Global Digital PCR Market Size, Share, Trends, Industry Analysis Report

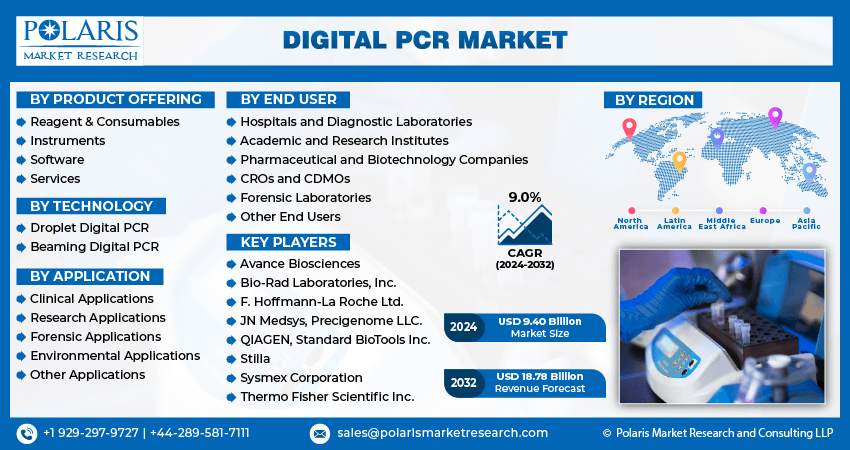

: Information By Product Offering (Reagent & Consumables, Instruments, Software, Services), By Technology, By Application, By End User, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 116

