Global Grafted Polyolefins Market Size, Share, Trends, Industry Analysis Report

: By Type (Maleic Anhydride Grafted PE, Maleic Anhydride Grafted PP, Maleic Anhydride Grafted EVA, and Others), By Processing Technology, By Application, By End-Use, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 115

- Format: PDF

- Report ID: PM4985

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

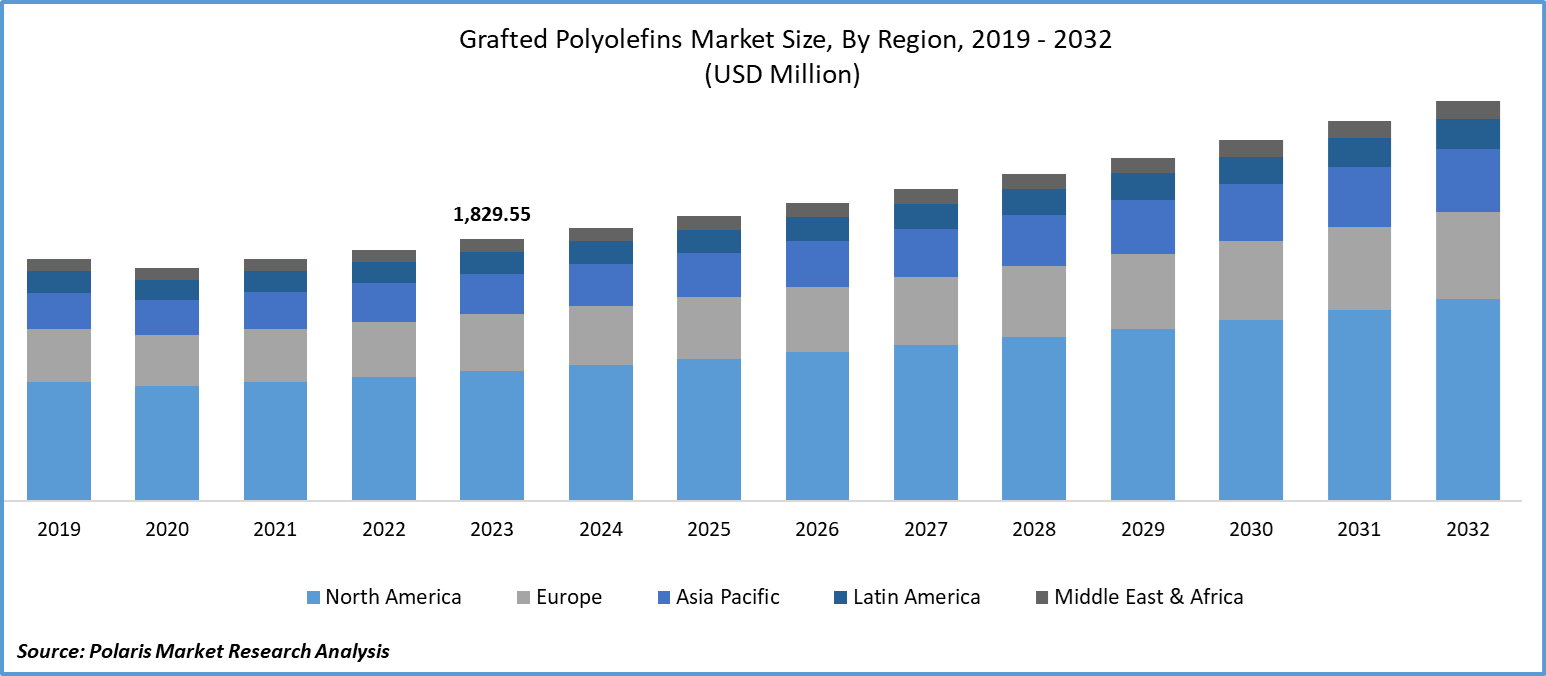

Global grafted polyolefins market size was valued at USD 1,829.55 million in 2023. The grafted polyolefins industry is projected to grow from USD 1,907.68 million in 2024 to USD 2,797.00 million by 2032, exhibiting a compound annual growth rate (CAGR) of 4.9% during the forecast period (2024 - 2032). The grafted polyolefins market is growing rapidly due to the increasing number of people building new houses around the world. This, along with rising rental costs, is significantly boosting the expansion of the construction industry. As a result, there is a higher demand for construction equipment and tools, including adhesives and sealants. Grafted polyolefins are becoming more popular in building and construction activities due to their compatibility with multiple substrates and their extensive adhesive properties, which is driving the market industry. Furthermore, the growing number of researchers evaluating the characteristics of grafted polyolefins and the increasing efforts to promote their use in industrial applications are likely to boost their demand in the coming years.

