Military Drone Market Share, Size, Trends, Industry Analysis Report,

By Product Type (Hybrid, Rotary Wing, Fixed Wing); By Technology; By System; By Range; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4652

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

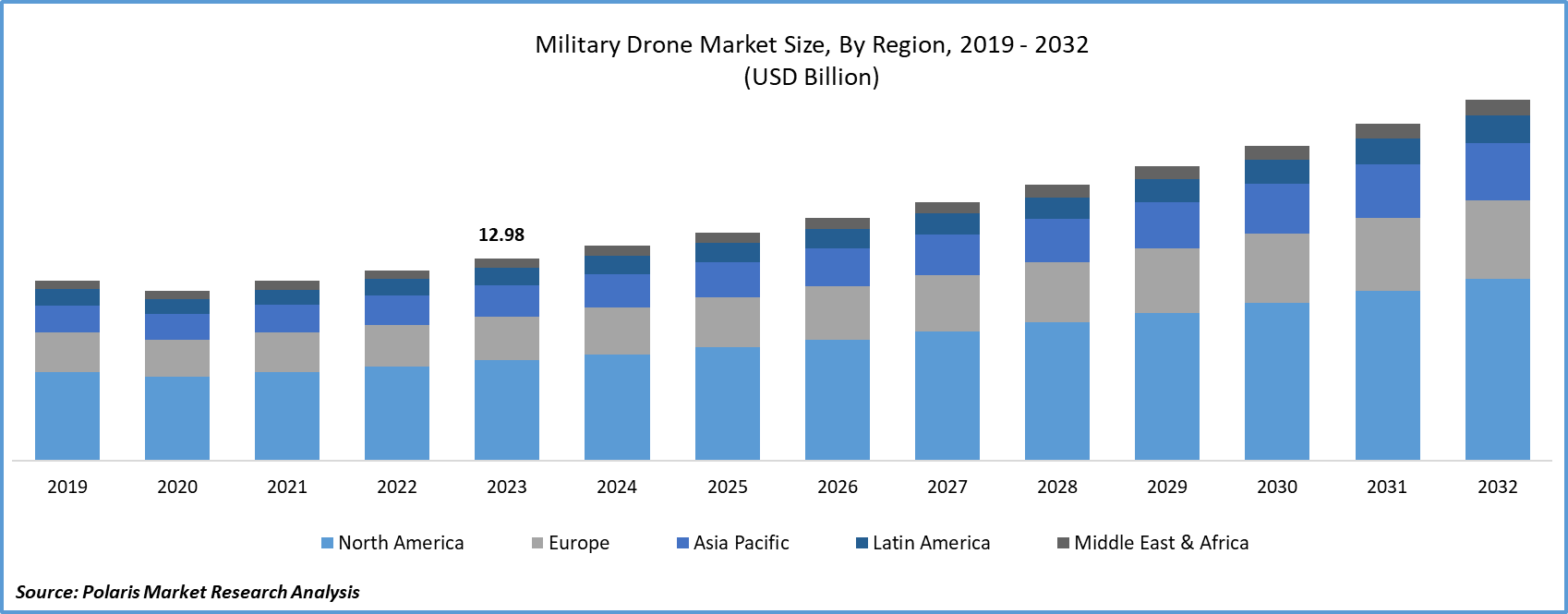

Global military drone market size was valued at USD 12.98 billion in 2023. The market is anticipated to grow from USD 13.79 billion in 2024 to USD 23.15 billion by 2032, exhibiting a CAGR of 6.7% during the forecast period

Military Drone Market Overview

Military drones can swiftly cover extensive areas, detect individuals requiring aid by analyzing their thermal signatures, evaluate their well-being and surroundings using high-definition video, and relay real-time information to ground resources. This includes details such as the victim's location, challenges in ground accessibility, and other essential information crucial for ground resource assets striving to reach those in need.

Multiple factors drive the anticipated Military Drones market size growth. The global expansion of this market is attributed to an upswing in military budgets and an increasing demand for enhanced surveillance technologies. However, the military drone market's progression is hindered by the elevated costs associated with Unmanned Aerial Vehicle (UAV) solutions. Furthermore, a key factor expected to fuel growth during the forecast period is defense modernization. As nations strive to strengthen their armed forces and defense capabilities, the market for Military Drones is projected to rise. Military UAVs are predominantly employed for Intelligence, Surveillance, and Reconnaissance (ISR) purposes. Ongoing developments include the adaptation of military UAVs for diverse tasks such as combat search and rescue, suppression/destruction of enemy air defenses (SEAD), communication relays, electronic attack (EA), network nodes, and strike missions.

To Understand More About this Research: Request a Free Sample Report

Moreover, escalating geopolitical tensions and conflicts across diverse regions have amplified the need for military drones, specifically in combat operations, surveillance, and reconnaissance. Military drones offer a cost-effective alternative to traditional human-crewed aircraft, demanding support infrastructure, lower maintenance, and fuel. This efficiency translates into potential cost savings for military entities, allowing them to allocate additional resources to different operational areas. Additionally, advancements in technologies like advanced sensors, artificial intelligence, and machine learning have contributed to the creation of more advanced drones. These drones boast enhanced capabilities such as improved endurance, extended ranges, and increased payloads, further fueling the demand in the military drone market.

Military Drone Market Dynamics

Market Drivers

Escalating geopolitical pressures and confrontations bolstering the growth of the Military Drone market share.

In contemporary warfare, the prevalence of military drones has surged as numerous nations employ them for precision strike operations, surveillance, intelligence gathering, and reconnaissance. These unmanned aerial vehicles offer various advantages, such as accurate target objectives, the capability to navigate hazardous environments and maintain persistent surveillance. The heightened geopolitical tensions and conflicts worldwide have spurred greater demand for military drones as nations strive to bolster their military capabilities and adeptly operate in intricate and demanding settings. Drones offer a means for countries to execute military maneuvers without exposing their personnel to risk, a crucial consideration in asymmetric warfare, where adversaries frequently employ unconventional tactics and strategies.

Apart from their conventional application in warfare, military drones are seeing a growing role in counter-terrorism operations and various security-related endeavors. They prove valuable in monitoring borders, tracking terrorist activities, and furnishing situational awareness to security forces. Additionally, military drones, commonly referred to as unmanned aerial vehicles (UAVs), have become indispensable in modern warfare owing to their capacity for delivering real-time intelligence, surveillance, and reconnaissance (ISR) capabilities. Consequently, there has been a noteworthy upswing in the demand for military drones, particularly in regions marked by conflict or heightened geopolitical tensions in recent years.

Market Restraints

Security threats of cybersecurity are likely to hamper the growth of the market.

Military drones face susceptibility to cyber-attacks, which can undermine their functionality and grant adversaries access to confidential information. These cybersecurity threats may restrict the deployment of military drones in specific regions or for particular missions, especially those entailing sensitive or classified data. A cyber-attack on a military drone system carries significant repercussions, ranging from the loss of control over the drone to the compromise of valuable data gathered by its sensors. Additionally, such attacks can jeopardize the integrity of the drone's communication systems, creating challenges for military forces in coordinating their operations.

Hence, military drone manufacturers are dedicating resources to implement cybersecurity measures, safeguarding their systems against potential cyber-attacks. These precautions encompass the adoption of secure communication protocols, encrypted data transmission, and reinforced access controls to thwart unauthorized entry into drone systems. Despite these proactive measures, cybersecurity threats persist as a significant worry for the military drone market, given the continuous advancement of adversaries in devising more sophisticated cyber-attack techniques. Consequently, the development and deployment of military drones necessitate robust cybersecurity measures to guarantee their secure and efficient operation.

Report Segmentation

The market is primarily segmented based on technology, product type, system, range, application, and region.

|

By Technology |

By Product Type |

By System |

By Range |

By Application |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Military Drone Market Segmental Analysis

By Product Type Analysis

- In 2023, the fixed-wing segment claimed the largest share of the military drone market, a military drone market trend expected to persist during the entire forecast period. Fixed-wing aircraft, in contrast to Vertical Takeoff and Landing (VTOL) UAVs, generally boast the ability to carry heavier loads for extended flight durations while consuming less power. This characteristic makes them particularly well-suited for missions covering significant distances, such as strategic defense, mapping, surveillance, and defense applications demanding high durability. Military authorities worldwide leverage fixed-wing drones effectively in the defense sector, contributing to the anticipated growth of this segment throughout the forecast period.

