Gas Separation Membrane Market Share, Size, Trends, Industry Analysis Report,

By Material (Cellulose Acetate, Polysulfone and Polyimide & Polyaramide); By Module; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4765

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

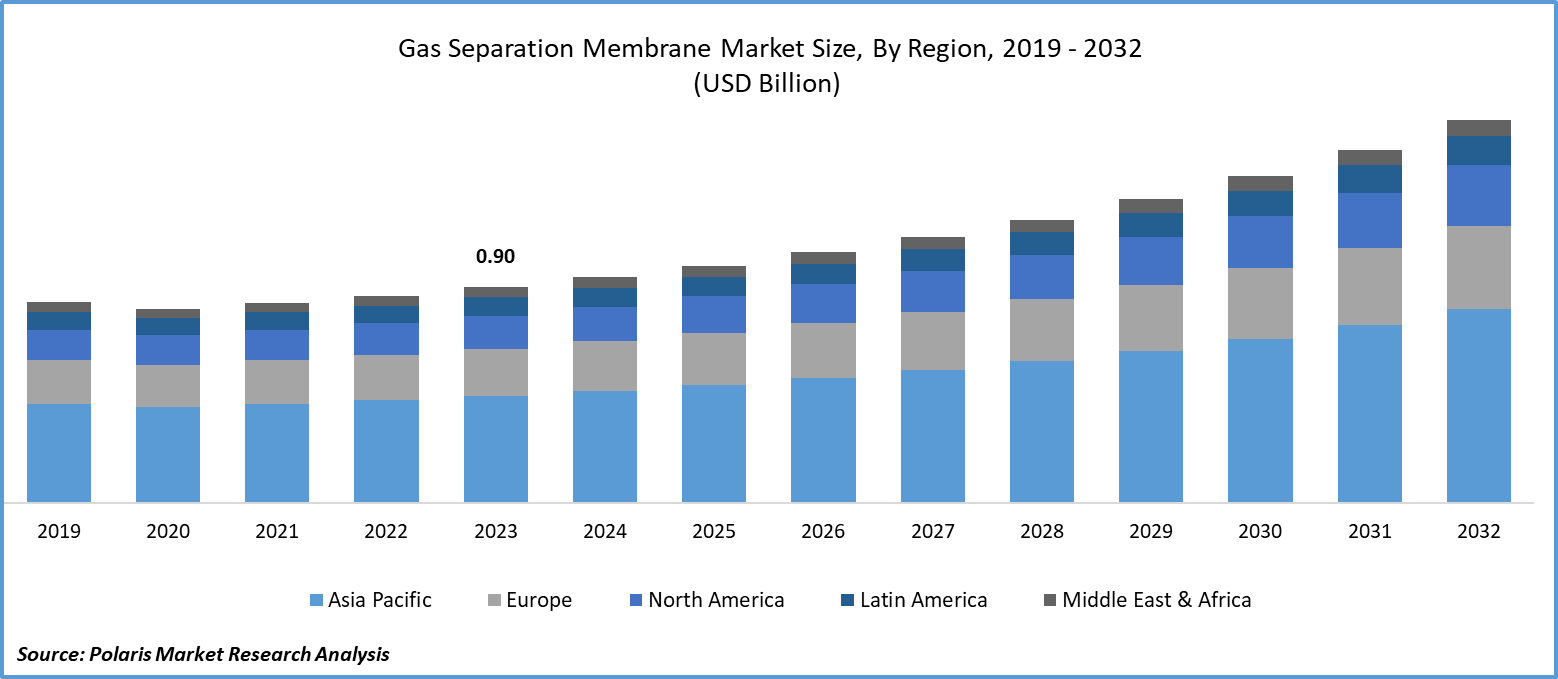

Global gas separation membrane market size was valued at USD 0.90 billion in 2023. The market is anticipated to grow from USD 0.94 billion in 2024 to USD 1.60 billion by 2032, exhibiting the CAGR of 6.8% during the forecast period

Gas Separation Membrane Market Overview

Gas separation membranes are widely employed for purifying & isolating specific substances from gas or vapor mixtures, finding applications across diverse industries. These membranes are utilized in food and beverage processing, chemical processing, pharmaceutical and medical applications, water and wastewater treatment, industrial gas processing, and various other sectors. Gas separation technology offers cost and energy savings and is more efficient compared to conventional methods such as cryogenic distillation, adsorption, and absorption.

