Automotive Shredded Residue Market Share, Size, Trends, Industry Analysis Report,

By Application (Landfill, Energy Recovery, Recycling); By Composition; By Technology; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 114

- Format: PDF

- Report ID: PM4600

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

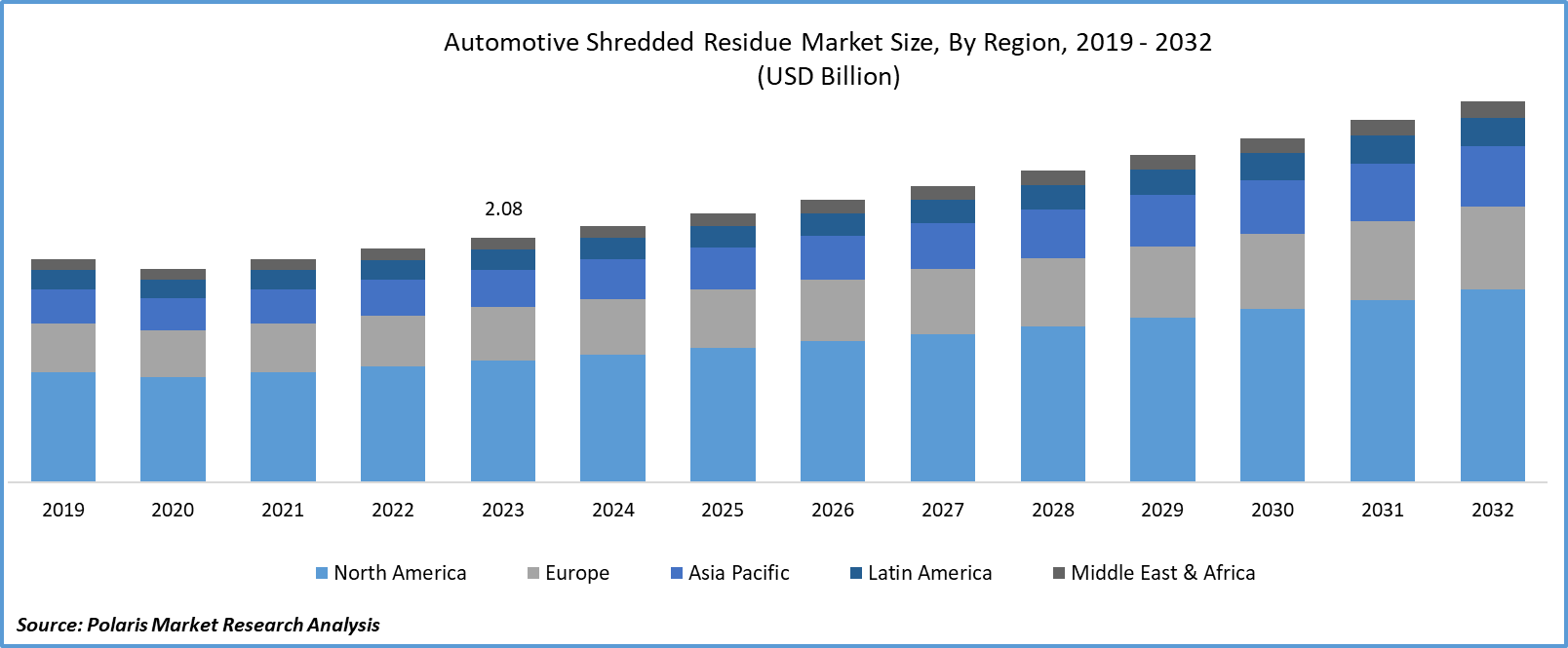

Global automotive shredded residue market size was valued at USD 2.08 billion in 2023. The market is anticipated to grow from USD 2.18 billion in 2024 to USD 3.24 billion by 2032, exhibiting the CAGR of 5.1% during the forecast period.