- The rotary wing segment is expected to experience notable expansion in the foreseeable future, primarily driven by the growing advancements in rotary wing technologies. Widely employed for various road and logistics applications globally, rotary wings excel in carrying substantial loads. Additionally, rotary wing drones play a crucial role in tactical operations, particularly for Reconnaissance (ISR) missions, Surveillance, and Intelligence, leveraging their vertical take-off and landing capabilities.

By Technology Analysis

- The remotely operated segment is projected to maintain a substantial military drone market share over the forecast period. Many contracted Unmanned Aircraft Vehicles (UAVs) operate remotely worldwide due to stringent government requirements for extended autonomous flight. This technology is implemented on UAVs for Radio communications, Command & Control (C&C), and telemetry systems.

- The autonomous segment is anticipated to experience the fastest CAGR throughout the forecast period. Developing economies are emphasizing the creation and advancement of autonomous unmanned aerial vehicles to provide both tactical and strategic services.

Military Drone Market Regional Insights

The North America region dominated the global market with the largest market share in 2023

This substantial market share is primarily held by several Original Equipment Manufacturers (OEMs) in the U.S., including General Atomics Aeronautical Systems, Inc., Northrop Grumman Corporation, and others. Technological advancements in drone technology have led to significant developments within the U.S. military, and increased investments by key regional players have propelled military drone market growth. The U.S. stands as one of the world's major exporters of unmanned aerial vehicles, a factor expected to fuel regional expansion. Historically, Lockheed Martin Corporation and General Atomic Aeronautics have secured contracts for military High-Altitude Long Endurance (HALE) and Medium-Altitude Long Endurance (MALE) drones from NATO and major defense partners like India. These companies are anticipated to secure additional military drone contracts for various operation-specific models designed for Intelligence, Surveillance, and Reconnaissance (ISR), target acquisition, or Manned-Unmanned Teaming Platforms (MUM-T).

Europe emerges as a significant market for military drones, with major contributions to its growth coming from Germany, the United Kingdom, and France. This can be attributed to the rising defense budgets, an escalating demand for advanced Intelligence, Surveillance, and Reconnaissance (ISR) capabilities, and the imperative to modernize military capabilities. European countries have bolstered their defense budgets in response to the escalating security threats in the region, thereby fostering an increased demand for military drones. The growing need for advanced ISR capabilities has further propelled the expansion of the military drone market in Europe. Unmanned Aerial Vehicles (UAVs) equipped with advanced sensors and imaging technologies play a pivotal role in providing real-time ISR data, a crucial asset for military operations.

Competitive Landscape

The Military Drone market players are fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AeroVironment, Inc.

- BAE Systems

- Boeing

- Elbit Systems Ltd (Israel)

- General Atomics Aeronautical Systems, Inc.

- Israel Aerospace Industries Ltd.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- SAAB Group

- Textron Systems

- Thales Group

Recent Developments

- In February 2023, The Indian Army declared its intention to procure 850 indigenous nano drones specifically designed for surveillance and counter-terrorism operations in special military endeavors.

- In February 2023, the development of face recognition technology in Unmanned Aerial Vehicles (UAVs) was accomplished by the U.S. Air Force. Autonomous drones now possess the capability to identify targets and potentially engage them independently. Moreover, these drones will be employed by special operations forces for intelligence gathering and mission-specific information collection.

- In January 2023, A contract from the U.S. Department of Defense was granted to the State-owned Israel Aerospace Industries for the development and supply of innovative attack drones. Named Point Blank, these drones are designed for easy portability in soldiers' backpacks and can be launched from any location.

Report Coverage

The Military Drone market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive technology, product type, system, range, application, and futuristic growth opportunities.

Military Drone Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 13.79 billion |

|

Revenue Forecast in 2032 |

USD 23.15 billion |

|

CAGR |

6.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Technology, By Product Type, By System, By Range, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Military Drone market size is expected to reach USD 23.15 billion by 2032

Key players in the market are AeroVironment, Inc., BAE Systems, Boeing, Elbit Systems Ltd (Israel), General Atomics Aeronautical Systems, Inc

North America contribute notably towards the global Military Drone Market

Military Drone Market exhibiting a CAGR of 6.7% during the forecast period

The Military Drone Market report covering key segments are technology, product type, system, range, application, and region.