Europe Commercial Vehicles Market Share, Size, Trends, Industry Analysis Report,

By Fuel Type (Fossil Fuel, Electric, Alternative Fuel, Hybrid); By Gross Vehicle Weight; By Application; By Country; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 115

- Format: PDF

- Report ID: PM4947

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

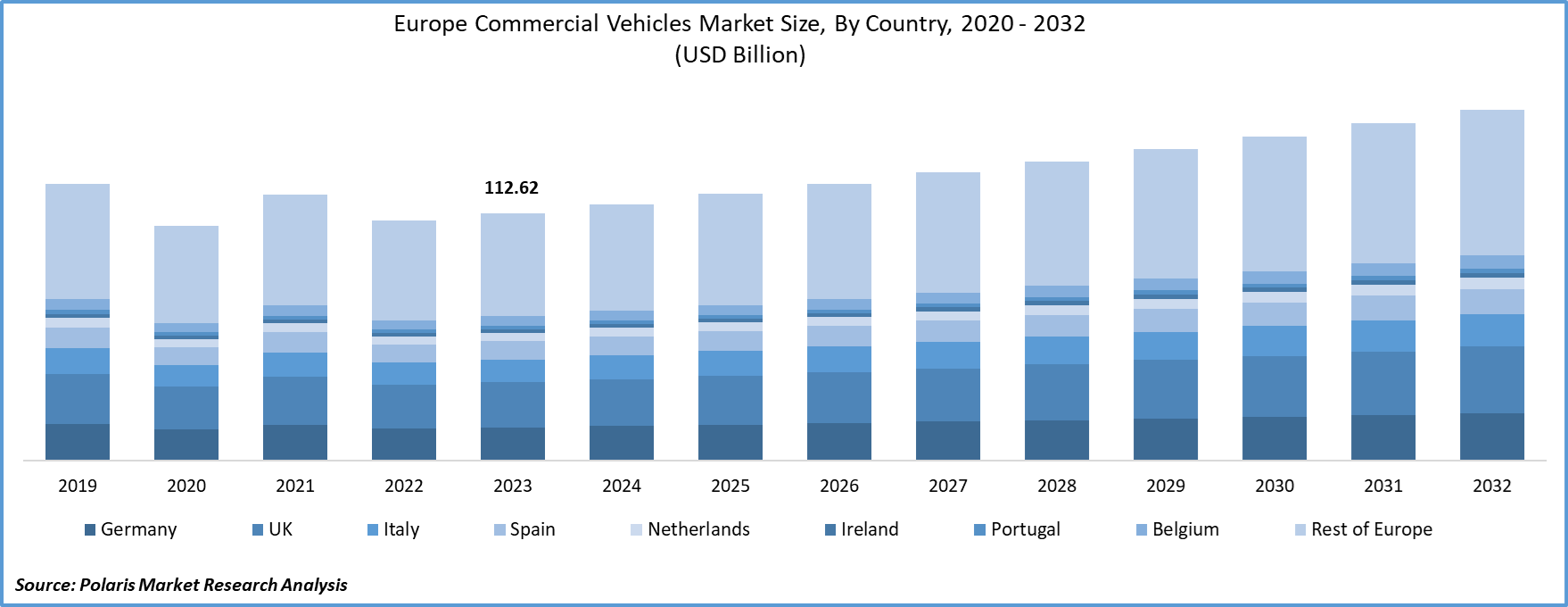

Europe commercial vehicles market size was valued at USD 112.62 Billion in 2023. The market is anticipated to grow from USD 116.94 Billion in 2024 to USD 159.93 Billion by 2032, exhibiting the CAGR of 4.0% during the forecast period.

Industry Trends

The European commercial vehicles market for goods and cargo is a dynamic and essential sector that plays a crucial role in the continent's economy. This market segment encompasses a wide range of vehicles used for the transportation of goods, including trucks, vans, and specialized vehicles designed to handle various cargo types.

To Understand More About this Research:Request a Free Sample Report

The European commercial vehicles market is substantial, driven by the continent's robust trade and industrial activities. It is a key component of the transportation and logistics industry, facilitating the movement of goods across borders and within domestic markets. The demand for commercial vehicles is influenced by economic growth, consumer spending, and industrial production levels, making it sensitive to fluctuations in these areas.

In recent years, the European commercial vehicles market has witnessed notable trends and innovations aimed at improving efficiency, reducing emissions, and enhancing safety. Electric and hybrid commercial vehicles have gained traction as companies and governments prioritize sustainability and environmental concerns. Advancements in autonomous driving technology are also being explored to increase road safety and optimize logistics operations. Moreover, digitalization and connectivity solutions are transforming fleet management and route planning, enabling real-time tracking and data-driven decision-making.

