Future of Batteries Market Share, Size, Trends, Industry Analysis Report,

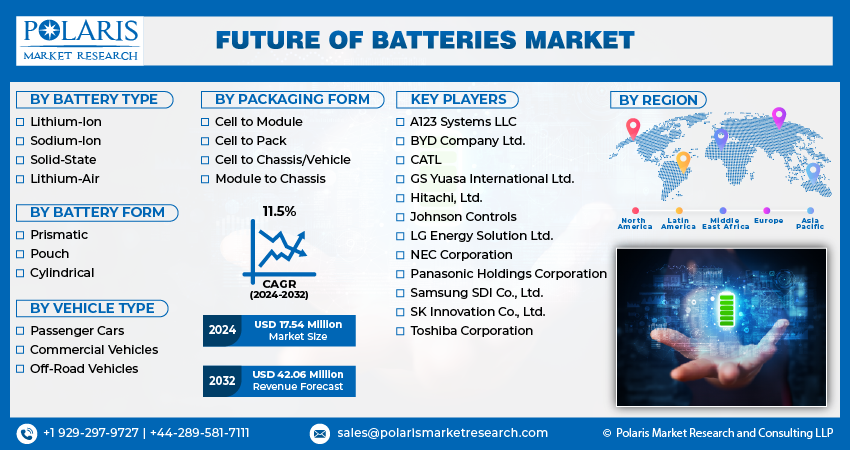

By Battery Type (Lithium-lon, Sodium-lon, Solid-State, Lithium-Air); By Battery Form; By Vehicle Type; By Packaging Form; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 118

- Format: PDF

- Report ID: PM4958

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

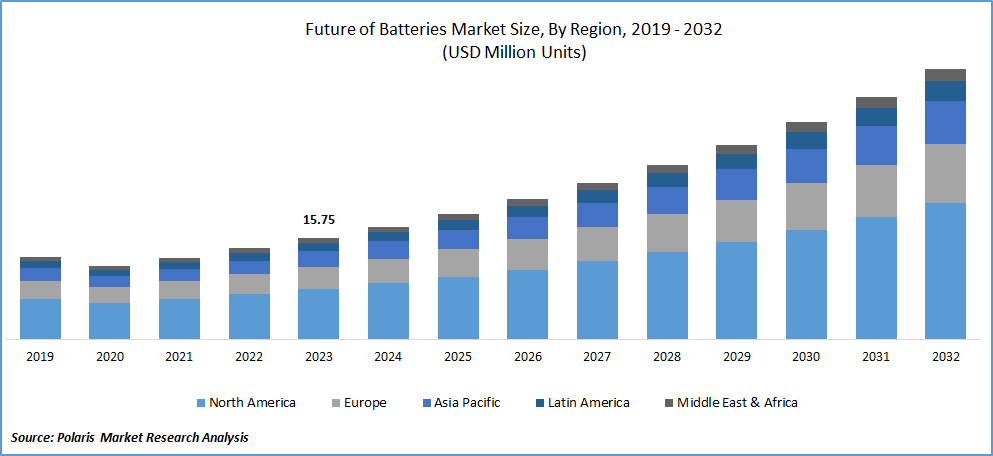

Future of Batteries Market size was valued at USD 15.75 million units in 2023. The market is anticipated to grow from USD 17.54 million units in 2024 to USD 42.06 million units by 2032, exhibiting the CAGR of 11.5% during the forecast period.

Market Overview

The future of batteries involves the development and commercialization of advanced battery technologies with improved energy density, longer lifespan, faster-charging capabilities, and enhanced safety features. This includes lithium-ion batteries, solid-state batteries, lithium-sulfur batteries, flow batteries, and other emerging technologies.

To Understand More About this Research:Request a Free Sample Report

The transition toward electric mobility is a significant driver of the battery market. The future of batteries is closely linked to the adoption of electric vehicles, including passenger cars, buses, trucks, and two-wheelers. Advancements in battery technology are critical for increasing the driving range of EVs, reducing charging times, and lowering costs to make electric vehicles more accessible to consumers.

Market growth is highly influenced by the rise in interest in consuming sustainable e-mobility options over conventional vehicles. This is primarily due to the demand for batteries, owing to their potential to promote vehicle functioning and durability. Moreover, growing research activities also increase the effectiveness of batteries, which, thereby, opens numerous opportunities in battery development.

For instance, in September 2023, Lyten announced to production of light-weight & lithium-sulfur batteries for electric vehicles (EVs) with an investment amounting to USD 200 Mn in its Series B fund raised by the Prime Movers Labs. With this investment, they will establish an automated manufacturing facility in California.

Moreover, the growing development of new batteries with advanced features will grab consumers' attention and, thereby, generate demand for batteries over the study period. For instance, in October 2023, Ionblox introduced its battery with an extremely efficient fast-charging capability made up of Li-Si.

Growth Drivers

Growing Government Support to Promote Electric Vehicle (EV) Use and Infrastructure Development

The increasing government support to boost the production of EVs and charging stations is optimally driving market growth. For instance, in March 2023, the Government of India (GoI) announced its strategy to invest an INR 800 crore subsidy in state-owned oil marketing firms to install 7,432 charging stations across the country. These projects will enhance the availability of charging stations and other ancillary shops, leading to enhanced convenience for e-mobility users.

Additionally, in April 2024, Charge Zone received a USD 19 Mn grant from British International Investment to expand its efficient charging station network, catering to electric trucks, cars, and buses on Indian highways and highly populated urban metros. Such initiatives will encourage users to choose e-vehicles over conventional automobiles in the long run, driving demand for batteries in the coming years.

