Brine Concentration Minerals Market Share, Size, Trends, Industry Analysis Report,

By Technology (Osmotically Assisted RO and Solar Evaporation); By Type; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4604

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

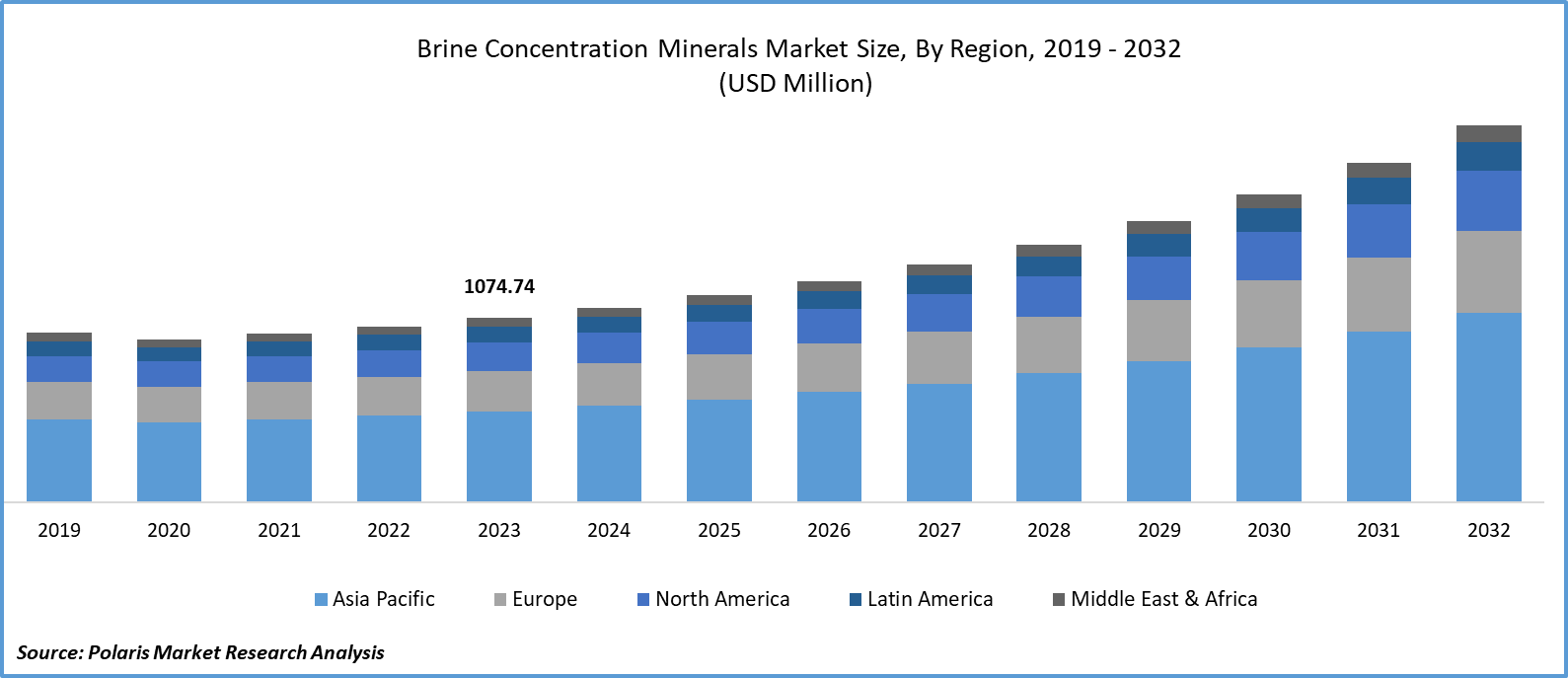

Global brine concentration minerals market size was valued at USD 1074.74 million in 2023. The market is anticipated to grow from USD 1134.61 million in 2024 to USD 2191.07 million by 2032, exhibiting the CAGR of 8.6% during the forecast period.

