Global Hospital Electronic Health Records Market Share, Size, Trends, Industry Analysis Report

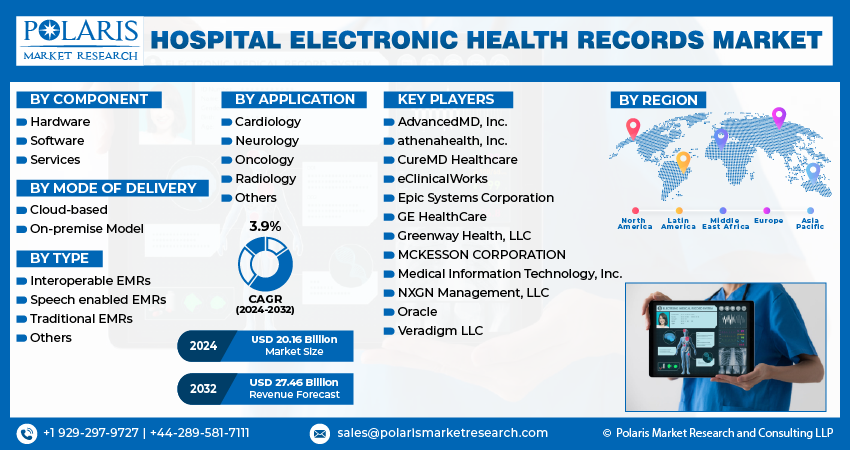

: By Component (Hardware, Software, Services), By Mode of Delivery, By Type, By Application, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 118

