Nordic Eyewear Market Share, Size, Trends, Industry Analysis Report,

By Product (Spectacles, Sunglasses, Contact Lenses); By Distribution channel; By End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4737

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

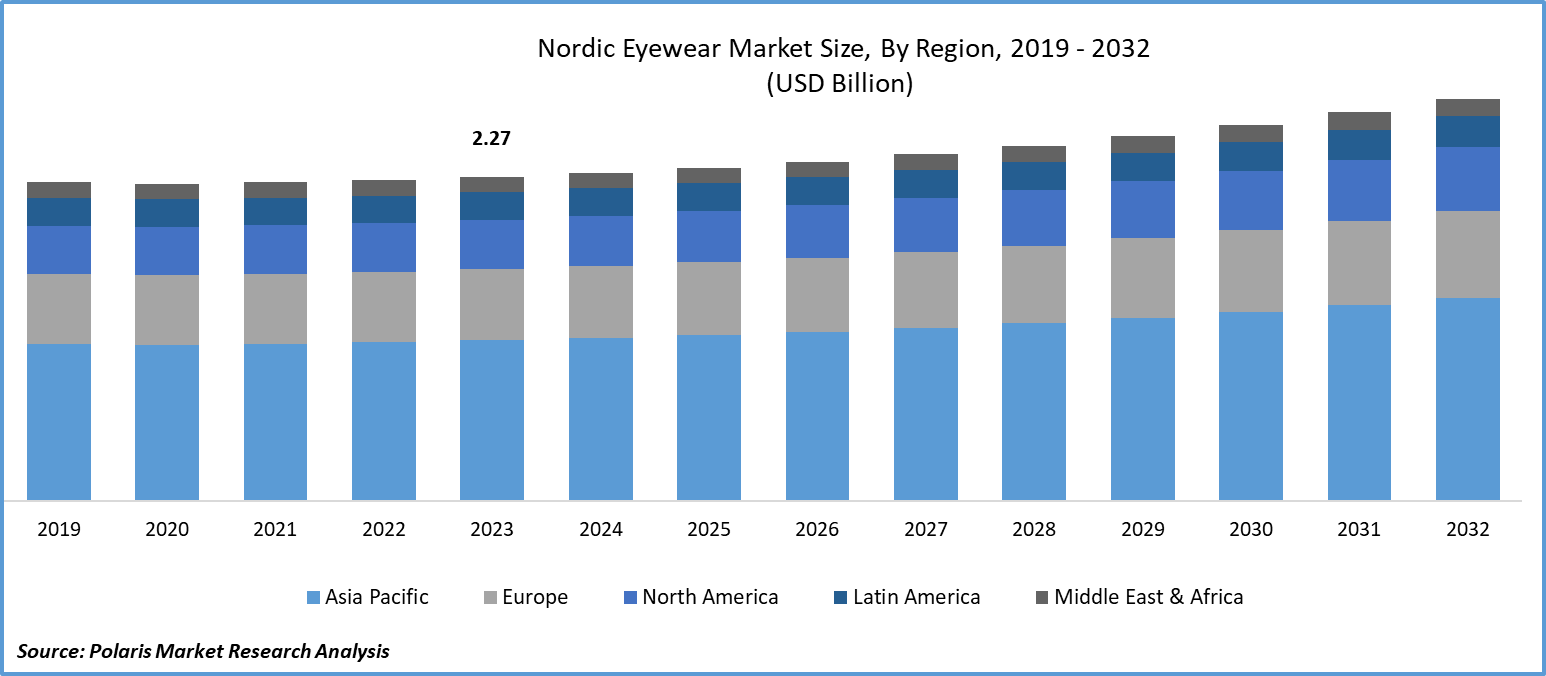

The nordic eyewear market size was valued at USD 2.27 billion in 2023. The market is anticipated to grow from USD 2.29 billion in 2024 to USD 2.81 billion by 2032, exhibiting the CAGR of 2.6% during the forecast period

Nordic Eyewear Market Overview

A number of factors, including an aging population, increased use of digital screens, an increase in myopia cases, a rise in online shopping adoption, higher disposable income, the growing popularity of sports eyewear, and an increase in visual impairment rates, have contributed to the growth of the nordic eyewear market development in the region. The expanding acceptance of refractive surgery and the growing need for less expensive sunglasses and frames, however, may pose challenges to this expansion.

- For instance, in November 2023, Chimi, the Swedish eyewear brand, has collaborated with the global brand management firm BRDG Group to launch its products in the Indian market.

To Understand More About this Research:Request a Free Sample Report

The COVID-19 pandemic had a significant impact on the Nordic eyewear market growth in several ways. The closure of ophthalmic clinics and retail stores for an extended period due to lockdowns and safety measures has led to a decrease in foot traffic and, consequently, a decline in sales revenue for many eyewear retailers and manufacturers. The postponement of non-urgent eye examination appointments has further contributed to the decline in sales, as many consumers have delayed purchasing new eyewear without updated prescriptions.

