Automotive Cold-End Exhaust Aftermarket Size, Share, Trends, Industry Analysis Report,

By Type (Basic, Performance); By Vehicle Type (Passenger Cars, Commercial Vehicle); By Region; Segment Forecast, 2024 – 2032.

- Published Date:Aug-2024

- Pages: 118

- Format: PDF

- Report ID: PM1424

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

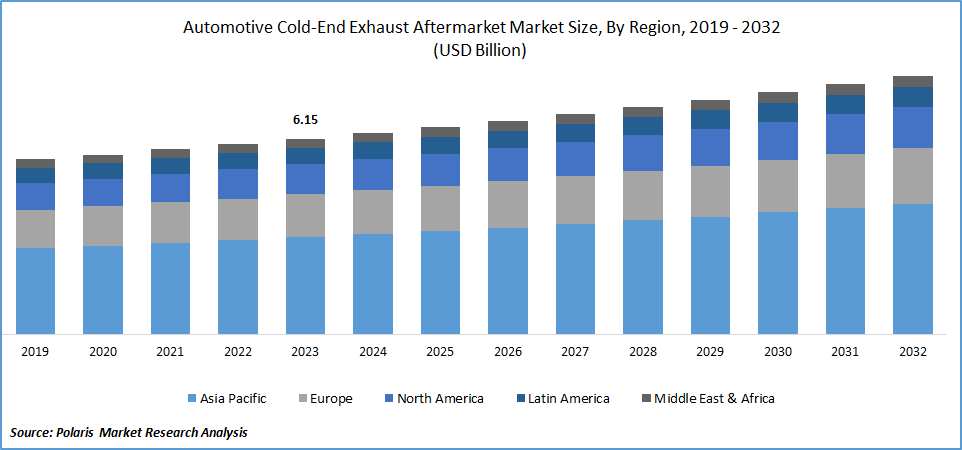

Automotive cold-end exhaust aftermarket size was valued at USD 6.15 billion in 2023. The market is anticipated to grow from USD 6.33 billion in 2024 to USD 8.13 billion by 2032, exhibiting a CAGR of 3.2% during the forecast period.

Automotive Cold-End Exhaust Aftermarket Overview

The aftermarket for automotive cold-end exhaust systems is experiencing rapid growth due to increased demand from manufacturers and consumers for advanced exhaust systems that can improve the performance, sustainability, and efficiency of vehicle exhaust. Exhaust systems are designed to enhance fuel combustion, reducing pollution levels by continuously monitoring emissions in real time. Digital sensors accurately measure various engine characteristics such as temperature, pressure, and gas composition, allowing for precise adjustments to engine performance while minimizing harmful emissions.

Furthermore, digitization simplifies the application of predictive maintenance algorithms. This allows for the proactive detection of potential issues before they escalate, reducing downtime and improving overall reliability. Additionally, the connectivity of digital exhaust systems to vehicle networks and cloud platforms enables data-driven insights for continuous enhancement of exhaust system design, operation, and adherence to increasingly stringent pollution regulations.

To Understand More About this Research:Request a Free Sample Report

For instance, in September 2022, Mangla Tubes and an Italian firm collaborated on cutting-edge exhaust systems. The company management states that under this JV, an investment of roughly INR 105 crore is planned over the next five years to strengthen the R&D capabilities and establish two new production sites in India.

The automobile industry needs to prioritize the reduction of vehicle emissions due to increasing sustainability and environmental concerns. Traditional exhaust systems are typically made of stainless steel. However, the industry is now exploring sustainable materials that enhance efficiency and address emissions issues while considering factors such as heat management, noise reduction, emissions control, weight reduction, and longer service life. Materials like new polymers, lightweight alloys, composites, and high-temperature ceramics serve as alternatives to the conventional materials used in automobile cold-end exhaust systems.

Exhaust systems in hybrid cars frequently include parts such as thermal management technology and exhaust gas recirculation (EGR) systems to maximize engine efficiency and minimize emissions. Exhaust systems in electric cars are being repurposed for battery thermal management, making use of the current infrastructure to vent heat produced during operation and charging.

Automotive Cold-End Exhaust Aftermarket Dynamics

Market Drivers

Rise in Installation of Exhaust Systems for Hybrid Vehicles

The increasing use of exhaust systems in modern hybrid cars, such as plug-in hybrid electric vehicles (PHEVs) and full hybrid cars, is driving market growth. Driving in electric mode results in lower exhaust system temperatures compared to a pure combustion engine. This improves the driving experience and enhances efficiency, aligning with sustainability goals. For example, in March 2024, the Environmental Protection Agency (EPA) announced new regulations for automotive exhaust systems aimed at reducing carbon emissions and promoting the use of hybrid and electric cars. These regulations apply to model years 2027 through 2032 and will significantly reduce the emission of greenhouse gases and other air pollutants from newly manufactured passenger cars, light vehicles, and pickups.

Rise In Technological Advancements

The advancement in technology has led to the development of active exhaust systems. These systems modify the exhaust flow in response to driving circumstances, enhancing efficiency and performance. Furthermore, advancements in noise reduction technology have improved muffler designs, reducing noise levels without sacrificing functionality. For instance, in April 2024, Ferrari developed a new exhaust system that incorporated Active Aerodynamic Functionality. With the new exhaust system, Ferrari aims to improve the performance and sound of their V8 engines without violating pollution standards. The system modifies the sound based on the driving mode, swapping acoustic quality for increased aerodynamic efficiency at high speeds. This system is designed specifically for rear-wheel drive (RWD) twin-turbo V8 front-engine sports cars.

