Styrenic Block Copolymer Market Share, Size, Trends, Industry Analysis Report,

By Product (Hydrogenated Styrenic Block Copolymers, Styrene-butadiene-styrene, Styrene-isoprene-styrene); By Application; By End-user; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 115

- Format: PDF

- Report ID: PM4956

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

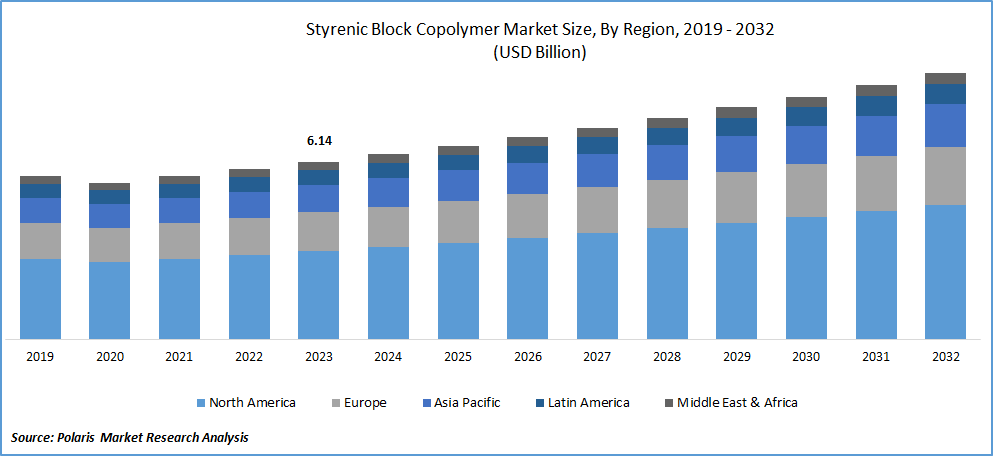

Styrenic Block Copolymer Market size was valued at USD 6.14 billion in 2023. The market is anticipated to grow from USD 6.41 billion in 2024 to USD 9.22 billion by 2032, exhibiting the CAGR of 4.6% during the forecast period.

Market Overview

Rising consumer disposable income is one of the major factors driving the use of leather bags, shoes, and other apparel in the global marketplace. The growing number of people using social media is promoting the fashion industry by creating FOMO (fear of missing out). This significantly fuels the demand for artificial leather and, thereby, styrenic block copolymers in the world. Furthermore, the growing companies' initiatives to enhance their production capacity and regional landscape are optimally influencing the global styrenic block copolymer.

To Understand More About this Research:Request a Free Sample Report

- For instance, in March 2023, Kraton Corporation announced the expansion of its Belpre facility's production capacity by 2024. The production of styrene-butadiene-styrene block copolymers is estimated to grow by 24 kilotons per year after 2024.

Moreover, the use of styrenic block copolymers is increasing in polymer modification activities. The need to improve modified material properties, such as heat, weather, and impact resistance, in several applications is gaining adoption. This technology has the capability to improve the toughness of the material for applications in automotive and healthcare.

However, the uncertain pricing of these compounds is likely to force users to utilize economical alternatives. This is due to unstable raw material availability and, thereby, its price volatility in the marketplace.

Growth Drivers

Rising studies exploring the development of new styrenic block copolymer.

Researchers and manufacturers are utilizing available technology and materials to create unique properties based on the styrenic block copolymer. This will certainly drive awareness about its uses and propel its integration into industrial activities.

Various industries, including automotive, construction, electronics, packaging, and healthcare, are continuously seeking innovative materials to improve product performance, reduce costs, and meet regulatory requirements. New developments in SBCs offer opportunities to innovate and differentiate products in these markets, driving demand for novel formulations.

With growing awareness of sustainability and environmental concerns, there is a shift towards the use of eco-friendly materials in manufacturing processes. Researchers are exploring the development of bio-based and recyclable SBCs as alternatives to traditional petrochemical-based polymers, aligning with the industry's sustainability goals.

Increasing demand for medical devices

The growing prevalence of healthcare diseases is facilitating the need for effective diagnostic devices to detect health diseases in the global marketplace. The increasing demand for medical devices will boost production activities, driving the production of the production of the required raw materials. This includes paints, adhesives, coatings, and sealants. This will fuel the necessity for styrenic block copolymers in the marketplace.