Since, disruptions in the manufacturing and transportation of eyewear products, including spectacle lenses, contact lenses, and sunglasses, have also played a role in the Nordic eyewear market growth. Supply chain disruptions, restrictions on international trade, and logistical challenges have made it difficult for companies to produce and distribute eyewear products efficiently. Overall, the combination of these factors has resulted in a challenging year for the Nordic eyewear market expansion in 2020, with many players experiencing a significant downturn in sales and revenue.

Nordic Eyewear Market Dynamics

Market Drivers

Technological advancements in materials

Innovations in lens materials, coatings, and designs have revolutionized the eyewear industry, offering consumers a wide array of benefits. Advanced lens materials, such as high-index plastics and Trivex, provide thinner and lighter lenses, enhancing comfort for users. Anti-reflective coatings reduce glare and improve visual clarity, especially in bright environments. Scratch-resistant coatings increase the durability of lenses, ensuring longer-lasting eyewear. Additionally, photochromic lenses that darken in response to sunlight offer convenience and protection from UV rays. Design innovations, such as rimless and semi-rimless frames, provide a sleek and modern aesthetic, appealing to fashion-conscious consumers. These advancements have not only improved the functionality and durability of eyewear but also enhanced its overall appeal, driving more consumers to upgrade their glasses.

Awareness and education of regular vision check-ups

Growing awareness about the importance of eye health and regular vision check-ups has led to a shift in consumer behavior towards investing in prescription eyewear. People are increasingly recognizing the impact of eye conditions on their overall health and quality of life, prompting them to prioritize eye care. Regular vision check-ups are now seen as essential preventive healthcare measures, encouraging individuals to get their eyes tested and obtain prescriptions for corrective lenses when needed. This trend is driving the demand for prescription eyewear, including glasses and contact lenses, as more people seek to address vision issues and maintain optimal eye health. Additionally, the availability of a wide range of stylish and functional eyewear options has made it easier for consumers to embrace prescription eyewear as a practical and fashionable accessory.

Market Restraints

Cost associated with prescription eyewear

One of the main restraints for the Nordic eyewear market opportunity is the high cost associated with prescription eyewear. Many people, especially in developing countries or regions with limited access to healthcare, may find it difficult to afford eyewear, leading to a barrier in obtaining necessary vision correction. Additionally, the lack of awareness about the importance of regular eye check-ups and vision care in certain demographics can limit the Nordic eyewear market development. Moreover, the presence of counterfeit or low-quality eyewear products in the market can undermine consumer confidence and hinder the growth of reputable eyewear brands. Lastly, the impact of the COVID-19 pandemic, with its economic uncertainties and restrictions on retail operations, has also posed challenges to the Nordic eyewear market growth.

Report Segmentation

The market is primarily segmented based on product, distribution channel, end-use, and region.

|

By Product |

By Distribution Channel |

By End-Use |

By Country |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Nordic Eyewear Market Segmental Analysis

By Product Analysis

- The contact lenses segment accounted for a significant revenue share in 2023 and is poised for substantial growth in the future. This growth is fueled by the introduction of advanced products like light-adaptive lenses and multifocal toric lenses. These innovative lenses are designed to adapt swiftly and seamlessly to varying lighting conditions, minimizing the irritation and dryness commonly associated with traditional contact lenses. Continued research and development efforts aimed at enhancing the aesthetics and quality of contact lenses are expected to bolster the segment's expansion.

- The spectacles segment accounted for the major revenue share in 2023 and is expected to retain its position throughout the Nordic eyewear market forecast period. Attributed to the growing prevalence of computer vision syndrome (CVS) caused by the increased use of mobile phones and digital screens worldwide. This trend has been further exacerbated by the rise in online learning and smart eyewear technology, particularly during the pandemic. Consequently, there has been a notable increase in CVS cases among children, prompting a greater adoption of anti-glare and anti-fatigue glasses.

By Distribution Channel Analysis

- The brick and mortar segment holds significant revenue share in 2023. This was driven by the growing awareness of the importance of regular eye checkups and the use of eyeglasses, leading to increased sales through physical stores. Many companies are focusing on expanding their brick and mortar presence to enhance their competitiveness. For instance, in November 2023, the Cult Swedish brand entered the Indian market in collaboration with the BRDG Group, offering a collection of 11 signature silhouettes to cater to various tastes. The segment experienced a slight decline in revenue share during the pandemic due to lockdown restrictions in several countries. However, with the easing of these restrictions and a higher consumer preference for physical stores, the segment is expected to witness growth in the foreseeable future.

Competitive Landscape

The Nordic Eyewear market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Grand Vision

- Synsam

- Specsavers

- Synologen AB

- Optik Team

- Krogh Optikk

Report Coverage

The Nordic Eyewear market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, distribution channel, end-use and their futuristic growth opportunities.

Nordic Eyewear Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.29 billion |

|

Revenue forecast in 2032 |

USD 2.81 billion |

|

CAGR |

2.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Distribution Channel, By End-Use, By Region |

|

Regional scope |

Nordic Countries (Finland, Denmark, Sweden, Norway) |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Nordic Eyewear Market report covering key segments are product, distribution channel, end-use, and region.

Nordic Eyewear Market Size Worth $2.81 Billion By 2032

Nordic Eyewear Market exhibiting the CAGR of 2.6% during the forecast period

key driving factors in Nordic Eyewear Market are technological advancements in materials