Rockets and Missiles Market Share, Size, Trends, Industry Analysis Report,

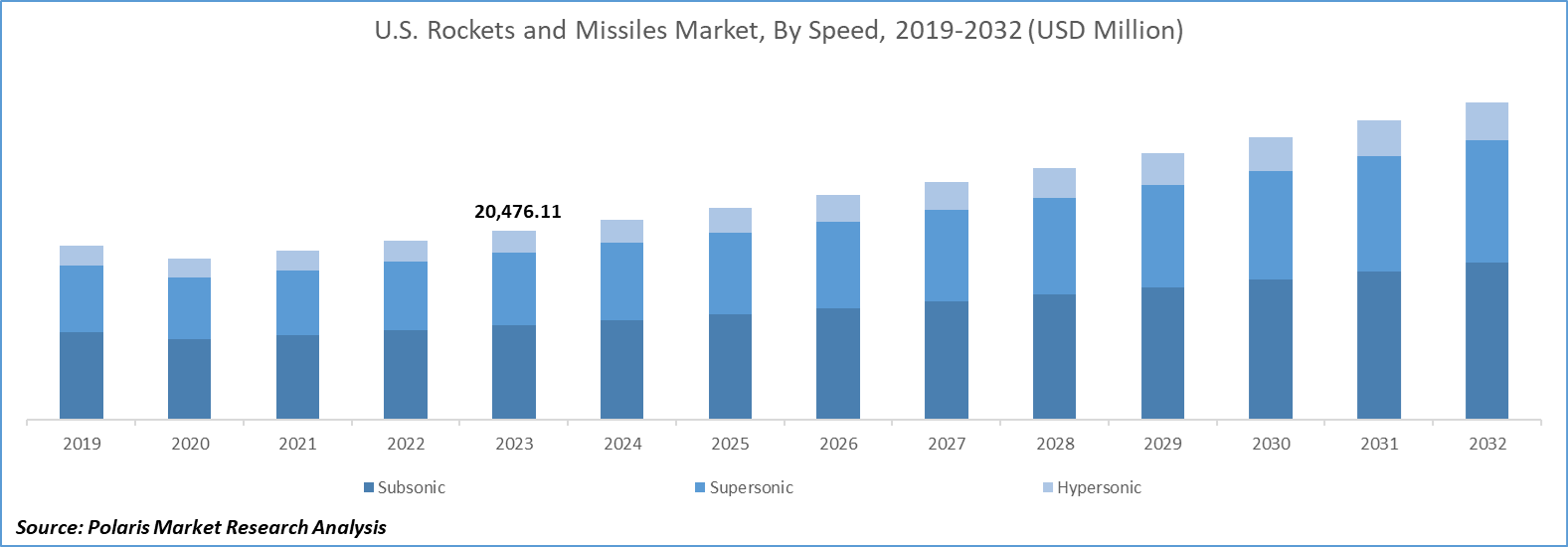

By Speed (Subsonic, Supersonic, Hypersonic); By Product; By Propulsion Type; By Launch Mode; By Region; Segment Forecast, 2024 - 2032

- Published Date:May-2024

- Pages: 119

- Format: PDF

- Report ID: PM2374

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Rockets and missiles market size was valued at USD 59,862.24 million in 2023. The market is anticipated to grow from USD 63,202.56 million in 2024 to USD 98,253.49 million by 2032, exhibiting the CAGR of 5.7% during the forecast period.

Industry Trends

The global rocket and missile market is experiencing significant growth, driven by various factors that underscore the increasing importance of advanced defense technologies in modern warfare. One key driver of this growth is the development of new-generation air and missile defense systems, which are being pursued by both military and defense industries worldwide. These systems aim to enhance defense capabilities against evolving threats, including missile attacks and aerial threats, thereby stimulating demand for rockets and missiles equipped with advanced guidance and interception capabilities.

To Understand More About this Research: Request a Free Sample Report

Additionally, the rising incidents of terrorist activities and territorial conflicts have heightened concerns about national security across the globe. This has led to a growing emphasis on military preparedness and defense expenditure, particularly in developing countries. Nations are increasingly investing in high-end rockets and missiles to bolster their defense capabilities and effectively target adversaries in the event of aggression. As a result, there is a surge in research and development efforts focused on enhancing the performance, speed, accuracy, and stealth capabilities of rockets and missiles to meet the evolving security challenges.

Despite the market's growth potential, certain factors hinder its expansion, including the rising cost of advanced technologies. Manufacturers are continuously striving to improve their products by incorporating new technologies, which often come with higher production costs. This results in elevated prices for finished rocket and missile systems, particularly in developing countries with limited defense budgets. The affordability of these advanced systems becomes a significant consideration for governments, impacting their procurement decisions and, consequently, the growth of the global rocket and missile market.