Restraining Factors

Limited knowledge and availability of effective alternatives

The availability of compatible substitutes for the styrenic block copolymers, including thermoplastic elastomers, and lower awareness about their properties are likely to limit their adoption around the world. The increasing adoption of sustainable practices is boosting the use of bio-based polymers, which is expected to reduce their demand in the coming years.

Report Segmentation

The market is primarily segmented based on product, application, end-user, and region.

|

By Product |

By Application |

By End-user |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

Styrene-butadiene-styrene segment is expected to witness the highest growth during the forecast period

The styrene-butadiene-styrene segment is projected to grow at a CAGR due to its ability to offer durability and flexibility with polystyrene. It will increase the stretchability of the polybutadiene composition, gaining its adoption in polymer modification, adhesives, sealants, and asphalt modification.

Styrene-ethylene propylene styrene is likely to witness significant industrial adoption in the coming years due to its potential to withstand harsh weather conditions and ease of processing. The thermal stability associated with the hydrogenation procedure is expected to boost its utility in the thermoplastic modification of hot-melt adhesives, paving, and roofing.

By Application Analysis

The footwear segment accounted for the largest market share in 2023

The footwear segment accounted for the largest market share in 2023 and is expected to maintain its dominance. This dominance is due to its superior performance in combining two substrates effectively. The unique characteristics of styrenic block copolymers, such as flexibility, heat resistance, longevity, and elasticity, are further bolstering their use in new footwear designs.

By End-user Analysis

The construction segment held a significant market revenue share in 2023

In 2023, the construction segment held a significant revenue share due to the continuous rise in global population growth. This is creating the need for styrene block copolymer due to its enormous potential to enhance asphalt adhesion and elasticity. The compound's water solubility property is gaining utility in the roofing, pavement, and waterproofing activities in the construction industry.

Regional Insights

North America region registered the largest share of the global market in 2023

The North American region held the dominant share in 2023. This is mainly attributable to the increasing integration of styrenic block copolymers in the food packaging industry, specifically for wrapping films. The presence of a higher-income population in the region, particularly in the United States, is boosting demand for footwear, consumer apparel, and food. This will likely drive the production of adhesives and sealant chemical compounds, including styrene block copolymers, in the coming years.

According to the OEC World, in January 2024, styrenic polymer imports increased from USD 97.7 million to USD 101 million, accounting for a growth of 2.93%. This trend is likely to continue further with the growing automotive and construction industries.

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the growing expansion of automobile manufacturing and increasing demand for consumer apparel. The increasing working population, specifically women's, is creating significant demand for footwear and artificial leather bags. The established payers in the region, mainly in China, are optimally driving market growth by increasing production to meet global needs.

Key Market Players & Competitive Insights

The styrenic block copolymer market is moderately consolidated. Major companies are focusing on research and development activities to increase their productivity and meet the ongoing transition towards a green economy.

Some of the major players operating in the global market include:

- Asahi Kasei Corporation

- China Petrochemical Corporation (Sinopec)

- Denka Company Limited

- Dynasol Group

- INEOS Styrolution Group GmbH

- JSR Corporation

- KRATON CORPORATION

- Kuraray Co., Ltd.

- LCY Group

- LG Chem

- TSRC

- ZEON CORPORATION

Recent Developments in the Industry

- In March 2022, Sabic, a chemical manufacturer, announced its collaboration with Kraton, a polymer and bio-based product producer, aiming to deliver sustainable butadiene to produce styrenic block copolymer, which is anticipated to reduce fossil depletion by 80%.

Report Coverage

The styrenic block copolymer market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, end-user, and their futuristic growth opportunities.

Styrenic Block Copolymer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.41 billion |

|

Revenue forecast in 2032 |

USD 9.22 billion |

|

CAGR |

4.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Styrenic Block Copolymer Market Size Worth $ 9.22 Billion By 2032

The top market players in Styrenic Block Copolymer Market are Asahi Kasei Corporation, China Petroleum & Chemical Corporation

North America contribute notably towards the Styrenic Block Copolymer Market

Styrenic Block Copolymer Market exhibiting the CAGR of 4.6% during the forecast period.

Styrenic Block Copolymer Market report covering key segments are product, application, end-user, and region.