Singapore, Malaysia, and China Corporate Secretarial Services Market Size, Share, Trends, Industry Analysis Report

: Information By Type, By Application (Charity Companies, Non-Listed PLCs, Listed Companies, and Academy Schools), By Industry, By Size And By Country (Singapore, Malaysia, and China) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 86

- Format: PDF

- Report ID: PM4993

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Singapore, Malaysia, and China corporate secretarial services market size was valued at USD 1,846.94 million in 2023. The Singapore, Malaysia, and China corporate secretarial services industry is projected to grow from USD 1,957.70 million in 2024 to USD 3,244.41 million by 2032, exhibiting a compound annual growth rate (CAGR) of 6.5% during the forecast period 2024 - 2032.

The Singapore, Malaysia, and China corporate secretarial services market is experiencing robust growth driven by several key factors, such as increasing regulatory complexities, globalization of businesses, and the rising number of startups. The expansion of startups, driven by innovators and entrepreneurs, has increased the demand for corporate secretarial services.

These services ensure compliance with legal requirements, helping startups avoid legal pitfalls and penalties, thus contributing to the Singapore, Malaysia, and China corporate secretarial services market growth. Additionally, Singapore, Malaysia, and China corporate secretarial services market growth is driven by the need for compliance with diverse regulatory requirements, efficient corporate governance, and seamless operations across multiple jurisdictions to support international expansion and complex cross-border activities.

To Understand More About this Research: Request a Free Sample Report

Corporate secretarial services encompass a range of essential administrative functions required for a company's smooth operation and legal compliance. Corporate secretarial services include managing corporate records, ensuring compliance with statutory and regulatory requirements, facilitating board and shareholder meetings, maintaining statutory registers, filing annual returns, and advising on governance best practices. Companies focus on their core business activities while ensuring that all legal obligations are met efficiently and accurately by outsourcing these tasks to professional service providers.

In Singapore, the government's pro-business policies and robust regulatory framework made it a preferred destination for startups and multinational corporations. For Instance, Singapore's startup ecosystem, ranked No. 1 in Asia Pacific for 2022, boasts 12 unicorns and over 3,800 tech-enabled startups. The regulatory bodies in Singapore mandate strict compliance requirements that necessitate the need for professional corporate secretarial services. Similarly, Malaysia's dynamic business environment and China's vast market potential have attracted numerous entrepreneurs and investors. Consequently, the need for professional corporate secretarial services has surged to ensure companies adhere to the evolving legal and regulatory frameworks in these countries.

Singapore, Malaysia, and China Corporate Secretarial Services Market Trends

Increasing Demand for Corporate Governance Expertise is Driving the Market Growth

Market CAGR for corporate secretarial services in Singapore, Malaysia, and China is being driven by the rising demand for corporate governance expertise. As businesses face increasing regulatory scrutiny and the need for transparent corporate practices, companies are seeking specialized services to ensure compliance with evolving laws and regulations. In these countries, corporate secretarial services play a crucial role in maintaining accurate records, managing statutory filings, and ensuring corporate governance standards are met. The emphasis on accountability and transparency, particularly in the wake of high-profile corporate scandals, has further increased the importance of these services.

Additionally, the growing complexity of global operations and cross-border transactions necessitates robust governance frameworks, propelling demand for professional corporate secretarial expertise. The trend is supported by government initiatives aimed at strengthening corporate governance frameworks, thereby fostering a robust market for these essential services. As a result, providers in Singapore, Malaysia, and China are experiencing a surge in demand, catering to both domestic and international clients.

Growth in Foreign Investments and Multinational Expansions

The growth in foreign investments and multinational expansions is significantly driving the demand for Singapore, Malaysia, and China corporate secretarial services market. Compliance with local regulations becomes crucial as businesses expand. Corporate secretarial services ensure adherence to legal requirements, facilitating smooth operations and risk mitigation. These services are essential for foreign companies aiming to establish a foothold in new markets, providing expertise in local governance, regulatory filings, and corporate governance practices. The increasing complexity of regulatory environments further underscores the necessity for professional corporate secretarial services to manage compliance effectively.