- Format: PDF

- Report ID: PM4989

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

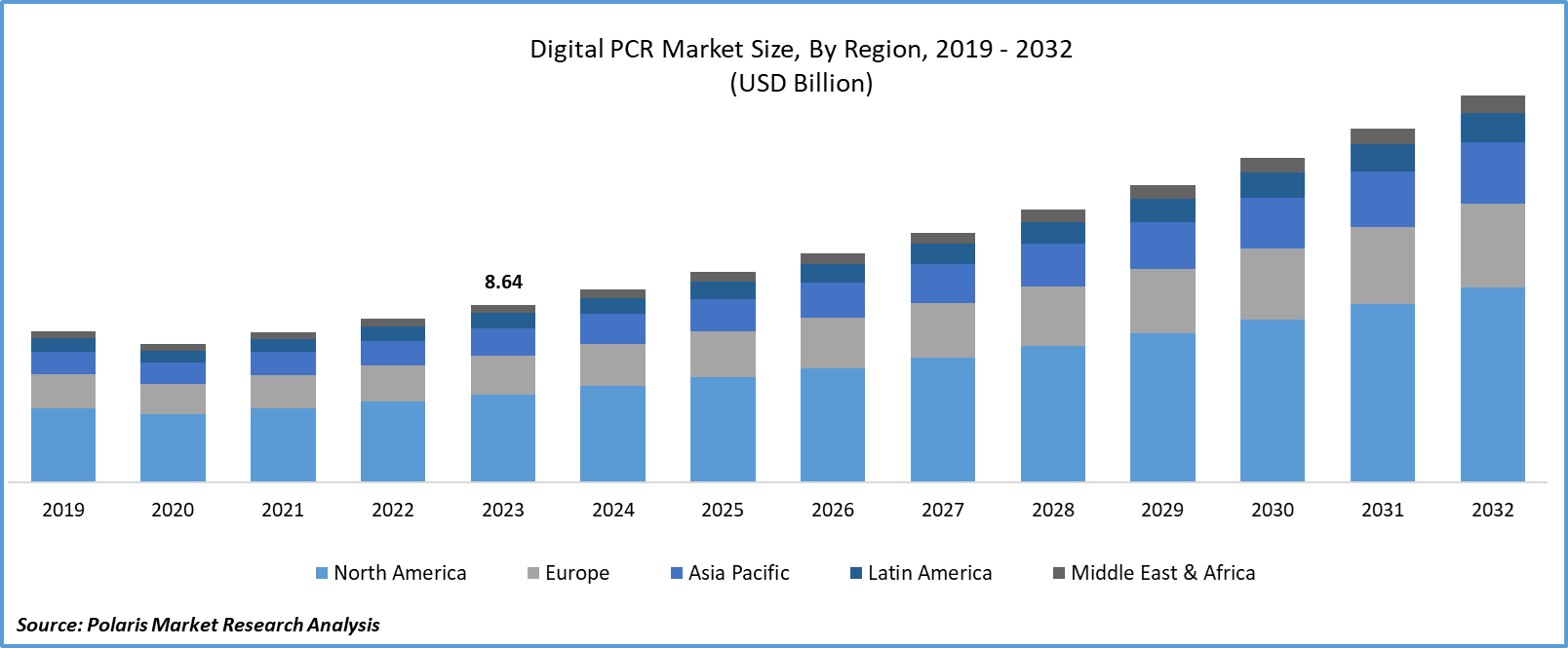

Global digital PCR market size was valued at USD 8.64 billion in 2023. The digital PCR industry is projected to grow from USD 9.40 billion in 2024 to USD 18.78 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 9.0% during the forecast period (2024 - 2032).

Digital PCR, a specialized form of endpoint PCR, is tailored for absolute quantification and the analysis of minority sequences within a background of predominant sequences. This technology excels in precision and sensitivity for nucleic acid quantification, driving its increasing adoption across various applications. In contrast, traditional PCR, which relies on agarose gel electrophoresis to detect amplified products, offers semi-quantitative results and is being gradually supplemented by the higher accuracy and reliability of digital PCR technologies in the expanding digital PCR market.

The rise in diabetic cases has boosted the need for accurate diagnostic tools, driving demand in the digital PCR (polymerase chain reaction) market. Digital PCR technology provides highly precise and sensitive detection of genetic markers linked to diabetes, facilitating early diagnosis and personalized treatment strategies. Its capability to detect infrequent modifications and quantify target DNA with remarkable precision is crucial for observing disease advancement and assessing treatment effectiveness in diabetic patients. Furthermore, ongoing research and development efforts drive innovations in product development, continually enhancing the efficiency, accuracy, and speed of digital PCR systems.

To Understand More About this Research: Request a Free Sample Report

These advancements cater to growing demands for precise nucleic acid quantification across biotechnology, healthcare, and diagnostics. R&D initiatives prioritize enhancing assay sensitivity, multiplexing capabilities, and automation, empowering researchers to tackle complex biological inquiries with heightened precision and throughput. As a result, the digital PCR market experiences sustained growth, driven by organizational investments in R&D to remain competitive and meet evolving customer expectations for advanced molecular analysis technologies.

Digital PCR Market Trends

Technological Advancements in Digital PCR is Driving the Market Growth

Market CAGR for digital PCR is being driven by technological advancements, such as continuous improvements in digital PCR technologies that have led to enhanced precision and sensitivity in nucleic acid quantification. This allows for more accurate detection of genetic mutations, rare sequences, and low-abundance targets, which is crucial in both clinical diagnostics and research settings. Innovations in automation have streamlined workflows and increased throughput in digital PCR systems. Automated platforms reduce human error, improve efficiency, and enable high-throughput processing of samples, thereby meeting the growing demand for scalability and rapid analysis in laboratories.

Furthermore, advancements in digital PCR technology and an increasing number of product launches in the global market are expected to drive growth in the digital PCR industry.

For instance, in June 2021, Bio-Rad Laboratories, Inc., a prominent player in the life sciences sector, introduced its PREvalence ddPCR SARS-CoV-2 wastewater quantification kit designed for COVID-19 wastewater testing.

Rising Prevalence of Cancer

The digital PCR market is witnessing substantial growth, mainly driven by the increasing prevalence of cancers such as lung cancer, blood cancer, and brain tumors. These conditions necessitate precise and sensitive molecular diagnostics for accurate detection and monitoring. Digital PCR tests play a crucial role in molecular cancer diagnosis, offering enhanced capabilities in detecting rare mutations and monitoring disease progression. As the demand for accurate and early cancer detection rises, digital PCR technology is becoming increasingly indispensable in oncology, contributing significantly to the digital PCR market's expansion.

For instance, according to GLOBOCAN 2020 estimates from the International Agency for Research on Cancer, there were approximately 19.3 million new cancer cases and nearly 10.0 million cancer-related deaths globally. This significant burden underscores the increasing healthcare expenditures in developing countries and the rising demand for precise molecular diagnostics contributing to driving the digital PCR market revenue.

