Polyethylene Market Share, Size, Trends, Industry Analysis Report,

By Type (LDPE, MDPE, HDPE); By Technology; By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 116

- Format: PDF

- Report ID: PM4961

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

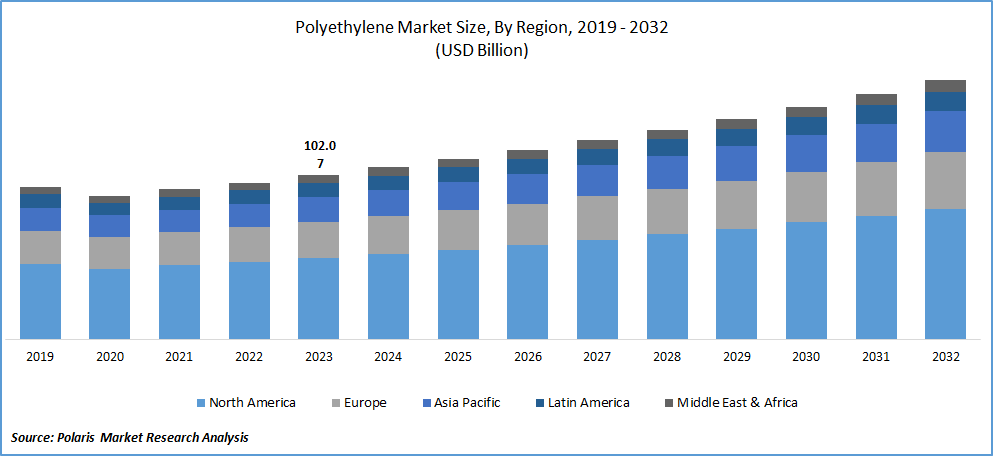

Polyethylene Market size was valued at USD 102.07 billion in 2023. The market is anticipated to grow from USD 106.97 billion in 2024 to USD 161.08 billion by 2032, exhibiting the CAGR of 5.2% during the forecast period.

Polyethylene Market Overview

Rising plastic integration in several applications is frequently fueling the demand for plastic, including polyethylene. This is attributable to its appealing properties, such as chemical resistance, corrosion resistance, and the ability to withstand harsh atmospheric conditions. Furthermore, the growing demand for plastic in the world is significantly emphasizing global players to expand their production through partnerships, collaborations, and investments.

To Understand More About this Research:Request a Free Sample Report

- For instance, in July 2023, Braskem, a Brazilian company, announced its plan to extend its biopolymer manufacturing capacity with an investment of USD 87 million, aiming to meet growing demand for eco-friendly products globally. This is one of the strategies to reach one million tons of biopolymer production, by 2030.

Additionally, the rising development of agriculture tools and machines with polyethylene and the growing demand for fertilizers and seeds are increasing the need for effective packaging material. Moreover, the growing demand for polyethylene is further boosting its production in the marketplace. For instance, in September 2023, Neste announced that it had entered into a partnership framework with Mitsubishi Corporation to manufacture polyethylene terephthalate.

Growth Drivers

Rising Availability of Polyethylene in the Marketplace

The rising production of plastic, with the presence of established market players around the world, is significantly promoting its availability in the market. The lower complexity of producing polyethylene is further expanding its accessibility and affordability in the worldwide market. According to the Observer Research Foundation, plastic production has grown from 230 million tons at the beginning of the twentieth century to 450 million tons before the COVID-19 outbreak.

Increasing Use of Polyethylene in Packaging Activities

Polyethylene is gaining adoption in the packaging industry. This is attributable to its lightweight and affordability. Stretchable properties of HDPE-based polyethylene and tear and puncture resistance are further fueling their utility in grocery, garbage, and retail bags. Additionally, the ongoing investments in developing effective polyethylene packaging solutions by the companies are propelling global polyethylene growth. For instance, in February 2024, Pregis LLC announced the development of a foam packaging product in collaboration with ExxonMobil Corp.

Restraining Factors

Rising Environmental Consciousness is Likely to Impede Market Growth

The growing studies focusing on reviewing the characteristics of plastic and recycled plastic are likely to obstruct polyethylene market growth. According to the 2024 study, around 15 distinct recycled plastic products were found to be toxic. Furthermore, the growing environmental pollution, leading to a rise in greenhouse gas emissions, is further limiting the use of plastic in the marketplace. However, the rising initiatives to recycle plastic, including polyethylene, are anticipated to drive its use. For instance, in August 2023, Fastenal joined forces with Trex, aiming to recycle polyethylene resins.