Key Takeaways

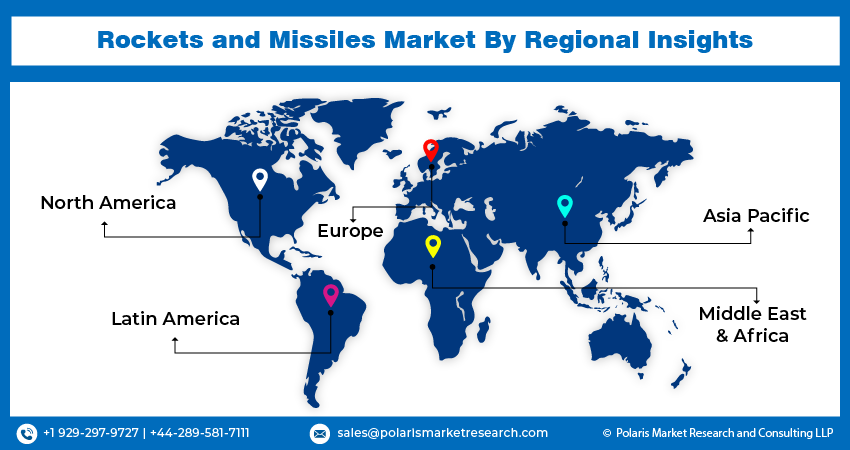

- North America dominated the market and contributed over 35% market share of the rockets and missiles market size in 2023

- By speed category, the subsonic segment dominated the global rockets and missiles market size in 2023

- By product category, the cruise missiles segment is projected to grow with a significant CAGR over the rockets and missiles market forecast period

What are the Market Drivers Driving the Demand for the Market?

Increasing Military Expenditure in Developing Nations

The growing defense budgets of emerging economies are playing a significant role in influencing the rocket and missile market. As these countries prioritize strengthening their military capabilities, there is a corresponding increase in demand for advanced missile and rocket systems. This is driven by the need to modernize their armed forces and enhance their defensive capabilities against evolving threats. The investment in defense technology, including rockets and missiles, is seen as essential for establishing deterrence and ensuring national security in an increasingly complex geopolitical landscape.

Simultaneously, the increasing investment in armed forces by established powers to establish dominance on the battlefield is driving the growth of the rocket and missile market. For instance, in October 2021, KONGSBERG signed contracts worth MNOK 1,426 with the Norwegian Navy for delivering new Naval Strike Missiles (NSM) and extending the operational lifespan of existing inventory.

Countries, including Russia, the U.S., China, and India, are bolstering their military strength through advancements in weapons capabilities, which include the development and deployment of sophisticated missile and rocket systems. For instance, in March 2019, Lockheed Martin secured a $1.13 billion contract from the U.S. Army for Lot 14 production of Guided Multiple Launch Rocket System (GMLRS) rockets and associated equipment. The pursuit of military superiority drives the demand for cutting-edge technology in missile defense, precision strikes, and battlefield dominance, thereby fueling the growth of the rocket and missile market globally.

Which Factor is Restraining the Demand for the Market?

Stringent Regulations

The rocket and missile industry face stringent regulations primarily driven by concerns related to international security, the potential misuse of advanced missile technology, and the proliferation of weapons of mass destruction. A key regulatory framework is the Missile Technology Control Regime (MTCR), designed to restrict the export of missiles capable of carrying such weapons. MTCR member countries limit the export of specific missile-related technologies, presenting challenges for manufacturers in entering new markets, especially with non-MTCR member states.

National export controls and licensing requirements further complicate international sales of rocket and missile technology. Governments scrutinize and restrict the transfer of sensitive technologies, including guidance systems and propulsion. These restrictions lead to procurement delays and limit market access, while enforcement can result in diplomatic tensions and trade disputes, affecting the global flow of missile-related products.

Report Segmentation

The market is primarily segmented based on speed, product, propulsion type, launch mode, and region.

|

By Speed |

By Product |

By Propulsion Type |

By Launch Mode |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Speed Insights

Based on speed category analysis, the market has been segmented on the basis of subsonic, supersonic, and hypersonic. In 2023, subsonic emerged as the dominant segment in the global market. Subsonic aircraft and missiles are characterized by speeds slower than the speed of sound, approximately 760 miles per hour at sea level. Many commercial aircraft operate at subsonic speeds. Subsonic missiles, traveling below Mach 1, are easier to develop and deploy compared to supersonic and hypersonic counterparts.

Various subsonic missiles are effective against aircraft carriers. One such type is the cruise missile—a guided projectile flying at low altitudes with the capability to cover extensive distances. Cruise missiles come equipped with diverse warheads, ranging from conventional to nuclear. The key advantage of subsonic flight is the extended range it provides. Cruise missiles with ranges exceeding 800 km are invariably subsonic. Despite their smaller size compared to supersonic counterparts, subsonic missiles deliver significantly longer ranges, making them a practical choice. Subsonic missiles utilize various propulsion systems, including jet engines, ramjets, and scramjets, with jet engines being the most prevalent in this category.

