LEO Satellite Market Share, Size, Trends, Industry Analysis Report,

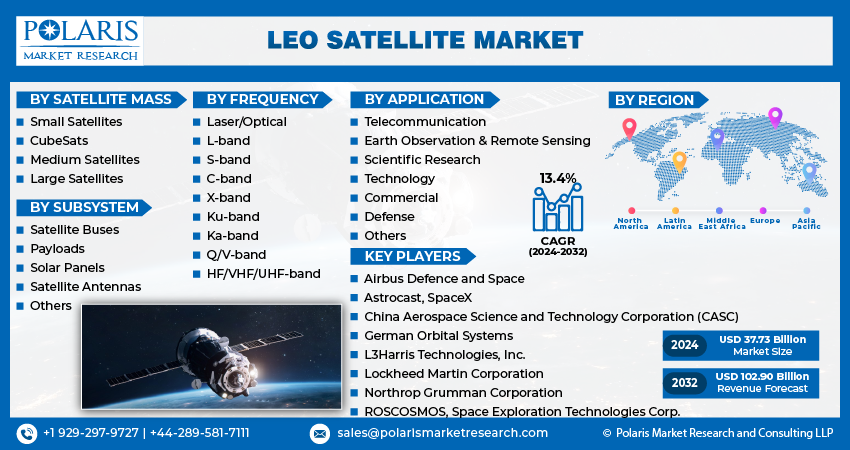

By Satellite Mass (Small Satellites, Medium Satellites, Large Satellites); By Subsystem; By Frequency; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 115

- Format: PDF

- Report ID: PM4978

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

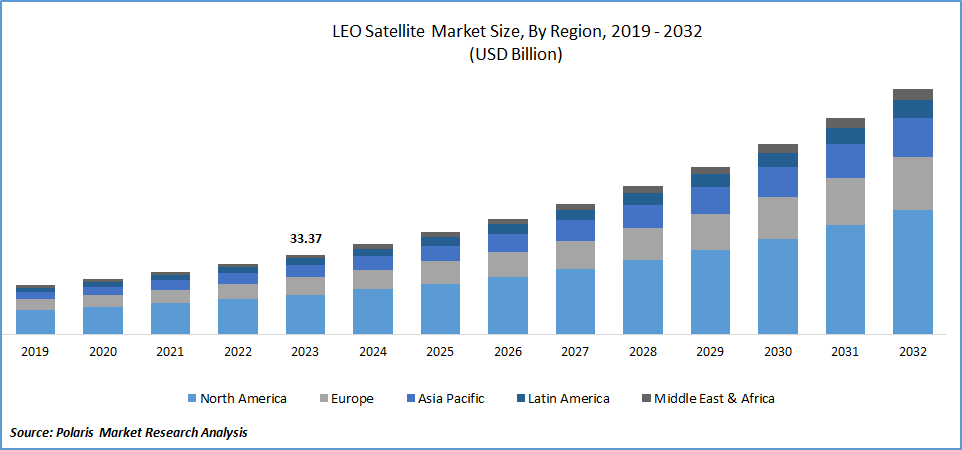

LEO Satellite Market size was valued at USD 33.37 billion in 2023. The market is anticipated to grow from USD 37.73 billion in 2024 to USD 102.90 billion by 2032, exhibiting the CAGR of 13.4% during the forecast period.

LEO Satellite Market Overview

The LEO satellite market is witnessing rapid growth and expansion owing to its several advantages. Due to their proximity to the Earth's surface, they provide reduced latency and high data transfer rates. However, it is important to note that at this altitude, the coverage area of each satellite is relatively small. As a result, in order to ensure seamless coverage, a larger number of satellites need to be deployed in orbit. Additionally, the receiving equipment must be capable of smoothly transitioning to the next satellite, passing overhead approximately every 10 minutes. Its reduced latency, high-speed transmission capabilities, and potential for lower costs are driving the growth of this market.

To Understand More About this Research:Request a Free Sample Report

- For instance, in November 2023, Telesat commenced a mission to Taiwan and South Korea. The Ottawa-based company is actively working with corporations and government agencies to introduce its ambitious Low-Earth Orbit (LEO) satellite project, "Lightspeed Constellation," which has secured its largest funding at US$500 million.

The use of smaller ground stations further contributes to cost reduction. Moreover, the shorter transmission distances associated with LEO orbits enable higher data rates, making them well-suited for data communication in support of the Internet of Things (IoT). Another advantage of communicating with LEO satellites is that it can be achieved using smaller and more energy-efficient hardware. Companies are also interested in developing satellite capabilities for collecting diverse types of imaging and sensing data. These applications range from monitoring weather conditions at a street level, conducting detailed observations of assets such as oilfields and shipping lanes, facilitating traffic monitoring for autonomous vehicles, to gathering valuable scientific data.

The advancement in technology has led to the development of the LEO Nanosatellite network, which is designed with the capability of high-speed satellite crosslinks in RF and high-speed downlinks with RF and Optical systems. Each relay satellite is equipped with a high-gain dual-band antenna and a high-speed laser downlink. Key performance metrics consist of high-speed satellite RF crosslink and high-speed optical downlink. The objectives of this network encompass achieving high satellite crosslink data capacity, ensuring successful data relay through multiple satellite nodes, and maintaining low latency data relay throughout the network.

LEO Satellite Market Dynamics

Market Drivers

- Rising Integration of IoT in LEO Satellites

The rise of the Internet of Things (IoT) in LEO satellites has made it possible to directly collect data from sensors on land through small but effective. However, advancements in technology have made it easier to access cloud-based services that offer shared ground station networks and advanced computing capabilities for data processing. 5G satellite-based IoT technologies provide particular and critical services like emergency communications during natural disasters such as wildfires, hurricanes, flooding, and crop failures that can remain operational even in the absence of power. The growing utilization of technologies like AI, ML, and cloud computing is fueling the demand for the integration of IoT in LEO satellites.

- Rise in Demand of Satellite Internet Services

There is a rise in demand for satellite internet services due to the need for affordable, high-speed broadband with enhanced data transmission capabilities among businesses and governments. Additionally, there is a surge in the desire for cost-effective Internet connectivity among individual consumers residing in rural regions and less developed nations where Internet access may be scarce or restricted. Furthermore, the efficient provision of internet services and rapid speeds are propelling the advancement of LEO constellation networks.

LEO Satellite Market Restraints

- Concerns Regarding the Growing Amount of Space Debris

Low-Earth orbit (LEO) satellites can pose a threat to the space environment due to their placement in densely populated orbits. Unlike larger and more expensive spacecraft, these auxiliary payloads are often placed in close proximity to other significant satellites in geostationary transfer orbits of which are known for their space debris. Microsatellites and nanosatellites lack the agility to navigate through such orbits, making them vulnerable. Additionally, the weak radar signals emitted by these satellites make them difficult to detect by space surveillance systems. The presence of space debris further heightens the risk of collisions or system malfunctions for low-Earth orbit (LEO) satellites.

Report Segmentation

The market is primarily segmented based on satellite mass, subsystem, frequency, application, and region.

|

By Satellite Mass |

By Subsystem |

By Frequency |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

LEO Satellite Market Segmental Analysis

By Satellite Mass Analysis

- The small satellites segment dominated the market. Small satellites, referred to as smallsats or miniature satellites, are satellites that weigh less than 500 kg (1100 lb). Their dominance in the market is due to their small size, simplified construction, and increased launch options, and these satellites are cost-effective for many businesses and organizations. By utilizing these small satellites, benefits such as reduced development and launch costs, rapid deployment, and operation in large constellations can be achieved. Numerous missions, including navigation, research, and remote sensing, rely on these compact devices.

- The medium satellites segment is projected to grow at a CAGR during the projected period, mainly driven by its optimal zone for latency, transmission speeds, and coverage at an altitude ranging from 2,000 to 36,000 km. MEO systems only need six satellites for global coverage. Additionally, MEO satellites only need to hand off once per hour, which is comparatively less than other satellites. Moreover, transmission rates can be scaled up to gigabits per second, surpassing those of other satellites.