The flow of Foreign Direct Investment (FDI) has significantly influenced the demand for Singapore, Malaysia, and China corporate secretarial services market growth. For instance, according to the Singapore Department of Statistics, Singapore's corporate sector saw a 5% increase in FDI stock from $2,494 billion at the end of 2021 to $2,619 billion at the end of 2022. High FDI inflows indicate investor confidence and economic stability, prompting multinational companies to set up subsidiaries and branches. The surge in foreign enterprises necessitates robust corporate secretarial support to manage compliance, corporate governance, and statutory obligations efficiently. Consequently, the rising FDI necessitates professional services to navigate complex regulatory landscapes, ensuring seamless business operations and sustained growth, thereby boosting the Singapore, Malaysia, and China corporate secretarial services market revenue.

Singapore, Malaysia, and China Corporate Secretarial Services Market Segment Insights

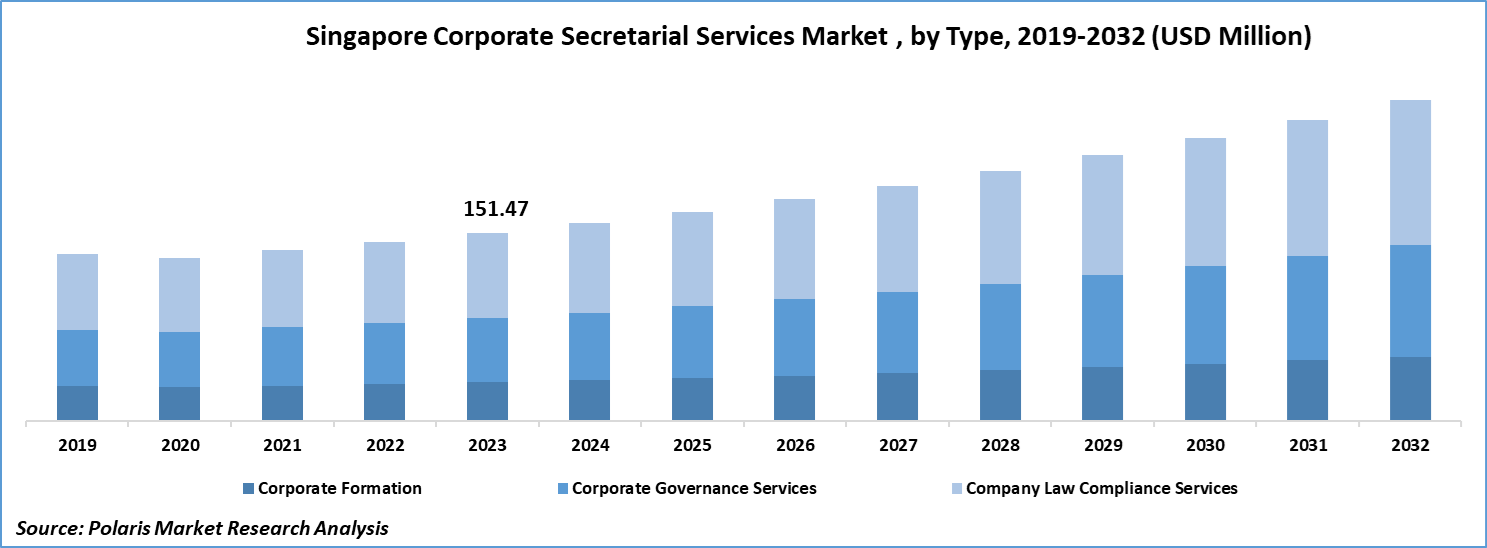

Singapore, Malaysia, and China Corporate Secretarial Services Type Insights:

The Singapore, Malaysia, and China corporate secretarial services market segmentation, based on type, includes corporate formation, corporate governance services, and company law compliance services. In 2023, the company law compliance services segment dominated the market, accounting for 46.72% of into Singapore, Malaysia, and China corporate secretarial services market revenue (812.13 million). Company law compliance services refer to a comprehensive set of services that assist companies in meeting their legal obligations and maintaining good corporate governance. Moreover, these services are closely related to corporate secretarial functions, as both aim to ensure compliance with regulations and effective company administration.