Brine Concentration Minerals Market Overview

The growth of brine concentration minerals is driven by several key factors that mirror global trends toward sustainability and rising demand in crucial industries. The increasing use of renewable energy projects and the adoption of electric vehicles are driving the need for minerals such as lithium, potassium, and magnesium, which are essential for batteries and lightweight materials. The shift towards cleaner energy sources is also increasing the demand for energy storage solutions, in which minerals derived from brine are crucial.

- For instance, in December 2023, Ganfeng Lithium Group Co., Ltd started production in Argentina, the Cauchari-Olaroz Salt Lake project holds a lithium resource of about 24.58 million tons of lithium carbonate equivalent (LCE), establishing it as one of the largest Salt Lake lithium extraction projects globally. The initial phase aims to achieve a capacity of 40,000 tons of LCE, while Phase 2 is targeting no less than 20,000 tons of LCE.

To Understand More About this Research: Request a Free Sample Report

Moreover, the increased use of these minerals in industries beyond energy, such as agriculture, pharmaceuticals, and construction, adds to the growing demand. The importance of sustainable practices in resource extraction makes brine concentration methods more appealing, especially those that reduce environmental impact.

Geopolitically, establishing strategic partnerships and making investments in lithium-rich regions, like the lithium triangle in South America, helps secure a reliable supply chain. Furthermore, advancements in technology, including innovative extraction processes, improve the efficiency and cost-effectiveness of producing brine concentration minerals.

Brine Concentration Minerals Market Dynamics

Market Drivers

The increasing need for lithium-ion batteries

The increasing demand for lithium-ion batteries is a major factor driving the brine concentration minerals market development, mainly because lithium is a key component in these batteries. Lithium-ion batteries are widely used in electric vehicles, consumer electronics, and renewable energy storage systems. As the world moves towards cleaner and more sustainable energy sources, the demand for lithium-ion batteries is expected to rise sharply. Lithium, crucial for these batteries, is primarily sourced from brine concentration minerals like lithium-rich brine deposits. Extracting lithium from brine is cost-effective and typically involves concentrating the lithium in brine pools through evaporation. This has led the brine concentration minerals market expansion to meet the increasing demand for lithium-ion batteries.

The specific geological conditions needed for lithium-rich brine deposits result in resources being concentrated in certain regions, leading to the emergence of key players in those areas. Countries with abundant lithium resources, such as those in the lithium triangle (Chile, Argentina, and Bolivia), have become focal points for brine concentration mineral extraction. This highlights the crucial role these minerals play in supporting the growing market demand for clean and renewable energy technologies, as well as the global transition towards cleaner energy. The brine concentration minerals market growth is also driven by the growing emphasis on sustainable practices, particularly in terms of environmental friendliness and water resource conservation.

Market Restraints

Recovering minerals selectively and dealing with low mineral concentrations are likely to impede the market growth.

The brine concentration minerals market development faces significant challenges due to low mineral concentration and the need for selective mineral recovery. Extracting minerals from brine, such as lithium, magnesium, and calcium, involves concentrating and isolating these minerals, which becomes difficult when the initial concentration is low. This complexity and cost of extraction increase as larger volumes of brine must be processed to obtain viable amounts of minerals. Furthermore, selectively recovering specific minerals from brine can be technically challenging. Different brine sources contain a mix of minerals, and achieving high selectivity for desired minerals while avoiding contamination adds complexity and cost. Advanced technologies and additional processing steps are often required for selective recovery, further increasing operational costs. These challenges impact the economic viability and competitiveness of brine concentration minerals in the market.

Report Segmentation

The market is primarily segmented based on technology, type, application and region.

|

By Technology |

By Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Brine Concentration Minerals Market Segmental Analysis

By Technology Analysis

- The solar evaporation segment accounted for the largest revenue share in 2023 and is expected to retain its position over brine concentration minerals market forecast period. Because of a number of benefits, the solar evaporation method is unique for extracting minerals from brine. First of all, because it uses natural solar energy and requires little infrastructure, operating expenses are minimized. The process's ease of use makes it possible to execute and run it quickly, which reduces setup delays and initial capital costs. Solar evaporation is thought to be environmentally benign since it uses less energy and doesn't require the use of chemical reagents, which is in line with sustainability objectives. Sun evaporation, depending on the properties of the brine source, is especially beneficial in areas with high sun radiation, such as the lithium triangle (Chile, Argentina, Bolivia). It targets minerals, including calcium, potassium, magnesium, and lithium.