Increasing Preference for E-Mobility

The growing number of people preferring e-mobility and the growing awareness about the importance of sustainability is propelling the global electric vehicle market and, consequently, the demand for batteries in the marketplace. According to the International Energy Agency, around 18% of cars consumed in the world will be electric in 2023, a rise from 14% in 2022. More than 250,000 new e-vehicle registrations will be made weekly in 2023. This trend is showcasing significant growth potential for the global future of the battery market.

Restraining Factors

The Resistance to Adopt EVs Due to Lower Battery Capacity

The reluctance to change their vehicles and the limited penetration of EV charging stations are expected to hinder their adoption in the global market. Additionally, the limited longevity of batteries and lower electric vehicle infrastructure development are projected to reduce their demand over the study period.

Report Segmentation

The market is primarily segmented based on battery type, battery form, vehicle type, packaging form, and region.

|

By Battery Type |

By Battery Form |

By Vehicle Type |

By Packaging Form |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Battery Type Analysis

Lithium-Ion Battery Segment is Expected to Witness the Highest Growth During the Forecast Period

The lithium-ion battery segment is projected to grow at the fastest pace during the forecast period, owing to its higher rate of utility in battery manufacturing from earlier due to its superior performance. This technology has undergone multiple research and development activities traditionally, emphasizing the manufacturer's integration of well-known compounds into their new production initiatives. For instance, in November 2023, Toshiba Corporation announced the launch of its latest lithium-ion battery, developed by using high-performance cobalt-free 5V-class cathode material.

By Vehicle Type Analysis

Passenger Car Segment Accounted for the Largest Market Share in 2023

The passenger segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. This is mainly attributable to the increasing concerns among companies and consumers about carbon neutrality and the circular economy. The growing disposable income among the population and increasing mobility, specifically among populous nations like India, are stimulating the EV demand, making firms engage in battery production.

By Battery Form Analysis

Cylindrical Battery Form is Expected to Register Significant Growth over the Study Period

The cylindrical battery form segment is expected to witness significant growth in the coming years, driven by its higher applications in consumer electronics, electric vehicles, and other power equipment. The increasing demand for two-wheeler and three-wheeler EVs in the marketplace is encouraging firms to manufacture cylindrical batteries. For instance, in March 2024, Panasonic Group announced its plan to start a new venture with Indian Oil Corporation (IOC) to produce cylindrical lithium-ion batteries in India.

Regional Insights

Europe Region Registered the Largest Share of the Global Market in 2023

The Europe region held the largest market share in 2023. The growing emphasis on the circular economy and increasing government regulations to reduce greenhouse gas emissions. This is significantly driving EV adoption and, thereby, battery production. The increasing funding activities to boost the battery production capacity are showing new growth opportunities for the market in the coming years. For instance, in April 2024, Horizon Europe announced its plan to boost battery production with the new funding and technology strategy in 2025, driven by rising climate change issues and stimulating the demand for EVs. , Volkswagen announced to development of six battery factories in Europe by 2030 with a combined capacity of 240 gigawatts (GWh).

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the growing government policies and major electric vehicle and battery producers in the region, particularly in China and India. According to China's Ministry of Public Security (MPS) data released in January 2024, China's new energy vehicle consumption reached 20.41 million by the end of 2023, contributing 6% of the total vehicle consumption (336 million). In the new energy vehicles ownership in 2023, 76.04% of them are battery electric vehicles.

The presence of established players engaged in producing affordable and efficient batteries is likely to drive EV use in the region. Additionally, as per the International Energy Agency, India is expected to become the third largest market for utility-scale batteries globally by 2030, with the battery capacity extension to 9 GW. This will further boost the future of batteries market growth during the forecast timeframe.

Key Market Players & Competitive Insights

The future of the batteries market is highly competitive, with the growing number of people consuming electric vehicles, driving the need for efficient batteries and stimulating new research and development activities among the market players. For instance, in April 2024, Toyota announced an investment of USD 1.4 billion in an Indiana plant to produce lithium-ion batteries for the manufacturing of electric SUVs.

Some of the major players operating in the global market include:

- A123 Systems LLC

- BYD Company Ltd.

- CATL

- GS Yuasa International Ltd.

- Hitachi, Ltd.

- Johnson Controls

- LG Energy Solution Ltd.

- NEC Corporation

- Panasonic Holdings Corporation

- Samsung SDI Co., Ltd.

- SK Innovation Co., Ltd.

- Toshiba Corporation

Recent Developments in the Industry

- In March 2024, StoreDot, known for its cutting-edge extreme fast charging (XFC) battery technology designed for electric vehicles (EVs), unveiled a collaborative venture with EVE Energy. This partnership grants StoreDot access to EVE Energy's widespread manufacturing capabilities, enabling the mass production of its revolutionary 100 5 extreme fast-charging battery cells.

- In April 2024, CATL and Beijing Hyundai inked a strategic partnership agreement during Auto China 2024. This collaboration aims to bolster Beijing Hyundai's electric vehicle (EV) initiatives, with CATL providing the battery power for upcoming electric models under the Beijing Hyundai brand.

Report Coverage

The future of batteries market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, battery type, battery form, vehicle type, packaging form, and their futuristic growth opportunities.

Future of Batteries Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.54 Million |

|

Revenue forecast in 2032 |

USD 42.06 Million |

|

CAGR |

11.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Future of Batteries Market are A123 Systems, BYD Company, CATL, GS Yuasa International, Hitachi, Johnson Controls

Future of Batteries Market exhibiting the CAGR of 11.5% during the forecast period.

Future of Batteries Market report covering key segments are battery type, battery form, vehicle type, packaging form, and region.

The key driving factors in Future of Batteries Market are Growing government support to promote electric vehicle (EV) use and infrastructure development

Future of Batteries Market Size Worth USD 42.06 million units by 2032