Market Overview

The increasing recycling activities at the global level highly influence the growth of the automotive shredded residue (ASR) market size. The rising awareness about the importance of recycling and the benefits of circular economy initiatives is positively driving the automotive shredder residue industry.

The global carbon neutrality trend and, particulate matter reduction, growing waste from end-of-life vehicles, and the rising number of internal combustion engine discards in the world are grabbing attention towards the recycling of automotive shredder residue. The key players are playing a vital role in promoting the automotive shredded residue market.

To Understand More About this Research: Request a Free Sample Report

- For instance, in October 2023, Pacific Steel and Recycling proposed its plan to construct a shredder residue landfill in Montana to the Department of Environmental Quality (DEQ). It includes 90 acres within the 320 acres of private property, with the aim of an approximate landfill of 25,000 tonnes from its billing recycling facility.

Moreover, the rise of end-of-life automotives worldwide is anticipated to promote the utilization of advanced recycling technologies to extract valuable resources from automotive shredder residue and lower waste landfills.

However, the need for more awareness about the cost-effective automotive shredded residue technology at the global level is expected to restrain the growth of the global automotive shredded residue market value in the coming years.

Growth Drivers

Rising research activities to create effective recycling processes

The rising research and development activities exploring new ways of recycling processes with a view to limiting waste are positively influencing the market growth opportunities of the automotive shredded residue market. For instance, a 2023 study published in PubMed Central focused on the manufacturing of four types of products with the use of automotive shredded residue melting slag. It evaluated the recycling potential of the produced products. The asphalt paving aggregate showed the best performance, followed by lightweight swelled ceramic, clay, and interlocking bricks.

Advancements in chemical recycling

Advancements in chemical recycling are considered a significant growth driver for the automotive shredded residue (ASR) market. Automotive Shredded Residue refers to the leftover materials from the process of shredding end-of-life vehicles, and it typically contains a mix of metals, plastics, rubber, glass, and other materials. Chemical recycling technologies enable the extraction and recovery of valuable resources from ASR, such as polymers and metals, more efficiently. Advanced processes help separate and purify materials from the shredded residue, allowing for a higher percentage of materials to be recycled.

Restraining Factors

The decline in the ferrous and non-ferrous metal prices

With global economic trends, major recycling companies are witnessing significant losses. For instance, Sims Ltd., an Australia-based recycling company, reported a 14% loss of sales revenue and a 62% drop in earnings in its 2023 annual reports compared to the prior year. This is signaling a decline in the earning potential in the shredder residue market, which can hamper the new players' arrivals in this market.

Additionally, the declining sales price of ferrous and non-ferrous metals in the global market scope is expected to demotivate market players to engage in automotive shredded recycling activities, driven by lower returns on investment. According to Sims Ltd. annual reports, along with the backdrop of its sales volume, the average sales price of ferrous metals and non-ferrous metals declined by 14.4% and 7.4%, respectively, in line with the earlier year.

Report Segmentation

The market is primarily segmented based on application, composition, technology, and region.

|

By Application |

By Composition |

By Technology |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Analysis

Recycling segment is expected to witness the highest growth during the forecast period

The recycling segment is expected to witness the highest growth during the forecast period, mainly driven by its higher rate of environmental sustainability over landfill and energy recovery applications. The development of recycling methods with a higher potential to create value from existing waste with higher efficiency is a major factor contributing to the higher segmental growth in the global automotive shredder residue market.

After recycling, the energy recovery segment has significant potential to drive market growth due to the rising demand for sustainable energy resources driven by growing concerns about lowering greenhouse gas emissions by converting waste to energy. The growing measures to lower landfills are expected to promote recycling and energy recovery segment growth during the forecast period.

By Composition Analysis

The non-ferrous metals segment held the largest market share in 2023

In 2023, the non-ferrous metals segment held the largest market share and is likely to stimulate its market dynamics throughout the forecast period. The growth of the segment is attributable to the rising awareness campaigns promoting the importance of plastic recycling around the world. The higher environmental effects associated with plastic enable companies to work on recycling plastic in automotive shredder residue.

