Chipotle Salt Market Share, Size, Trends, Industry Analysis Report,

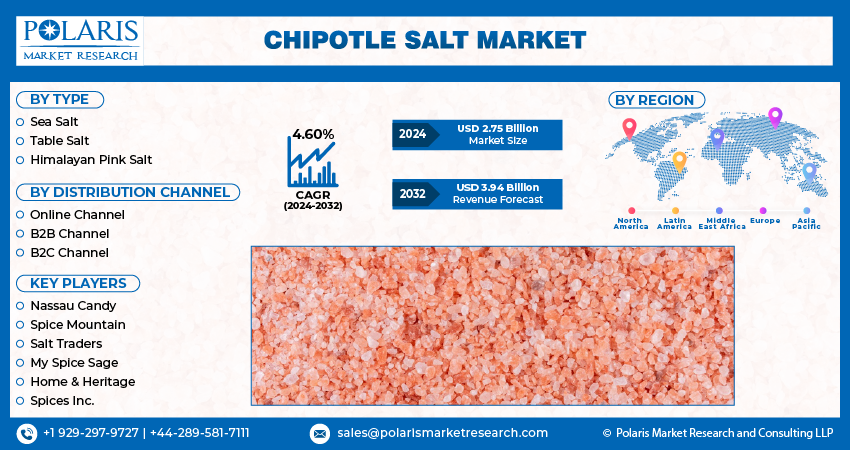

By Type (Sea Salt, Table Salt, Himalayan Pink Salt); By Distribution Channel (Online Channel, B2B Channel, B2C Channel); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 112

- Format: PDF

- Report ID: PM3505

- Base Year: 2023

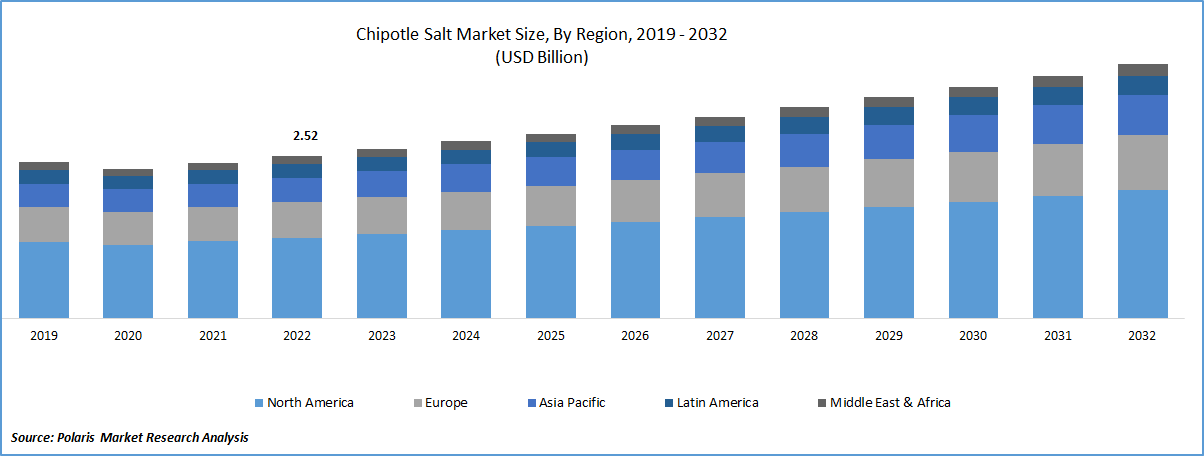

- Historical Data: 2019-2022

Report Outlook

The global chipotle salt market was valued at USD 2.63 billion in 2023 and is expected to grow at a CAGR of 4.60% during the forecast period. Growth of the market is attributed to including changing consumer preferences, the increasing popularity of Mexican cuisine, and the health benefits associated with using natural sea salts. Chipotle salt is a type of seasoning that combines ground chipotle chili peppers with salt. The result is a smoky and slightly spicy flavor that can be used to enhance the taste of a wide variety of dishes, including meats, vegetables, and snacks. Chipotle salt is a popular ingredient in Mexican and Southwestern cuisine, and it can be used as a rub for grilling or as a finishing salt to add flavor to a dish.

To Understand More About this Research: Request a Free Sample Report

To make chipotle salt, dried and smoked chipotle chili peppers are ground into a fine powder and then mixed with salt. The amount of Chipotle used can vary depending on the desired level of spiciness. Some variations of chipotle salt may also include other ingredients, such as garlic or paprika, to enhance the flavor.

Chipotle salt can be found in specialty food stores and online retailers, and it is also easy to make at home. It can be used as a substitute for regular salt in many recipes to add a smoky and spicy flavor. Chipotle salt is also a popular ingredient in homemade spice blends and rubs for grilling and smoking meats. Chipotle salt can be used as a rub for meats, added to soups and stews for flavor, sprinkled on vegetables before roasting, or used as a finishing seasoning for dishes like avocado toast or popcorn. It is a versatile seasoning that can add a unique smoky and spicy flavor to many different types of dishes.

Chipotle salt is gaining popularity in the market owing to the increasing demand for natural and healthy ingredients in the food industry. Consumers are becoming more health-conscious and are seeking out natural and organic alternatives to traditional seasoning blends. Chipotle salt is made with natural ingredients, and many brands offer organic options, making it an attractive seasoning choice for health-conscious consumers. Additionally, the popularity of Mexican cuisine has also contributed to the growing demand for Chipotle salt. Chipotle is a type of smoked chili pepper commonly used in Mexican cooking, and it imparts a distinct smoky flavour to dishes. As Mexican cuisine has become more popular worldwide, so has the use of Chipotle as a flavoring agent.

