Seismic Support Vessels Market Share, Size, Trends, Industry Analysis Report,

By Dimension (medium, large, very large); By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 120

- Format: PDF

- Report ID: PM4722

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

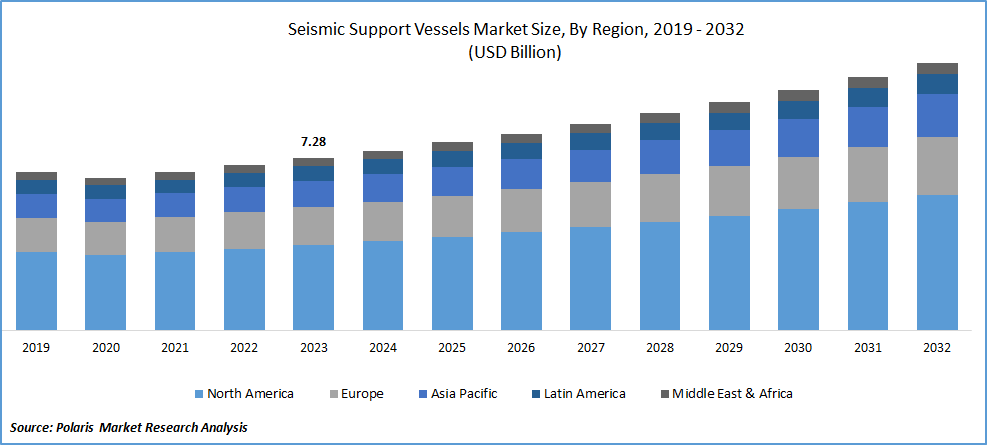

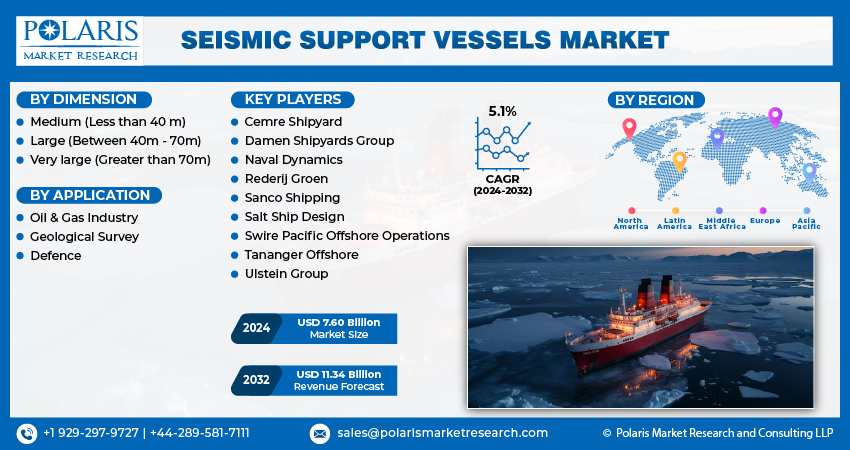

The global seismic support vessels market was valued at USD 7.28 billion in 2023 and is expected to grow at a CAGR of 5.1% during the forecast period.

Seismic vessels are ships primarily used in seismic survey procedures in higher seas and oceans. This plays a crucial role as a survey vessel in order to identify and locate the ideal location for oil drilling in the middle of the oceans. These vessels are used by businesses engaged in the oil drilling process to locate the optimum underwater locations for drilling oil. Another key factor driving the use of seismic vessels is the possibility of adverse effects on the marine ecosystem driven by the inappropriate selection of suitable locations for drilling oil and gas. Seismic support vessels enable companies to choose an effective place with their oil and gas reserves, restraining the adverse environmental effects. The increasing acquisitions among the companies are contributing to the expansion of the global seismic support vessel market.

To Understand More About this Research:Request a Free Sample Report

- For instance, in September 2023, Norwegian surveyor Argeo and offshore seismic expert Shearwater GeoServices formed an alliance to "transform" the sub-sea & ocean bottom node (OBN) seismic service sectors. As part of this, Argeo will pay Sheerwater USD 6 Mn in cash and approximately 20.1 Mn shares of the company in exchange for the seismic vessel SW Bell.

Moreover, the rising global demand for oil and natural gas is encouraging companies to explore new reserves, which in a way is driving the demand for seismic support vessels as they ensure effective identification of possible exploration activities.

However, the prevalence of ongoing interests in renewable energy sources, including solar, wind, hydropower, and more, is hampering oil and gas activities among the key market players, contributing to the lower demand for seismic support vessels.

Growth Drivers

- Rising investments in the oil and gas industry are boosting the demand for seismic support vessels

The increasing investment in oil exploration is fueling the need for seismic support vessels in the coming years. Schlumberger, an oil field services company, is projected to witness more than 20% growth in 2023 and anticipates a rise in investment decisions in the oil and gas field totaling more than $500 million between 2022 and 2025, a 90% increase from the period from 2016 to 2019. This growth is attributable to the ongoing development projects. Production capacity increases in Africa, substantial development projects in Guyana, Brazil, and the Middle East, as well as a revival of exploration and appraisal in the more recent offshore provinces of Namibia, Tanzania, Colombia, India, and the East Mediterranean, will all contribute to the growth, which will further create new growth opportunities for seismic support vessels in the coming years.