Company law compliance services involve preparing and submitting various forms and documents to regulatory authorities, such as the Registrar of Companies (ROC). They also include filing annual returns, maintaining statutory registers, and ensuring adherence to the provisions of the Companies Act.

Moreover, a key aspect attributed to the growth of company law compliance services is the preparation of annual returns. Companies are required to file annual returns with the ROC, providing details of their share capital, shareholders, and officers at a designated date. In addition, corporate secretarial services support the annual returns process by ensuring that the necessary information is gathered and presented in the required document format, thereby promoting Singapore, Malaysia, and China corporate secretarial services market growth.

Singapore, Malaysia, and China Corporate Secretarial Services Application Insights:

The Singapore, Malaysia, and China corporate secretarial services market segmentation, based on application, includes charity companies, non-listed PLCs, listed companies, and academy schools. The listed companies segment is expected to grow at the fastest CAGR of 6.7% during the forecast period. Listed companies, also known as publicly traded companies, are organizations that trade on a public stock exchange, such as the London Stock Exchange (LSE) and New York Stock Exchange (NYSE), among others. In addition, being listed on a stock exchange allows companies to raise capital from the public, which increases their transparency and enhances their credibility. However, the process of trading also subjects the companies to obey stringent regulatory requirements and corporate governance standards. Therefore, ensuring proper and constant compliance helps companies to protect investors' interests and ensure Singapore, Malaysia, and China corporate secretarial services market integrity.

Singapore, Malaysia, and China Corporate Secretarial Services Country Insights:

By country, the study provides market insights into Singapore, Malaysia, and China. China dominated the Singapore, Malaysia, and China corporate secretarial services market due to its robust economic growth, influx of multinational corporations, stringent regulatory environment, and emphasis on compliance and corporate governance. China's corporate revolution, driven by government initiatives, globalization, liberalization, and privatization, has attracted foreign direct investment and established the country as an economic power. The influx of multinational corporations and complex regulatory requirements have spurred demand for corporate secretarial services. The 14th Five-Year Plan emphasizes technological innovation and green development, necessitating compliance with foreign investment laws and environmental regulations. The State Administration for Industry and Commerce enforces Company Law compliance, while laws promoting corporate social responsibility and environmental protection further boost the need for Singapore, Malaysia, and China corporate secretarial services market.

Further, the major countries studied in the market report are Singapore, Malaysia, and China.

Malaysia witnessed a significant corporate uplift categorized by factors such as comprehensive government reforms, initiatives, and the implementation of regulations. The country has aimed at developing a more liberalized and globally integrated economy while maintaining corporate integrity through stringent compliance measures.

For instance, the Malaysian government launched the Malaysia Digital Economy Blueprint (MyDIGITAL), which aims to transform the country into a technologically advanced nation by 2030. The blueprint encompasses initiatives to boost digital infrastructure, enhance cybersecurity, and promote e-commerce and fintech sectors. The initiative encompasses technological advancements in sectors such as food and beverages, retail trade, transportation, and logistics, among others, with a 5% upliftment in labor productivity by 2025. Accordingly, new reforms are expected to create demand for corporate secretarial services during the forecast period for catering to the need for compliance.

Singapore, Malaysia, and China Corporate Secretarial Services Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Singapore, Malaysia, and China corporate secretarial services market grow even more. Market participants are also undertaking a variety of strategic activities to expand their Singapore, Malaysia, and China footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Singapore, Malaysia, and China corporate secretarial services industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Singapore, Malaysia, and China Corporate Secretarial Services industry to benefit clients and increase the market sector. In recent years, the Singapore, Malaysia, and China corporate secretarial services industry has offered some technological advancements. Major players in the Singapore, Malaysia, and China corporate secretarial services market, including BDO, Cogency Global Inc., Conpak CPA Ltd, Deloitte, Ecovis International, Enterprise Bizpal Pte Ltd, Grant Thornton International Ltd (GTIL), KPMG, PwC, A.1 Business Pte Ltd, Acclime, AXA Corporate Sdn Bhd, Osome Ltd., BoardRoom, and RSM Stone Forest.

BDO is a global firm offering auditing, tax, advisory, and business services across industries such as consumer business, financial services, and healthcare. The company’s comprehensive offerings include expertise in tax legislation, advisory support in cybersecurity and risk management, and global business services, including finance and compliance support.

Cogency Global Inc. specializes in comprehensive legal services, including registered agent representation, corporate compliance, and international business support. The company’s offerings cater to diverse needs such as UCC filings, legalizations, and court services, ensuring efficient statutory representation and compliance solutions for organizations globally.

Key Companies in the Singapore, Malaysia, and China Corporate Secretarial Services Market Include:

- A.1 Business Pte Ltd.

- Acclime

- AXA Corporate Sdn Bhd

- BDO

- BoardRoom

- Cogency Global Inc.

- Conpak CPA Ltd

- Deloitte

- Ecovis International

- Enterprise Bizpal Pte Ltd.

- Grant Thornton International Ltd. (GTIL)

- KPMG

- Osome Ltd.

- PwC

- RSM Stone Forest

Singapore, Malaysia, and China Corporate Secretarial Services Industry Developments

March 2024: Singapore proposed the Corporate Service Providers (CSP) Bill, which requires all corporate service firms offering corporate secretarial services to register with ACRA. The legislation aims to enhance anti-money laundering controls and transparency in beneficial ownership.

February 2024: China's amended Company Law, effective July 1, 2024, introduced stricter capital contribution requirements and enhanced corporate governance standards, impacting corporate secretarial services with increasing compliance and governance responsibilities for firms operating in China.

August 2021: Under Malaysia's National Recovery Plan, company secretarial firms may operate under Phases 1 and 2 with approval from SSM and adherence to SOPs.

Singapore, Malaysia, and China Corporate Secretarial Services Market Segmentation

Singapore, Malaysia, and China Corporate Secretarial Services Type Outlook

- Corporate Formation

- Corporate Governance Services

- Company Law Compliance Services

Singapore, Malaysia, and China Corporate Secretarial Services Application Outlook

- Charity Companies

- Non-Listed PLCs

- Listed Companies

- Academy Schools

Singapore, Malaysia, and China Corporate Secretarial Services Industry Outlook

- Manufacturing

- Retail

- Financial Services

- Technology

Singapore, Malaysia, and China Corporate Secretarial Services Size Outlook

- Large Enterprises

- Medium Businesses

- Small Businesses

Singapore, Malaysia, and China Corporate Secretarial Services Country Outlook

- Singapore

- Malaysia

- China

Singapore, Malaysia, and China Corporate Secretarial Services Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,846.94 million |

|

Market size value in 2024 |

USD 1,957.70 million |

|

Revenue Forecast in 2032 |

USD 3,244.41 million |

|

CAGR |

6.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Country scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Singapore, Malaysia, and China corporate secretarial services market size was valued at USD 1,846.94 Million in 2023 and is projected to be valued at USD 3,244.41 million by 2032

The Singapore, Malaysia, and China market is projected to grow at a CAGR of 6.5% during the forecast period, 2023-2032.

China had the largest share in the Singapore, Malaysia, and China market

Who are the key players in the Singapore, Malaysia, and China corporate secretarial services market?

The company law compliance services category dominated the market in 2023

The non-listed PLCs had the largest share in the Singapore, Malaysia, and China market.