Hemodynamic Monitoring Devices Market Share, Size, Trends, Industry Analysis Report,

By System Type; By Product (Disposables, And Monitors); By End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Jun-2024

- Pages: 116

- Format: PDF

- Report ID: PM1302

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

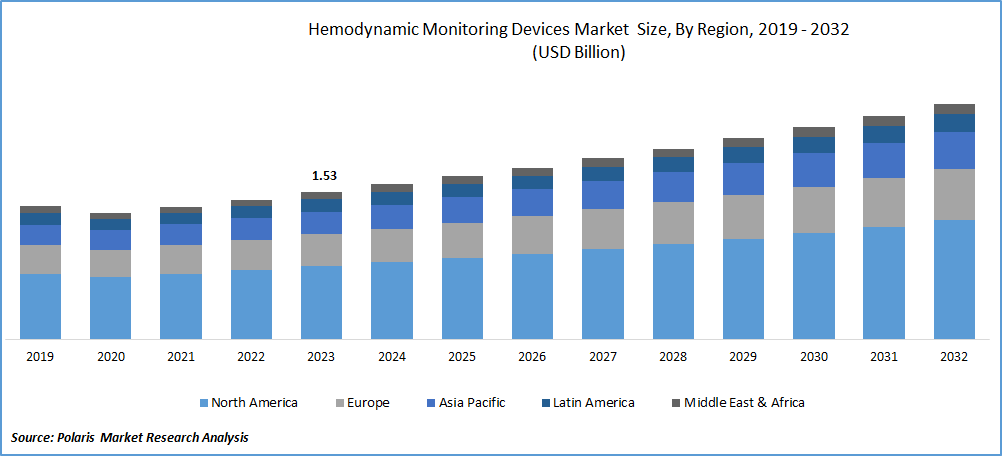

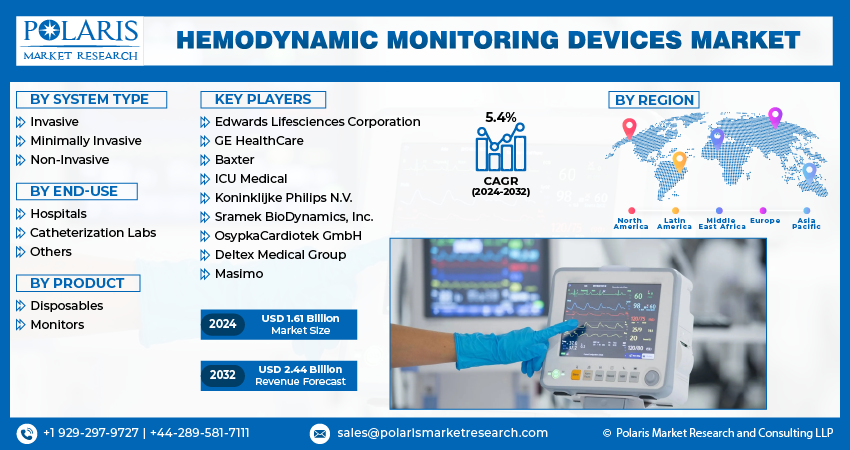

The hemodynamic monitoring devices market size was valued at USD 1.53 billion in 2023. The market is anticipated to grow from USD 1.61 billion in 2024 to USD 2.44 billion by 2032, exhibiting a CAGR of 5.4% during the forecast period.

Industry Trend

Hemodynamic monitoring devices are crucial in assessing the cardiovascular health of patients by measuring blood pressure, cardiac output, and oxygen levels in the blood. These devices provide critical information that helps healthcare professionals manage and treat conditions such as heart failure, sepsis, and post-operative care. Hemodynamic monitoring can be invasive, such as pulmonary artery catheters, or non-invasive, like Doppler ultrasound and impedance cardiography.

To Understand More About this Research:Request a Free Sample Report

The market for hemodynamic monitoring devices has been experiencing significant growth, driven by the rising prevalence of cardiovascular diseases, technological advancements, and an increasing aging population. These devices are vital in intensive care units (ICUs), operating rooms, and emergency departments, where continuous monitoring of a patient’s hemodynamic status is essential for timely and accurate medical interventions.

Cardiovascular diseases (CVDs) are among the leading causes of death globally. The World Health Organization (WHO) estimates that CVDs account for approximately 17.9 billion deaths annually. This high prevalence of cardiovascular conditions drives the demand for hemodynamic monitoring devices, as they are essential in diagnosing and managing these diseases. The growing incidence of hypertension, coronary artery disease, and heart failure significantly contributes to market expansion.