By Frequency Analysis

- The laser/optical segment is expected to grow at the fastest CAGR over the next coming years on account of the rapid increase in the utilization of laser/optical technology for inter-satellite communication, offering a viable solution due to the short distances between satellites and the absence of atmospheric interference in space. In an Optical Intersatellite Link (OISL), data is transmitted through a near infrared laser beam via small telescopes on both sending and receiving satellites. This method requires less power for high-data-rate transmission over long distances, which is crucial for efficient satellite operations.

By Application Analysis

- The commercial segment dominated the market with the highest revenue share. Organizations in both the public and private sectors are currently engaged in deploying a significant number of satellites into Low-Earth orbit (LEO). The primary objective behind these satellite 'constellations' is to enhance and expand their telecommunications infrastructure. These constellations provide the highest possible bandwidth transmission at the lowest cost, crucial for individual satellites to establish direct communication through high-speed links.

- The defense segment is anticipated to grow with the fastest CAGR as it enhances the robustness of communication networks and delivers cutting-edge telecommunications services to the military in order to facilitate digital transformation. Ensuring that military personnel have access to timely and precise information is essential for enabling informed decision-making and empowering deployed forces to enhance operational readiness and situational awareness by providing real-time access to current intelligence, maps, and critical mission information, enabling rapid responses to changing circumstances.

LEO Satellite Market Regional Insights

The North America Region Dominated the Global Market with the Largest Market Share

The North America region dominated the global market with the largest market share and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed to the growing need for LEO satellites to improve satellite navigation and communication is expected to drive market expansion. Moreover, the increasing deployment and acceptance of 5G networks throughout North America are projected to amplify the market's growth. The existence of established research facilities, strong network infrastructure, and growing investments in space exploration and research initiatives are predicted to accelerate market expansion.

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to a strong emphasis on advancing technologies for laser- and optics-based satellites. LEO satellites play a crucial role in collecting Earth observation and scientific data, aiding in climate monitoring, agricultural planning, soil protection, and border surveillance. Furthermore, the rising demand for digital TV and direct-to-home (DTH) entertainment services in the Asia Pacific is driving the launch of more LEO satellites to enhance communication capabilities in this region.

Competitive Landscape

The LEO satellite market is fragmented and is anticipated to witness competition due to several players' presence. Key players are focusing on the product development, range refinement, frequency band optimization and weight reduction of the satellites. They are constantly upgrading the existing technology to avail accurate and optimized outputs serving wide range of industries. This enables various industries to adopt LEO satellites into their functioning by focusing on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Airbus Defence and Space

- Astrocast

- China Aerospace Science and Technology Corporation (CASC)

- German Orbital Systems

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- ROSCOSMOS

- Space Exploration Technologies Corp.

- SpaceX

Recent Developments

- In November 2023, Tata Advanced Systems and Satellogic partnered to create Low-Earth Orbit Satellites in India. The TASL satellite AIT plant will be constructed at its Vemagal facility in Karnataka, focusing on satellite manufacturing and imagery development for national defense and commercial applications within the country.

- In September 2023, Eutelsat and OneWeb joined forces to establish the world's inaugural GEO-LEO satellite space connectivity corporation. This newly formed entity endeavors to revolutionize space communications and cater to the expanding connectivity market.

Report Coverage

The LEO satellite market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, satellite mass, subsystem, frequency, application, and their futuristic growth opportunities.

LEO Satellite Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 37.73 billion |

|

Revenue forecast in 2032 |

USD 102.90 billion |

|

CAGR |

13.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Satellite Mass, By Subsystem, By Frequency, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

LEO Satellite Market Size Worth $ 102.90 Billion By 2032

The top market players in LEO Satellite MarketAirbus Defence and Space, Astrocast, China Aerospace Science and Technology Corporation (CASC),

North America is the region contribute notably towards the LEO Satellite Market

LEO Satellite Market exhibiting the CAGR of 13.4% during the forecast period

LEO Satellite Market report covering key segments are satellite mass, subsystem, frequency, application and region.