Relay Market Share, Size, Trends, Industry Analysis Report,

By Voltage Range (Low, Medium, High); By Type; By Application; By Mounting Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM3863

- Base Year: 2023

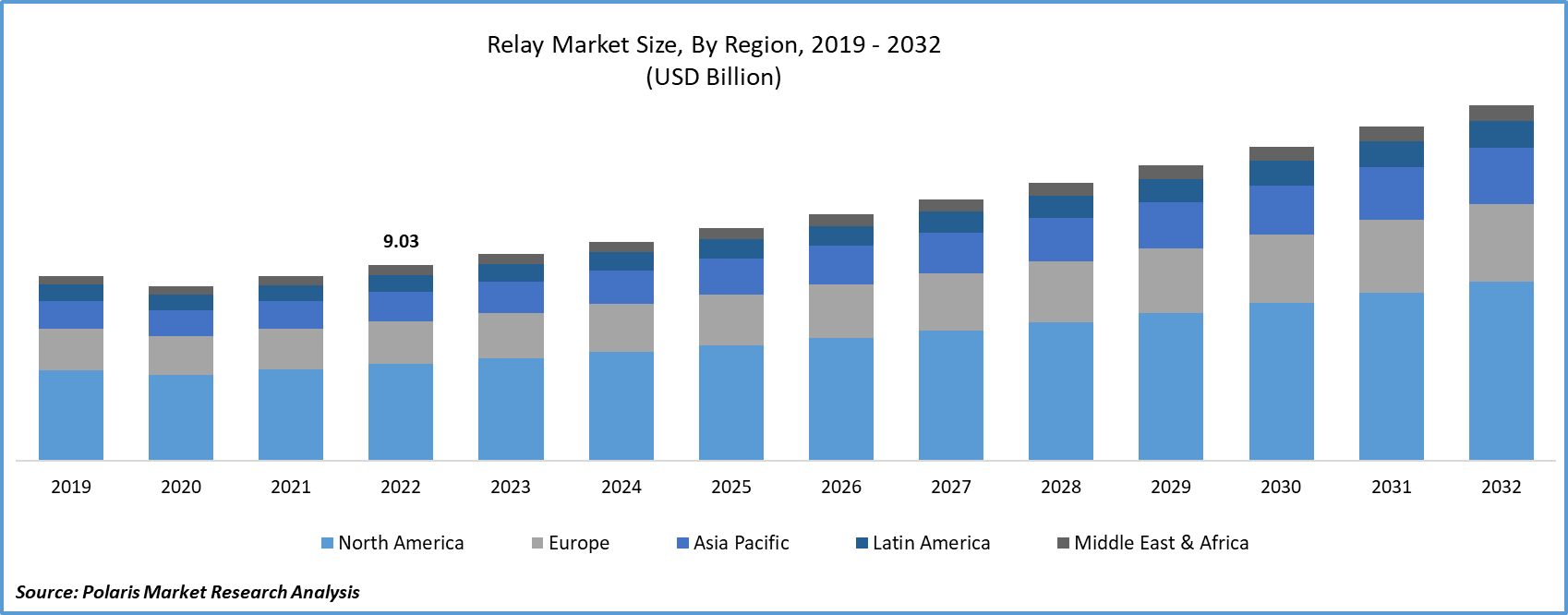

- Historical Data: 2019-2022

Report Outlook

The global relay market size and share was valued at USD 9.56 billion in 2023 and is predicted to surpass at a CAGR of 6.20% during the forecast period.

The relay market is poised for growth, driven by several key factors, such as increasing power consumption, the surging popularity of electric vehicles, the adoption of smart power grids, and the increasing use of vehicular safety technology. Nonetheless, the market's expansion during the forecast period could face potential challenges due to fluctuating raw material prices. On a global scale, both emerging and developed nations are making substantial investments in the advancement of smart power grids, which is expected to boost the relay market in the years ahead significantly.

We use relays for a broad range of applications, such as cars and bikes (automobiles), home automation, test and measurement equipment, industrial applications, and many more. A fundamental electromechanical switch is known as a relay. Relays are buttons that connect or disconnect two circuits, simply like normal switches do when we manually open or close a circuit. However, a relay uses an electrical signal in the position of a manual process to manage an electromagnet, which then disconnects or connects another circuit.

