Global EV Charging Stations Market Share, Size, Trends, Industry Analysis Report

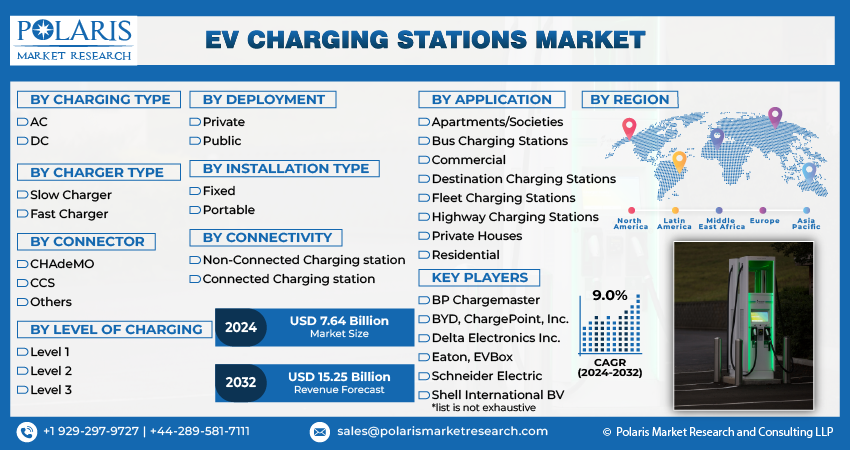

: Information By Charging Type (AC and DC), By Charger Type, By Connector, By Level of Charging, By Deployment, By Installation Type, By Connectivity, By Application, And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) – Market Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 116

- Format: PDF

- Report ID: PM1029

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

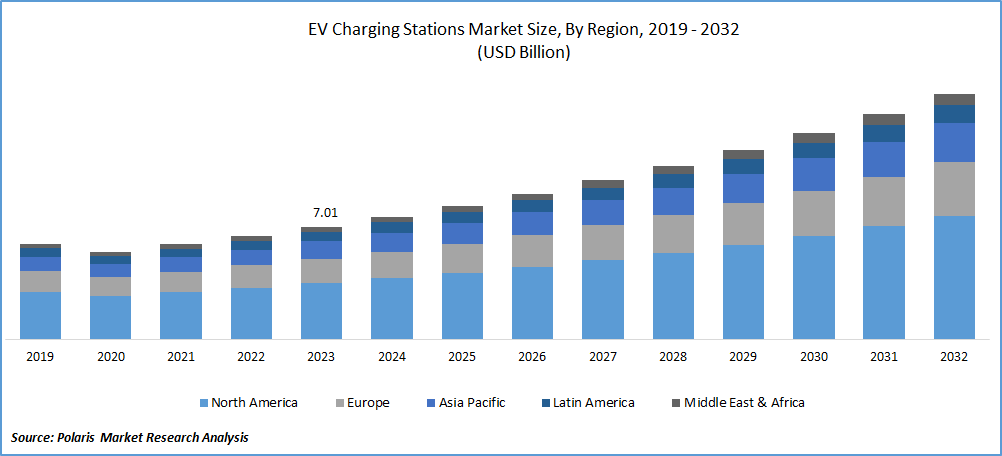

Global EV Charging Stations Market Size was valued at USD 7.01 Billion in 2023. The EV Charging Stations Industry is projected to grow from USD 7.64 Billion in 2024 to USD 15.25 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 9.0% during the forecast period (2024 - 2032). The market growth of the EV Charging Stations is driven by increasing concerns about carbon emissions and the global adoption of electric vehicles (EVs). As the world grapples with the escalating impacts of climate change, reducing carbon emissions has become a critical priority for governments, businesses, and consumers. The transportation sector, a significant contributor to greenhouse gas emissions, is at the forefront of this shift towards sustainability. Electric vehicles, which produce zero tailpipe emissions, represent a pivotal solution to this environmental challenge. As a result, governments across the globe are implementing stringent regulations and offering substantial incentives to promote the adoption of EVs. Policies such as emission reduction targets, subsidies for EV purchases, and investments in renewable energy are catalyzing the transition from internal combustion engine (ICE) vehicles to electric ones.

