Bubble Tea Market Share, Size, Trends, Industry Analysis Report,

By Flavor (Original Flavor, Coffee Flavor, Fruit Flavor, Chocolate Flavor, and Others); By Base Ingredient; By Component; By Region; Segment Forecast, 2024 – 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4481

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

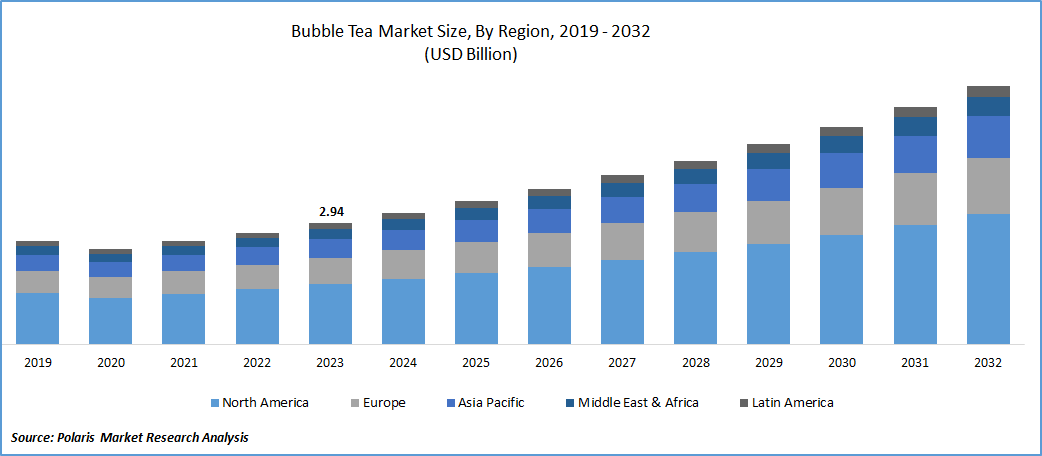

The global bubble tea market was valued at USD 2.94 billion in 2023 and is expected to grow at a CAGR of 8.8% during the forecast period.

The rising intake of tea and coffee as a type of nootropic drinks among working individuals as well as students all over the world and growing awareness about the low-calorie contents and zero fat of such types of beverages, are among the major factors influencing growth of the market.

- For instance, as per a report published by The Tea Association of the USA, U.S people consumed over 85 billion servings of tea, and on any given tea, nearly half of American population drinks tea.

In addition, growing recommendations by health experts for the consumption of bubble tea due to their ability to improve concentration levels, brain function, and reduce cholesterol levels, is further likely to boost market’s growth.

To Understand More About this Research:Request a Free Sample Report

Furthermore, boba tea has been creating a significant buzz among individuals globally due to its rising appeal and novelty coupled with the growing consumer interest and preferences in innovative beverages with bold and unique flavors. Thus, major market companies are forced to invest significantly in the development and creation of new bubble tea flavors to meet emerging consumer demand and needs, which in turn, likely to have a positive impact on global market growth.

- For instance, in April 2022, Bubluv Inc., announced the launch of its new Bubble tea, which is a type of ready-to-drink boba alternative that contains no added sugar and made with a blend of tapioca starch and konjac. The newly launched product options are available direct-to-consumer at the company’s website for a price of USD 34.99 for a 6-pack.

However, the surging availability of alternative caffeinated drinks and lack of consumer awareness about the potential health benefits of regularly consuming bubble tea, are among the major factor expected to hinder global market growth.

Industry Dynamics

Growth Drivers

- Rising Consumer Shift Towards Healthy Alternatives and Continuous Market Expansion Are Boosting Market’s Growth

The growing prevalence of lifestyle disorders and increasing incidences of obesity and diabetes that are mainly associated with consumers hectic lifestyles, has led to a drastic shift towards the adoption of health and natural drinks like bubble tea, which drives the global market growth. For instance, as per a report by the World Health Organization, non-communicable diseases of which lifestyle disease are a part, results in 41 million lives annually which occurs over 70% of all deaths across the world.

Additionally, with key market players are constantly introducing new bubble tea beverages and implementing on several business expansion strategies like collaboration and acquisitions, the market for bubble tea is likely to emerge rapidly over the years.

- For instance, in August 2023, CoCo Fresh Tea & Juice, announced about its plan to expand their footprint in South Asia to meet the rising demand for the East Asian refreshments all over the world.

Report Segmentation

The market is primarily segmented based on flavor, base ingredient, component, and region.

|

By Flavor |

By Base Ingredient |

By Component |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Flavor Analysis

- Fruit Flavor Segment Accounted For the Largest Market Share in 2023

The fruit flavor segment accounted for the largest market share. The segment’s growth is driven by widespread availability of different fruit flavors such as pineapple, cantaloupe, avocado, passion fruit, peach, coconut, grape, honeydew, and banana, among many others along with their rising consumption among people worldwide because it contains lots of antioxidants & vitamins ad help in cleansing the toxin in the body.

The chocolate flavor segment is expected to witness highest growth. The growth is due to increasing demand for chocolate-flavor based drinks from different age groups due to their great taste and texture coupled with the growing awareness among individuals about health benefits associated with dark chocolate and cocoa.

