Technology Solutions in The U.S. Healthcare Payer Market Share, Size, Trends, Industry Analysis Report,

By Solution Type (Integrated, Standalone); By Payer Type; By Application; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 117

- Format: PDF

- Report ID: PM4836

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

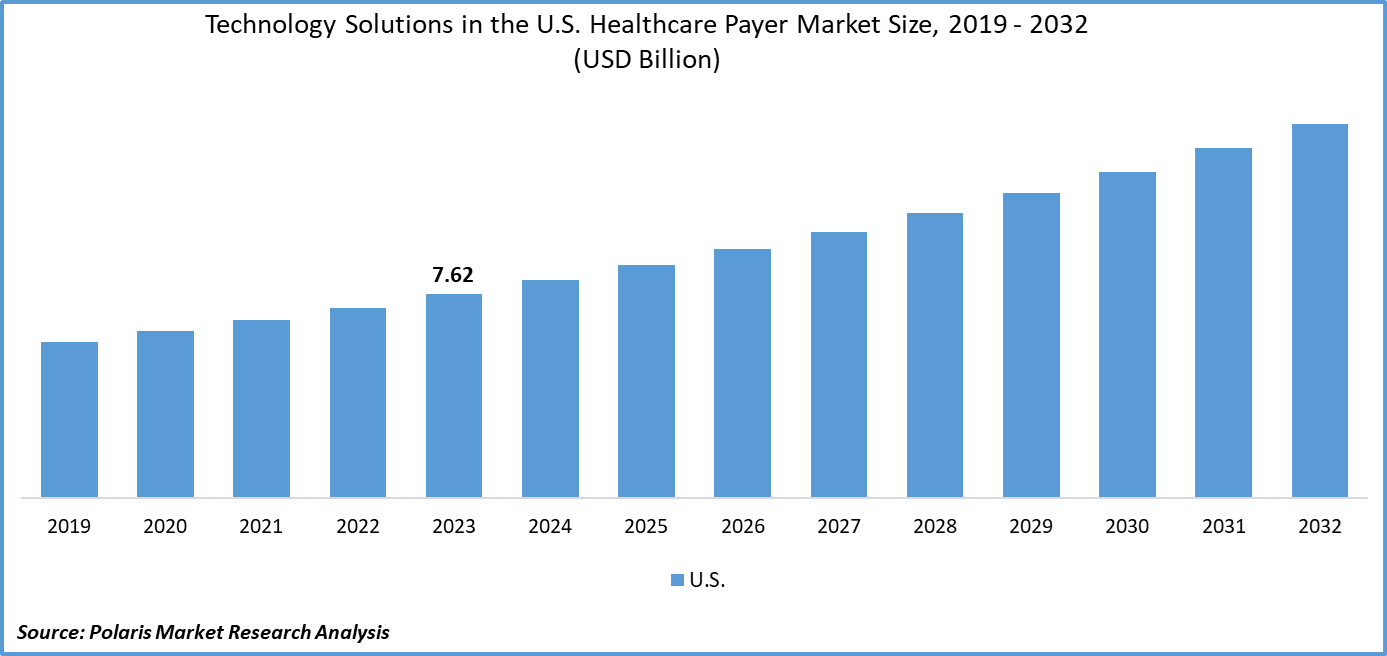

Global technology solutions in the U.S. healthcare payer market size was valued at USD 7.62 billion in 2023. The market is anticipated to grow from USD 8.15 billion in 2024 to USD 14.02 billion by 2032, exhibiting a CAGR of 7.0% during the forecast period

Industry Trends

The market is witnessing a significant surge in demand for Technology Solutions, driven by the need to streamline operations, enhance member experience, and improve overall efficiency. As the healthcare landscape continues to evolve, payers are increasingly turning to technological innovations to address challenges such as rising costs, regulatory compliance, and the growing demand for personalized care.

The prominent technology solution trend in the U.S. healthcare payer market is the adoption of data analytics and artificial intelligence (AI) solutions. Payers are leveraging advanced analytics tools to gain insights from vast amounts of data, enabling them to make informed decisions regarding risk management, fraud detection, and care management. AI-powered solutions are being utilized to automate processes, improve accuracy, and personalize member engagement, thereby driving operational efficiency and enhancing member satisfaction.

To Understand More About this Research:Request a Free Sample Report

- For instance, in July 2023, Codoxo, a provider of AI-powered solutions for healthcare payers, agencies, and PBMs, launched a new generative AI product called ClaimPilot. By leveraging advanced AI algorithms, ClaimPilot aims to significantly enhance the efficiency of healthcare cost containment and payment integrity programs.