In November 2023, a study published in Construction and Building Materials introduced functional graft copolymers and polyolefins. The study demonstrated improved temperature performance compared to modified bitumen, making it suitable for road construction.

To Understand More About this Research: Request a Free Sample Report

The growing use of grafted polyolefins in the automotive industry and textile manufacturing is significantly impacting the global market. This is driven by the increasing disposable income of the population, which is creating a demand for essential, stylish, and high-end products worldwide. There is a notable demand for grafted polyolefins as more companies are developing new vehicle models with efficient performance due to their substantial chemical resistance and lightweight characteristics.

Grafted Polyolefins Market Trends:

Growing Consumption of High Performing Polymers is Driving the Market Growth

The market for grafted polyolefins is growing due to the increasing demand for heat-resistant polymers with lower susceptibility to UV radiation. The versatility of grafted polyolefins is projected to create a wide range of growth opportunities in the market. Additionally, the lightweight nature of grafted polyolefins is a key characteristic, especially in the automotive industry. The growing use of electric vehicles is prompting companies to focus on developing lightweight vehicles, which will further drive the expansion of grafted polyolefins in the future.

Furthermore, the increasing innovation activities by the major players are playing a vital role in market expansion. These types of development activities are likely to fuel the need for grafted polyolefins due to their potential to combine two substrates effectively.

The Increasing Development of Effective Recycling Methods

The increasing investment in the production of sustainable polyolefins is being driven by efforts to reduce plastic usage and promote a circular economy worldwide. This trend is significantly fueling research initiatives and is expected to drive increased usage in the coming years as more people become aware of recycling procedures. For instance, a 2023 study published in the Composites journal focused on designing environmentally friendly bio-composites by using recycled polyolefins derived from almond hull and shell.

Chemical methods such as pyrolysis and depolymerization break down grafted polyolefins into reusable components, while mechanical processes like grinding and melt extrusion enable the production of recycled pellets or products. Additionally, biodegradable options provide environmentally friendly disposal pathways, and energy recovery methods offer an alternative when recycling isn't feasible. These innovations demonstrate ongoing efforts by researchers and industry leaders to minimize waste, conserve resources, and reduce environmental impact through improved recycling technologies for grafted polyolefins, which are contributing to the growth of the grafted polyolefins market.

Grafted Polyolefins Market Segment Insights:

Grafted Polyolefins Processing Technology Insights:

The global grafted polyolefins market segmentation, based on processing technology includes extrusion, melt grafting, and others. The melt grafting segment held the largest market share in 2023 and is expected to maintain its position throughout the forecast period. Its ability to reduce the need for additional processing phases makes it a favorable option for grafted polyolefin manufacturing among producers. Additionally, its higher convenience in managing reaction time and real-time monomer concentration is leading to widespread adoption globally.

Grafted Polyolefins Application Insights:

The global grafted polyolefins market segmentation, based on application, includes adhesion, promotion, impact modification, compatibilization, bonding, and others. In 2023, the impact modification segment held a significant market share, due to its ability to enhance the shelf life and toughness of end-products. The increasing demand for rigidity, chemical resistance, and impact resistance in the automotive and packaged goods industries is a major driver of revenue for grafted polyolefins in impact modification applications.

Global Grafted Polyolefins Market, Segmental Coverage, 2019 - 2032 (USD Million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Grafted Polyolefins Regional Insights:

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America region held the dominant share in 2023. This is mainly attributable to the increasing investments in the automobile industry and the presence of upgraded infrastructure facilities in the region. Further, the growing disposable income among individuals, specifically in the United States, is creating diverse opportunities for grafted polyolefins in terms of automobiles, packaging solutions, and electric components. Also, stringent regulations to mitigate greenhouse gas emissions by the Canadian government are anticipated to create significant demand for grafted polyolefins. For instance, the new regulations by the government emphasize the necessity of equipping zero emission vehicles by 20%, 60%, and 100% at the end of 2026, 2030, and 2035, respectively.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, and others.