By Base Ingredient Analysis

- Black Tea Segment Held the Significant Market Share in 2023

The black tea segment held the significant revenue share. The segment dominance is attributable to authentic natural flavor of black tea and its ability to help reducing blood sugar level and bad cholesterol and improving gut health. Thereby, with the continuous increase in the number of people suffering from health diseases including diabetes and high or bad cholesterol levels, the demand and need for black tea is growing rapidly and acting as major factor boosting segment market over the coming years.

- For instance, according to a report published by The Lancet, the number of people suffering with diabetes globally is projected to increase from 529 million in 2023 and approx. 1.3 billion by 2050 with every country in the world seeing an increase during the period.

By Component Analysis

- Liquid Segment Is Expected to Witness Highest Growth

The liquid segment will grow at highest growth rate. This segment’s growth is accelerated by growing availability of various liquid flavors and syrups and increasing consumer preference and inclination towards liquid options as they allow for customization and innovations to create new flavors as customer dietary needs and requirements.

The flavor segment led the market with noteworthy share. The segment’s growth is fueled by increased consumer need and preferences for diverse and unique tea flavors along with the growing focus on major companies in the market towards introducing unique and innovative flavor combinations to attract customers and gain a competitive edge over their competitors.

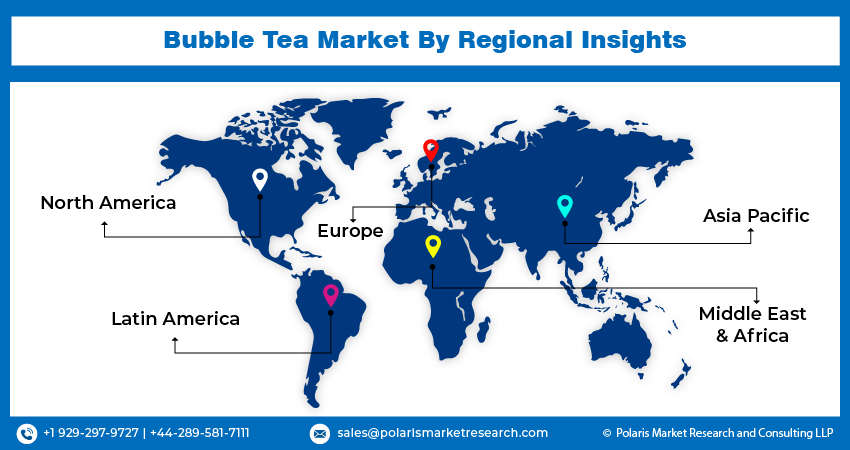

Regional Insights

- North America Region Dominated the Global Market in 2023

The North America region dominated the global bubble tea market. This growth is accelerated by significant consumption of flavor tea beverages and growing number of bubble tea shops across the region that makes the product easily accessible and recognizable among consumers. For instance, according to a study conducted by IBISWorld, the number of bubble tea shops in the United States reached 3,096 in 2022, with a significant increase of 23.4% as compared to previous year. Additionally, with consumers becoming health conscious and aware of the product they consume, companies are increasing their focus on the inclusion of healthier ingredients like natural sweeteners and fresh organic fruits that led to high demand among health-conscious consumers.

The Asia Pacific region is anticipated to register prominent growth rate. The region’s significant growth is attributed to robust presence of some of the world’s leading bubble tea consumers and growth in the number of product manufacturers and entrepreneurs in the region who are focusing on establishing their restaurants and cafes specializes in bubble tea.

- For instance, according to a report by Asean Post & Grab’s data, on an average people in Thailand consumes nearly 6 cups of bubble tea every month, as compared to other countries in the region

Key Market Players & Competitive Insights

Major players are competing on various factors including quality of ingredients, product texture, innovation in recipes, variety of flavors, and effective marketing strategies, to consolidate their position. For instance, in November 2023, Loob Holding, announced the opening of its new bubble tea facility in the Selangor. The new production facility have a capacity of 400 tonnes of the tapioca pearls.

Some of the major players operating in the global market include:

- Boba Box Limited

- Bubble Tea House Company

- Chatime Group

- Coca Fresh Tea & Juice

- Cuppo Tee Company Limited

- Gong Cha

- K.O.I. The Co, Ltd.

- KF Tea Franchising LLC

- Lollicup USA Inc.

- Quickly

- Tbaar Inc.

- TIGER SUGAR

- Xing Fu Tang

- Yummy Town

Recent Developments

- In August 2023, Frazy, an emerging café-quality custom beverage start-up, announced about the launch of its Frazy Boba Tea to their popular Frazy Bottles with 6 new boba flavours.

- In June 2023, JOYBA, announced the launch of ‘Real Tea, Real Milk’ campaign and also said that they are partnering with Netflix’s Ginny & Georgia star. The company is bringing awareness with the launch of this new tea and is providing individuals with the knowledge, skills, and confidence.

Bubble Tea Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.19 billion |

|

Revenue forecast in 2032 |

USD 6.27 billion |

|

CAGR |

8.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Flavor, By Base Ingredient, By Component, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Bubble Tea Market Size Worth $ 6.27 Billion By 2032.

The top market players in Bubble Tea Market include Cuppo tea Company Limited, Chatime Group, Bubble Tea House Company.

North America is contribute notably towards the Bubble Tea Market.

The global bubble tea market is expected to grow at a CAGR of 8.8% during the forecast period.

Bubble Tea Market report covering key segments are flavor, base ingredient, component, and region.