Pet Snacks and Treats Market Share, Size, Trends, Industry Analysis Report,

Product Type (Eatable, Chewable); By Pet Type; By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 120

- Format: PDF

- Report ID: PM4955

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

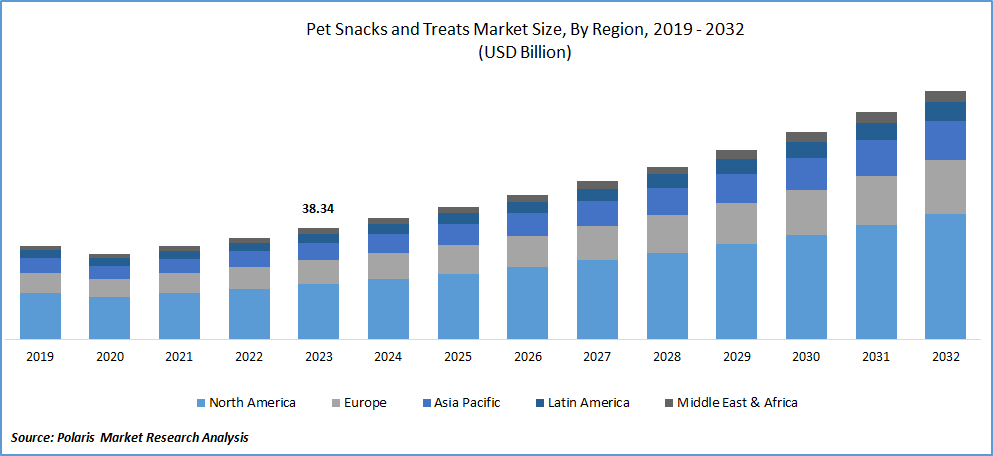

Pet Snacks and Treats Market size was valued at USD 38.34 billion in 2023. The market is anticipated to grow from USD 41.85 in 2024 to USD 85.84 by 2032, exhibiting the CAGR of 9.4% during the forecast period.

Market Overview

The scope of the Pet Snacks and Treats Market encompasses a wide range of products and services tailored for pets, including dogs, cats, birds, and small mammals like rabbits and guinea pigs. This market segment caters to pet owners looking to provide their animals with high-quality, nutritious, and enjoyable treats and snacks. Here's an overview:

To Understand More About this Research:Request a Free Sample Report

The market includes a diverse array of pet snacks and treats, ranging from traditional favorites like biscuits, jerky, and rawhide chews to more specialized options such as freeze-dried meats, dental chews, and natural treats made from fruits and vegetables.

With a growing emphasis on pet health and wellness, there is a significant demand for snacks and treats that offer functional benefits beyond just taste. This includes products formulated to support dental health, joint health, skin and coat health, digestive health, and weight management. Many pet owners prefer natural and organic snacks and treats for their pets, free from artificial colors, flavors, and preservatives. The market includes a wide range of natural and organic options made from high-quality ingredients sourced from trusted suppliers.

As pet owners become more aware of their pets' dietary sensitivities and allergies, there is a growing demand for grain-free and limited-ingredient snacks and treats. These products cater to pets with food sensitivities or those following specialized diets.

Rising awareness regarding pet nutrition and health, led to demand in consumption of pet snacks and treats in the forecast period. A rise also influences the market's growth in disposable income. Market offerings include healthy treats and specialty snacks. The surge in pet adoption globally has bolstered demand for these products.

According to the American Pet Association (APPA), around 66 percent of U.S. households own a pet, totaling 86.9 million households.

For the first time, pet ownership is evenly distributed between younger generations (Gen Z and Millennials) and older ones (Gen X and Baby Boomers). While younger generations report higher pet-related expenditures in the past year, they are also more cost-conscious about pet ownership. Moreover, older generations prioritize the benefits of pet ownership and maintain their pets' well-being as pets have always done.

Manufacturers are anticipated to find profitable prospects through product innovations featuring clean-label ingredients, sustainable and eco-friendly packaging, health enhancements, and extended shelf life. The surge in expenditure on pet health and nutrition has been a key driver of market expansion.

Growth Drivers

Rising Pet Ownership and Humanization of Pets is A Growing Trend

Pet ownership is experiencing a global surge, with a growing number of individuals regarding their furry pet companions as integral family members. This trend of "humanization of pets" is flourishing, lea"ing pet owners to invest more in premium food, treats, and even attire for their beloved pets.

The number of households owning pets, including dogs, cats, birds, and small mammals, has been steadily increasing over the years. Pets provide companionship, emotional support, and unconditional love, which is particularly appealing to individuals living alone or in nuclear families. Changes in lifestyle, such as urbanization, delayed marriage and childbirth, and an aging population, have led to a greater emphasis on pet ownership as a way to fulfill emotional needs and enhance overall well-being.

Also, as pets become integral members of the family, there is a growing tendency among pet owners to treat them as such, a phenomenon known as the humanization of pets. Pet owners are increasingly willing to invest in high-quality products and services for their pets, including nutritious food, stylish accessories, grooming services, and personalized healthcare. It often adopts trends and practices from human lifestyles, such as organic and natural diets, eco-friendly products, luxury accommodations, and personalized experiences.

Launch of Innovative Products by the Pet Food Manufacturers

To meet the increasing trend of pet indulgence, pet food manufacturers are continuously introducing innovations. In 2022, Mankind Pharma made its entry into the Indian market with PetStar, providing a range of food choices, including dry kibble, wet food, and treats. A notable collaboration occurred in October 2023, when Scientific Remedies and Affinity Petcare joined forces to introduce Affinity Advance, a new brand emphasizing advanced pet nutrition in India. This trend signifies a shift in pet food towards providing specialized options that promote overall pet health and wellness, going beyond mere sustenance.

