Connected Aircraft Market Share, Size, Trends, Industry Analysis Report,

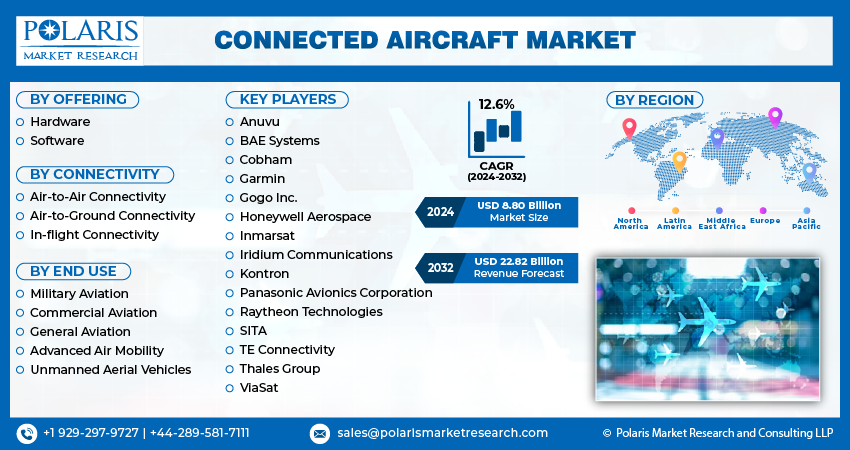

By Offering (Hardware, Software); By Connectivity; By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4379

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

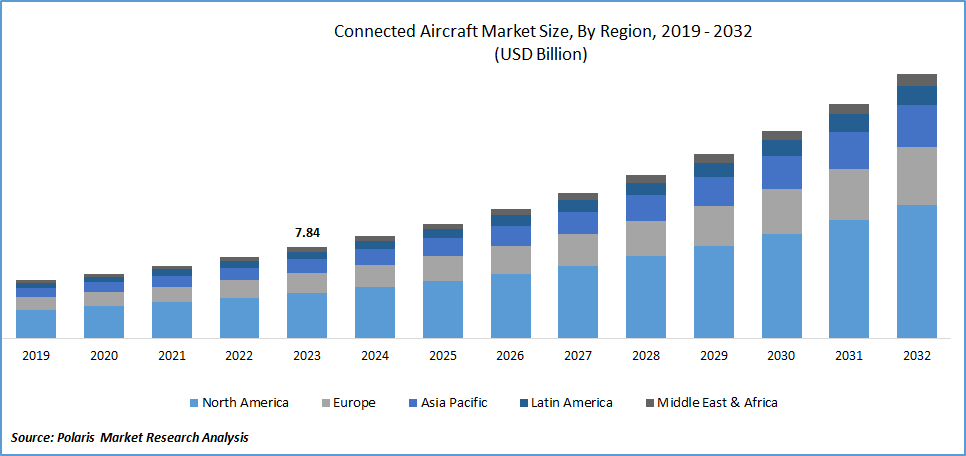

The global connected aircraft market was valued at USD 7.84 billion in 2023 and is expected to grow at a CAGR of 12.6% during the forecast period.

The integration of connected aircraft technologies significantly improves safety standards by providing real-time data on crucial factors such as weather conditions, air traffic patterns, and potential hazards. Air traffic controllers and pilots gain from this improved situational awareness, which promotes safer and more efficient flight operations.

Adoption of connected aircraft systems is required due to the constantly changing aviation laws. Airlines are investing more and more in technologies that guarantee adherence to changing regulatory requirements pertaining to communication, safety, and thorough data capture.

To Understand More About this Research: Request a Free Sample Report

- For instance, in October 2023, Porter Airlines of Canada and Viasat, Inc. revealed that Viasat's in-flight connectivity and wireless In-Flight Entertainment (IFE) systems will be integrated at the factory on an additional 20 new Embraer E195-E2 aircraft on order.

The market for connected aircraft is being driven primarily by rapid improvements in technology, such as satellite communication systems, the Internet of Things (IoT), and improved avionics. These advancements improve overall technological capabilities by facilitating effective data transmission, seamless networking, and the integration of intelligent technologies within the aircraft. In a market where competition is severe, providing excellent in-flight amenities and connectivity has become a strategic need for airlines. The integration of connected aircraft technologies is a crucial distinction that gives airlines a competitive advantage over their rivals by luring passengers with improved services.

Through a number of methods, connected aircraft systems greatly save costs. These technologies are financially appealing to the airline sector because they increase the overall financial performance of airlines through decreased operational disruptions, streamlined maintenance schedules, and improved fuel efficiency. The increasing amount of air travel worldwide highlights the necessity for advanced navigation and communication systems. The management of the growing complexity of air traffic is made possible by connected aircraft technologies, which guarantee effective and well-organized air travel operations worldwide.

The market for connected aircraft is being driven by the integration of cutting-edge technologies like edge computing, 5G connectivity, and artificial intelligence. Future advancements are made possible by these technologies, which also increase the capacity for data processing and allow for more complex applications. The adoption of connected aircraft systems is being influenced by the aviation industry's dedication to environmental sustainability. These technologies enable more environmentally friendly operations through fuel-saving, improved routes, and effective flight planning. These developments are in line with the industry's objective of lessening its environmental impact.

Industry Dynamics

Growth Drivers

Rise in Demand for In-Flight Connectivity and Greater Need for Operational Efficiency

As more travelers look for seamless internet access and a wide range of entertainment options while flying, the demand for in-flight connection and entertainment is rising. Due to this, airlines are now making large investments in connected aircraft technologies in an effort to meet and even surpass the changing expectations of their passengers for a more interactive and seamless air travel experience.

Connected aircraft solutions are essential for improving operational effectiveness. Predictive maintenance is made possible by continuous aircraft health monitoring through real-time data transfer. Furthermore, these systems enable more effective flight planning, which minimizes aircraft downtime and contributes to significant cost savings, maximizing overall operational effectiveness.

Report Segmentation

The market is primarily segmented based on offering, connectivity, end use, and region.

|

By Offering |

By Connectivity |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Offering Analysis

The software segment accounted for a significant market share in 2023.

The software segment accounted for a significant market share. Facilitating seamless communication between onboard systems, cockpit, and ground control, the software ensures real-time data transmission for improved decision-making, predictive maintenance, and operational efficiency. Elevating passenger experiences, it provides high-speed internet, entertainment streaming, and personalized services. Additionally, the software enhances safety through advanced avionics, improving navigation, weather monitoring, and collision avoidance. Owing to technological innovation, the evolution of connected aircraft software continues, incorporating artificial intelligence and blockchain for optimized operations, data security, and future advancement.

By Connectivity Analysis

The in-flight connectivity segment accounted for a significant market share in 2023.

The in-flight connectivity segment accounted for a significant market revenue share. In-flight connectivity is now an essential part of the flying experience, meeting the expectations of a connected world. Airlines are investing in cutting-edge technology and partnerships to offer high-speed internet and real-time communication. This demand, intensified by the pandemic, prompts accelerated efforts to upgrade connectivity. The future promises 5G speeds, IoT integration, and AI personalization. Yet, challenges like regulation and cybersecurity require collaborative solutions for a safe, secure, and connected aviation future.

By End Use Analysis

The commercial aviation segment accounted for the largest market share in 2023.

The commercial aviation segment accounted for the largest market share in 2023. The primary driver behind the use of advanced connectivity in commercial aircraft is the desire to improve passenger experiences. Airlines are providing seamless connectivity during flights by installing in-flight entertainment systems and Wi-Fi. This meets the demands of modern travelers. Aside from amenities focused on passengers, connected aircraft allow for real-time data transfer, which improves operational effectiveness. Airlines use predictive analytics, quicker maintenance processes, and enhanced safety measures owing to this connectivity. These technologies lower operating costs, improve reliability and lessen downtime.

Regional Analysis

North America accounted for the largest revenue share in 2023

North America accounted for the largest revenue share of the market and is likely to hold the same dominance over the market forecast period. The connected aircraft sector in the region is essential to boosting airline operations' efficiency, facilitating real-time data transmission, and improving the customer experience. Airlines are using these technologies more frequently in order to provide smooth passenger connectivity, facilitate effective communication between the pilot and ground control, and use predictive analytics to enhance maintenance procedures. In North America, the connected aircraft market is dominated by telecommunications firms, aircraft manufacturers, and technology suppliers working together to create and execute cutting-edge solutions. The North American connected aircraft market is anticipated to develop further, propelling advances in aviation technology as the demand for connectivity and data-driven insights grows.

Asia-Pacific is expected to experience significant market growth during the forecast period. Growing air travel demand has increased the focus on enhancing the whole passenger experience. Meeting these expectations is facilitated by connected aircraft technology, including real-time communication, entertainment systems, and in-flight Wi-Fi. Airlines and aircraft manufacturers in the region are implementing sophisticated avionics systems that provide data exchange, analytics, and communication. The maintenance protocols, safety, and operating efficiency are improved. For safe and effective operations, real-time data transfer between aircraft and ground control is essential. The smooth interchange of data made possible by connected aircraft technologies helps airlines make well-informed decisions and react quickly to changes.

Key Market Players & Competitive Insight

The connected aircraft market faces fierce rivalry, with companies leveraging cutting-edge technology, top-notch product offerings, and a robust brand reputation to propel revenue expansion. Key market players employ diverse tactics, including dedicated research and development, strategic mergers and acquisitions, and continuous technological advancements. These strategic maneuvers are aimed at broadening their product ranges and sustaining a competitive advantage. The market dynamic is shaped by constant innovation and a commitment to delivering high-quality solutions, underscoring the importance of strategic initiatives in ensuring sustained competitiveness.

Some of the major players operating in the global market include:

- Anuvu

- BAE Systems

- Cobham

- Garmin

- Gogo Inc.

- Honeywell Aerospace

- Inmarsat

- Iridium Communications

- Kontron

- Panasonic Avionics Corporation

- Raytheon Technologies

- SITA

- TE Connectivity

- Thales Group

- ViaSat

Recent Developments

- In May 2023, Inmarsat unveiled an updated version of its Jet ConneX (JX) inflight broadband solution, introducing a range of new service plans aimed at redefining connectivity within the business aviation market. These innovative service plans deliver improved performance utilizing JetWave terminal, developed in collaboration with Inmarsat's partner, Honeywell.

Connected Aircraft Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.80 billion |

|

Revenue forecast in 2032 |

USD 22.82 billion |

|

CAGR |

12.6% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Offering, By Connectivity, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global connected aircraft market size is expected to reach USD 22.82 billion by 2032

Garmin, Gogo Inc., Honeywell Aerospace, Inmarsat, Iridium Communications, Panasonic Avionics Corporation are the top market players in the market.

North America region contribute notably towards the global Connected Aircraft Market.

The global connected aircraft market is expected to grow at a CAGR of 12.6% during the forecast period.

Offering, connectivity, end use, and region are the key segments in the Connected Aircraft Market.