The COVID-19 pandemic had an impact on the commercial vehicle industry in Europe, with around 50,000 thousand Units of output lost during March and April due to factory closures, workplace regulations, supply chain disruptions, and stay-at-home orders. By the end of 2020, commercial vehicle manufacturing in the region had decreased by nearly 20% compared to the previous year. Countries like Poland in Central Europe and Italy in Western Europe, which heavily rely on trucking for transporting goods throughout Europe, experienced a significant decline in demand during this period.

Key Takeaways

- UK is expected to grow significantly over the forecast period in the Europe commercial vehicles market

- By fuel type category, the fossil fuel segment accounted for the largest Europe commercial vehicles market share in 2023

- By gross vehicle weight category, the less than 3.5 tons segment is anticipated to grow with a lucrative CAGR over the Europe commercial vehicles market forecast period

What are the market drivers driving the demand for market?

E-commerce and Last-Mile Delivery

The rise of e-commerce has profoundly impacted the commercial vehicle market in Europe, transforming the way goods are delivered to consumers. As consumers increasingly turn to online shopping for convenience and a wide range of products, the demand for efficient last-mile delivery services has surged. Last-mile delivery refers to the final leg of the delivery process, where goods are transported from distribution centres to the end consumer's doorstep. This critical stage of the supply chain presents unique challenges and opportunities for the commercial vehicle industry. The e-commerce boom in Europe has been fuelled by improved internet connectivity, smartphone penetration, and changing consumer preferences. Consumers now have access to a vast array of products worldwide and expect fast and reliable delivery services. As a result, e-commerce companies are under immense pressure to optimize their last-mile delivery operations to meet customer expectations.

Urbanization has played a significant role in shaping the last-mile delivery landscape in Europe. With more people residing in densely populated urban areas, the need for efficient and timely deliveries has intensified. Commercial vehicles, especially vans, and smaller trucks, have become essential for navigating congested city streets and delivering packages to the end consumer's doorstep. In response to this urbanization trend, companies have strategically located distribution centres and fulfilment hubs closer to major cities to reduce delivery distances and improve delivery speed.

Which factor is restraining the demand for market?

Increasingly stringent emission regulations and shortage of semiconductor

One of the prominent restraining factors is the increasingly stringent emission regulations imposed by European Union authorities. As environmental concerns mount, there is growing pressure to reduce the carbon footprint of commercial vehicles. This has led to the implementation of strict emissions standards, prompting manufacturers to invest in costly research and development to produce vehicles that comply with these regulations. The need to adopt cleaner and greener technologies, such as electric and hybrid powertrains, has posed a financial challenge for many companies, especially smaller ones, which might need help to keep up with the pace of technological advancement.

Moreover, the ongoing global semiconductor shortage has significantly impacted the commercial vehicles industry in Europe. Modern commercial vehicles rely heavily on electronic components and advanced technology systems for functions ranging from engine control to infotainment. The shortage of semiconductors has disrupted the production of these vehicles, leading to supply chain disruptions, delayed deliveries, and in some cases, increased costs.

Report Segmentation

The market is primarily segmented based on fuel type, gross vehicle weight, application, and country.

|

By Fuel Type |

By Gross Vehicle Weight |

By Application |

By Country |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Fuel Type Insights

Based on fuel type category analysis, the market has been segmented on the basis of fossil fuel, electric, alternative fuel, and hybrid. The fossil fuel segment dominated Europe's commercial vehicles market in 2023. Fossil fuels, primarily diesel, and gasoline, have historically been the dominant energy sources for commercial vehicles in Europe. However, the detrimental impact of these fuels on air quality and their contribution to greenhouse gas emissions have prompted European governments to enact stricter regulations and set ambitious targets for reducing carbon emissions. This regulatory environment has catalyzed a shift towards alternative fuels and electrification.

Despite rising interest in electric and hybrid vehicles, diesel engines remain significant in the Europe Commercial Vehicle Market. This is particularly for heavy-duty applications, where diesel engines' high torque and long-haul capabilities remain unmatched. Additionally, the extensive refueling infrastructure for diesel in Europe contributes to its continued relevance.