The European grafted polyolefins market is expected to grow significantly during the forecast period owing to rising technological advancements, stringent regulations, and the presence of various key players, such as Arkema, which provides polyamide-grafted polyolefins using melt grafting. In addition, European manufacturers continue to innovate to meet the needs of various industries, such as automotive, construction, and packaging, further boosting the demand for grafted polyolefins.

The Asia Pacific region is expected to experience rapid growth with a significant CAGR during the projected period. This is due to the increasing use of electric vehicles, which is driving the demand for lighter battery components and polymers in the region, particularly in China and India. The region's higher population with increased disposable income is creating a favorable market for electric vehicles and packaged goods. For instance, according to the International Energy Agency, electric car sales in China reached 8 million in 2023, up from 6 million in 2022.

Global Grafted Polyolefins Market, Regional Coverage, 2019 - 2032 (USD Million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Grafted Polyolefins Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the grafted polyolefins market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the grafted polyolefins industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global grafted polyolefins industry to benefit clients and increase the market sector. In recent years, the grafted polyolefins industry has witnessed some technological advancements. Major players in the grafted polyolefins market include Arkema, Borealis AG, Clariant, COACE, Dow, Guangzhou Lushan New Materials Co., Ltd., LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Group Corporation, Mitsui Chemicals Asia Pacific, Ltd., SI Group, Inc.

Clariant is a specialty chemical company with three core business areas including care chemicals, natural resources, and catalysis. The care chemicals segment focuses on personal care, home care, crop solutions, paints & coatings, aviation, construction chemicals, and industrial lubricants. In May 2024, Clariant introduced innovative polymer solutions at NPE 2024 to enhance sustainability and performance in plastics, including PFAS-free AddWorks PPA for polyolefin film extrusion and Licolub PED 1316 wax for PVC processing in construction.

Dow Inc. provides a variety of materials science solutions to various industries, such as packaging, infrastructure, transportation, and consumer goods. The company’s operating business segments include performance materials & coatings, packaging & specialty plastics, and industrial intermediates & infrastructure. In March 2024, Dow introduced a POE-based artificial leather alternative for automotive seats. This alternative offers soft tactility, color stability, and reduced environmental impact while meeting stringent industry standards for performance and weight reduction.

Key Companies in the grafted polyolefins market include:

- Arkema

- Borealis AG

- Clariant

- COACE

- Dow

- Guangzhou Lushan New Materials Co., Ltd.

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Group Corporation

- Mitsui Chemicals Asia Pacific, Ltd.

- SI Group, Inc.

Grafted Polyolefins Industry Developments

June 2024: Borealis announced a new recyclate-based polyolefins compounding line in Belgium to advance circular economy solutions for high-quality PP and PE materials.

March 2024, Dow introduced a polyolefin elastomer-based artificial leather as a sustainable, high-performance alternative for the automotive and broader markets.

March 2022: The Compound Co., a chemical compound manufacturer, completed the acquisition of a production line and manufacturing facility for polymer resins pertaining to ExxonMobil, a natural gas company, to expand its production capacity to 70,000 tons annually.

Grafted Polyolefins Market Segmentation:

Grafted Polyolefins Type Outlook

- Maleic Anhydride Grafted PE

- Maleic Anhydride Grafted PP

- Maleic Anhydride Grafted EVA

- Others

Grafted Polyolefins Processing Technology Outlook

- Extrusion

- Melt grafting

- Others

Grafted Polyolefins Application Outlook

- Adhesion Promotion

- Impact Modification

- Compatibilization

- Bonding

- Others

Grafted Polyolefins End-Use Outlook

- Automotive

- Packaging

- Construction

- Textiles

- Adhesives & Sealants

- Others

Grafted Polyolefins Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Grafted Polyolefins Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,829.55 Million |

|

Market Size Value in 2024 |

USD 1,907.68 Million |

|

Revenue Forecast in 2032 |

USD 2,797.00 Million |

|

CAGR |

4.9% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global grafted polyolefins market size was valued at USD 1,829.55 million in 2023 and is projected to grow to USD 2,797.00 million by 2032.

The global market is projected to grow at a CAGR of 4.9% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market are Arkema, Borealis AG, Clariant, COACE, Dow, Guangzhou Lushan New Materials Co., Ltd., LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Group Corporation, Mitsui Chemicals Asia Pacific, Ltd., SI Group, Inc.

The melt grafting category dominated the market in 2023.

The impact modification had the largest share in the global market.