Dry Type Transformer Market Share, Size, Trends, Industry Analysis Report,

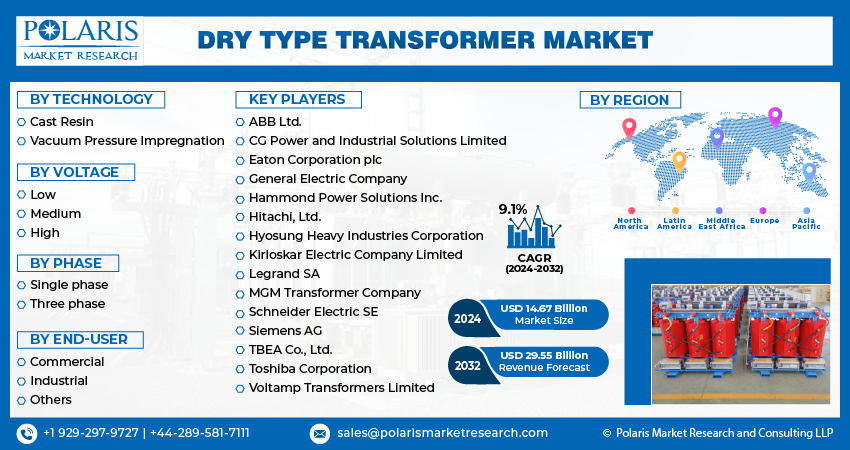

By Technology (Cast Resin, Vacuum Pressure Impregnation); By Voltage; By Phase; By End-User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4054

