Land Survey Equipment Market Share, Size, Trends, Industry Analysis Report,

By Industry (Mining & Construction, Transportation); By Solution; By Application; By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 114

- Format: PDF

- Report ID: PM4761

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

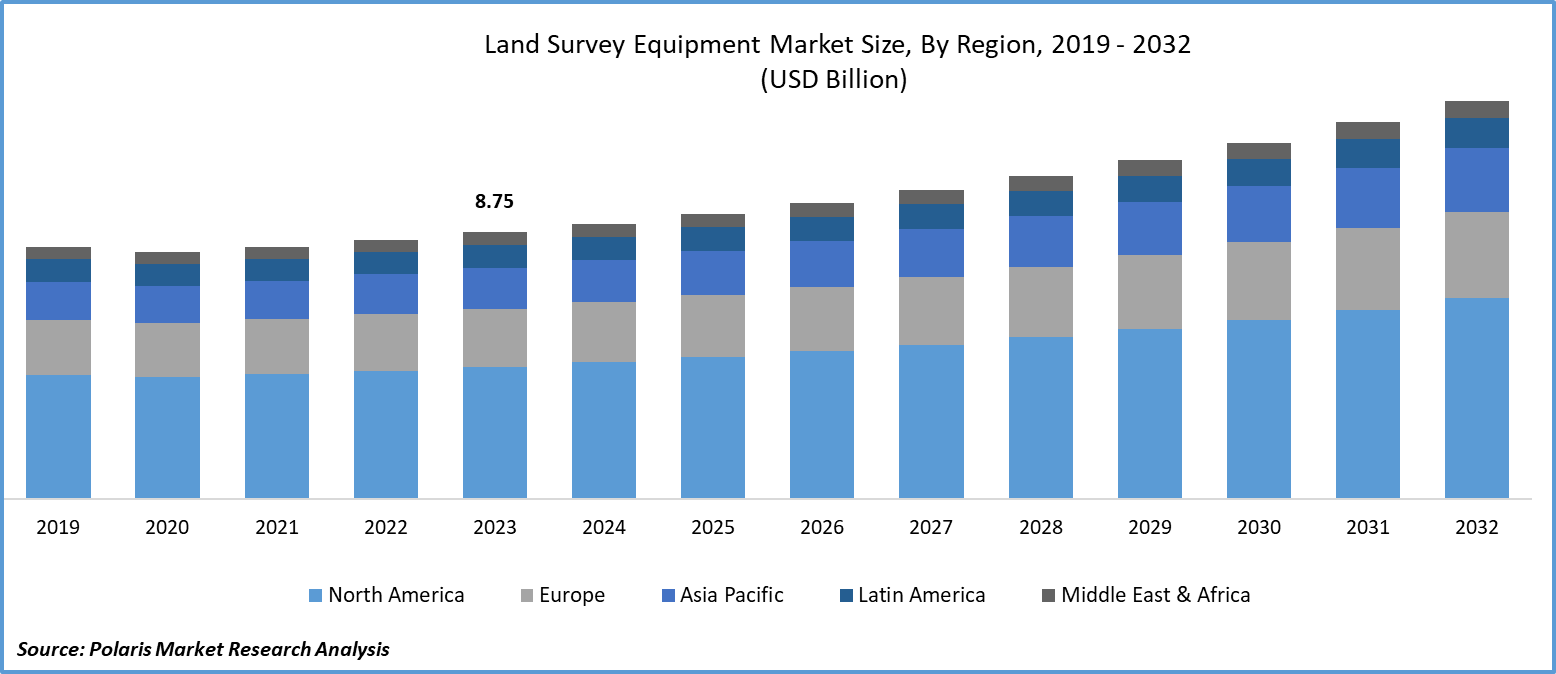

Global land survey equipment market size was valued at USD 8.75 billion in 2023. The market is anticipated to grow from USD 9.03 billion in 2024 to USD 13.07 billion by 2032, exhibiting the CAGR of 4.7% during the forecast period

Land Survey Equipment Market Overview

The land survey equipment market growth is propelled by urbanization and industrialization in developing nations. Nations such as South Africa, Argentina, Brazil, India, and China are rapidly growing, constructing numerous new infrastructures. The planning of several smart cities highlights the crucial role of land survey equipment in initial surveys. In countries like India, governments are planning new cities, such as Dream City in Gujarat and New Kanpur, necessitating surveying and inspection activities prior to construction. This is expected to drive growth in the land survey equipment market development.

- For instance, in February 2024, John Deere and Leica Geosystems subsidiary of Hexagon partnered together and aimed to revolutionize digitalization in heavy construction. By combining the strengths of both companies, they plan to advance technology and service delivery for construction globally. Integrating SmartGrade with Leica solutions represents a peak of innovation, enabling John Deere and its dealers to serve various job sites and meet evolving technological needs. This collaboration leverages Leica Geosystems' advanced technology and John Deere's equipment performance to ensure unmatched productivity, efficiency, and seamlessness for construction site users.

To Understand More About this Research: Request a Free Sample Report

Moreover, the use of drones for capturing images and videos has surged, with their autonomous operation making them popular for control via computers or smartphones. However, the land survey equipment market opportunity faces challenges due to its high initial costs and limited rental and leasing options. The market is poised for growth due to advancements in data collection and management systems driven by innovative software and equipment.

Additionally, technological progress in land survey methods is expected to propel market expansion further. These advancements promise more efficient and accurate surveying processes, which are crucial for various industries such as construction, infrastructure development, and urban planning.

Land Survey Equipment Market Dynamics

Market Drivers

Growing Development of Infrastructure

The land survey equipment market growth is driven by infrastructure development spurred by renewable energy projects, rapid urbanization, and improved transportation networks. Urban expansion and new infrastructure projects demand precise land surveying for determining property boundaries, mapping terrain, and assessing environmental factors. Land survey equipment is crucial for real estate development, city planning, and land zoning. Transportation networks, including roads, airports, highways, and railways, require precise land surveying for alignment, grading, and construction. Additionally, land survey equipment is essential for renewable energy projects, helping assess site suitability, optimize layout design, and ensure regulatory compliance, ultimately maximizing energy production and minimizing environmental impact.

Market Restraints

Robotics and Automation Integration is likely to impede the market growth.

Integration with automation and robotics in land surveying promises increased efficiency but poses challenges due to costs and complexities. While these technologies streamline workflows and reduce manpower, the initial investment and maintenance costs can be prohibitive for smaller companies. Specialized expertise and training are also needed, which may be difficult for organizations with limited resources. Additionally, continuous upgrades are required to stay competitive, adding to the financial strain. Despite their potential, the high costs and complexities of automation and robotics present significant challenges, especially for smaller players and occasional users.

Report Segmentation

The market is primarily segmented based on industry, solution, application, end-user, and region.

|

By Industry |

By Solution |

By Application |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Land Survey Equipment Market Segmental Analysis

By Industry Analysis

- The mining and construction segment led the industry market with a significant revenue share in 2023. Land survey equipment is essential in the mining and construction sectors for precise mapping, measurement, and site monitoring. The market is driven by the growth of the construction industry, particularly in urbanizing economies in Asia and Africa. In mining, these tools are used for mineral exploration, mine planning, and infrastructure development, including total stations, levels, GNSS receivers, and UAVs. Total stations, for instance, are crucial for geodetic and engineering surveys, providing accurate data for geological mapping and assessing mineral deposits.

By Solution Analysis

- The hardware segment accounted for the largest market share in 2023 and is likely to retain its position throughout the land survey equipment market forecast period. The hardware components of land surveying equipment encompass a wide array of tools, including GNSS systems, total stations, theodolites, levels, lasers, 3D laser scanners, UAVs, and machine control systems. Among these, Unmanned Aerial Vehicles (UAVs) are expected to become increasingly dominant in the near future. Also referred to as remote aerial vehicles, UAVs are pivotal in both commercial and defense sectors. In commercial applications, they are indispensable for tasks such as mapping, surveying, aerial imaging, and photogrammetry.