Advancements in technology have led to the development of more sophisticated and accurate hemodynamic monitoring devices. Innovations such as minimally invasive devices, wireless monitoring systems, and real-time data analysis have improved patient outcomes and reduced complications associated with invasive procedures. For instance, the advent of advanced sensors and wearable devices has made continuous monitoring more feasible and less intrusive, enhancing patient comfort and compliance. The global population is aging, with the number of people aged 60 years and older expected to double by 2050, according to the United Nations. Older adults are more susceptible to chronic conditions, including cardiovascular diseases, which necessitate regular monitoring. This demographic shift is expected to drive the demand for hemodynamic monitoring devices as healthcare systems adapt to manage the increasing burden of chronic illnesses in an aging population.

The COVID-19 pandemic has also impacted the hemodynamic monitoring devices market. The virus can cause severe cardiovascular complications, necessitating continuous monitoring of affected patients. The pandemic highlighted the importance of advanced monitoring systems in managing critical conditions, leading to increased adoption and innovation in this field.

Key Takeaway

- North America dominated the largest market and contributed to more than 38% of the share in 2023.

- The Asia Pacific market is expected to be the fastest-growing CAGR during the forecast period.

- By product category, the monitors segment accounted for the largest market share in 2023.

- By end-use category, the hospitals segment is projected to grow at a high CAGR during the projected period.

What are the Market Drivers Driving the Demand for the Hemodynamic Monitoring Devices Market?

Rising Prevalence of Cardiovascular Diseases

The rising prevalence of cardiovascular diseases (CVDs) is a significant driver of the hemodynamic monitoring devices market. Cardiovascular diseases, including conditions such as coronary artery disease, hypertension, heart failure, and arrhythmias, are the leading cause of morbidity and mortality globally. This escalating burden of CVDs necessitates advanced diagnostic and monitoring tools to manage and treat these conditions effectively. Here's how the increasing prevalence of cardiovascular diseases impacts the hemodynamic monitoring devices market:

As the incidence of CVDs continues to rise, there is an urgent need for early diagnosis and continuous monitoring to manage these conditions effectively. Hemodynamic monitoring devices play a crucial role in providing real-time data on the cardiovascular system's functioning. These devices help in detecting early signs of deterioration, enabling timely medical intervention and reducing the risk of severe complications or sudden cardiac events.

Patients with cardiovascular diseases often require intensive monitoring, especially those in critical care settings such as intensive care units (ICUs) and emergency departments. Hemodynamic monitoring devices provide continuous and accurate measurements of parameters like blood pressure, cardiac output, and oxygen saturation. This continuous monitoring is essential for managing patients with acute cardiac conditions, post-operative cardiac surgery care, and patients with chronic heart failure, ensuring optimal treatment and patient safety.

Which Factor is Restraining the Demand for Hemodynamic Monitoring Devices?

Complexity and Training Requirements

The operation of advanced hemodynamic monitoring devices typically necessitates specialized training due to their intricate functionalities and data interpretation methods. Healthcare professionals, including nurses, physicians, and technicians, must undergo comprehensive training programs to understand the principles behind these devices, learn how to set them up correctly, and interpret the obtained hemodynamic data accurately. Hemodynamic parameters such as cardiac output, stroke volume, and systemic vascular resistance are crucial indicators of cardiovascular health. However, interpreting these parameters accurately requires a deep understanding of cardiovascular physiology and the ability to analyze complex data sets generated by the monitoring devices. Healthcare professionals must be trained to recognize abnormal trends or patterns in the data and make informed clinical decisions based on these observations.

Report Segmentation

The market is primarily segmented based on system type, product, end-use, and region.

|

By System Type |

By Product |

By End-use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Product Insights

Based on product analysis, the market is segmented on the disposables, monitors. Monitors segment held the largest market share in 2023. Monitors offer comprehensive monitoring capabilities, allowing healthcare providers to assess various hemodynamic parameters such as blood pressure, cardiac output, oxygen saturation, and heart rate. These devices provide real-time data visualization and analysis, enabling clinicians to make informed decisions regarding patient care. The monitors segment encompasses a diverse range of products, including multi-parameter monitors, bedside monitors, telemetry systems, and central monitoring stations. This variety caters to different healthcare settings and patient needs, ranging from critical care units to ambulatory settings. Continuous advancements in monitoring technology have enhanced the performance and features of hemodynamic monitors.

By End-use Insights

Based on end-use analysis, the market has been segmented on the basis of hospitals, catheterization labs, others. The hospitals segment expected to be the fastest growing CAGR during the forecast period. Hospitals are the primary healthcare providers and receive substantial investments to upgrade their infrastructure and medical equipment. As healthcare expenditure continues to rise globally, hospitals have greater financial resources to invest in advanced hemodynamic monitoring devices to enhance patient care and clinical outcomes. With an aging population and increasing prevalence of chronic diseases, hospitals are experiencing higher patient volumes and a greater demand for medical services.

Regional Insights

North America

North America region accounted to be the largest market share in 2023. North America features an extensively developed healthcare infrastructure marked by cutting-edge medical facilities, advanced hospitals, and a strong network of healthcare providers. This well-established healthcare system fosters the adoption of cutting-edge medical technologies, including hemodynamic monitoring devices. The region is home to leading medical device manufacturers and research institutions that drive advancements in hemodynamic monitoring technology. Continuous innovation and product development contribute to the widespread adoption of these devices across North America. Cardiovascular diseases (CVDs) remain a significant health concern, with high prevalence rates of conditions such as hypertension, coronary artery disease, and heart failure. The need for effective management and monitoring of these cardiovascular conditions fuels the demand for hemodynamic monitoring devices in the region.

Asia Pacific

Asia Pacific is expected for the growth of fastest CAGR during the forecast period. Economic growth in countries across the Asia Pacific region has led to increased healthcare spending. Governments and private sector entities are investing in healthcare infrastructure, including hospitals, clinics, and medical equipment. This growing healthcare expenditure fosters the adoption of advanced medical technologies, including hemodynamic monitoring devices.

The Asia Pacific region is witnessing a surge in the prevalence of cardiovascular diseases (CVDs) due to changing lifestyles, dietary habits, and aging populations. Conditions such as hypertension, coronary artery disease, and heart failure are becoming more prevalent, driving the demand for hemodynamic monitoring devices for early diagnosis and effective management. As the population in the Asia Pacific region ages, there is a higher incidence of age-related cardiovascular conditions and chronic diseases. The elderly population is more susceptible to cardiovascular issues, necessitating continuous monitoring of hemodynamic parameters. This demographic trend contributes to the increased demand for hemodynamic monitoring devices in hospitals, clinics, and long-term care facilities.

Competitive Landscape

In the competitive landscape of the hemodynamic monitoring devices market, numerous players vie for market share and innovation prowess. Key industry contenders such as Edwards Lifesciences Corporation, Baxter International Inc., and LiDCO Group plc, among others, are prominent contributors driving advancements in monitoring solutions. These companies distinguish themselves through extensive product portfolios, focusing on continuous innovation, strategic partnerships, and global market expansion initiatives. GE Healthcare and Philips Healthcare, renowned for their comprehensive monitoring solutions, exhibit a robust presence, leveraging their global reach and technological expertise to cater to diverse clinical needs. Additionally, regional players like Nihon Kohden Corporation and Teleflex Incorporated offer specialized monitoring devices tailored to specific market segments. With a relentless focus on quality, reliability, and customer satisfaction, companies in the hemodynamic monitoring devices market navigate a landscape shaped by dynamic market trends, regulatory requirements, and evolving customer preferences.

Some of the major players operating in the global market include:

- Edwards Lifesciences Corporation

- GE HealthCare

- Baxter

- ICU Medical

- Koninklijke Philips N.V.

- Sramek BioDynamics, Inc.

- OsypkaCardiotek GmbH

- Deltex Medical Group

- Masimo

Recent Developments

- In May 2021, Philips has unveiled its new integrated Interventional Hemodynamic System featuring the IntelliVue X3 Patient Monitor at the ACC.21 conference. This innovative system is designed to enhance workflow efficiency and improve patient focus during image-guided procedures.

Report Coverage

The hemodynamic monitoring devices market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, system type, product, end-use, and their futuristic growth opportunities.

Hemodynamic Monitoring Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.61 billion |

|

Revenue forecast in 2032 |

USD 2.44 billion |

|

CAGR |

5.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By System Type, By Product, By End-Use And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Hemodynamic Monitoring Devices Market are Edwards Lifesciences Corporation, GE HealthCare, Baxter, ICU Medical, Koninklijke Philips N.V

The hemodynamic monitoring devices market exhibiting a CAGR of 5.4% during the forecast period

Hemodynamic Monitoring Devices Market report covering key segments are system type, product, end-use, and region.

The key driving factors in Hemodynamic Monitoring Devices Market are Increasing Adoption in Various Healthcare Settings

Hemodynamic Monitoring Devices Market Size Worth $ 2.44 Billion by 2032