The ferrous metals segment is expected to register optimal growth in the study period owing to the existence of a significant number of ferrous metals, primarily steel and iron materials, in the end-of-life automotive industry, which is expected to impact market growth positively. The growing incorporation of recycled materials by manufacturing companies and increasing government support for circular economy initiatives are expected to facilitate demand for ferrous metal recycling from automotive shredder residue in the coming years.

By Technology Analysis

The magnetic Separation segment held a significant revenue share in 2023

The magnetic separation segment held a significant revenue share in 2023, which is highly accelerated due to its ability to extract ferrous metals, including iron and steel, accurately and at a faster rate. Its effectiveness in acquiring higher levels of purity components from the shredded residue is driving its adoption in the marketplace. The potential to offer direct utilization of extracted metals with higher levels of integrity is expected to create significant demand in the study period.

Furthermore, the optical sorting technology segment is expected to drive significant demand for automotive shredded residue in the coming years due to the rising number of companies investing in this technology. For instance, in November 2023, DataBeyond Technology, a company engaged in AI and optical sorting equipment, raised approximately $100 million in Series B funding.

Regional Insights

North America region accounted for the largest market share in 2023

In 2023, the region accounted for the largest market share. This is due to the existence of established automobile producers and the ever-increasing consumption of automobiles in the region, primarily in the United States & Canada. According to the trade organization, automotive recycling is the top most recycled product, with 12 million vehicles processed annually. The higher rate of automobile recycling processes going on in the region is promoting the growth of the automotive shredded residue market.

The Asia Pacific region is expected to witness the fastest CAGR during the projected period.

The Asia Pacific region is expected to witness the fastest-growing region with a healthy CAGR during the projected period, owing to the rising demand for automobiles with the presence of a larger middle-class population supported by rising disposable income. The mechanical recycling initiatives by companies in the region, specifically China and India, are expected to propel market growth. For instance, Covestro, a China-based company, unveiled its mechanical recycling polycarbonate production line in Shanghai with the capacity to offer 25,000 tonnes of polycarbonate annually.

Key Market Players & Competitive Insights

The automotive shredded residue (ASR) market features several key players and competitive dynamics, with companies involved in recycling and processing automotive shredder residue. These players contribute to sustainable waste management and resource recovery. The key players contribute to the competitive landscape of the Automotive Shredded Residue market by employing advanced technologies, emphasizing sustainability, and promoting resource recovery from end-of-life vehicles. The industry continues to evolve as companies strive to address environmental challenges and contribute to the circular economy.

Some of the major players operating in the global market include:

- Axion Ltd

- CP Manufacturing Inc.

- Galloo

- Machinex Industries Inc.

- MBA Polymers Inc.

- Sims Limited

- Eriez Manufacturing Co.

- Steinert

- Tomra Systems ASA

- Wendt Corporation

Recent Developments in the Industry

- In March 2023, Sims Metals, a recycling company completed the acquisition of Northeast Traders, which is capable of processing and selling 60,000 tonnes of nonferrous metal annually.

Report Coverage

The automotive shredded residue market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, application, composition, technology, and their futuristic growth opportunities.

Automotive Shredded Residue Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.18 billion |

|

Revenue forecast in 2032 |

USD 3.24 billion |

|

CAGR |

5.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global automotive shredded residue market size is expected to reach USD 3.24 billion by 2032

Key players in the market are Axion Ltd, CP Manufacturing Inc., Galloo, Machinex Industries Inc., MBA Polymers Inc

North America contribute notably towards the global Automotive Shredded Residue Market

Automotive shredded residue market exhibiting the CAGR of 5.1% during the forecast period.

The Automotive Shredded Residue Market report covering key segments are application, composition, technology, and region.