- For instance, in January 2023, UBE Corporation has unveiled its strategy to enhance production capabilities for polyimide hollow fiber gas separation membranes at its Ube Chemical Factory, alongside augmenting gas separation membrane module production facilities at its Sakai Factory. These expansions are geared towards addressing the soaring demand, notably for CO2 separation membranes. With operations slated to begin in the initial half of fiscal year 2025, the upgraded facilities will bolster production capacity by around 1.8 times.

To Understand More About this Research: Request a Free Sample Report

Moreover, with the rising costs of energy, the use of gas separation membrane technology is expected to become more prominent. This technology not only helps in reducing the environmental impact of industrial processes but also lowers overall costs. As industries continue to seek more sustainable and cost-effective solutions, the demand for gas separation membranes is likely to increase, driving further innovation and advancements in the gas separation membrane market development.

However, the pharmaceutical industry is constantly seeking innovative methods to improve separation processes and reduce costs associated with the manufacturing of active ingredients. Gas separation membranes play a crucial role in this sector, particularly in the separation of oxygen gas for medical purposes. By utilizing gas separation membranes, pharmaceutical companies can ensure the purity of oxygen used in medical applications, meeting stringent quality standards and ensuring the safety and efficacy of their products. This technology not only helps in reducing production costs but also contributes to the overall efficiency and sustainability of pharmaceutical manufacturing processes.

Gas Separation Membrane Market Dynamics

Market Drivers

Advancements in the field of membrane technology

The ongoing research and development efforts focused on membrane materials and manufacturing techniques have led to the production of gas separation membranes that are not only more cost-effective but also more efficient. These advancements have expanded the range of applications for gas separation membranes and have significantly improved the efficiency of gas separation processes. As a result, these developments are driving the expansion of the gas separation membrane market opportunity.

Growing number of industrial uses

Gas separation membranes play a critical role in various industries, including petrochemicals, chemicals, pharmaceuticals, food and beverage, and healthcare. These membranes are integral to processes such as carbon capture, hydrogen recovery, and gas purification, which are essential for the operations of these industries. As these sectors continue to expand and adopt membrane-based separation technologies, the demand for gas separation membrane market development is expected to grow significantly. This trend is driving the growth of the gas separation membrane market share as industries increasingly recognize the benefits of these membranes for enhancing efficiency, reducing emissions, and improving overall process reliability.

Market Restraints

Technical Limitations are likely to impede the gas separation membrane market growth.

Gas separation membranes, while effective in many applications, can face challenges in certain scenarios. One such challenge is their selectivity, permeability, and stability, which may not always meet the requirements of specific gas separation processes or harsh operating conditions. These technical limitations can restrict the adoption of gas separation membrane market growth in certain applications where these factors are critical. However, ongoing research and development efforts are focused on addressing these limitations to enhance the performance and applicability of gas separation membranes across a wider range of industries and applications.

The price and accessibility of the materials

Gas separation membranes are typically manufactured using materials such as ceramics or polymers. However, the availability and cost of these materials can vary due to market dynamics, leading to price fluctuations and potential supply chain disruptions. The scalability and competitiveness of gas separation membrane technology rely heavily on a stable supply of high-quality materials at reasonable prices. Any disruptions or price swings in the supply chain can impact the production costs and overall viability of gas separation membrane market growth. Therefore, ensuring a reliable supply of materials at affordable prices is crucial for the continued advancement and widespread adoption of gas separation membranes.

Report Segmentation

The market is primarily segmented based on material, module, application and region.

|

By Material |

By Module |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Gas Separation Membrane Market Segmental Analysis

By Material Analysis

- The polysulfone segment is projected to grow at the fastest CAGR during the projected period. Polysulfone is a commonly used organic polymer in gas separation applications, known for its excellent thermal and chemical stability in membranes. It is highly resistant to mineral acids, electrolytes, and oxidizing agents, making it a preferred material. Apart from its exceptional thermal stability & Chemical resistance, polysulfone also exhibits strong mechanical properties, including high resistance to compaction, even under high pressures. Thin film structures appropriate for gas separation procedures can be created by casting or fabricating this polymer. Due to its inherent properties, polysulfone acts as a selective barrier, allowing specific gases to pass through based on their size, shape, and solubility characteristics. Its wide use in gas separation applications is due to its cost-effectiveness and desirable attributes, such as high rigidity, resistance to creep, strength, and a high heat deflection temperature.

By Module Analysis

- The plate and frame technology is widely accepted as the most efficient and adaptable method for gas separation, and it is expected to continue leading the gas separation membrane market during the forecast period. The module design consists of stacked plates and frames, providing a large surface area for effective gas separation techniques such as adsorption and membrane filtration. As a result, it has become the preferred choice for various applications, including industrial gas purification, greenhouse gas capture, and natural gas processing. Its modular design also allows for easy customization and integration into existing gas separation systems, providing a cost-effective and eco-friendly solution to meet the growing demand for advanced gas segregation technologies.

By Application Analysis

- Based on application analysis, the market has been segmented on the basis of air dehydration, H2S removal, hydrogen recovery, nitrogen generation & oxygen enrichment, vapor separation, gas separation, and carbon dioxide removal. The gas separation segment is expected to grow with fastest CAGR during the gas separation membrane market forecast period. Fueled by its effectiveness in tackling a range of industry obstacles, this technology involves separating different vapor components from gas mixtures, proving invaluable across sectors like petrochemicals, natural gas processing, and environmental conservation. Its expansion is credited to its ability to achieve high-purity separations with lower energy consumption compared to conventional gas separation methods. With industries placing greater emphasis on environmental sustainability and strict quality criteria, gas separation emerges as a crucial solution to address these requirements, resulting in its rapid uptake and expansion within the gas separation industry.

Gas Separation Membrane Market Regional Insights

The Asia Pacific region dominated the global market with the largest market share in 2023

The Asia Pacific region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. The gas separation membrane industry in the Asia-Pacific region is experiencing notable growth and advancement. This expansion is propelled by several factors, including the region's thriving industrial sectors, growing focus on environmental sustainability, and rising demand for clean energy solutions. Gas separation membranes, employed in various applications such as nitrogen generation, carbon capture, and natural gas processing, are increasingly favored due to their energy efficiency and economic viability.

Moreover, governmental initiatives aimed at reducing greenhouse gas emissions are further boosting the adoption of gas separation membranes, positioning the Asia-Pacific market as a key hub for the progression and deployment of these cutting-edge technologies. For instance, in May 2023, Governments across Asia and the Pacific unanimously supported a UN resolution to urgently address climate change and its effects. They have reaffirmed their commitment to immediately reduce greenhouse gas emissions, with the region currently responsible for more than half of global emissions.

Competitive Landscape

The gas separation membrane market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Air Liquide

- Air Products and Chemicals, Inc.

- DIC Corporation

- FUJIFILM Manufacturing Europe B.V.

- Generon

- Honeywell UOP

- Membrane Technology and Research, Inc.

- PARKER HANNIFIN CORPORATION

- SLB

- UBE Corporation.

Recent Developments

- In September 2023, Membrane Technology and Research, Inc. enlarged its operations by constructing the largest membrane-based carbon capture facility in Gillette, Wyoming. This expansion will enable the company to utilize Polaris polymeric membrane technology to capture over 150 tonnes of CO2 daily.

- In June 2022, FUJIFILM Manufacturing Europe B.V. increased membrane production at its Tilburg manufacturing plant in the Netherlands, prioritizing sustainability. The facility incorporates efforts to attain CO2-neutral status and utilizes eco-friendly technologies for wastewater treatment. This expansion has enabled the company to enhance membrane production capacity and meet growing product demands.

Report Coverage

The Gas Separation Membrane market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, material, module, application and their futuristic growth opportunities.

Gas Separation Membrane Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 0.94 billion |

|

Revenue forecast in 2032 |

USD 1.60 billion |

|

CAGR |

6.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Material, By Module, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Gas Separation Membrane Market are Air Liquide, Air Products and Chemicals, Inc., UBE Corporation, Honeywell UOP, FUJIFILM Manufacturing Europe B.V., SLB

Gas Separation Membrane Market exhibiting the CAGR of 6.8% during the forecast period

The Gas Separation Membrane Market report covering key segments are material, module, application and region.

key driving factors in Gas Separation Membrane Market are advancements in the field of membrane technology

The global Gas Separation Membrane market size is expected to reach USD 1.60 billion by 2032