Furthermore, the relay technique can be separated into two major classifications: no movable connections (MOS FET relay, solid state relay) and movable connections (mechanical relay). Also, the expanded demand for safer and more relaxed vehicles and rising sales of electric and hybrid vehicles are boosting the relay market demand.

To Understand More About this Research: Request a Free Sample Report

Smart grids represent advanced infrastructures for electric power distribution, enhancing reliability and efficiency through automated control systems, modern communication networks, high-power converters, contemporary energy management techniques, and sensing and metering technologies. Within the framework of an automated power grid, the demand for relays is substantial. Relays play a critical role in monitoring transformers and providing protection against various issues, including transformer overload, overexcitation, and fault occurrences. They also serve standard protective functions, including overcurrent, differential protection, and earth fault protection.

- For instance, July 2021, The GridWise Alliance has unveiled a $5 billion investment aimed at modernizing the transmission and distribution infrastructure in the United States. This initiative will involve the integration of smart sensors, control systems, and storage solutions.

The automotive industry is undergoing a significant shift from hardware-focused to software-driven vehicles, leading to a rapid increase in the average software and electronics content per vehicle. Electronics play a crucial role in enabling the integration of new functionalities and features in automobiles, expanding their presence in critical applications like powertrain, safety management, body systems, and convenience or infotainment.

Furthermore, the pursuit of passenger safety is a compelling factor pushing the adoption of automated automotive systems. The incorporation of safety features and systems has substantially contributed to the reduction of accidents and fatalities on the road over the past few decades. The expanding use of electric components in both current and upcoming vehicles continues to fuel the demand for reliable and standardized components that ensure efficient, safe, and secure management of electric loads. These factors are presently the driving forces behind the growth of the market.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces relay market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Prominent relay manufacturers are currently grappling with formidable competition from unregulated market participants who offer inexpensive and subpar products. This category comprises local and grey market players. Local entities produce and sell goods under their in-house brand names, while the grey market involves the unauthorized import and distribution of products by dealers. These unorganized sector players outperform larger competitors due to their price competitiveness and well-established local supply networks, which are challenging for global companies to replicate. The expansion of relay sales in the grey market tarnishes the reputation of market leaders, as substandard products are sold under their branding. The growing sales of both local and grey market participants limit the opportunities for global players to boost their revenues and market share.

Industry Dynamics

Growth Drivers

Increasing capital allocation to renewable energy sources will Facilitate Market Growth

Globally, both developed and developing nations are shifting away from traditional fossil fuel-based electricity generation in favor of renewable energy sources. This transformation is, in part, a response to the growing concerns about climate change. The Intergovernmental Panel on Climate Change (IPCC) has identified the energy supply sector as the largest contributor to worldwide greenhouse gas emissions.

Renewable power generation technologies, often referred to as clean energy technologies, are increasingly being prioritized over conventional methods. Investments in these technologies are expected to rise worldwide, driven by the need to achieve electrification goals and address climate-related targets. According to projections by the International Renewable Energy Agency (IRENA), renewable energy has the potential to make up 57% of the global power supply by the year 2030.

Report Segmentation

The market is primarily segmented based on type, application, voltage range, mounting type, and region.

|

By Type |

By Application |

By Voltage Range |

By Mounting Type |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Thermal relays segment held the largest revenue share in 2022

Thermal relays serve as a safeguard against overloads in motors and various electrical equipment or circuits. Overloads occur when these machines or circuits operate abnormally, resulting in decreased motor speed, heightened current within the winding, and elevated winding temperatures. If the overload duration is brief, the current increase is modest, and the motor winding temperature remains within permissible limits, the overload is manageable. Thermal relays are capable of handling such overloads by design.

The Asia Pacific region is anticipated to emerge as the most extensive and swiftly expanding market for thermal relays.

By Voltage Range Analysis

The Medium voltage segment accounted for the highest market share during the forecast period

Medium voltage relays are protective devices designed for voltage ranges spanning from 1 kV to 33 kV. These relays typically serve in networks characterized by lower voltages and often share similar applications with high-voltage relays. Their primary deployment occurs within distribution utilities, where they play vital roles in safeguarding distribution transformers, feeders, busbars, and various electrical components. Moreover, these relays are integral to energy-intensive sectors such as mining, power generation, and oil gas.

