Latin America Diabetes Devices Market Share, Size, Trends, Industry Analysis Report,

By Type (BGM Devices, Continuous Glucose Monitoring Devices, Insulin Delivery Devices); By End-use; By Distribution Channel; By Country; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 118

- Format: PDF

- Report ID: PM4975

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

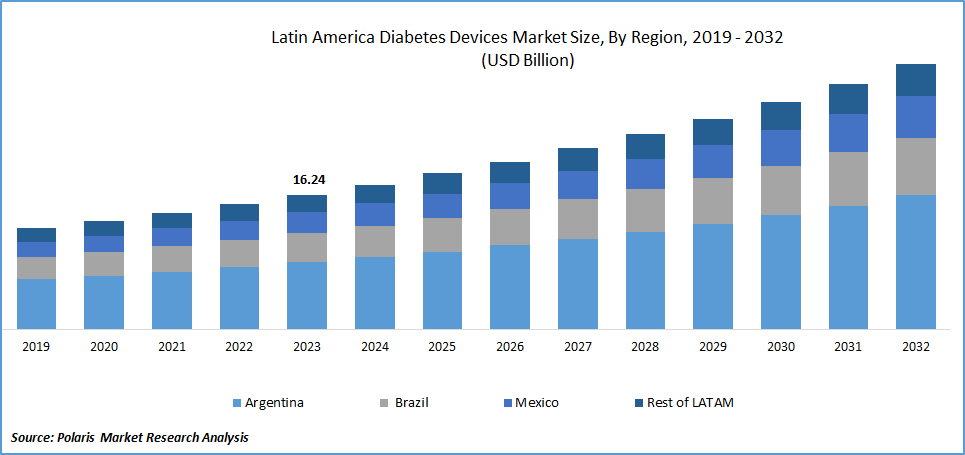

Latin America Diabetes Devices Market size was valued at USD 16.24 billion in 2023. The market is anticipated to grow from USD 17.48 billion in 2024 to USD 32.01 billion by 2032, exhibiting the CAGR of 7.9% during the forecast period.

Market Overview

The surge in people who have diabetes, investments in the sector, awareness regarding diabetes management, and the emergence of health wearables are key factors influencing the market growth. Diabetes is a chronic metabolic disease that occurs when the levels of blood glucose, also known as blood sugar, are elevated, damaging the heart, blood vessels, kidneys, eyes, & associated nerves. The three main types of diabetes are type I diabetes (T1D), type II diabetes mellitus, & gestational diabetes mellitus (GDM).

To Understand More About this Research:Request a Free Sample Report

Diabetes devices play a crucial role in monitoring and managing this condition. These devices provide accurate data, facilitate medication delivery, and offer constant monitoring and feedback. The prevalence of diabetes has been consistently increasing across Latin American countries, augmenting the demand for diabetes devices over the forecast period.

- For instance, according to the Diabetes Research and Clinical Practice, in Brazil, the prevalence of diabetes in 2019 was 16.8 million cases and is expected to reach 21.5 cases by 2030.

Latin America Diabetes Devices Market Growth Factors

The Rising Incidence of Diabetic Patients has Spurred the Demand for Diabetes Devices

As the prevalence of diabetes is rapidly increasing, there is a growing need for better management to achieve blood glucose control to prevent complications and reduce the burden of the disease. Diabetes is driven by obesity, a stressful lifestyle, unhealthy dietary habits, and aging populations. Diabetes devices play a pivotal role in monitoring blood sugar and insulin levels and managing the condition effectively.

- For instance, according to the Trust for America's Health, the obesity rate among Latino adults accounted for 45.6% in 2023.

Technological Advancements in Diabetes Devices are Propelling the Market Growth.

The technology is constantly improving in safety, bioanalytical performance, duration of wearing time, bio-compatibility, and other clinical features. Continuous innovation in diabetes device technology has led to the development of devices with integration with digital health platforms. These advancements in diabetes devices enable patients to understand the condition better and make informed decisions to control their blood sugar levels. For instance, in January 2024, Medtronic introduced the MiniMed 780 G system with the Simplera Sync, a disposable CGM, and announced the worldwide approval of the device.

Latin America Diabetes Devices Market Restraining Factors

The High cost of Diabetes Devices is Likely to Limit the Market Growth

According to the World Health Organization, diabetes is the second most common cause of death in Mexico. Diabetes prevalence and incidence rates have been increasing faster in low and middle-income countries across Latin America. The costs for diabetes treatment are relatively high. This is attributed to a lack of insurance coverage for the treatment by policymakers and a limited number of specialists in the region. For instance, according to the estimates provided by the ADA, the total estimated cost associated with diabetes was estimated at USD 412.9 billion in Latin America and the Caribbean. Further, the low focus on the prevention and diagnosis phases of the disease is another prominent factor that will hamper the market growth in the near future.

Latin America Diabetes Devices Market Report Segmentation

The market is primarily segmented based on type, end-use, distribution channel, and country.

|

By Type |

By End-use |

By Distribution Channel |

By Country |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Insights

The Insulin Delivery Devices Segment Held the Largest Market share in 2023

The insulin delivery devices segment accounted for the largest Latin America Diabetes Devices Market share in 2023. Insulin delivery devices range from simple patches to insulin pumps to automated insulin delivery (AID) systems. It also aids in taking insulin and the wide range of devices available in the market. Additionally, a large number of diabetic patients in the region require insulin to manage their glucose levels.

- For instance, according to the Organisation for Economic Cooperation and Development (OECD), more than 40 million adults live with diabetes in Latin America.

The BGM devices segment is anticipated to witness the fastest CAGR over the forecast period. Blood glucose monitoring devices are essential for the effective management of Type 1 Diabetes Mellitus (T1D). Moreover, the growing adoption of diabetes devices has spurred significant progress in the technology of blood glucose monitoring devices, with a specific emphasis on the development of minimally invasive & non-invasive methods.

By End-use Insights

The Hospitals Segment Held a Significant Market Revenue share in 2023

The hospitals segment accounted for the largest market share in 2022. The segment’s growth is due to rising diabetes cases and the adoption of advanced diabetes technologies and devices to improve patient care. The rapid increase in the burden of diabetes has led to the improvement of primary healthcare capacity for early diagnosis, treatment, and prevention of diabetes-related complications.

The diagnostic centers segment is projected to grow at the fastest CAGR over the forecast period. This growth is primarily due to the increasing burden of type 2 diabetes. Further, the increase in demand for specialized healthcare services is anticipated to fuel the segment’s growth prospects.

- For instance, according to the International Diabetes Federation (IDF) estimates, the economic burden of diabetes care will be the highest in Mexico, approximately USD 8,604 million, by 2025.

Country Insights

Brazil Dominated the Latin American Market in 2023

Brazil dominated the market and is also expected to register a substantial growth rate. The rising occurrence of obesity and overweight cases in Brazil has resulted in more people developing type 2 diabetes (T2D). Poorly managed diabetes has led to conditions such as blindness and kidney failure. The growing need for preventing these health conditions is a prominent factor that is likely to spur the demand for diabetes devices over the forecast period.

Furthermore, according to the report published by the World Health Organization (WHO), the Brazilian Ministry of Health provides free of charge drugs for diabetic patients and related conditions. Therefore, the increase in government initiatives to control and prevent obesity is positively affecting the market growth in the country.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The Latin American Diabetes Devices Market involves numerous key players, and the anticipated arrival of new contenders is poised to intensify competition. Leading market players are constantly focused on enhancing their product portfolio to maintain a competitive advantage. In addition, these players are also focusing on collaboration with other companies and research institutions to expand their market presence.

Some of the major players operating in the Latin America Diabetes Devices Market include:

- Medtronic PLC

- ARKRAY, Inc

- Abbott Diabetes Care

- BD

- Biocorp

- LifeScan Inc.

- Novo Nordisk

- Molex

- Phillips-Medisize

- GlucoModicum

- B Braun Melsungen AG

- Roche Diabetes Care

- Johnson & Johnson

- Tandem Diabetes Care, Inc.

- Senseonics, Inc

Recent Developments in the Industry

- In October 2023, GlucoModicum teamed up with Phillips-Medisize to announce the development of a noninvasive, needle-free continuous glucose monitor (CGM).

- In May 2023, Medtronic plc announced an agreement to acquire EOFlow Co., a manufacturer of wearable and fully disposable insulin delivery devices.

Latin America Diabetes Devices Market Report Coverage

The Latin America diabetes devices market report emphasizes key countries across the region to better inform users about the product. The report also provides market insights into recent developments and trends and analyzes technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, end-user, distribution channel, and futuristic growth opportunities.

Latin America Diabetes Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.48 billion |

|

Revenue Forecast in 2032 |

USD 32.01 billion |

|

CAGR |

7.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Country scope |

|

|

Competitive Landscape |

|

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, countries, and segmentation. |

FAQ's

Latin America Diabetes Devices Market Size Worth $ 32.01 Billion By 2032

The top market players in Latin America Diabetes Devices Market are Abbott Diabetes Care, BD, Medtronic PLC

Latin America Diabetes Devices Market exhibiting the CAGR of 7.9% during the forecast period

Latin America Latin America Diabetes Devicess Market report covering key segments are type, end-use, distribution channel, and country