Electric Tractor Market Share, Size, Trends, Industry Analysis Report,

By Power Output (<50 HP, 51 – 100 HP, >100 HP); By Battery Capacity; By Propulsion; By Application; By Region.; Segment Forecast, 2024- 2023

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM4810

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

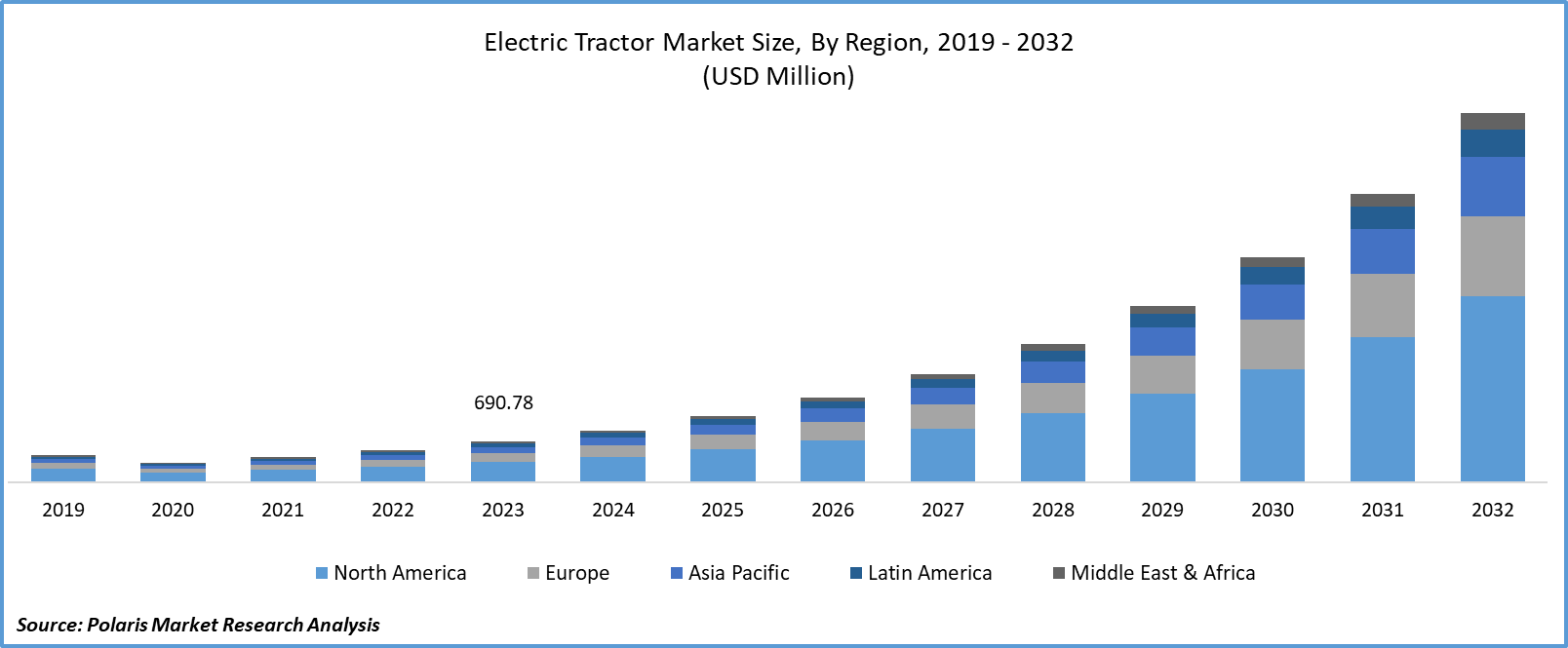

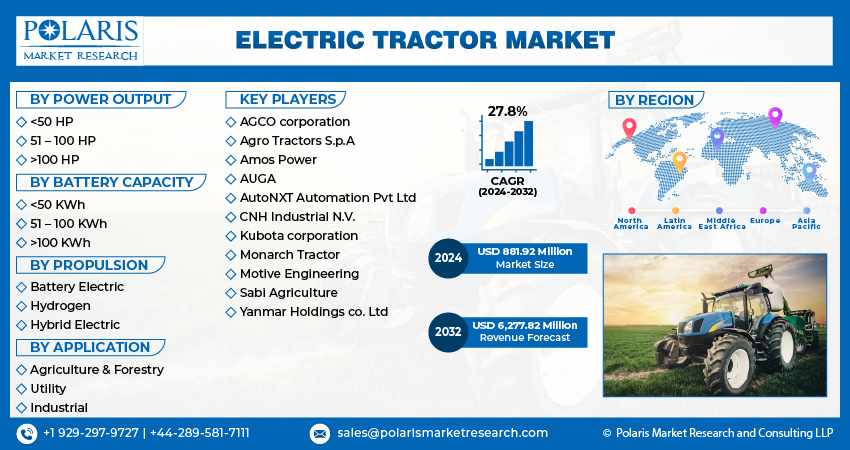

The electric tractor market size was valued at USD 690.78 million in 2023. The market is anticipated to grow from USD 881.92 million in 2024 to USD 6,277.82 million by 2032, exhibiting a CAGR of 27.8% during the forecast period

Industry Trend

Electric farm tractors represent a significant shift in agricultural machinery, opting for electric motors over traditional internal combustion engines. These tractors draw power from battery arrays, offering a streamlined design with fewer mechanical components compared to their conventional counterparts. A global push towards sustainable farming practices propels the surge in the electric farm tractor market. With a heightened focus on environmental stewardship, there's a growing demand for clean technologies in agriculture. Factors such as rising fuel costs and governmental incentives to adopt eco-friendly solutions further fuel this demand.

However, the majority of farms worldwide are small-scale operations managed by individual farmers. These farmers, seeking efficient yet affordable solutions, are increasingly turning to compact electric farm tractors for tasks requiring lower power outputs. Moreover, a notable trend in the agricultural landscape is the consolidation of smaller farms into larger commercial enterprises. This transition towards larger-scale farming operations is driving up the need for robust machinery, including electric farm tractors. With electric motors boasting double the torque of gasoline equivalents, these tractors can handle heavier workloads efficiently. Surprisingly, even a 60-horsepower electric tractor can be compared to the implementation of a 120-horsepower diesel counterpart.

To Understand More About this Research:Request a Free Sample Report

The company has undertaken a notable innovation initiative, signaling a strong commitment to advancing its operations. Through a comprehensive strategy aimed at expanding market reach, appealing to new demographics sustainable growth in a dynamic business environment, the company is placed for success. By harnessing the combined strengths of investment, technology, innovation, and strategic planning, it is poised to maintain its competitive advantage and emerge as a leader in its sector. As a result, significant growth is expected in the electric tractor market share during the forecast period.

- For instance, in August 2023, Solectrac introduced the e25H model, an electric tractor designed for smaller farms, vineyards, and landscaping tasks. With 25HP power, it efficiently handles light duties such as mowing, tilling, and hauling, thanks to its instant torque electric motor. This eco-friendly machine offers a 5-hour range on a single charge, meeting most workday requirements. Its compact size and foldable ROPS make navigating tight spaces effortless, while features like LED headlights and a PTO enhance its versatility. Additionally, Solectrac offers a version with a 19kW motor and Li NMC battery for extended capabilities.

Moreover, Cost-effectiveness is a key advantage of electric farm tractors. By minimizing operational expenses, they contribute to improved profitability in agriculture, ultimately enhancing yield. Additionally, cementing their position in the agricultural machinery market. Hence, the market is estimated to show significant growth in the electric tractor market share.

Key Takeaway

- North America dominated the largest market and contributed to more than 40% of the share in 2023.

- The European market is expected to grow at fastest-growing CAGR during the forecast period.

- By propulsion category, the battery electric segment accounted for the largest market share in 2023.

- By application category, the agriculture & forestry segment is projected to grow at a high CAGR during the projected period.

What are the market drivers driving the demand for the Electric Tractor Market?

Increasing fuel prices and a shift towards greener farming practices have been projected to spur product demand.

The agricultural sector operates within tight margins, and any fluctuations in fuel costs can significantly impact farmers' bottom line. With the volatility of oil prices in recent years, farmers have become increasingly aware of the need to manage their operating expenses effectively. Electric tractors present an appealing alternative to traditional diesel-powered machinery due to their cost-effective nature. Unlike diesel tractors that rely on fossil fuels, electric tractors harness electricity as their primary source of power. This electricity can be generated from renewable energy sources such as solar or wind power. By leveraging these sustainable energy options, farmers can effectively insulate themselves from the uncertainties and price fluctuations associated with fossil fuels. Investing in renewable energy infrastructure allows farmers to produce their electricity or purchase it from renewable energy providers at stable rates, thereby reducing their dependence on conventional fuel sources.

Moreover, electric tractors offer long-term cost savings. While the initial investment in electric machinery may be higher than that of traditional tractors, the ongoing operational expenses are significantly lower. Electricity is generally cheaper than diesel fuel on a per-unit basis, leading to reduced fuel costs over the lifetime of the tractor.

Furthermore, the potential for government incentives and subsidies for adopting clean energy technologies adds another layer of financial benefit for farmers. Many governments around the world offer grants, tax credits, and subsidies to encourage the adoption of electric vehicles and renewable energy solutions in agriculture. These incentives help offset the initial investment costs and make electric tractors even more financially attractive for farmers.

Which factor is restraining the demand for Electric Tractor?

High Initial Purchase and Maintenance Cost

While electric tractors offer long-term cost savings in terms of reduced fuel and maintenance expenses, their initial purchase price tends to be higher than that of conventional tractors. This upfront cost can pose a barrier to adoption, particularly for farmers operating on tight budgets or facing financial constraints. Additionally, the infrastructure required to support electric tractors, such as charging stations and access to reliable electricity grids, may only be readily available in some rural areas. Limited access to charging infrastructure can hinder the practicality and convenience of using electric tractors, especially in remote regions where electrification may be less developed.

Moreover, concerns regarding battery technology and range limitations may also restrain demand. While advancements in battery technology have improved the performance and efficiency of electric tractors, some farmers persist with concerns about battery life, charging times, and range anxiety. The need to recharge or replace batteries frequently during long working hours may disrupt workflow and productivity, particularly for operations that require continuous use of machinery.

Furthermore, the perceived performance capabilities of electric tractors compared to their diesel counterparts may influence purchasing decisions. Farmers accustomed to the power and torque of diesel engines may be hesitant to switch to electric tractors if they perceive them as less capable of handling heavy-duty tasks or operating in challenging terrain.

Report Segmentation

The market is primarily segmented based on power output, battery capacity, propulsion, application, and region.

|

By Power Output |

By Battery Capacity |

By Propulsion |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Propulsion Insights

Based on propulsion analysis, the market is segmented into battery electric, hydrogen, and hybrid electric. The battery-electric segment held the largest market share in 2023. The continuous improvements in battery technology have enhanced the performance and capabilities of battery electric tractors. Innovations in battery chemistry, such as lithium-ion batteries, have resulted in increased energy density, longer battery life, and faster charging times, making BE tractors more practical and efficient for agricultural applications. Battery electric tractors offer significant environmental benefits by producing zero emissions during operation. With growing concerns about air pollution and climate change, there has been a heightened emphasis on adopting clean energy solutions in agriculture. The eco-friendly nature of BE tractors aligns with these sustainability goals, driving their popularity among farmers and policymakers alike. With the volatility of diesel prices and increasing awareness of operational costs, farmers are increasingly turning to BE tractors as a more economically viable option in the long run.

By Application Insights

Based on application analysis, the market has been segmented on the basis of agriculture & forestry, utility, and industrial. The agriculture & forestry segment is expected to grow at the fastest CAGR during the forecast period. The agriculture and forestry industries are undergoing significant modernization efforts globally. Farmers and forestry operators are increasingly recognizing the benefits of adopting advanced technologies to improve productivity, efficiency, and sustainability. Electric tractors represent a modern and eco-friendly alternative to traditional diesel-powered machinery, aligning with the modernization goals of the sector. Electric tractors, which produce zero emissions during operation, are seen as a key solution to reducing the environmental footprint of agricultural and forestry activities. As sustainability becomes a top priority, the demand for electric tractors is expected to rise significantly.

Regional Insights

North America

North America region accounted for the largest market share in 2023. North America has been at the forefront of technological innovation and adoption, including in the agricultural sector. The region has a robust research and development ecosystem, with companies continuously investing in the development of electric tractors and related technologies. This early adoption and innovation have positioned North America as a leader in the electric tractor market. North America boasts a strong and diverse agricultural industry, with large-scale commercial farming operations as well as smaller family-owned farms. As a result, there is a significant demand for electric tractors among North American farmers looking to modernize their operations and reduce environmental impact.

Europe

Europe is expected to grow at the fastest CAGR during the forecast period. Europe has some of the most stringent environmental regulations in the world, particularly regarding emissions from agricultural machinery. The European Union (EU) has set ambitious targets to reduce greenhouse gas emissions and combat climate change. As a result, there is increasing pressure on farmers and agricultural businesses to adopt cleaner and more sustainable technologies, including electric tractors. Government incentives and subsidies further encourage the adoption of electric vehicles, contributing to market growth. Governments across Europe are actively promoting the transition to clean energy and low-emission transportation systems. Subsidies, tax incentives, grants, and other financial incentives are available to support the purchase of electric vehicles and machinery, including electric tractors. Additionally, regulatory measures such as emission standards and vehicle bans in urban areas create a favorable environment for electric tractor adoption, driving market growth.

There is a growing awareness of environmental sustainability and a shift towards more sustainable agricultural practices in Europe. Electric tractors, which produce zero emissions during operation, are seen as an environmentally friendly alternative to traditional diesel-powered machinery, making them attractive to environmentally conscious farmers and agricultural businesses.

Competitive Landscape

The competitive landscape in the electric tractor market refers to the overall structure and dynamics of the market concerning the various companies and factors that influence competition within the industry. This includes an analysis of key players, market trends, technological advancements, regulatory environment, and customer preferences. Examination of trends such as increasing demand for sustainable farming practices, advancements in battery technology, government incentives for electrisc vehicles, and shifting consumer preferences towards eco-friendly agricultural equipment.

Some of the major players operating in the global market include:

- AGCO corporation

- Agro Tractors S.p.A

- Amos Power

- AUGA

- AutoNXT Automation Pvt Ltd

- CNH Industrial N.V.

- Kubota corporation

- Monarch Tractor

- Motive Engineering

- Sabi Agriculture

- Yanmar Holdings co. Ltd

Recent Developments

- In November 2023, Fendt introduced the e100 V Vario electric tractor, designed for specialized use in vineyards, orchards, municipalities, and greenhouses. With a 100kWh battery capacity and maximum power of 68 horsepower (50 kW), it offers an evaluated range of 4 to 7 hours for tasks like mowing, cutting, or road maintenance.

Report Coverage

The electric tractor market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, power output, battery capacity, propulsion, application, and their futuristic growth opportunities.

Electric Tractor Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 881.92 Million |

|

Revenue forecast in 2032 |

USD 6,277.82 Million |

|

CAGR |

27.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Power Output, By Battery Capacity, By Propulsion, By Application And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Electric Tractor Market are AGCO Corporation, Agro Tractors S.p.A, Amos Power, AUGA, AutoNXT Automation Pvt Ltd, CNH Industrial N.V

The electric tractor market exhibiting a CAGR of 27.8% % during the forecast period

The Electric Tractor Market report covering key segments are power output, battery capacity, propulsion, application, and region.

key driving factors in Electric Tractor Market are increasing fuel prices and a shift towards greener farming

The global electric tractor market size is expected to reach USD 6,277.82 million by 2032