Due to their extensive use in distribution infrastructure, this segment is poised for growth in both developing and developed regions across the globe, with the most significant markets situated in Asia Pacific, North America, and Europe. Key players in this sector include Schneider Electric, ABB, and AMETEK.

By Mounting Type Analysis

The DIN Rail segment accounted for the highest market share during the forecast period

DIN rail mounting is a versatile solution that allows multiple timers to be stacked on a single DIN rail, making it invaluable for various applications. DIN rail-mounted relays are widely used in commercial and cabinet timing and are particularly important for manufacturers of power distribution boards, industrial control cabinets, meter cabinets, and control panels. Additionally, DIN rails play a vital role in connecting various components to a single datalogger terminal, establishing power buses, and streamlining the installation of equipment like power supplies, conditioners, and breakers.

The key catalyst propelling the expansion of the DIN rail segment within the relay market is the surging demand for industrial equipment. As the global population steadily increases and urbanization remains a prevailing trend, the utilization of electrical components, including circuit breakers, fused terminal blocks, and wire connections, is on the upswing. Consequently, this heightened demand is poised to boost the need for DIN rail-mounted relays, with a particular emphasis on the Asia Pacific region.

Regional Insights

Asia Pacific dominated the largest market in 2022

In the foreseeable future, the Asia-Pacific region is positioned to secure a substantial market share. This growth in the relay market within Asia-Pacific primarily stems from the expanding capacity of renewable energy sources. Additionally, a surge in grid infrastructure projects and a strong focus on substation automation in alignment with the IEC 61850 standard are expected to propel market expansion in the region. The burgeoning renewable energy sector in the region opens up valuable opportunities for relay manufacturers, as relays are extensively utilized in a range of applications due to their capacity to provide substantial contact gaps and robust switching capabilities. Furthermore, both governmental entities and regional businesses have made significant investments in the development of this sector. Notably, the Chinese government's initiatives, such as the "Made in China 2025" plan, advocate for increased research and development in factory automation and related technologies, accompanied by substantial investments. Given that a significant portion of automation equipment is currently imported from countries like Germany and Japan, the "Made in China" initiative aims to strengthen domestic production of automation hardware and equipment.

In North America and Europe, there has been a strong emphasis on renewable energy initiatives and energy-efficient sectors. To link the primary grid with countries that source their energy from renewable sources, North America is making substantial investments in promoting electrification and transportation throughout the region. This increased focus on electrification and transportation has subsequently led to a rising demand for relays.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- ABB

- Eaton Corporation

- Electronic Relays India (ERI)

- GE

- Omron

- Phoenix Contact

- Schneider Electric

- SEL

- Siemens

- TE Connectivity

Recent Developments

- In March 2022, OMRON has unveiled a Compact Non-leaded MOSFET Relay, tailored as an optimal solution for test and measurement equipment. This innovative MOSFET relay features a compact surface mount design, along with a wide ambient operating temperature range and a high current rating (200V 0.35A).

- In May 2021, Panasonic has unveiled their latest Photovoltaic MOSFET High Power Type PhotoMOS Relays product line. These new products are offered in a compact SSOP package size and feature increased short circuit current and lower drop-out voltage to the MOSFET's gate. This driver is designed to effectively drive high Vgs MOSFETs, including SiC MOSFETs, enabling high switching capacities at rapid switching speeds.

Relay Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.13 billion |

|

Revenue forecast in 2032 |

USD 16.43 billion |

|

CAGR |

6.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Application, By Voltage Range, By Mounting Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ABB, Eaton Corporation, Electronic Relays India (ERI), GE, Omron, Phoenix Contact, Schneider Electric, SEL, Siemens, and TE Connectivity. |

Delve into the intricacies of the relay market landscape with the latest statistical insights for 2024, meticulously crafted by Polaris Market Research Industry Reports. Uncover the market's share, size, and revenue growth rate, supplemented by a forward-looking market forecast until 2032 and a retrospective glance at its history. Elevate your understanding of this dynamic industry by securing a complimentary PDF download of the sample report and stay ahead in the ever-evolving realm of relay market.