Digital PCR Market Segment Insights

Digital PCR Product Offering Insights

The global digital PCR market segmentation, based on product offering, includes reagents & consumables, instruments, software, and services. In 2023, the instruments segment accounted for the largest market share. Instruments in the digital PCR market encompass the hardware and equipment necessary to perform digital PCR tests, including dPCR systems, thermal cyclers, and associated consumables. Continuous innovations in dPCR instruments have improved their sensitivity, accuracy, and throughput, making them more efficient and reliable for molecular diagnostics and research applications.

Manufacturers are expanding their product portfolios and geographic presence through strategic partnerships, collaborations, and product launches. This expansion aims to meet the diverse needs of customers and capitalize on emerging market opportunities.

For instance, In August 2022, Roche presented the Digital LightCycler System, marking its debut in digital PCR technology. This advanced system is tailored for the precise detection of diseases, enabling accurate quantification of minute amounts of specific DNA and RNA targets that conventional PCR methods often cannot detect. The system is capable of conducting PCR and performing advanced data analysis on the outcomes.

Digital PCR Application Insights

The global digital PCR market segmentation, based on application, includes clinical applications, research applications, forensic applications, environmental applications, and other applications. The research application segment held the largest market share in 2023. Researchers in genetics, molecular biology, and biomedical sciences need precise tools for nucleic acid quantification. Digital PCR offers accuracy and sensitivity, ideal for research applications driving the research segment in the digital PCR market.

Furthermore, forensic applications are expected to grow significantly during the forecast period due to rising collaborations between academic institutions, research organizations, and market key players. The players have facilitated the integration of digital PCR into various research projects. These partnerships help in the development of new applications and expand the reach of dPCR technology.

For instance, in May 2024, Qiagen N.V. joined a collaborative research and development agreement (CRADA) with the U.S. Federal Bureau of Investigation (FBI) to develop an innovative test for its QIAcuity digital PCR devices. This collaboration aims to enhance forensic science by enhancing the quantification of DNA in human samplings.

Global Digital PCR Market, Segmental Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Digital PCR Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America holds the largest share of the digital PCR market during the forecast period due to its highly developed healthcare infrastructure, which facilitates the adoption of advanced technologies like PCR. Hospitals, diagnostic laboratories, and research institutions in the region are well-equipped with advanced tools and resources to invest in sophisticated diagnostic and research technologies, further driving the market growth.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

The United States digital PCR market held the largest market share in 2023, primarily due to the high prevalence of chronic diseases such as cancer, cardiovascular diseases, and infectious diseases. The precision and sensitivity of dPCR make it an indispensable tool for early diagnosis, disease monitoring, and personalized treatment, thereby driving its demand in clinical diagnostics. The market is further bolstered by the strong presence of leading companies such as Bio-Rad Laboratories, Thermo Fisher Scientific, and Qiagen. Their extensive distribution networks and continuous product innovations instill confidence in the digital PCR market's stability and growth.

For instance, in September 2021, Thermo Fisher Scientific presented the Applied Biosystems QuantStudio Absolute Q Digital PCR System, the first completely incorporated digital PCR (dPCR) system engineered to deliver positively correct and consistent developments in just 90 minutes.

The Canadian digital PCR market has a significant market share due to continuous technological innovations leading to improvements in dPCR platforms. These advancements enhance accuracy, efficiency, and ease of use, attracting more users and expanding the applications of dPCR in various fields. The collaboration between key players demonstrates the potential of dPCR technology in providing reliable and timely data, boosting confidence in its applications, and driving the market for the future.

For instance, in August 2021, QIAGEN and G.T. Molecular announced a collaboration to provide a comprehensive SARS-CoV-2 wastewater detection solution utilizing QIAcuity Digital PCR technology. This advanced workflow is designed to comply with CDC guidelines for new U.S. wastewater surveillance systems and is also applicable for use in Canada and other countries globally.

The Asia-Pacific digital PCR market is projected to experience the highest compound annual growth rate (CAGR) during the forecast period. Many countries in the Asia-Pacific region are significantly increasing their healthcare budgets. Governments and private sectors are investing in advanced healthcare technologies, including molecular diagnostics, to improve healthcare infrastructure and patient outcomes. This investment fuels the adoption of innovative diagnostic tools like dPCR.

Additionally, India's digital PCR market held the largest market share in 2023 due to the rising prevalence of chronic diseases such as cancer, infectious diseases, and genetic disorders. On the other hand, China's digital PCR market is expected to continue its steady growth during the forecast period, with heavy investments in biotech research leading to increased use of dPCR technology in various research applications.

Further, the major countries studied in the market report are the US, Canada, German, France, the U.K., Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, and others.

Global Digital PCR Market Regional Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Digital PCR Key Market Players & Competitive Insights

Leading market players are driving innovation and expanding the application scope of this advanced molecular technology. These companies focus on strategic partnerships, product launches, and extensive research and market development activities to maintain their competitive edge and meet the growing demand for precise nucleic acid quantification. The competitive landscape is dynamic, with continuous advancements and strategic initiatives shaping the future of the dPCR industry.

The digital PCR market is poised for significant growth, driven by the efforts of key players to innovate, collaborate, and expand their reach, which drives the global digital PCR industry. Major players in the digital PCR market, including Thermo Fisher Scientific Inc., QIAGEN, Bio-Rad Laboratories, Inc., Sysmex Corporation, JN Medsys, Stilla, Standard BioTools Inc., Precigenome LLC., F. Hoffmann-La Roche Ltd., and Avance Biosciences.

Thermo Fisher Scientific Inc. provides services to the scientific community. They are improving patient health via diagnostics, promoting the study of life sciences, resolving complex analytical problems, increasing lab productivity, or creating and producing therapies that will change people's lives. Its instruments, apparatus, software, services, and consumables enable scientists to address challenging analytical problems in pharmaceutical, biotechnology, academic, and clinical laboratory research. In 2021, Thermo Fisher acquired Combinati and its advanced digital PCR (dPCR) technology to develop and commercialize it rapidly, complementing their expanding portfolio of assays.

F. Hoffmann-La Roche Ltd is a prominent biotechnology firm dedicated to advancing medical solutions for various significant ailments. Its focus encompasses the development of drugs and diagnostic tools to combat major diseases, such as cancer, autoimmune disorders, central nervous system conditions, and respiratory issues. Roche also provides comprehensive diabetes management solutions, in vitro diagnostic systems, and cutting-edge cancer diagnostics based on tissue analysis. In February 2022, Roche expanded its COVID-19 PCR test portfolio by introducing the new Cobas 5800 System in countries that accept the CE Mark.

Key Companies in the Digital PCR market include:

- Avance Biosciences

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- JN Medsys

- Precigenome LLC.

- QIAGEN

- Standard BioTools Inc.

- Stilla

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Digital PCR Industry Developments

- November 2023: QIAGEN launched new QIAcuity digital PCR kits and software, expanding their use for food safety and biopharma customers.

- In March 2023, Atila BioSystems and Stilla Technologies announced a contract to market digital PCR kits and assays optimized for Stilla's 6-color Leica system for detecting circulating tumor DNA (ctDNA) from liquid biopsy samples in high-occurrence cancers like lung, melanoma, prostate, and colorectal.

- In October 2022, Standard BioTools Inc. launched X9 Real-Time PCR System. This creative, high-capacity genomics instrument is developed for superior efficiency, providing our customers with a reliable and powerful tool for their research.

Digital PCR Market Segmentation:

Digital PCR Product Offering Outlook

- Reagent & Consumables

- Instruments

- Software

- Services

Digital PCR Technology Outlook

- Droplet Digital PCR

- Beaming Digital PCR

Digital PCR Application Outlook

- Clinical Applications

- Research Applications

- Forensic Applications

- Environmental Applications

- Other Applications

Digital PCR, End User Outlook

- Hospitals and Diagnostic Laboratories

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- CROs and CDMOs

- Forensic Laboratories

- Other End Users

Digital PCR Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital PCR Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 8.64 billion |

|

Market size value in 2024 |

USD 9.40 billion |

|

Revenue Forecast in 2032 |

USD 18.78 billion |

|

CAGR |

9.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global digital PCR market size was valued at USD 8.64 billion in 2023 and is projected to grow to USD 18.78 billion by 2032.

The global market is projected to grow at a CAGR of 9.0% during the forecast period, 2024-2032.

North America held the largest share of the global market.

The key players in the market are Thermo Fisher Scientific Inc., QIAGEN, Bio-Rad Laboratories, Inc., Sysmex Corporation, JN Medsys, Stilla, Standard BioTools Inc., Precigenome LLC., F. Hoffmann-La Roche Ltd., and Avance Biosciences.

The instruments segment accounted for the largest market share in 2023.

The research application segment under the QPCR application held the largest market share in 2023.