Report Segmentation

The market is primarily segmented based on dimension, application and region.

|

By Dimension |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Dimension Analysis

- Very large segment is expected to witness the highest growth during the forecast period

The very large segment is projected to grow at a CAGR during the projected period, mainly driven by its ability to operate effectively in deep-water environments. As industrial players show interest in finding energy reserves in deep water, there will be a huge demand for very large-diameter seismic support vessels. Furthermore, the ongoing large-scale survey missions at sea are driving the need for greater than 70-metre vessels due to their higher capabilities to handle larger equipment, people, and supplies. In addition, this dimension vessel is suitable for various survey types, including 2D, 3D, ocean bottom node seismic surveys, and more, gaining traction from larger industrialists driven by its versatility.

The large segment led the industry market with a substantial revenue share in 2022, largely attributable to its capacity and convenience in various seismic operations in the oil and gas industry. It is widely used in projects that require stability between manoeuvrability and capacity. This will further boost the ongoing expansion of the market during the forecast period.

By Application Analysis

- Oil and gas industry accounted for the largest market share in 2023

The oil and gas segment accounted for the largest market share. The increasing expansion of offshore operations necessitates the need for seismic support vessels, primarily to evaluate drilling sites. Furthermore, these vessels play a crucial role for companies specializing in oil and gas exploration due to their ability to measure the reserves beneath the seabed and the potential availability of hydrocarbons. This finding assists oil companies to adopt data-driven strategies before making huge investments in developing projects. These factors are contributing to the demand for seismic support vessels in the oil and gas industry in the coming years.

The geological survey segment is expected to grow at the fastest rate over the next few years on account of the increasing research activities on earth. The ongoing geographical research on the earth's surface, plate tectonics, sedimentary processes, and earthquakes is driving the demand for seismic support vessels because of their assistance to the scientists in the collection of relevant data. Furthermore, scientists are exploring minerals, oil and gas reserves, elements on earth, and more, fueling the demand for seismic support vessels due to their capability in mapping and assessing the resources.

Regional Insights

- Asia Pacific region registered the largest share of the global market in 2023

The Asia Pacific region witnessed the largest global market share. The developing countries in this region, including China and India, are witnessing a higher demand for oil and gas exploration activities driven by the growing need for oil and gas. Governments are incentivizing companies to increase oil and gas exploration as a part of Atma Nirbhar Bharat in India to cater to consumer and commercial electricity needs.

According to the India Brand Equity Foundation, the demand for oil in India is expected to increase by 2x to reach 11 barrels per day by 2045. India's oil demand reached a 24-year high in February 2023 because of an increase in industrial activity. It was the fifteenth consecutive increase in demand year over year. This data demonstrates the increasing demand for oil, which will enhance the need for seismic support vessels as they are important in finding a suitable site for oil and exploration activities. As countries in this region are witnessing a rapid increase in demand for oil and gas, there will be huge potential for the seismic support vessel market in the coming years.

The North American will grow at healthy CAGR, owing to the ongoing oil supply disruptions in the region. Countries in this region, like the United States and Canada, are experiencing supply shortages driven by the Russian-Ukrainian invasion. Drilling in the United States will increase by 8.2%, while total hole footage is expected to expand by 8.7% to 289 MMft. As companies in the region showcase the increase in oil and gas exploration activities, there will be a huge demand for seismic support vessels, fueling the expansion of the market in the next few years.

Key Market Players & Competitive Insights

The seismic support vessels market is witnessing a rapid increase in competition driven by growing partnerships, collaborations, mergers, and acquisitions among the key market players and widening the expansion and growth of the market. The growing product innovations in the marketplace are propelling the availability of products to end consumers.

Some of the major players operating in the global market include:

- Cemre Shipyard

- Damen Shipyards Group

- Naval Dynamics

- Rederij Groen

- Sanco Shipping

- Salt Ship Design

- Swire Pacific Offshore Operations

- Tananger Offshore

- Ulstein Group

Recent Developments

- In August 2023, Sercel introduced new sea-bed nodal solutions for all kind of water depths upto 6,000 m to address the expanding industry demand for OBN seismic surveys.

Seismic Support Vessels Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.60 billion |

|

Revenue forecast in 2032 |

USD 11.34 billion |

|

CAGR |

5.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Dimension, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Seismic Support Vessels Market include Cemre Shipyard, Damen Shipyards Group, Naval Dynamics, Rederij Groen, Sanco Shipping.

The global seismic support vessels market is expected to grow at a CAGR of 5.1% during the forecast period.

Seismic Support Vessels Market report covering key segments are dimension, application and region.

The key driving factors in Seismic Support Vessels Market are Rising investments in the oil and gas industry are boosting the demand for seismic support vessels.

Seismic Support Vessels Market Size Worth $ 11.34 Billion By 2032.