Report Segmentation

The Polyethylene Market is primarily segmented based on type, technology, end-user, and region.

|

By Type |

By Technology |

By End-User |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

HDPE Segment is Expected to Witness the Highest Growth During the Forecast Period

The high-density polyethylene segment is projected to grow at a CAGR during the projected period, mainly driven by its longer shelf life, chemical, moisture and tear resistance, and stretchable properties. This makes them compatible for applications in food and consumer goods packaging, including shampoo bottles, milk packets, and grocery bags. The growing demand for consumer goods will essentially create the need for high density polyethylene during the forecast period.

By Technology Analysis

Injection Molding Segment Accounted for the Largest Market Share in 2023

The injection molding segment accounted for the largest market share. This is attributable to its potential for producing lower residue, high precision, and effectiveness. The lower production and maintenance charges of polyethylene production using injection molding due to less labor and maintenance costs is further driving new market entrants to prefer injection molding over other options.

By End-User Analysis

Packaging Segment Held the Significant Market Revenue Share in 2023

The packaging segment held a significant market share in revenue in 2023, which is highly accelerated due to the continuous rise in production of innovative food and beverages, driving the need for compatible packaging design. The increasing consumer purchasing power and growing net income are further stimulating demand for consumer goods, specifically personal care and cosmetics. This is optimally fueling the adoption of polyethylene for packaging due to its durability, lower chemical exposure, and ability to protect from hazardous contaminants.

Regional Insights

North America Region Registered the Largest Share of The Global Market in 2023

The North America region held the dominant share in 2023. This is driven by the increasing adoption of plastic in automotive, agriculture, electronics, consumer goods, and packaging, along with the enhanced availability of polyethylene and rising production activities. However, increasing government stringent regulations to combat environmental pollution and growing circular economy initiatives are lowering their utility.

Conversely, the growing sustainable plastic production is projected to create diverse opportunities for the polyethylene market. For instance, in July 2023, Republic Services, a North American recycling company, joined forces with a polymer recycling firm, Ravago, to improve plastic recycling activities. With their joint venture, Blue Polymers, they are planning to establish four new recycling manufacturing facilities pertaining to polyethylene terephthalate, high-density polyethylene, and polypropylene in the US.

The Asia Pacific region will grow with rapid pace, owing to the growing demand for sustainable packaging. The changing consumer preferences towards environmentally friendly product packaging are creating a favorable environment for the polyethylene market in the region, particularly in China, India, and Japan. This is enabling companies to increase their use of clean-labeled packaging. For instance, in August 2023, Dow announced the introduction of a polyethylene-based sustainable yogurt pouch in partnership with Mengniu in China. This will certainly drive demand for polyethylene as a packaging material as more companies opt for eco-friendly packaging designs over the study period.

Europe is projected to register significant growth with increasing investments in the development of polyethylene production technology. For instance, in February 2024, Evonik Industries signed a collaboration agreement with the University of Mainz to introduce advanced polyethylene glycol lipids.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The polyethylene market is moderately consolidated and expected to register competition with the growing expansion activities. Companies are working on cost minimization and building contracts to meet increasing demand from the construction, packaging, and automotive industries. For instance, in November 2023, Nova Chemicals entered into a partnership agreement with a packaging company, Amcor, to supply sustainable polyethylene.

Some of the major players operating in the global market include:

- Chevron Phillips Chemical Company (US)

- China Petrochemical Corporation (China)

- Exxon Mobil Corporation (US)

- Formosa Plastics Corporation (Taiwan)

- Ineos Group Holdings (UK)

- LyondellBasell Industries NV (UK)

- Mitsui Chemicals Inc. (Japan)

- Petronas Chemicals Group (Malaysia)

- SABIC (Saudi Arabia)

- Sasol Ltd. (South Africa)

- Sumitomo Chemical (Japan)

Polyethylene Market Recent Developments in the Industry

- In May 2023, New Energy Blue and Dow announced that they had entered into a collaboration agreement with a view to producing sustainable plastic materials from corn waste.

Polyethylene Market Report Coverage

The polyethylene market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, technology, end-user, and their futuristic growth opportunities.

Polyethylene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 106.97 billion |

|

Revenue forecast in 2032 |

USD 161.08 billion |

|

CAGR |

5.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Polyethylene Market Size Worth $ 161.08 Billion By 2032

The top market players in Polyethylene Market are Chevron Phillips Chemical Company, China Petrochemical, Exxon Mobil Corporation

North America is the region contribute notably towards the Polyethylene Market

Polyethylene Market exhibiting the CAGR of 5.2% during the forecast period.

Polyethylene Market report covering key segments are type, technology, end-user, and region.