By Gross Vehicle Weight Insights

Based on gross vehicle weight category analysis, the market has been segmented on the basis of less than 3.5 tons and 3.5 to 7 tons. The less than 3.5 tons segment is poised for significant growth over the forecast period in Europe's commercial vehicles market. Light Duty Vehicles (LDVs) with a gross vehicle weight of less than 3.5 tons constitute a pivotal category within Europe's commercial vehicle market. Engineered for lighter tasks, these LDVs play a vital role in transportation and delivery, especially in urban and suburban settings were agility and efficiency reign supreme. This weight classification encapsulates the vehicle's mass and maximum load-bearing capacity, showcasing its versatility.

LDVs offer a robust solution for moderately heavier undertakings within this weight range. Industries like local freight transport and construction benefit from their resilience, catering to jobs with elevated payload requirements. Despite their sturdiness, LDVs retain their manoeuvrability and convenience, making them indispensable for businesses necessitating frequent stops and starts. LDVs with a gross vehicle weight of less than 3.5 tons embody an intricate amalgamation of compact design, efficiency, and adaptability. They are an indispensable asset for many industries, encapsulating the essence of modern urban mobility while seamlessly integrating evolving regulations and technological advancements.

Country-wise Insights

UK

UK is anticipated to experience significant growth over the forecast period since the market is influenced by various factors, including economic conditions, industry trends, regulations, technological advancements, and consumer demand. The demand for commercial vehicles can be affected by the overall state of the economy, as businesses tend to invest in new vehicles when their operations are expanding or improving. As per, International Labor Organization data published in July 2023, the automobile industry directly contributes £15 billion in GVA to the UK economy, with the vast majority of value generated outside of the South East. Over 80% of autos and 60% of commercial vehicles manufactured in the UK are exported, with the country selling into 150 countries worldwide. The automotive sector is the most major source of goods exports for the United Kingdom. Despite a -2.5% decline, the EU remains the most significant market for British businesses. Thus, the rising growth of automobile industry is propelling the UK commercial vehicle market.

Competitive Landscape

The market is characterized by intense competition due to the presence of numerous significant players. These players have implemented strategies such as expansions, agreements, collaborations, and partnerships. Additionally, they are actively involved in the development of new products with accelerated speed and enhanced features. These efforts are aimed at bolstering their product portfolio and securing a formidable position within the market.

Some of the major players operating in the European market include:

- BAIC Group Co., Ltd.

- BYD Company Limited

- Daimler Truck Holding AG

- Dongfeng Motor Group Company Limited

- Ford Motor Company

- Iveco Group N.V.

- Leyland Trucks

- Mercedes-Benz Group AG

- Nissan Motor Co. Ltd.

- Renault Group

- Rivian Automotive, Inc.

- Stellantis N.V.

- Toyota Motor Corporation

- Traton SE

- Volkswagen AG

Recent Developments

- In July 2023, MAN planned the 2024 launch of the electric long-haul truck, aiming for half of Europe's annual truck registrations to be battery-electric by 2030, urging infrastructure development and CO2 pricing support for EV competitiveness.

- In April 2023, Ford introduced its F-150 Lightning electric pickup in Norway to tap into robust EV demand, despite its larger size and leverage the country's strong preference for battery-powered vehicles.

- In May 2022, Stellantis and Toyota expanded partnership with a new large-size commercial van, including an electric version, enhancing both companies' LCV line-ups and sustainable mobility efforts in Europe.

- In December 2021, Top Delivery Services (TDS) partnered with BYD and Bluekens EV to enhance emission-free distribution, procuring 10 BYD ETM6 electric trucks for IKEA deliveries in Amsterdam, promoting eco-friendly logistics and zero-emission goals.

Report Coverage

The Europe Commercial Vehicles market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, fuel type, gross vehicle weight, application, and their futuristic growth opportunities.

Europe Commercial Vehicles Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 116.94 Billion |

|

Revenue forecast in 2032 |

USD 159.93 Billion |

|

CAGR |

4.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD Billion, Volume in Thousand Units, and CAGR from 2024 to 2032 |

|

Segments covered |

By Fuel Type, By Gross Vehicle Weight, By Application, By Country |

|

Country scope |

Germany, UK, Italy, Spain, Netherlands, Ireland, Portugal, Belgium, Rest of Europe |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Europe Commercial Vehicles Market are BAIC Group Co., Ltd., BYD Company Limited, Daimler Truck Holding AG

Europe commercial vehicles market exhibiting the CAGR of 4.0% during the forecast period.

Europe Commercial Vehicles Market report covering key segments are fuel type, gross vehicle weight, application, and country.

The key driving factors in Europe Commercial Vehicles Market are E-commerce and Last-Mile Delivery

Europe Commercial Vehicles Market Size Worth USD 159.93 Billion by 2032.