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

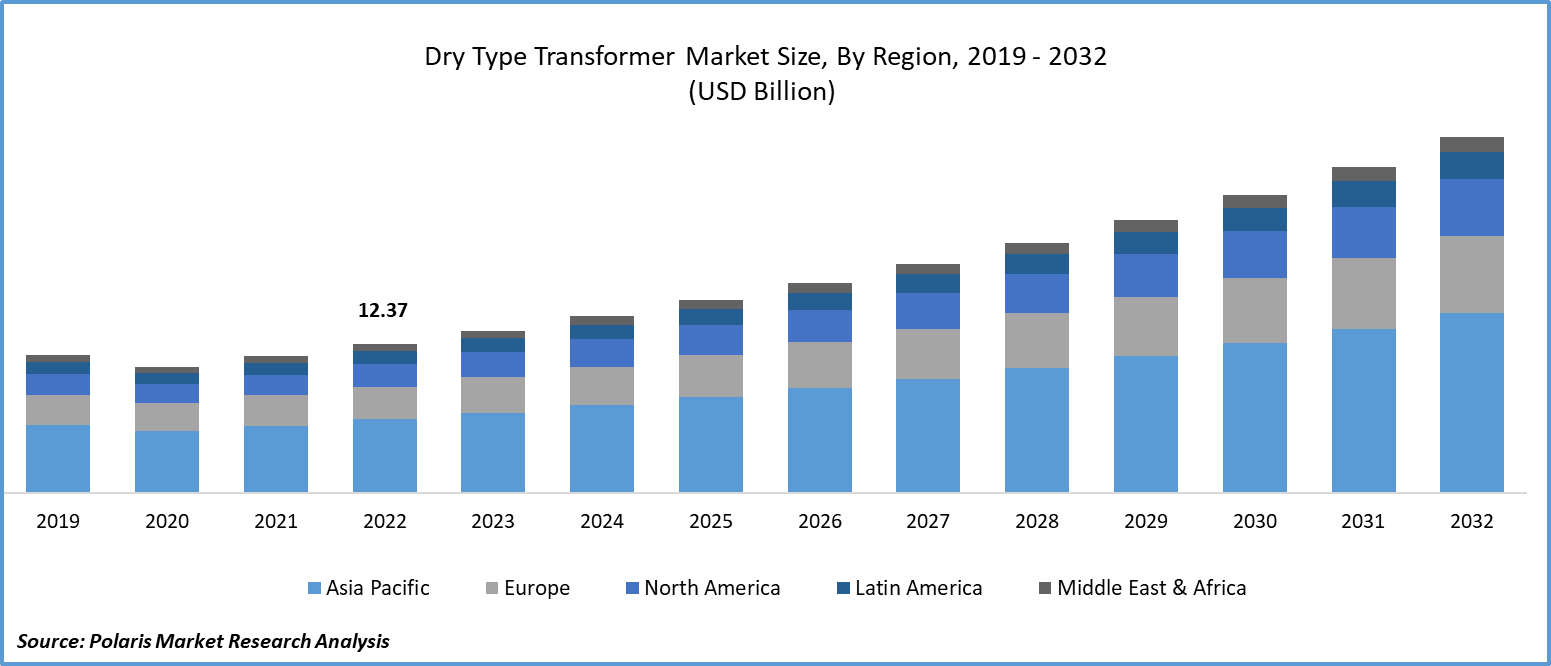

The global dry type transformer market was valued at USD 13.47 billion in 2023 and is expected to grow at a CAGR of 9.1% during the forecast period.

The dry type transformer market has exerted a significant influence across diverse industries, with a particularly notable impact observed in the energy sector. The escalating demand for electricity, alongside the imperative for efficient and dependable power distribution, has propelled the widespread adoption of dry type transformers. These transformers assume a critical role in the secure and efficient transmission of electricity, thereby bolstering the stability of power grids.

To Understand More About this Research: Request a Free Sample Report

Furthermore, environmental considerations have played a pivotal role in shaping the market's influence. The shift towards sustainable and eco-conscious solutions has resulted in a surge in the integration of dry type transformers. Their minimal environmental footprint, coupled with the absence of risks associated with oil usage, and adherence to stringent environmental regulations, have positioned them as the preferred choice for both utilities and industries.

- For instance, in June 2023, Hitachi Energy unveiled its most recent breakthroughs in Transformers Insulation and Components, providing engaging sessions with experts and debuting a new product in the bushing portfolio: EasyDry, an innovative dry-type, paperless bushing.

However, higher initial cost, and limited cooling capacity are the factors hampering the growth of dry type transformers market. Dry type transformers tend to have a higher upfront cost compared to their oil-immersed counterparts. This can be a deterrent for some budget-constrained projects or regions where the initial capital investment is a significant concern.

Additionally, while dry type transformers are efficient for moderate power applications, they may not be suitable for extremely high power levels where liquid cooling systems are more effective. This limitation can restrict their application in certain industrial settings.

Furthermore, the worldwide shift towards renewable energy sources opens up a significant avenue for the dry type transformer market. These transformers are ideally designed for integrating renewable energy sources into the grid, owing to their efficiency and advanced safety features. Also, with the global progression towards smarter, interconnected grids, there is a rising demand for cutting-edge transformers. Dry type transformers, characterized by their contemporary design and enhanced safety features, are positioned to take on a central role in the evolution of smart grid infrastructure.

Growth Drivers

- Rising energy consumption is projected to spur the product demand.

With the growing global population and increasing urbanization, there is an escalating demand for electricity. This surge in energy consumption is a primary driver of the dry type transformer market. These transformers are adept at handling high voltage levels, making them indispensable in modern power distribution networks.

Moreover, safety and reliability is another factor contributing to the growth of this market. Safety is a paramount concern in any industry. Dry type transformers eliminate the risk associated with oil-filled transformers, as they do not use flammable oil as a cooling medium. This renders them the preferred option for environments where fire safety is of paramount importance, such as high-rise buildings, hospitals, and underground substations.

The imposition of rigorous environmental regulations and the imperative to curtail carbon emissions have prompted a transition towards eco-conscious solutions. Dry type transformers, being free from hazardous oil, align perfectly with these sustainability goals. Their compliance with regulations like RoHS (Restriction of Hazardous Substances) further enhances their attractiveness.

Report Segmentation

The market is primarily segmented based on technology, voltage, phase, end-user, and region.

|

By Technology |

By Voltage |

By Phase |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Technology Analysis

- Cast resin segment is expected to witness highest growth during forecast period

The cast resin segment in the dry type transformer market has experienced robust growth in recent years. This surge can be attributed to the segment's remarkable insulation properties, which enhance the transformer's reliability and performance. Additionally, Cast Resin transformers are eco-friendly, as they do not contain hazardous materials. Their ability to operate efficiently in diverse environments, including high humidity and corrosive atmospheres, further contributes to their popularity. Moreover, the increasing adoption of renewable energy sources has propelled the demand for Cast Resin transformers, as they are well-suited for integration into modern, sustainable power systems. This segment is poised for continued expansion in the foreseeable future.

By Voltage Analysis

- Medium voltage segment accounted for the largest market share in 2022

The medium voltage segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period in various industrial and commercial applications. These transformers are adept at handling voltage levels between 1kV to 69kV, making them indispensable for medium-scale power distribution. Their compact size, reduced maintenance requirements, and enhanced safety features have bolstered their popularity. Additionally, as industries increasingly adopt advanced technologies, the demand for reliable and efficient medium voltage transformers has surged. The segment is poised for sustained growth, driven by the ongoing modernization of electrical infrastructure and the integration of renewable energy sources into the grid.

By Phase Analysis

- Single phase segment is expected to witness highest growth during forecast period

The single phase segment in the dry type transformer market has experienced robust growth in recent years. This surge can be attributed to the segment's versatility and applicability in various settings, especially in residential and small-scale commercial applications. Single Phase transformers are ideal for powering single-phase electrical systems, making them essential for homes and smaller businesses. Their compact size and ease of installation further contribute to their popularity. Additionally, as the demand for distributed energy resources continues to rise, Single Phase transformers play a pivotal role in facilitating decentralized power generation. This segment is poised for continued expansion in the evolving energy landscape.

By End-User Analysis

- Infrastructure segment held the significant market revenue share in 2022

The industrial segment in the dry type transformer market has experienced remarkable growth due to its pivotal role in powering heavy machinery and equipment across various industries. These transformers are engineered to withstand rigorous industrial environments, ensuring reliable and efficient power distribution. Industries such as manufacturing, mining, and petrochemicals heavily rely on them for uninterrupted operations. Additionally, the emphasis on energy efficiency and safety in industrial settings has further driven the demand for Dry Type Transformers. As global industrialization continues, the segment is poised for sustained growth, underpinned by the imperative for robust, high-performance electrical infrastructure in industrial applications.

Regional Insights

- Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed due to surge is propelled by rapid urbanization, industrialization, and infrastructural development across the region. Increasing energy demand, driven by a burgeoning population and expanding economies, has bolstered the adoption of dry type transformers. Stringent environmental regulations and a growing emphasis on sustainable energy solutions have also played a significant role. Moreover, technological advancements and government initiatives to modernize electrical infrastructure have further fueled market expansion. As Asia-Pacific continues its trajectory towards economic development, the dry type transformer market is poised for sustained and substantial growth.

North America is poised to exhibit the highest growth rate during the forecast period in the dry type transformer market. This remarkable growth can be attributed to the surging electricity demand in the region. As industries expand, and there's a growing focus on sustainable energy solutions, the need for reliable power distribution systems, including dry type transformers, has intensified. Furthermore, North America's drive for grid modernization and the integration of renewable energy sources contribute significantly to this upward trajectory. With its robust industrial sector and a commitment to meeting evolving energy demands, North America is primed to be a pivotal driver of growth in the dry type transformer market.

Key Market Players & Competitive Insights

The dry type transformer market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ABB Ltd.

- CG Power and Industrial Solutions Limited

- Eaton Corporation plc

- General Electric Company

- Hammond Power Solutions Inc.

- Hitachi, Ltd.

- Hyosung Heavy Industries Corporation

- Kirloskar Electric Company Limited

- Legrand SA

- MGM Transformer Company

- Schneider Electric SE

- Siemens AG

- TBEA Co., Ltd.

- Toshiba Corporation

- Voltamp Transformers Limited

Recent Developments

- In April 2022, Siemens Energy launched a dry-type single-phase transformer tailored for pole applications. Engineered to meet the specific demands of the American grid, this novel cast-resin distribution transformer offers a dependable and eco-friendly substitute for traditional oil-filled transformers.

Dry Type Transformer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.67 billion |

|

Revenue forecast in 2032 |

USD 29.55 billion |

|

CAGR |

9.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Technology, By Voltage, By Phase, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |