Ready to Drink Tea & Coffee Market Share, Size, Trends, Industry Analysis Report,

By Packaging (PET Bottle, Canned, Glass Bottle, Others); By Distribution channel; By Product; By Price; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 120

- Format: PDF

- Report ID: PM1147

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

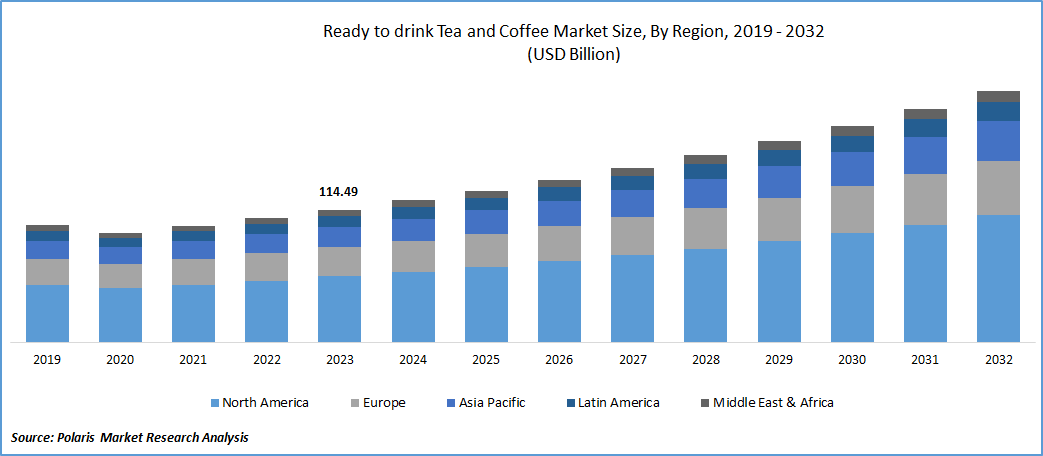

Global Ready-to-Drink Tea and Coffee Market Size was valued at USD 114.49 Billion in 2023. The Ready to Drink Tea and Coffee Market industry is projected to grow from USD 122.63 Billion in 2024 to USD 216.40 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.4% during the forecast period (2024 - 2032). The ready-to-drink tea and coffee market growth is driven by its increasing consumption, especially among urban population. In urban cities, individuals have busy schedules and limited time for traditional meal and beverage preparation, further fuelling the demand. According to the survey conducted by the United States’ State of Work, approximately 58% of the American workforce is focused and productive in their daily duties, leaving them with limited time for activities outside of their primary responsibilities. The increasing popularity of ready-to-drink tea and coffee is attributed to the convenience of high-quality beverages during work hours, or while participating in various activities such as travelling, outdoor exercises, and social gatherings. Moreover, convenience and portable options available with ready-to-drink tea and coffee have gained its popularity since these products offer quick and easy access to caffeine and refreshments without the need for brewing or steeping.

To Understand More About this Research:Request a Free Sample Report

Additionally, consumers are becoming more health-conscious and are seeking alternatives to beverages, such as sugary sodas and artificial drinks. Ready-to-drink teas are perceived as healthier drinks due to the presence of natural ingredients and potential health benefits, such as antioxidants. Similarly, ready-to-drink coffees cater to individuals looking for a quick energy boost without the added sugars and calories. Thus, the health benefits associated with ready-to-drink tea and coffee have led to its emergence as an attractive option for a wide range of consumers.

Ready-to-Drink Tea and Coffee Market Trends:

Increasing Product Launches Are Fueling the Ready to Drink Tea and Coffee Market Growth

Market CAGR for ready-to-drink tea and coffee is driven by the increasing product launches within the food and beverages industry. In the ready-to-drink tea and coffee market outlook, the companies are continually introducing new flavors, formulations, and packaging to capture the attention of consumers and differentiate themselves in a competitive market. For instance, in July 2024, DAVIDsTEA launched ready-to-drink (RTD) sparkling cold-brewed iced tea, which features an Organic Earl Grey blend produced in collaboration with LOOP Mission. The product feature highlights the health benefits, such as low calories and unique ingredients that attract consumers. Thus, product launches by manufacturers maintain consumers' interest and attract new customers with new flavor offerings. The dynamic and innovative approach fosters product adoption and ensures a continuous influx of fresh and stimulating alternatives, thereby propelling overall ready-to-drink tea and coffee market growth.

Variety in Flavor Profiles and Premiumization Is Bolstering the Ready-to-Drink Tea and Coffee Market Size

The ready-to-drink tea and coffee market is experiencing strong growth due to its wide variety of flavors, such as ginseng and honey, fruit juice cocktails, mint, lemon, peach, strawberry, and fruity cereal-flavored coffee. Manufacturers such as Coca-Cola HBC, Snapple Beverage Corp., Arizona Beverages USA, and PepsiCo Inc., among others, consistently innovate and introduce a wide spectrum of flavors that cater to various taste preferences and cultural influences. This proliferation of unique flavors is attracting a diverse consumer base and encouraging repeat purchases as consumers explore new taste experiences. Furthermore, the market trends toward premiumization involve the use of premium ingredients, such as single-origin coffee beans, organic teas, and exotic flavors, that enhance the product's appeal and allow brands to command higher price points. Also, the emergence of single-origin coffee blends, artisanal cold brews, and handcrafted tea concoctions has attracted individuals seeking premium and exclusive taste experiences, further fueling the ready-to-drink tea and coffee market revenue.

Report Segmentation

The market is primarily segmented based on packaging, product, distribution channel, price, and region.

|

By Packaging |

By Product |

By Distribution Channel |

By Price |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Ready-to-Drink Tea and Coffee Market Segment Insights:

Ready-to-Drink Tea and Coffee Packaging Insights:

The global ready to drink tea and coffee market segmentation, based on packaging, includes PET bottle, canned, glass bottle, and others. The PET bottle segment held the largest market share in 2023 due to the recyclable nature of these bottles. PET bottles offer a sustainable packaging solution that aligns with the increasing consumer demand for environment-friendly products. These lightweight, shatter-resistant, and easily recyclable bottles are ideal for both manufacturers and consumers seeking to reduce environmental footprint. The availability of recycling infrastructure for PET bottles further enhances their adoption. According to the PET Resin Association (PETRA), over 1.5 billion pounds of post-consumer PET bottles and containers, such as beverage bottles and cosmetics containers, are recovered for recycling annually in the United States. This high rate of recycling helps to position PET bottles as an effective packaging option, pleading to eco-conscious consumers. Thus, the availability of recycling facilities, along with an emphasis on sustainability, has resulted in the dominance of PET bottle packaging in the ready-to-drink tea and coffee market.

Ready-to-Drink Tea and Coffee Distribution Channel Insights:

The global ready-to-drink tea and coffee market segmentation, based on distribution channel, includes food service, supermarkets/hypermarkets, convenience stores, and online. The online distribution channel in the ready-to-drink tea and coffee market is expected to grow significantly over the forecast period due to the growing e-commerce sale of beverages that provide convenience, product variety, and competitive pricing.

Furthermore, according to the Census Bureau of the Department of Commerce, retail e-commerce sales in the United States increased by 2.1% from the fourth quarter of 2023 to the first quarter of 2024, reaching a value of USD 289.2 billion. The growth of e-commerce has expanded the reach and optimized the distribution channels for ready-to-drink tea and coffee manufacturers, resulting in more personalized shopping experiences for consumers. Thus, the upward trend of the e-commerce sector underscores the growing consumer preference for online shopping, further fueling the online segment of the market.

Global Ready-to-Drink Tea and Coffee Market, By Product, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Ready-to-Drink Tea and Coffee Regional Insights:

By region, the study provides the ready-to-drink tea and coffee market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America ready to drink tea and coffee market held the largest revenue share in the global market due to the increasing consumption of tea across the region. For instance, the Tea Association of the USA reported that Americans consumed approximately 85 billion servings of tea, equivalent to over 3.9 billion gallons, in 2021. The preference for black tea, accounted for 84% of total consumption, and the share of green tea, at 15%, demonstrating a diverse demand for tea products. This high level of consumption drives market demand for convenient ready-to-drink tea options in North America.

Further, the major countries studied in the market report are the US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Global Ready-to-Drink Tea and Coffee Market Share, by Region 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Asia Pacific ready-to-drink tea and coffee market is anticipated to grow with a significant CAGR over the forecast period. The growth is attributed to the rising popularity and consumption of these beverages among millennials and Gen Zs. These younger demographics have preferred convenient and innovative beverage choices that cater to dynamic and fast-paced lifestyles. Thus, the preference for premium, trendy, and health-conscious products by millennials and Gen Zs is expected to fuel the market growth in the region.

Furthermore, China's ready-to-drink tea and coffee market is driven by the country's long-standing tea culture. Consumers within the country are increasingly embracing RTD tea due to its health benefits and wide variety of flavors. The popularity of herbal and traditional tea blends in RTD formats caters to health-conscious consumers. Additionally, Japan's market is well-established and highly innovative in the context of ready-to-drink tea and coffee. For instance, in April 2023, Asahi, a beverage company, launched a new ready-to-drink (RTD) green tea specifically formulated to cater to a new generation of Japan's tea consumers. Since Japan has a longstanding tradition of green tea consumption, the market for ready-to-drink tea and coffee in the country demonstrates the potential for significant growth in the forecast period.

Ready-to-Drink Tea and Coffee Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the ready-to-drink tea and coffee market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market climate, ready-to-drink tea and coffee industry must offer innovative solutions.

The ready-to-drink tea and coffee market is fragmented, with the participation of numerous global and regional market players. The leading market entities are placing substantial emphasis on a range of business development strategies, such as quality control assurance, product standardization, and enhancement of supply chain management systems. Major players in the ready-to-drink tea and coffee market, including AriZona Beverages USA, ASAHI GROUP HOLDINGS, LTD., Coca-Cola HBC, Danone, Monster Energy Company, Nestlé, PepsiCo, Pretty Tasty Tea, Starbucks Corporation, and SUNTORY HOLDINGS LIMITED.

Danone is a food and beverage company that focuses on health-oriented and rapidly expanding sectors across three main businesses, such as Essential Dairy & Plant-Based products, Waters, and Specialized Nutrition. The company specializes in a wide range of products, including fresh dairy items, bottled water, early-life nutrition, medical nutrition, and plant-based alternatives. Danone North America allocated USD 65 million to establish a new bottle production line in Jacksonville, Florida. The move aims to increase the production capacity of its ready-to-drink (RTD) coffee brand, SToK, and its plant-based creamers.

Asahi Group Holdings Ltd. is a Japanese company that specializes in manufacturing and selling food and beverages. The company operates through three segments, including soft drinks, alcoholic beverages, and food business. The soft drinks segment offers refreshing chilled beverages such as coffee, tea-based drinks, water, fruit and vegetable drinks, carbonated soft drinks, and lactic acid drinks. The alcoholic beverages segment includes various types of drinks, such as shochu, beer, spirits and whiskey, wine, and low-alcohol beverages. The food segment provides various products like pharmaceuticals, supplements, confectioneries, freeze-dried foods, baby products, retort-pouch foods, and seasonings. In May 2024, Asahi Europe & International (AEI) completed the acquisition of Octopi Brewing, a contract beverage production and co-packing facility situated in Waunakee, Wisconsin.

Key Companies in the Ready-to-Drink Tea and Coffee Market include:

- AriZona Beverages USA

- ASAHI GROUP HOLDINGS, LTD.

- Coca-Cola HBC

- Danone

- Monster Energy Company

- Nestlé

- PepsiCo

- Pretty Tasty Tea

- Starbucks Corporation

- SUNTORY HOLDINGS LIMITED

Ready-to-Drink Tea and Coffee Industry Developments

March 2024: Starbucks launched ready-to-drink coffee offerings, featuring the new Starbucks Oatmilk Frappuccino Chilled Coffee Drink, as well as updated versions of the Starbucks Cold Brew and Starbucks Multi-serve Cold Brew.

June 2024: Starbucks collaborated with Arla, a dairy company, to introduce a new series of ready-to-drink coffee beverages with a high protein content. The product line has been introduced in three flavor options, including Caffe Latte, Chocolate Mocha, and Caramel Hazelnut.

December 2022: MatchaKo introduced ready-to-drink premium matcha beverage with certifications for organic, non-GMO project Verification, and vegan status.

Ready-to-Drink Tea and Coffee Market Segmentation:

Ready-to-Drink Tea and Coffee Product Outlook

- RTD Coffee

- Flavored coffee

- Cold brew coffee

- Iced coffee

- Others

- RTD Tea

- Kombucha

- Green

- Black

- Fruit

- Others

Ready-to-Drink Tea and Coffee Packaging Outlook

- PET Bottle

- Canned

- Glass Bottle

- Others

Ready-to-Drink Tea and Coffee, Price Outlook

- Economy

- Premium

Ready-to-Drink Tea and Coffee, Distribution Channel Outlook

- Food Service

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

Ready-to-Drink Tea and Coffee Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ready-to-Drink Tea and Coffee Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 114.49 Billion |

|

Market size value in 2024 |

USD 122.63 Billion |

|

Revenue Forecast in 2032 |

USD 216.40 Billion |

|

CAGR |

7.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Ready to Drink Tea & Coffee Market report covering key segments are packaging, product, distribution channel, price, and region.

Ready to Drink Tea & Coffee Market Size Worth $ 216.40 Billion By 2032

The global Ready to Drink Tea & Coffee market is expected to grow at a CAGR of 7.4% during the forecast period.

Asia Pacific is leading the global market.

The key driving factors in Ready to Drink Tea & Coffee Market are Variety in Flavor Profiles and Premiumization.