Industry Dynamics

Growth Drivers

Chipotle salt market is expected to drive the growth of market in the coming years, as consumers continue to seek out flavourful and healthy seasoning options and different flavors for their meals. For example, In October 2021, Spice Lab company announced that it had experienced record sales growth over the past year, with its flavoured salt products, including Chipotle salt, being particularly popular among consumers. Spice Lab attributes this growth to the increasing demand for natural and high-quality seasonings, as well as the convenience and versatility of its products.

The popularity of Mexican cuisine, particularly in the US, has driven the growth of the Chipotle Salt Market. For instance, Salts of the 7 Seas offers a range of flavoured sea salts, including Chipotle Salt, that can be used to enhance the flavour of Mexican dishes. The trend of flavor-infused salts has been growing in recent years, with consumers looking for more unique and exciting flavour profiles. For example, Smoked Olive, offers a range of smoked and flavoured salts, including Chipotle Salt.

The new product launches in the Chipotle salt market highlight the ongoing innovation and product development efforts of key players in the Chipotle salt market. As consumers continue to seek out high-quality, natural seasonings that can add flavour and depth to their meals, companies like Frontier Co-op and Spice Lab are responding with new and innovative products that cater to these evolving tastes and preferences. The company's organic Chipotle salt products are particularly popular among consumers who are seeking out natural and healthy seasoning options.

Report Segmentation

The Chipotle salt market is segmented based on type, distribution channel, and region.

|

By Type |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The sea salt segment is expected to witness fastest growth in the forecast period

Sea salt is generally considered to be the most popular type of salt used in Chipotle Salt due to its natural and unrefined form, which contains more trace minerals than table salt. Himalayan pink salt is also gaining popularity due to its unique pink color and alleged health benefits. However, table salt is typically not used as much in the production of chipotle salt due to its highly refined and processed nature. It is important to note that the popularity of each type of salt can vary depending on consumer preferences and geographic location, so there is no clear winner in terms of market share.

The online channel segment accounted for the largest market share in 2022

The online channel has emerged as a significant distribution channel for Chipotle salt products. The rise of e-commerce and increasing online shopping behavior has made it easier for consumers to purchase Chipotle salt products from the comfort of their homes. Additionally, many online retailers offer a wide variety of Chipotle salt products, making it easier for consumers to find specific types and flavors of Chipotle salt.

B2B and B2C distribution channels also play a significant role in the Chipotle Salt Market. B2B distribution channels, such as supplying to restaurants and food service providers, are essential for manufacturers to reach a larger customer base. B2C distribution channels, such as supermarkets, specialty stores, and convenience stores, are also important for manufacturers to reach individual consumers.

North America garnered the largest revenue share in 2022

North America is currently the largest region driving the market, and it is expected to continue to dominate the market in the coming years. The increasing popularity of Mexican cuisine and the growing demand for natural and organic seasoning options are driving market growth in this region. The Spice Lab., based in Florida, offers a range of gourmet sea salts, including a Chipotle Salt variety. The Spice Lab's Chipotle Salt has gained popularity in North America due to its unique flavour and high-quality ingredients. The company also offers a range of other seasoning products, including smoked salts and blends, which are designed to appeal to health-conscious consumers who are looking for natural and healthy ingredients.

However, Europe is emerging as a popular region creating lucrative growth in the Chipotle salt market. The growth in the region is attributed to the rising desire for distinct sweet and tangy flavors owing to the number of people preferring a blend of the spicy and sweet flavor of salt in a variety of dishes provided by Chipotle salt.

Competitive Insight

Some of the major players operating in the global market include Nassau Candy, Spice Mountain, Salt Traders, My Spice Sage, Home & Heritage, and Spices Inc.

Recent Developments

- In 2020, Salts of the 7 Seas launched a new line of organic, non-GMO, and gluten-free sea salts, including a Chipotle Salt variety. The company's new line is designed to appeal to health-conscious consumers who are looking for natural and healthy ingredients.

- In June 2021, The Spice Lab launched a new line of smoked sea salts, including a Chipotle Salt variety with all-natural ingredients that features a bold, smoky flavor that is ideal for use on meats, vegetables, and other dishes. The company's new line is designed to appeal to consumers who are looking for unique and flavourful seasoning options for their dishes.

- In 2021, San Francisco Salt Company launched a new line of gourmet sea salts, including a Chipotle Salt variety. The company's new line is designed to appeal to consumers who are looking for high-quality and flavourful salts for their cooking and seasoning needs.

- In March 2021, Frontier Co-op introduced its new Organic Chipotle Adobo Seasoning, which combines Chipotle pepper with other natural ingredients such as garlic, onion, and paprika, to create a versatile seasoning blend that can be used to add flavour to a wide range of dishes.

Chipotle Salt Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.75 billion |

|

Revenue forecast in 2032 |

USD 3.94 billion |

|

CAGR |

4.60% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Latin America, Europe, Middle East & Africa, Asia Pacific |

|

Key companies |

Nassau Candy, Spice Mountain LTD, Salt traders, My Spice Sage, Home & Heritage, Spices Inc. |

FAQ's

The global Chipotle Salt market size is expected to reach USD 3.94 billion by 2032.

top market players in the Chipotle Salt marketNassau Candy, Spice Mountain, Salt Traders, My Spice Sage, Home & Heritage, and Spices Inc.

North America contribute notably towards the global Chipotle Salt market.

The global chipotle salt market expected to grow at a CAGR of 4.6% during the forecast period.

The Chipotle Salt Market report covering key are type, distribution channel, and region.