By Application Analysis

- Based on application analysis, the market has been segmented on the basis of layout points, volumetric calculations, inspection, and monitoring. The layout points segment held a significant market share in revenue share in 2023. Inland survey equipment and layout points are essential for translating construction blueprints into usable coordinates for upcoming structures. This process is crucial for aligning with design specifications and ensuring the timely completion of projects. Recent research has focused on using IT solutions such as 4D simulations, artificial intelligence, virtual reality, and Building Information Modeling (BIM) to enhance the efficiency of layout planning in various construction stages.

Land Survey Equipment Market Regional Insights

The North America region dominated the global market with the largest market share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. The growth in the region can be attributed to the rising adoption of construction software in the U.S., which facilitates efficient data flow management and significantly enhances productivity levels. Additionally, the increasing utilization of land survey equipment in Canada for civil engineering purposes is expected to stimulate market expansion further. The software's ability to streamline workflows and enhance project management capabilities is driving its popularity in the U.S. market. Similarly, in Canada, the demand for land survey equipment market demand is fueled by the need for precise and accurate measurements in various civil engineering projects. This trend underscores the growing importance of technology in the construction and engineering sectors across North America.

The Asia Pacific region is expected to be the fastest growing region, with a healthy CAGR during the anticipated period. The land survey equipment market development in Asia Pacific is expanding due to rapid urbanization, increased infrastructure spending, and the adoption of advanced technologies. The region's construction industry is growing significantly, supported by government initiatives for smart city development and transportation infrastructure improvement, driving the need for precise surveying instruments. Integration of technologies such as GNSS, 3D scanning, and UAVs enhances accuracy and efficiency. The real estate sector and agricultural reforms also contribute to the region's demand, establishing Asia Pacific as a key market for land survey equipment.

Competitive Landscape

The land survey equipment market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Autodesk, Inc.

- CHC Navigation

- CST/Berger (Robert Bosch Tool Corporation)

- FARO Technologies, Inc.

- Geospatial Corporation

- Hexagon AB

- Hi-Target Surveying Instrument Co., Ltd.

- Leica Geosystems (Hexagon)

- Nikon Corporation

- Sokkia (Topcon Corporation)

- South Surveying & Mapping Instrument Co., Ltd.

- Spectra Precision (Trimble)

- Stonex

- Topcon Corporation

- Trimble Inc.

Recent Developments

- In August 2023, Hexagon AB unveiled the Leica BLK2FLY Indoor, designed for indoor scanning to create comprehensive digital twins. The upgraded BLK2FLY offers exceptional autonomy, allowing it to scan entire structures seamlessly both indoors and outdoors. This advancement expands the BLK2FLY's functionality in various environments, including GNSS-deprived areas such as nuclear facilities. Using Hexagon's advanced visual SLAM technology, the system achieves real-time spherical imaging with an impressive operational range of up to 1.5 meters.

- In March 2023, Stonex introduced the R180 Robotic Total Station, a fast and highly accurate Android robotic station. With a rotation speed of 180°/sec and an EDM accuracy of 1 mm + 1 ppm, it can range up to 1000 m without a prism. The R180 comes in two versions, 0.5 and 1 second.

- In October 2022, eSurvey unveiled four new products. These offerings, which include cutting-edge hardware, software, and professional services, are set to transform several sectors and applications, such as building and construction, land surveying, agricultural and smart farming, GIS, and more.

Report Coverage

The land survey equipment market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, industry, solution, application, end-user, and their futuristic growth opportunities.

Land Survey Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.03 billion |

|

Revenue forecast in 2032 |

USD 13.07 billion |

|

CAGR |

4.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Industry, By Solution, By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Land Survey Equipment market size is expected to reach USD 13.07 billion by 2032

Key players in the market are Trimble Inc., Hexagon AB, Leica Geosystems, (Hexagon), Topcon Corporation, Autodesk, Inc., FARO Technologies, Inc

North America contribute notably towards the global Land Survey Equipment Market

Land Survey Equipment Market exhibiting the CAGR of 4.7% during the forecast period

The Land Survey Equipment Market report covering key segments are industry, solution, application, end-user, and region