Automotive Cold-End Exhaust Aftermarket Restraints

High Installation and Replacement Costs

The cost of installing a new exhaust system is influenced by factors such as the type of exhaust system, the year and model of your vehicle, and the labor costs charged by the technician. The installation cost varies depending on the type of exhaust system. The basic system is more affordable than the mid-range system, and the high-end system is the most expensive. Additionally, replacing or upgrading the entire exhaust system increases the expenses, impacting the market revenue.

Report Segmentation

The Automotive Cold-End Exhaust Aftermarket is primarily segmented based on type, vehicle type, and region.

|

By Type |

By Vehicle Type |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Automotive Cold-End Exhaust Aftermarket Segmental Analysis

By Type Analysis

The basic segment dominated the market in 2023 due to the need for regular maintenance or replacement. These components, like exhaust pipes, mufflers, and catalytic converters, are prone to wear and tear, leading to consistently high demand for substitute parts in the aftermarket. This continuous demand boosts the dominance of the basic system segment.

The performance segment is projected to grow at a significant CAGR during the projected period. This growth is mainly driven by developments in exhaust system technology. Manufacturers are continually investing in research and development (R&D) to produce aftermarket products with improved efficiency, performance, and durability. These technological advancements, such as the use of lighter materials and more sophisticated exhaust systems, attract buyers who are looking for aftermarket upgrades to enhance their cars' performance.

By Vehicle Type Analysis

The passenger segment accounted for the largest market share in 2023 due to the increasing number of passenger cars. Furthermore, the trend of car owners customizing and personalizing their vehicles has driven up the demand for aftermarket exhaust systems that enhance appearance, performance, and sound.

The commercial vehicle segment is expected to witness the fastest growth rate in the upcoming years. Commercial vehicles are subject to wear and tear from regular use and high mileage, requiring frequent replacements and upgrades. Additionally, investments in aftermarket exhaust solutions are being made to optimize performance and minimize environmental impact. These investments are in line with the focus on fuel efficiency and emissions compliance in commercial vehicles, such as heavy-duty trucks and buses.

Automotive Cold-End Exhaust Aftermarket Regional Insights

The Asia Pacific Region Dominated the Global Market With the Largest Market Share

The Asia Pacific region held the highest market share in 2023, mainly due to the rapid growth of the automotive industry and significant automotive markets in the region. The increasing number of cars on the road requires efficient exhaust systems to reduce emissions. Cold-end exhaust systems play a crucial role in helping the automotive industry achieve sustainability goals and enhance pollution control. For example, Eberspaecher Exhaust Technology International and Sharda Motor Industries have a 50:50 joint venture named Eberspaecher Sharda Exhaust Technology. This venture aims to develop, manufacture, and distribute exhaust after-treatment systems for commercial vehicle manufacturers in India. The products of this joint venture will help commercial vehicle OEMs meet the strict emission standards, such as Bharat Stage VI in India, with implementation in trucks and buses starting in 2020.

The North America region is expected to be the fastest growing region with a healthy CAGR during the projected period. This is due to the rising adoption of administrative rules and strict regional automotive authority criteria pertaining to vehicle emissions, which are driving the sales of cold-end exhaust systems. The government has imposed strict regulations on vehicle emissions due to growing concerns about pollution and consumer safety. For example, in December 2021, the Environmental Protection Agency (EPA) issued its final rule to modify the current national limits on greenhouse gas emissions for passenger cars and light trucks through the 2026 model year. The National Highway Traffic Safety Administration (NHTSA) released fuel efficiency requirements for light-duty vehicles for model years 2024–2026, along with the California Air Resources Board (CARB).

Automotive Cold-End Exhuast Aftermarket Competitive Landscape

The automotive cold-end exhaust aftermarket has enormous players competing to gain significant market shares by upgrading their product’s technology. This upgradation may include sustainability and endurance to ensure efficiency, integrity, and safety. Further advancements in the materials used for the exhaust such as alloy materials drive competitiveness. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over others to capture a significant market share.

Some of the major players operating in the global Automotive Cold-End Exhaust Aftermarket include:

- BOSAL

- Calsonic Kansei Corporation

- DRiV Inc.

- Eberspächer Exhaust Aftermarket GmbH & Co. KG

- Flowmaster, Inc.

- FORVIA Faurecia

- MagnaFlow

- Marelli Corporation

- Rogue Engineering

- Tenneco Inc.

Recent Developments

- In October 2023, Purem AAPICO, a joint venture between Eberspaecher and AAPICO Hitech, officially opened its new plant in Rayong, Thailand. The production facility, which is 100 kilometers southeast of Bangkok, will supply exhaust systems for a US automaker's pickup truck.

- In October 2022, AudioControl and Borla Exhaust formed a strategic alliance to target the electric vehicle (EV) sector. The new partnership aimed at developing audible exhaust to enhance the driving experience in electric vehicles.

Report Coverage

The automotive cold-end exhaust aftermarket report emphasizes on key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, vehicle type, and futuristic growth opportunities.

Automotive Cold-End Exhaust Aftermarket Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.33 billion |

|

Revenue Forecast in 2032 |

USD 8.13 billion |

|

CAGR |

3.2% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Vehicle Type, By Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global Automotive Cold-End Exhuast Aftermarket size was valued at USD 6.15 billion in 2023 and is projected to grow to USD 8.13 billion by 2032

The global market is projected to grow at a CAGR of 3.2% during the forecast period, 2024-2032.

Asia Pacific had the largest share of the global market

The key players in the market are BOSAL, Calsonic Kansei Corporation, DRiV Inc., Eberspächer Exhaust Aftermarket GmbH & Co. KG, Flowmaster, Inc., FORVIA Faurecia, MagnaFlow, Marelli Corporation, Rogue Engineering, and Tenneco Inc.

The basic segment held the highest share in the Automotive Cold-End Exhaust Aftermarket in 2023.

The passenger category had the largest market share in the global market.