To Understand More About this Research:Request a Free Sample Report

Furthermore, the growing adoption of EVs is driving the demand for a robust and accessible charging infrastructure. Consumers are increasingly inclined to switch to electric vehicles due to their environmental benefits, lower operational costs, and advancements in battery technology that enhance driving range and reduce charging times. Innovations such as fast-charging technology, smart grids, and wireless charging are not only improving the convenience for EV owners but also optimizing the integration of renewable energy sources into the grid. These advancements contribute to a more sustainable and resilient energy infrastructure, aligning with global efforts to combat climate change. Also, public and private sectors are collaborating to deploy charging stations in residential areas, workplaces, commercial establishments, and along highways.

EV Charging Stations Market Trends:

Increasing Need For Fast And Wireless Charging Is Driving The Market Growth

Market CAGR for EV Charging Stations is driven by the increasing need for fast and wireless charging. As electric vehicle adoption rises, consumers demand more efficient and convenient charging solutions that fit seamlessly into their busy lifestyles. Fast charging technology addresses this need by significantly reducing the time required to recharge EV batteries, making electric vehicles more practical for long-distance travel and daily use. Thus, to meet the growing demand for fast-charging solutions, players are launching innovative solutions.

For instance, in July 2023, WiTricity launched the FastTrack Integration Program for automotive OEMs, which enables initial vehicle integration. This program effectively speeds up automaker testing of wireless charging on existing and future EV platforms. The system has allowed wireless charging to be fully enabled and operational on the automaker’s EV platform through the use of the WiTricity Halo receiver and the WiTricity Halo 11kW charger. These advancements improve the practicality of owning an EV and fuel the development and expansion of charging infrastructure as stakeholders invest in modern charging stations to meet growing consumer demand.

Increasing Investments In EV Infrastructure By Governments Worldwide Are Boosting The Market Growth

Increasing investments in EV infrastructure by governments worldwide are significantly boosting the growth of the EV Charging Stations Market. Acknowledging the critical role of electric vehicles in reducing greenhouse gas emissions and combating climate change, governments are implementing comprehensive policies and allocating substantial funds to develop robust charging networks. For instance, in May 2024, the Biden-Harris Administration launched the application process for a significant funding opportunity of $1.3 billion aimed at developing electric vehicle charging and alternative fueling infrastructure in both rural and urban communities, as well as along designated highways and major roadways. This funding opportunity is a result of the Bipartisan Infrastructure Law. It encompasses the $2.5 billion Charging and Fueling Infrastructure (CFI) Discretionary Grant Program, along with funds from the NEVI (National Electric Vehicle Infrastructure) Formula Program that specifically targets strategic grants to states and local governments for the deployment of EV chargers. These investments enhance the availability and accessibility of charging infrastructure and make electric vehicles a more viable option for consumers and businesses alike. As a result, the rapid expansion of EV infrastructure on a global scale is a significant catalyst for the growth and uptake of electric vehicles. Consequently, this is driving the driving EV Charging Stations Market revenue.

Development Of Smart Cities With Integrated Charging Infrastructure Is Expected To Fuel The Market Growth

As urban areas evolve into smart cities, there is a concerted effort to incorporate advanced technologies that enhance efficiency, sustainability, and quality of life. The increasing smart city initiatives are prioritizing seamless mobility solutions. For instance, the U.S. Department of Transportation initiated the application process for four significant grant programs dedicated to infrastructure and transportation projects, with a combined funding of approximately $7.5 billion. Specifically, on March 28, 2024, the DOT commenced the acceptance of applications for three discretionary grant programs falling under the $5.1 billion Multimodal Project Discretionary Grant program. This increasing investment in smart city initiatives is expected to fuel the EV Charging Stations Market growth as it involves the implanting of charging infrastructure in key locations such as residential complexes, commercial hubs, public parking lots, and transit stations to ensure that EV users have convenient and reliable access to charging facilities.

EV Charging Stations Market Segment Insights:

EV Charging Stations Deployment Insights:

The global EV Charging Stations Market segmentation, based on deployment includes private and public. The public segment held the largest market in 2023. The public segment held the largest market in 2023. Public EV charging stations offer convenient access to charging facilities for EV owners who do not have access to private charging infrastructure, such as home charging stations. In 2021, the International Energy Agency (IEA) reported a total of 1,777,000 publicly accessible electric vehicle (EV) charging stations worldwide, comprising 1.2 million slow chargers and 577,000 fast chargers. It was projected that by the end of 2022, the global count of publicly available EV charging stations will increase to 2.8 million. These stations are usually located in high-traffic areas, making them easily accessible to a wide range of users. Public EV charging stations present commercial opportunities for charging station operators, energy companies, real estate developers, and other stakeholders. Thus, public EV charging stations are dominating the global market.

EV Charging Stations Application Insights:

The global EV Charging Stations Market segmentation, based on application, includes apartments/societies, bus charging stations, commercial, destination charging stations, fleet charging stations, highway charging stations, private houses, and residential. The commercial segment is poised to register the highest CAGR in the EV Charging Stations Market. Public transit agencies, ride-sharing companies, and other shared mobility service providers are expanding their electric vehicle fleets and making significant investments in charging infrastructure to support electric buses, taxis, and shared electric vehicles. Furthermore, in 2022, Volvo, Daimler, and Traton established a joint venture, Milence, with a collective investment of USD 539.15 million (EUR 500 million). This initiative was aimed to deploy over 1,700 fast (300 to 350 kW) and ultra-fast (1 MW) charging points across Europe to accelerate the scalability of fast and ultra-fast charging and make long-haul operations more technically and economically viable. The investments were specifically targeted towards commercial applications, with a focus on heavy-duty vehicles. Thus, the rising investment is expected to drive the commercial segment of EV Charging Stations with a significant CAGR over the forecast period.

Global EV Charging Stations Market, Segmental Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

EV Charging Stations Regional Insights:

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. Asia Pacific region accounted for the largest market share in 2023. The Asia Pacific region has been experiencing rapid growth in the adoption of electric vehicles (EVs) driven by government incentives, supportive policies, and growing environmental awareness. Countries like China, Japan, and South Korea have implemented ambitious plans to promote EV adoption, leading to a significant increase in the demand for EV charging infrastructure. The region is characterized by dense urban populations and growing urbanization, which creates a high demand for convenient and accessible charging infrastructure.

China is at the forefront of technological innovation in the EV charging sector. The country is home to several leading manufacturers of EV charging equipment, including fast chargers, wireless charging systems, and smart charging solutions. Technological advancements made in China contribute to the efficiency, reliability, and affordability of EV charging infrastructure.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Global EV Charging Stations Market, Regional Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Europe EV Charging Stations Market is expected to witness the fastest CAGR during the forecast period. The growing adoption of electric vehicles in Europe, fueled by consumer awareness, environmental consciousness, and expanding EV model offerings, contributes to the rising demand for charging infrastructure. As more consumers switch to electric mobility, the need for accessible and reliable charging solutions grows, boosting market growth. European countries have been at the forefront of promoting electric mobility through supportive government policies, incentives, and regulations.

EV Charging Stations Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the EV Charging Stations Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative fast charging solutions, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, EV Charging Stations industry must offer cost-effective solutions.

Automotive manufacturers are increasingly focusing on investing in EV charging stations infrastructure as a crucial aspect of their electric mobility strategy. Many automakers are providing integrated charging solutions and collaborating with infrastructure providers to improve the overall EV Charging Stations Market. Major players in the EV Charging Stations Market, including BP Chargemaster, BYD Company Ltd., ChargePoint, Inc., Delta Electronics Inc., Eaton, EVBox, Schneider Electric, Shell International BV, Siemens AG, State Grid Corporation of China, Tata Power, Tesla Inc, TGOOD Global Ltd.

BYD Company Ltd. is a multinational corporation that operates in segments including the Secondary Rechargeable Batteries and Photovoltaic sector. BYD produces and distributes various energy products, including photovoltaic items, nickel batteries, lithium-ion batteries, and iron batteries. These products are used for power tools, mobile phones, energy storage solutions, photovoltaic systems, and electric vehicles. In October 2019, EV manufacturer BYD announced a preferential collaboration with charging infrastructure provider AMPLY Power. The partnership enables fleet operators, including shuttle bus operators, transit agencies, school districts, universities, and municipalities, to swiftly transition to electric vehicles by offering integrated products and services covering both vehicles and infrastructure.

Siemens AG specializes in electrification, automation, and digitalization and operates in a diverse range of industries, such as energy, healthcare, financing, building technology, transportation, and manufacturing. The company provides a comprehensive range of products and services, including power generation systems, turbines, medical imaging equipment, and automation software, as well as building technologies and smart grid solutions. In March 2024, Siemens Smart Infrastructure introduced a new version of its SICHARGE D electric vehicle (EV) fast charger, specifically designed for IEC markets. This variant boasts a maximum output of 400 kW.

Key Companies in the EV Charging Stations Market include:

- BP Chargemaster

- BYD

- ChargePoint, Inc.

- Delta Electronics Inc.

- Eaton

- EVBox

- Schneider Electric

- Shell International BV

- Siemens AG

- State Grid Corporation of China

- Tata Power

- Tesla Inc

- TGOOD Global Ltd

EV Charging Stations Industry Developments

February 2024: Raízen Power and BYD entered into a strategic alliance to promote sustainable electric mobility in Brazil. The partnership's goal is to increase the public network of electric chargers substantially, offering users access to 100% clean and renewable energy while improving the recharging experience. With a target of capturing a 25% market share in Brazil's electromobility sector, Raízen Power plans to deploy around 600 new DC charge points.

December 2023: Tata Power EV Charging Solutions Limited (TPEVCSL), a provider of EV charging solutions, entered into a Memorandum of Understanding (MoU) with Indian Oil Corporation Limited (IOCL). The deal aspires to deploy fast and ultra-fast electric vehicle (EV) charging issues throughout India. Under this partnership, Tata Power will install over 500 EV charging points across various IOCL retail outlets.

June 2024: Inchcape, the distributor in Hong Kong for carmakers such as Land Rover, Toyota, Lexus, SAIC Maxus, and Jaguar, has installed its first publicly accessible electric vehicle (EV) charging station in the city in response to the increasing demand for electric vehicles.

EV Charging Stations Market Segmentation:

EV Charging Stations Charging Type Outlook

- AC

- DC

EV Charging Stations Charger Type Outlook

- Slow Charger

- Fast Charger

EV Charging Stations, Connector Outlook

- CHAdeMO

- CCS

- Others

EV Charging Stations Level of Charging Outlook

- Level 1

- Level 2

- Level 3

EV Charging Stations Deployment Outlook

- Private

- Public

EV Charging Stations Installation Type Outlook

- Fixed

- Portable

EV Charging Stations Connectivity Outlook

- Non Connected Charging station

- Connected Charging station

EV Charging Stations Application Outlook

- Apartments/Societies

- Bus Charging Stations

- Commercial

- Destination Charging Stations

- Fleet Charging Stations

- Highway Charging Stations

- Private Houses

- Residential

EV Charging Stations Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

EV Charging Stations Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 7.01 Billion |

|

Market size value in 2024 |

USD 7.64 Billion |

|

Revenue Forecast in 2032 |

USD 15.25 Billion |

|

CAGR |

9.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global EV Charging Stations Market size was valued at USD 7.01 Billion in 2023

The global market is projected to grow at a CAGR of 9.0% during the forecast period, 2023-2032.

Asia Pacific had the largest share in the global market

• The key players in the market are BP Chargemaster, BYD Company Ltd., ChargePoint, Inc., Delta Electronics Inc., Eaton, EVBox, Schneider Electric, Shell International BV, Siemens AG, State Grid Corporation of China, Tata Power, Tesla Inc, TGOOD Global Ltd.

The public category dominated the market in 2023

The commercial had the largest share in the global market