- Format: PDF

- Report ID: PM4984

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

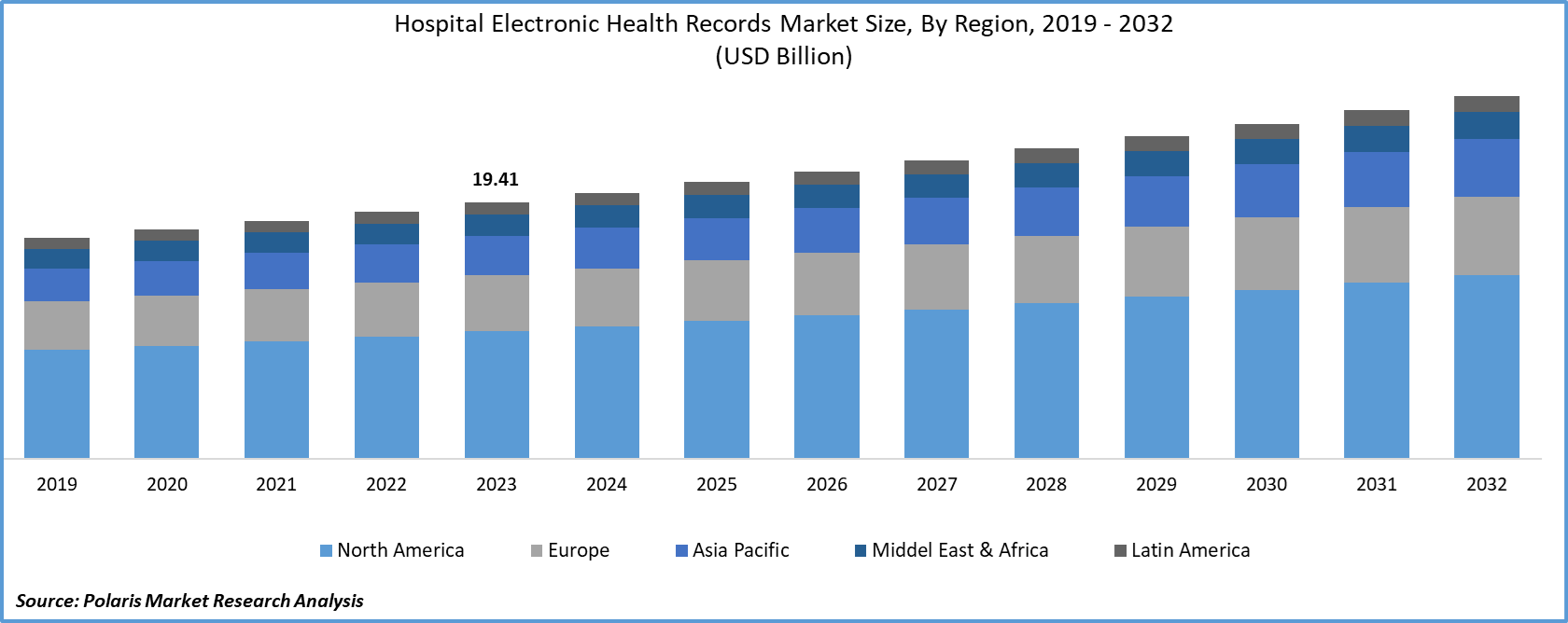

Global Hospital Electronic Health Records Market Size was valued at USD 19.41 billion in 2023. The hospital electronic health records industry is projected to grow from USD 20.16 billion in 2024 to USD 27.46 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 3.9% during the forecast period (2024 - 2032). An electronic health record is a digital compilation of a patient's medical information maintained by the healthcare provider. It encompasses essential administrative and clinical data such as demographics, medical issues, progress notes, medications, past medical history, vital signs, lab results, immunizations, and radiology reports. The increasing adoption of electronic health records by hospitals is a major driving force in the hospital electronic health records market.

For instance, according to the National Coordinator for Health Information Technology (ONC), in 2021, approximately 96% of non-federal acute care hospitals implemented certified EHR systems. The data represents a substantial advancement from 2011 when EHR adoption rates were at 28% for hospitals. Thus, the increase in the adoption of electronic health records for patient care, operational efficiency, and data management promoted digital health records in the healthcare industry is driving the hospital electronic health record market.

To Understand More About this Research: Request a Free Sample Report

Furthermore, government regulations, such as the HITECH Act, encouraged hospitals to shift from paper-based records to digital systems. The act provides incentives for the adoption of electronic health records and emphasizes the importance of safeguarding patient data. The enactment of the HITECH Act has resulted in enhanced communication, streamlined workflows, and provided a foundation for clinical decision support through electronic health records. This has led to a substantial expansion of the hospital electronic health records market.

Hospital Electronic Health Records Market Trends:

Increasing Product Launches are Fueling the Hospital Electronic Health Records Market Growth

In the hospital electronic health records market outlook, new EHR systems are equipped with enhanced features such as improved user interfaces, interoperability capabilities, advanced data analytics, and integration with emerging technologies such as AI and telehealth.

For instance, in March 2024, the Department of Veterans Affairs and the Defense Department introduced a new interoperable electronic health record at the Lovell FHCC (Capt. James A. Lovell Federal Health Care Center) in North Chicago.

The interoperability of electronic health record systems led to enhanced efficiency, user-friendliness, and the ability to deliver comprehensive patient care. Thus, hospitals are implementing electronic health records to provide a wide range of healthcare facilities such as accuracy and clarity of medical records and reduced delays in treatment, fueling the hospital electronic health records market growth.

Shift Towards Telemedicine Services is Propelling the Hospital Electronic Health Records Market Size

In the hospital electronic health records market, telemedicine has become an essential component of healthcare delivery as hospitals require electronic health records systems that support virtual consultations, remote monitoring, and digital communication between patients and providers. Healthcare providers, such as medical specialists and surgical specialists, are shifting towards the use of electronic health records to improve the efficiency and accuracy of healthcare delivery.

For instance, according to the National Electronic Health Records Survey, the utilization of telemedicine by medical specialists exceeded that of primary care physicians and surgical specialists, accounting for over 50% of patient visits. Furthermore, the American Hospital Association reported that approximately 76% of U.S. hospitals utilize video technologies to engage with patients and consulting practitioners.

The data represented the rising usage of hospital electronic health records as telemedicine services are becoming more prevalent in the healthcare industry. Thus, the integration of telemedicine enhances patient experience by providing timely and accessible care, further propelling hospital electronic health record market revenue.

Hospital Electronic Health Records Market Segment Insights:

Hospital Electronic Health Records Mode of Delivery Insights:

The global hospital electronic health records market segmentation, based on mode of delivery, includes cloud-based and on-premise models. The cloud-based segment of the hospital electronic health records market is projected to grow at a significant CAGR during the forecast period due to several benefits, such as improved decision-making, enhanced customer experience, improved productivity, and improved profitability.

Furthermore, cloud-based hospital electronic health records offer enhanced scalability, allowing healthcare providers to expand data storage and processing capabilities. In addition, several healthcare providers, including hospitals, are adopting cloud-based infrastructure to access patient records from diverse locations. Therefore, the cloud-based segment in the hospital electronic health records market is expected to grow significantly over the forecast period.

Hospital Electronic Health Records Type Insights:

The global hospital electronic health records market segmentation, based on type, includes interoperable EMRs, speech enabled EMRs, traditional EMRs, and others. The interoperable EMRs segment in the hospital electronic health records market is projected for significant growth, driven by a surge in product launches designed to meet the increasing demand for data exchange across healthcare systems. For instance, in April 2024, Vanderbilt Home Care introduced the Epic EHR Software to enhance interoperability with Vanderbilt University Medical Center's healthcare providers. This integration facilitated a comprehensive perspective of patient health data, enabling the delivery of tailored patient care. Thus, the innovations in interoperable EMRs are streamlining clinical workflows such as treatment plans, medical history, and medications, further propelling the adoption of interoperable EMRs in hospitals.

Global Hospital Electronic Health Records Market, Segmental Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Hospital Electronic Health Records Regional Insights:

By region, the study provides the hospital electronic health records market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America hospital electronic health records market held the highest revenue share in the global market since the region boasts advanced healthcare infrastructure and high levels of healthcare IT spending that enables hospitals to invest in electronic health record technologies.

For instance, as per the Definitive Healthcare HospitalView, the IT expenses of hospitals in the United States have shown an average annual increase of over 5% from 2017 to 2021. This data demonstrated that hospitals in the United States are continuously allocating a significant part of revenue for investment in technological upgrades, including electronic medical records, contributing to the dominance of North America in the global market.

Further, the major countries studied in the market report are the US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The Asia Pacific hospital electronic health records market is anticipated to grow significantly due to the growing prevalence of chronic diseases that are prompting healthcare providers to invest in technology that enhances patient care and operational efficiency. Furthermore, governments across the region are forming partnerships and hosting events to promote digital health equipment.

For instance, in October 2019, the Food and Health Bureau (FHB) of the Hong Kong Special Administrative Region Government and the Ministry of Health and Family Welfare of India, along with the Hong Kong Hospital Authority (HA), organized the Global Digital Health Partnership (GDHP) Summit at the Hong Kong Science Park. The summit emphasized the significance of digital health, particularly the electronic health record-sharing system (eHRSS). Consequently, the adoption of digital technologies in the healthcare sector by countries is driving growth in the Asia Pacific hospital electronic health records market.

Global Hospital Electronic Health Records Market, Regional Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Hospital Electronic Health Records Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the hospital electronic health records market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market climate, the hospital electronic health records industry must offer innovative solutions.

The hospital electronic health records market is fragmented, with the presence of numerous global and regional market players. The leading market players leverage advanced technologies such as cloud computing, artificial intelligence, and interoperability features to enhance data management, clinical workflows, and patient engagement within hospitals. Major players in the hospital electronic health records market, including AdvancedMD, Inc., athenahealth, Inc., CureMD Healthcare, eClinicalWorks, Epic Systems Corporation, GE HealthCare, Greenway Health, LLC, MCKESSON CORPORATION, Medical Information Technology, Inc., NXGN Management, LLC, Oracle, and Veradigm LLC.

Oracle Corporation provides products and services that address enterprise information technology environments globally. It offers licensed cloud-based business infrastructure solutions, middleware, and enterprise databases such as Oracle and Java. The company also offers Generative AI, which is powered by LLMs from Cohere, ensuring data security, performance, and deployment options for text generation. In September 2023, the GBIN (Georgian Bay Information Network), a collaboration of six Ontario healthcare establishments, enhanced the utilization of Oracle Health's electronic health records by integrating new functionalities for optimized medication administration, advanced clinical services, and oncology specialty support as part of its multi-year project, eNautilus.

Athenahealth is an IT services and IT consulting company that specializes in revenue cycle management, patient engagement, medical billing, electronic health records, care coordination, point-of-care mobile apps, population health management, and health information technologies. The company was founded in 1997 and is headquartered in Massachusetts, United States. In May 2024, Athenahealth launched advanced electronic health record products that integrate critical electronic health record and practice management functionalities with customized workflows designed to enhance the EHR experience.

Key Companies in the Hospital Electronic Health Records Market include:

- AdvancedMD, Inc.

- athenahealth, Inc.

- CureMD Healthcare

- eClinicalWorks

- Epic Systems Corporation

- GE HealthCare

- Greenway Health, LLC

- MCKESSON CORPORATION

- Medical Information Technology, Inc.

- NXGN Management, LLC

- Oracle

- Veradigm LLC

Hospital Electronic Health Records Industry Developments

May 2023: Seneca Healthcare District implemented an electronic health record (EHR) system that replaced the outdated system. The new EHR system offers patients a secure and efficient platform for electronically managing health and wellness information.

March 2023: Coryell Health initiated the implementation of the OracleCerner electronic health record (EHR) system to optimize operational workflows within the healthcare infrastructure. The integration of an advanced EHR platform aimed to enhance accessibility for healthcare providers and improve the overall patient care experience.

November 2021: The MHS GENESIS electronic health records (EHR) system has been implemented by the United States Coast Guard at 48 ashore sickbays and 26 clinics within the Coast Guard Atlantic Area, marking the completion of the initial phase of the service’s EHR system deployment.

April 2023: The Centre for Neuro Skills (CNS) implemented the MEDITECH Expanse, an Electronic Health Record (EHR) solution, through MEDITECH as a Service (MaaS). The implementation ensured the connectivity of patient records across all care teams and facilities, providing CNS with a comprehensive EHR system.

Market Segmentation:

Hospital Electronic Health Records Component Outlook

- Hardware

- Software

- Services

Hospital Electronic Health Records Mode of Delivery Outlook

- Cloud-based

- On-premise Model

Hospital Electronic Health Records, Type Outlook

- Interoperable EMRs

- Speech enabled EMRs

- Traditional EMRs

- Others

Hospital Electronic Health Records, Application Outlook

- Cardiology

- Neurology

- Oncology

- Radiology

- Others

Hospital Electronic Health Records Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Hospital Electronic Health Records Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 19.41 Billion |

|

Market Size Value in 2024 |

USD 20.16 Billion |

|

Revenue Forecast in 2032 |

USD 27.46 Billion |

|

CAGR |

3.9% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global hospital electronic health records market size was valued at USD 19.41 billion in 2023.

The global market is projected to grow at a CAGR of 3.9% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market are AdvancedMD, Inc., athenahealth, Inc., CureMD Healthcare, eClinicalWorks, Epic Systems Corporation, GE HealthCare, Greenway Health, LLC, MCKESSON CORPORATION, Medical Information Technology, Inc., NXGN Management, LLC, Oracle, and Veradigm LLC.

The cloud-based category is expected to grow with a significant CAGR in the market over the forecast period.

The interoperable EMRs are projected for significant growth in the global market.