Restraining Factors

Strict Government Regulations

Stringent regulations will hinder the expansion of the industry. These products are subject to rigorous control measures. In Western nations, the policies implemented pose a challenge to the industry's growth. The use of industry's ingredients undergoes thorough scrutiny. The strict regulation of these products is also expected to impede industry expansion. Additionally, while the industry offers high-quality, premium items, their expensive nature serves as another limiting factor for industry growth.

Report Segmentation

The market is primarily segmented based on product type, pet type, distribution channel, and region.

|

By Product Type |

By Pet Type |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

Eatable Segment Accounted for the Largest Market Share in 2023

In 2023, the eatable segment dominated the largest market share and is anticipated to exhibit a significant CAGR throughout the forecast period. The rising awareness surrounding pet food and treats that provide functional advantages, such as promoting joint, skin, and coat health, is fueling the demand for edible pet snacks and treats. Leading industry participants are proactively introducing a variety of products to address this escalating consumer need. For instance, in May 2022, Wellness Pet Company unveiled Good Dog by Wellness, a brand featuring treats made from premium, natural ingredients.

By Pet Type Analysis

Dogs Segment Accounted for the Largest Market Share in 2023

In 2023, the dogs segment emerged as the largest market share. The rising adoption of pets, particularly dogs, is expected to offer promising prospects for key market players throughout the forecast period.

The market offers a wide variety of snacks and treats specifically formulated for dogs, catering to various preferences, dietary requirements, and health needs. This diverse product range includes biscuits, jerky, dental chews, rawhide treats, freeze-dried meats, and more, appealing to dog owners seeking options to pamper and nourish their pets.

Pet owners are increasingly conscious of their dogs'dog's health and wellness, leading to a growing demand for functional treats that offer nutritional benefits. Treats formulated to support dental, joint, skin and coat, and digestive health are particularly popular among dog owners, further driving sales within the Dogs segment.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

In 2023, North America accounted for the largest market share. The surge of e-commerce, along with a significant increase in pet ownership among affluent households in the region, has created opportunities for animal food. These market developments highlight the ongoing and confirmed trends within the pet care sector.

Forbes data from 2023 revealed that a significant 66% of U.S. households, totaling 86.9 million homes, included pets. Among these, dogs were the most popular companions, with 65.1 million households owning a canine friend. Cats ranked second, with 46.5 million households, while freshwater fish were found in 11.1 million homes. In terms of demographics, millennials accounted for the largest portion of pet owners at 33%, followed closely by the Gen X generation at 25%, with baby boomers making up 24% of pet owners in the country.

The pet snacks and treats market in the Asia Pacific region is set to experience a significant Compound Annual Growth Rate (CAGR) from 2024 to 2030. This growth is driven by a surge in pet ownership among affluent, nuclear families, alongside evolving consumer lifestyles that prioritize pet health and well-being. Moreover, the region boasts the largest population of pet dogs and cats globally.

According to the Australian Trade and Investment Commission, the rising pet ownership in China is fueling a growing demand for high-quality imported pet food. Affluent Chinese pet owners are increasingly inclined towards imported pet food products containing nutritious, protein-rich ingredients. This trend is anticipated to persist over the medium term. The volume of Chinese pet food imports surged from 9,813 metric tons in 2016 to 97,560 metric tons in 2021 (GACC 2022). By 2025, it is projected that the value of China's pet food market will surpass US$16 billion (USDA 2022).

Key Market Players & Competitive Insights

In the competitive landscape of the pet snacks and treats market, several key players are vying for market share by introducing innovative products and leveraging strategic partnerships. For instance, Mars Petcare, one of the leading companies in the industry, continues to expand its product portfolio with offerings like dental chews and functional treats. Additionally, smaller, niche brands like Blue Buffalo and Wellness Pet Company are gaining traction among pet owners seeking specialized and high-quality snacks and treats for their furry companions. This competitive environment fosters continuous innovation and drives the market toward offering a diverse range of products to meet evolving consumer preferences.

Some of the major players operating in the global market include:

- Colgate Palmolive Company

- General Mills Inc.

- Mars, Incorporated

- Merrick Pet Care

- Nestlé S.A.

- Off-Leash Pet Treats

- Spectrum Brands, Inc.

- The J.M. Smucker Company

- VAFO Group.

- Wellness Pet, LLC

Recent Developments in the Industry

- In January 2024, VAFO Group, completed the acquisition of Finnish company Dagsmark Pet Food. This strategic move positions VAFO as the top player in the Nordic pet food market.

- In April 2024, Cymbiotika launched its latest pet line, featuring 4 distinct products: Probiotic+, Calm, Hip & Joint, and Allergy & Immune Health. Each supplement is meticulously crafted with premium ingredients, aimed at promoting optimal health for pets.

Report Coverage

The Pet Snacks and Treats market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, pet type, distribution channel, and their futuristic growth opportunities.

Pet Snacks and Treats Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 41.85 billion |

|

Revenue forecast in 2032 |

USD 85.84 billion |

|

CAGR |

9.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Pet Snacks and Treats Market include Colgate Palmolive Company, General Mills, Mars, Merrick Pet Care, Nestlé

Pet Snacks and Treats Market exhibiting the CAGR of 9.4% during the forecast period.

Pet Snacks and Treats Market report covering key segments are type, pet type, distribution channel, and region.

The key driving factors in Pet Snacks and Treats Market are Launch of innovative products by the pet food manufacturers

Pet Snacks and Treats Market Size Worth $ 85.84 Billion By 2032.