Elderly Nutrition Market Share, Size, Trends, Industry Analysis Report,

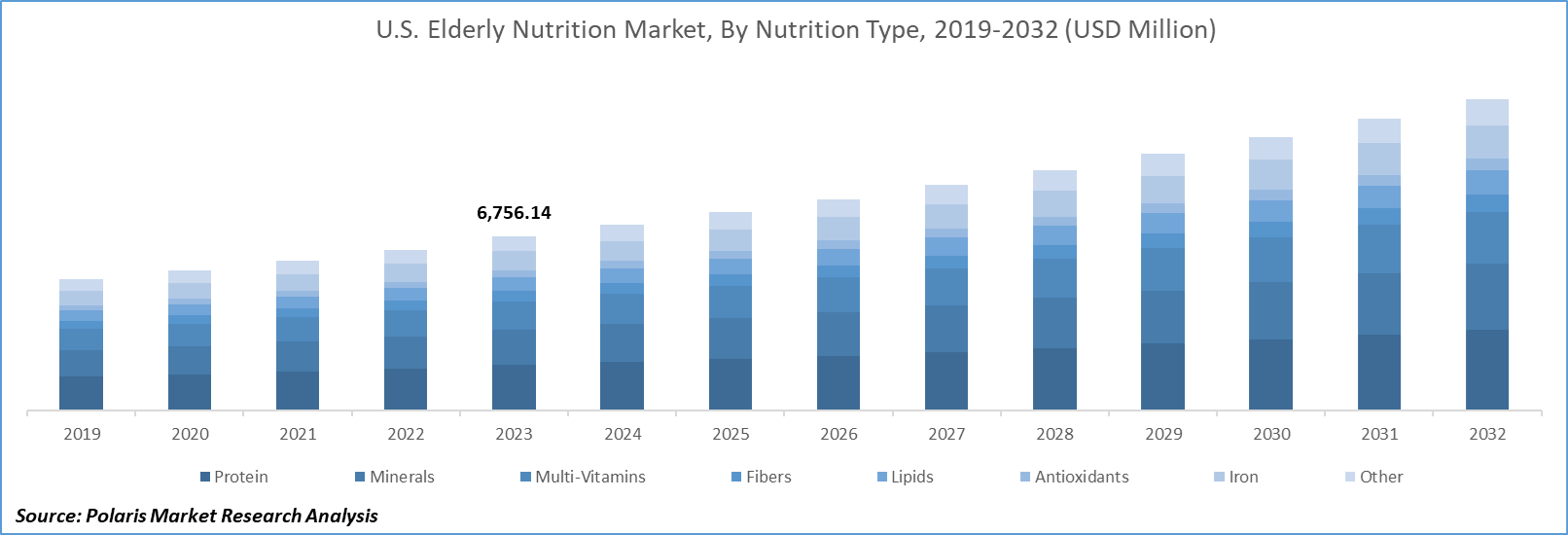

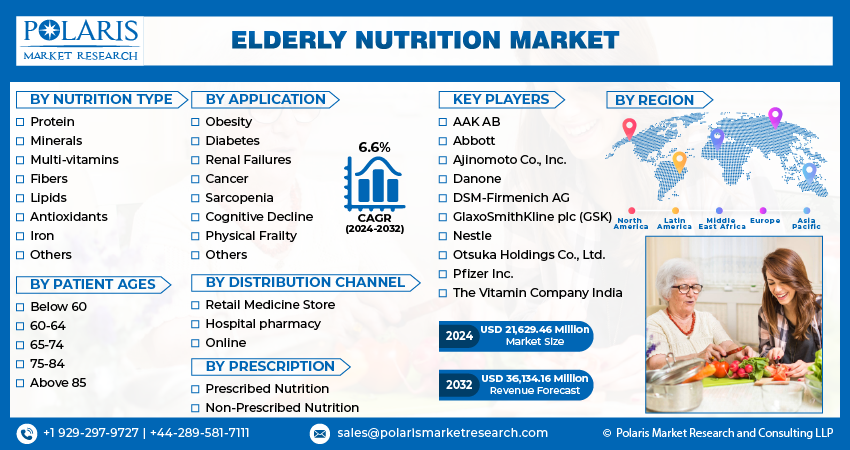

By Nutrition Type (Protein, Minerals, Multi-vitamins, Fibers, Lipids, Antioxidants, Iron, Others); By Application; By Distribution Channel; By Patient Ages; By Prescription; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 115

- Format: PDF

- Report ID: PM2918

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Elderly nutrition market size was valued at USD 20,294.11 million in 2023. The market is anticipated to grow from USD 21,629.46 million in 2024 to USD 36,134.16 million by 2032, exhibiting the CAGR of 6.6% during the forecast period.

Industry Trends

The Elderly Nutrition Market has emerged as a crucial segment within the broader health and wellness industry, catering to the specific dietary needs and challenges faced by aging populations worldwide. With advancements in healthcare and increased life expectancy, the Elderly Nutrition Market has witnessed significant growth in recent years. This growth is primarily driven by several key factors. Firstly, there is a growing awareness among the elderly population about the importance of nutrition in maintaining overall health and well-being. As individuals age, their nutritional requirements change, necessitating specialized dietary solutions to address age-related issues such as decreased appetite, loss of muscle mass, and reduced nutrient absorption. Consequently, there has been a rising demand for nutritionally dense and easy-to-consumer products tailored to the needs of seniors.

To Understand More About this Research:Request a Free Sample Report

Moreover, advancements in food science and technology have led to the development of innovative formulations specifically targeted at the elderly demographic. These formulations often focus on enhancing nutrient bioavailability, improving digestive health, and managing chronic conditions commonly associated with aging, such as osteoporosis and cardiovascular disease. Additionally, the proliferation of functional foods and supplements fortified with vitamins, minerals, and antioxidants has further fueled market growth, offering convenient solutions to bridge nutritional gaps in the elderly diet.

Key Takeaways

- North America dominated the market and contributed over 40% market share of the elderly nutrition market size in 2023

- By nutrition type category, the protein segment dominated the global elderly nutrition market size in 2023

- By application category, the diabetes segment is anticipated to grow with a significant CAGR over the elderly nutrition market forecast period

What Are the Market Drivers Driving the Demand for Market?

Increasing Use of Nutraceuticals and Dietary Supplements for Older Adults

The increasing use of nutraceuticals and dietary supplements among older adults reflects a growing trend in addressing the unique nutritional needs of this demographic within the elderly nutrition market. This trend is driven by several factors that intersect with the aging population's want for improved health and quality of life.

Firstly, advancements in research have shed light on the role of specific nutrients and bioactive compounds in supporting healthy aging and managing age-related conditions. Older adults are increasingly aware of the potential benefits of supplements such as proteins, vitamins, minerals, omega-3 fatty acids, and antioxidants in promoting longevity and reducing the risk of chronic diseases. For instance, In June 2020, Arla Foods Ingredients introduced a novel whey protein ingredient called Lacprodan HYDRO Rebuild. This innovative product is scientifically demonstrated to combat the natural decline of muscle mass associated with aging. It provides a rich source of branched-chain amino acids and essential amino acids like leucine, which play a crucial role in muscle synthesis among seniors. Additionally, it contributes to enhancing muscle mass, strength, and mobility in aging individuals.

Moreover, the aging process often brings about changes in nutrient absorption, metabolism, and physiological functions, leading to nutrient deficiencies or imbalances. As a result, older adults turn to supplements to bridge the gap between their dietary intake and nutritional requirements, especially when dietary restrictions or health conditions hinder optimal nutrient absorption. Additionally, lifestyle factors such as busy schedules, limited access to fresh foods, and preferences for convenience contribute to the appeal of nutraceuticals and dietary supplements as convenient and accessible means of obtaining essential nutrients.

Which Factor Is Restraining the Demand for the Market?

Rising Chronic Diseases Drives the Market

The increasing incidences of chronic diseases among geriatric patients have significantly influenced the elderly nutrition market in recent years. As the population ages, the prevalence of conditions such as diabetes, cardiovascular diseases, osteoporosis, and hypertension rises, necessitating a greater focus on dietary interventions tailored to meet the unique needs of older adults. For instance, according to the 2022 National Diabetes Statistics Report by the Centers for Disease Control and Prevention (CDC), over 130 million adults in the United States are affected by either diabetes or prediabetes. Type 2 diabetes is the predominant type, with communities of color, individuals residing in rural areas, and those with lower levels of education, income, and health literacy experiencing more significant impacts from the disease.

In addition, shifts in lifestyle habits, including sedentary behavior and poor dietary choices, have become more prevalent among aging populations. These lifestyle factors significantly impact health outcomes, exacerbating the risk of chronic diseases.

Report Segmentation

The market is primarily segmented based on nutrition type, application, distribution channel, patient ages, prescription, and region.

|

By Nutrition Type |

By Application |

By Distribution Channel |

By Patient Ages |

By Prescription |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Nutrition Type Insights

Based on nutrition type category analysis, the market has been segmented on the basis of protein, minerals, multi-vitamins, fibers, lipids, antioxidants, iron, and others. In 2023, protein emerged as the dominant segment in the global market because it is a vital macronutrient essential for maintaining normal bodily functions, including muscle repair, immune system support, and hormone regulation. As individuals age, the demand for protein in the elderly nutrition market increases due to various factors. One such factor is the growing awareness of the importance of protein consumption for overall health and well-being.

Additionally, advancements in research and development (R&D) have led to the creation of protein-based products tailored specifically for the elderly population. According to studies published by the National Library of Medicine, Research indicates that a higher dietary protein intake of up to 1.2 g/kg body weight per day allows to control sarcopenia and maintain musculoskeletal health in elderly individuals. This research highlights the role of protein in addressing age-related muscle loss, thereby emphasizing its importance in elderly nutrition.

By Application Insights

Based on application category analysis, the market has been segmented on the basis of obesity, diabetes, renal failures, cancer, sarcopenia, cognitive decline, physical frailty, and others. The diabetes segment is anticipated to grow with a significant CAGR in the forecasted years. Elderly individuals with diabetes require special attention to their nutrition to effectively manage their condition and maintain overall health. When selecting nutrition products for seniors with diabetes, it is essential to focus on options that are low in sugar and carbohydrates to help regulate blood sugar levels. For instance, in December 2021, Danone India launched Protinex Diabetes Care to meet the nutritional needs of Indians with diabetes, offering a scientifically developed product rich in protein, fiber, and low Glycemic Index aimed at managing blood sugar levels effectively. The initiative addresses the lack of awareness and inadequate nutrient intake among people with diabetes, with a focus on promoting healthier eating habits and lifestyle choices.

Additionally, meal supplement shakes such as Boost, Glucerna, Ensure, and Splenda can be convenient and beneficial choices as they are formulated to provide essential nutrients while being mindful of sugar content. These shakes can serve as meal replacements or snacks, offering a balanced option for elders who may have difficulty preparing or consuming regular meals.

Regional Insights

North America

North America accounted for a significant revenue share in the global market since elderly nutrition in the region is a significant concern as the aging population faces unique challenges related to maintaining optimal health through proper diet. With age, physiological changes, decreased appetite, and chronic conditions can impact nutrient intake and absorption, making it essential for older adults to focus on nutrient-dense foods. The Healthy Eating Index (HEI) suggests that older adults generally have better diet quality compared to other age groups. Protein intake is particularly important for older adults to prevent muscle loss and maintain strength. Vitamin B12 is also important for nerve function and the production of red blood cells, making it essential for overall health and well-being in older people. As individuals age, their nutritional needs change, often requiring additional support to maintain optimal health. Elderly nutrition supplements play a crucial role in addressing these changing needs by providing essential vitamins, minerals, and nutrients that may be lacking in the diet of older adults.

Asia Pacific

APAC is experiencing a rapid increase in its elderly population due to improvements in healthcare and rising life expectancies. This demographic shift creates a growing market for nutrition products and services tailored to the specific needs of older adults. Elderly individuals often face unique health challenges such as malnutrition, reduced appetite, chronic conditions, and age-related deficiencies. This drives the demand for nutritional supplements, functional foods, and specialized diets designed to support healthy aging and manage these health issues.

Competitive Landscape

The competitive landscape includes a wide range of products, including nutritional supplements, meal replacements, fortified foods and beverages, dietary fibers, vitamins, and minerals. Companies differentiate themselves based on the formulation, bioavailability, taste, convenience, and targeted health benefits of their products. Continuous research and development efforts drive innovation in the elderly nutrition market. Companies invest in developing products with enhanced nutrient absorption, reduced allergens, better taste and texture, and improved shelf stability. For example, there is a growing interest in plant-based and functional ingredients that offer health benefits beyond basic nutrition.

Some of the major players operating in the global market include:

- AAK AB

- Abbott

- Ajinomoto Co., Inc.

- Danone

- DSM-Firmenich AG

- GlaxoSmithKline plc (GSK)

- Nestle

- Otsuka Holdings Co., Ltd.

- Pfizer Inc.

- The Vitamin Company India

Recent Developments

- In November 2023, Nestlé introduces N3 milk with enhanced nutritional benefits and launches it initially in China. Amaing to individuals age, their nutritional needs evolve, necessitating specific nutrients to uphold their health and vitality and needs of healthy aging, Nestlé's N3 range comprises two products fortified with vitamins, minerals, and probiotics.

- In March 2024, Danone India has introduced its adult nutrition range, featuring zero-added-sugar versions of Protinex, now available in Tasty Chocolate and Vanilla Delight flavors.

- In September 2023, Danone has revealed plans for a €50 million expansion of its Opole production facility in Poland. This expansion is aimed at enhancing its medical nutrition capabilities to cater to patients globally as the company pursues additional growth in the adult medical nutrition market.

- In September 2021, Abbott announced the launch of the Abbott Center for Malnutrition Solutions, a global hub partnering with nutrition experts. It aims to address malnutrition in vulnerable populations, including mothers, infants, aging adults, and those lacking access to adequate nutrition.

Report Coverage

The elderly nutrition market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, nutrition type, application, distribution channel, patient ages, prescription, and their futuristic growth opportunities.

Elderly Nutrition Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 21,629.46 million |

|

Revenue forecast in 2032 |

USD 36,134.16 million |

|

CAGR |

6.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Nutrition Type, By Application, By Distribution Channel, By Patient Ages, By Prescription, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Elderly Nutrition Market report covering key segments are type, application, distribution channel, patient ages, prescription, and region

Elderly Nutrition Market Size Worth USD 36,134.16 Million by 2032

Elderly nutrition market exhibiting the CAGR of 6.6% during the forecast period.

North America is leading the global market

The key driving factors in Elderly Nutrition Market are Rising Chronic diseases drives the market.