By Product Insights

Based on product category analysis, the market has been segmented on the basis of cruise missiles, ballistic, rockets, and torpedoes. The cruise missile market is predicted to experience a significant growth rate in the coming years, given their ability to deliver a high-precision warhead over long distances. Modern cruise missiles come with advanced features, such as the capacity to travel at varying speeds, including high subsonic and supersonic to hypersonic speeds. These self-guided projectiles follow a non-ballistic trajectory and travel at extremely low altitudes.

The flight performance of a cruise missile is dependent on its velocity, whereas subsonic versions fly at low altitudes of less than 100 meters. At the same time, hypersonic variants operate at altitudes between 30 and 40 kilometers. Hypersonic cruise missiles use a rocket booster to attain near-hypersonic speeds initially and then use a supersonic combustion ramjet (scramjet) to maintain and further accelerate their flight above Mach 4. As self-propelled, uncrewed, guided vehicles, cruise missiles depend mainly on aerodynamic lift for their trajectory. Their primary mission is to deliver specialized payloads or ordnance to a predetermined target within the Earth's atmosphere. Cruise missiles have shorter ranges, smaller payloads, and slower speeds compared to ballistic missiles. Their use of jet engine technology is their distinguishing feature.

Regional Insights

North America

North America accounted for the largest revenue share in the global market. The region's defense against rockets and missiles involves various initiatives and collaborations between the United States and Canada. The North American Aerospace Defense Command (NORAD) plays a crucial role in aerospace warning, aerospace control, and maritime warning for North America. Additionally, the U.S. possesses a robust nuclear triad comprising land-, sea-, and air-based assets such as the LGM-30G Minuteman III intercontinental ballistic missiles (ICBMs), and the Ground Based Strategic Deterrent (GBSD) program aims to replace the current Minuteman III missiles.

Furthermore, the U.S. operates a national missile defense system, including elements such as the Ground-Based Interceptors (GBI) used by the Ground-Based Midcourse Defense (GMD) system. These measures ensure that North America remains prepared to defend against a wide array of threats posed by rockets and missiles.

Asia Pacific

The Asia-Pacific region has emerged as a focal point for missile development and deployment due to its intricate geopolitical dynamics and security concerns. Multiple countries in the area are investing heavily in advanced missile technologies, including hypersonic missiles capable of speeds five times faster than sound. This proliferation of missiles has raised concerns about stability, security, and the potential for miscalculations and conflicts. International observers and defense analysts closely monitor the evolving missile capabilities in the Asia-Pacific region due to their implications for regional and global security. While most of these capabilities are conventional, the potential for them to escalate nuclear risks has not been fully appreciated.

Competitive Landscape

The rocket and missile market is highly competitive, and companies are constantly striving to gain market share through technological advancements, strategic partnerships, and innovation. These companies have a substantial customer base and robust distribution networks, which provide them with an advantage in terms of market reach and penetration. In order to keep up with the evolving needs of the industry and meet strict quality standards, companies are investing heavily in research and development. The landscape of the rocket and missile market is intricate and dynamic, with various players competing across different segments and geographies.

Some of the major players operating in the global market include:

- BAE Systems

- Bharat Dynamics Limited

- Boeing

- Denel Dynamics

- L3Harris Technologies

- Lockheed Martin

- MBDA

- Northrop Grumman Corporation

- RTX

- Thales Group

Recent Developments

- In January 2024, L3Harris Technologies is in the upgradation of its solid rocket motor manufacturing facilities; Aerojet Rocketdyne, a company under L3Harris Technologies, is set to meet a new contract from Lockheed Martin; this contract involves the ongoing provision of propulsion systems for the U.S. Army's Guided Multiple Launch Rocket System (GMLRS) programs.

- In February 2023, Bharat Dynamics Limited (BDL) unveiled three new advanced missile technologies at the Aero India 2023 exhibition in Bengaluru, including Vertical Launched-Short-Range Surface-to-Air Missile (VL SR SAM), Semi-Active Laser Seeker Homing Anti-Tank Guided Missile for BMP-II, Drone Delivered Missile.

- In February 2024, MBDA has entered into two Memorandums of Understanding (MoUs) partnerships with Greek firms MILTECH and ALTUS under its "R&D Booster" initiative in Greece. Through its collaboration with ALTUS in the second partnership agreement, MBDA aims to pioneer the development of a series of tactical drones featuring AKERON MP missiles.

- In October 2023, L3Harris Technologies, Leidos, and MAG Aerospace have joined forces for the U.S. Army's High Accuracy Detection and Exploitation System (HADES) program. The collaborative effort aims to provide a fleet of aerial intelligence, surveillance, and reconnaissance (ISR) aircraft for the swift collection of operational intelligence against the nation's most advanced adversaries.

Report Coverage

The rockets and missiles market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, speed, product, propulsion type, launch mode, and their futuristic growth opportunities.

Rockets and Missiles Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 63,202.56 million |

|

Revenue forecast in 2032 |

USD 98,253.49 million |

|

CAGR |

5.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Speed, By Product, By Propulsion Type, By Launch Mode, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |