined fluids. Less density decreases the hydrostatic head of fluids, enabling them to be raised to the surface.

Regional Insights

North America

The North American artificial lift market is one of the largest in the world, with the United States and Canada being the major contributors to the market. The market is driven by the growing demand for oil and gas, particularly from shale formations. The North American artificial lift market is highly competitive, with several major players operating in the market. Some of the key players include Schlumberger, Baker Hughes, GE Oil & Gas, Weatherford International, and Halliburton, among others. The market is expected to grow steadily in the coming years, driven by factors such as increasing demand for oil and gas, growing adoption of advanced technologies such as digitalization and automation, and the shift towards renewable energy sources. However, factors such as volatile oil and gas prices and environmental concerns could hinder the growth of the market.

Asia Pacific

The Asia-Pacific is projected to be the third-largest contributor to the artificial Asia-Pacific, lifts market in terms of revenue, globally, mainly due to rising energy demand and large-scale investments, in India, China, and Malaysia. Although the Asia- Pacific is projected to remain a net importer of oil & gas, the need to drive toward self-sufficiency is likely to help it maintain market share. In the Asia-Pacific, there are several countries that help generate demand for electrical submersible pumps. Over the years, there has been a steady demand for ESPs from countries, such as, Malaysia, Australia and China.

Competitive Landscape

The industry is characterized by significant consolidation, with a few major companies dominating the market in 2023. Key players in this sector include Baker Hughes Incorporated, Dover Corporation, Halliburton Company, LLC., Borets International Limited, NOV Inc., OiLSERV, and Schlumberger Limited. These companies are dedicated to research and development efforts aimed at delivering tailored solutions that meet the specific needs of well sites and customers while also devising effective techniques to maximize the extraction of hydrocarbons. In addition, intense competition has prompted manufacturers to invest in product innovation to address customer requirements better.

Some of the major players operating in the global market include:

- Baker Hughes Company

- Borets International Limited

- Dover Corporation

- Halliburton

- JJ Tech (J&J Technical Services, LLC)

- National Oilwell Varco Inc

- Novomet

- OiLSERV

- Schlumberger Limited

- Weatherford

Recent Developments

- In August 2022, Baker Hughes announces the acquisition of AccessESP, a leading provider of advanced technologies for artificial lift solutions. In fact, these are intended to further transform oil and gas operations by reducing costs and downtime for operators.

- In November 2021, Halliburton signed an MOU with Cairn Oil & Gas to develop new technologies to help Cairn Oil & Gas achieve its target of increasing recoverable reserve to 300 MMboe from 30 MMboe, which will help Cairn Oil & Gas increase its domestic production of crude oil.

- In October 2021, Baker Hughes inaugurated a regional hub of oilfield services (OFS) located in King Salman Energy Park (SPARK). The new facility will support ongoing customer activities for three OFS product lines, ensuring high-quality service delivery and positioning BHGE for future growth in the region.

Report Coverage

The artificial lift market report emphasizes on key regions across the globe to provide better understanding of the type to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, mechanism, type, well type, application, and their futuristic growth opportunities.

Artificial Lift Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7,292.65 million |

|

Revenue forecast in 2032 |

USD 10,984.71 million |

|

CAGR |

5.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Mechanism, By Type, By Well Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The artificial lift market report covering key segments are type, mechanism, well type, application, and region.

Artificial Lift Market Size Worth USD 10,984.71 Million by 2032

Artificial lift market exhibiting the CAGR of 5.2% during the forecast period.

North America is leading the global market.

the key driving factors in artificial lift market are Increasing Drilling Activities.