By Type Analysis

- The magnesium derivatives segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. Magnesium is highly valued in various industries for its diverse applications. In automotive manufacturing, it is preferred for its lightweight properties, which improve fuel efficiency and reduce emissions. This aligns with the industry's push for sustainable transportation solutions, driving up demand for magnesium derivatives. In agriculture, magnesium derivatives are used as fertilizers to address soil deficiencies and promote plant growth. The pharmaceutical sector also relies on magnesium compounds for formulating medications and dietary supplements, highlighting their role in health promotion. Additionally, in construction, magnesium oxide serves as a fire-resistant material, enhancing safety standards. Overall, the broad applications of magnesium derivatives across these industries position them as significant player in the brine concentration minerals market.

By Application Analysis

- Based on application analysis, the market has been segmented on the basis of water treatment, metallurgical, and fertilizers. The metallurgical sector is the largest in the brine concentration minerals market, mainly due to the use of these minerals in refractories. Refractories, which are heat-resistant materials used in metal smelting and glass manufacturing, often contain minerals like magnesium oxide, calcium oxide, and alumina from brine. These minerals enhance the refractories' ability to withstand high temperatures and harsh conditions in metallurgical processes.

The demand for refractories in the metallurgical industry, including steel production and non-ferrous metal processing, drives the significance of the metallurgical segment in the market development. With the growth of the global steel industry and metallurgical activities, the demand for brine-derived minerals in refractories is expected to increase, further solidifying the metallurgical segment's importance.

Brine Concentration Minerals Market Regional Insights

The Asia Pacific region dominated the global market with the largest market share in 2023

The Asia Pacific region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the market forecast period. China, a key economic player, drives the demand for brine concentration minerals, using them extensively in electronics, automotive, and construction. The country's strong manufacturing sector, coupled with its position as a top electric vehicle producer, boosts the need for minerals like lithium, potassium, and magnesium in batteries and lightweight materials.

Additionally, in the Asia Pacific region, agriculture relies on these minerals as fertilizers, particularly in countries like India and China, to improve soil fertility and productivity. Asia Pacific also boasts significant lithium resources, crucial for lithium-ion batteries in energy storage and electric vehicles. Despite South America's lithium-rich deposits, Asia Pacific countries invest in the region to secure a steady supply of minerals.

Competitive Landscape

The Brine Concentration Minerals market development is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Albemarle Corporation

- Arcadium Lithium

- Ganfeng Lithium Group Co., Ltd

- ICL Industrial Products

- Konoshima Chemical Co., Ltd

- Magrathea

- Olokun Minerals

- SEALEAU

- Solvay

- SQM S.A

Recent Developments

- In March 2023, Albemarle Corporation announced that the lithium hydroxide Mega-Flex facility, previously planned by the company, will be located in Chester County, South Carolina, US. The facility's plans include an initial investment of at least USD 1.3 billion, aimed at addressing the increasing demand for electric vehicles and lithium-ion batteries both domestically and internationally.

Report Coverage

The Brine Concentration Minerals market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, technology, type, application and their futuristic growth opportunities.

Brine Concentration Minerals Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1134.61 million |

|

Revenue Forecast in 2032 |

USD 2191.07 million |

|

CAGR |

8.6% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Technology, By Type, By Application, By Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global brine concentration minerals market size is expected to reach USD 2191.07 million by 2032.

Key players in the market are Magrathea, Olokun Minerals, Albemarle Corporation, Ganfeng Lithium Group Co., Ltd

Asia Pacific contribute notably towards the global Brine Concentration Minerals Market

Global brine concentration minerals market exhibiting the CAGR of 8.6% during the forecast period.

The Brine Concentration Minerals Market report covering key segments are technology, type, application and region.