The driving factors, including regulatory mandates, are compelling payers to invest in technology solutions to ensure compliance, data security, and interoperability. The growing focus on consumerism and member engagement is prompting payers to adopt digital health tools, mobile apps, and telehealth platforms to deliver personalized experiences and empower members to take control of their health. In addition, the COVID-19 pandemic has accelerated the adoption of telehealth and remote monitoring solutions, prompting payers to invest in virtual care technologies to meet the evolving needs of members and providers.

However, the adoption of Technology Solutions in the U.S. Healthcare Payer Market is affected by the complexity and fragmentation of the healthcare ecosystem, which poses interoperability challenges and impedes seamless data exchange between payers, providers, and patients.

Key Takeaways

- By payer type category, the commercial segment accounted for the largest technology solutions in the U.S. healthcare payer market share in 2023

- By application category, the revenue management and billing segment is expected to grow with a significant CAGR over the technology solutions in the U.S. healthcare payer market forecast period

What are the market drivers driving the demand for the market?

Compliance with regulations drives the adoption of technology solutions in the U.S. healthcare payer market.

Compliance with regulations is a significant driver of the adoption of technology solutions in the U.S. healthcare payer market. Regulations such as the Affordable Care Act (ACA) and the Health Insurance Portability and Accountability Act (HIPAA) impose strict requirements on data security, privacy, and interoperability within the healthcare ecosystem.

The ACA offers premium tax credits to eligible consumers, which helps reduce healthcare costs for households with incomes ranging from 100% to 400% of the federal poverty level (FPL), as per the U.S. Centers for Medicare & Medicaid Services. To adhere to the regulations and avoid potential penalties, healthcare payers are compelled to invest in technology solutions that ensure the secure exchange of sensitive information, facilitate interoperability between disparate systems, and enable comprehensive compliance management. By leveraging technology to meet regulatory requirements, payers not only mitigate legal and financial risks but also enhance operational efficiency, ultimately driving the widespread adoption of advanced technological innovations in the industry.

Which factor is restraining the demand for the market?

The data security and privacy concerns hinder the technology solutions in the U.S. healthcare payer market growth.

The market is facing significant obstacles due to concerns around data security and privacy. The sensitive nature of patient information, combined with the increasing sophistication of cyber threats, has put immense pressure on healthcare payers to protect data from unauthorized access, breaches, and misuse. These concerns around data breaches, identity theft, and regulatory non-compliance are deterring payers from adopting cloud-based technology solutions and data-sharing initiatives.

Similarly, the healthcare sector is intrinsically risk-averse due to the sensitive nature of patient data and the potential impact of data breaches on individuals' privacy and well-being. As a result, healthcare payers often require assistance in adopting new technologies, with a focus on prioritizing security and privacy over innovation and efficiency.

Report Segmentation

The market is primarily segmented based on solution type, payer type, and application.

|

By Solution Type |

By Payer Type |

By Application |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Payer Type Insights

Based on payer type analysis, the market is segmented on the basis of commercial and government. In 2023, the commercial segment emerged as the dominant segment in technology solutions in the U.S. healthcare payer market share. This is because commercial payers cater to a diverse range of clients, including large corporations, small businesses, and individual consumers, necessitating robust technology solutions to manage the complexities of enrollment, claims processing, and member management efficiently.

Also, commercial payers operate in a highly competitive landscape, where differentiation through technological innovation is crucial for attracting and retaining customers. These payers often leverage advanced technologies such as data analytics, artificial intelligence, and telehealth platforms to enhance member experience, improve operational efficiency, and stay ahead of the competition. Along with this, commercial payers typically have greater financial resources and flexibility to invest in cutting-edge technology compared to government counterparts, further fueling their dominance in the adoption of technology solutions in the U.S. healthcare payer market.

By Application Insights

Based on application analysis, the market has been segmented on the basis of analytics, claims management, clinical decision support, data management and support, enrollment and member management, personalize/CRM, provider management, revenue management and billing, value-based payments, and others. The revenue management and billing segment is poised for significant growth with a substantial CAGR over the technology solutions in the U.S. healthcare payer market forecast period as healthcare costs continue to rise; payers are under increasing pressure to streamline revenue management processes and optimize billing operations to maximize revenue capture and minimize revenue leakage.

Advanced technology solutions offer automation, accuracy, and efficiency in revenue management tasks such as claims processing, coding, and billing, leading to improved financial performance for payers. Also, regulatory changes and evolving reimbursement models necessitate adaptable and agile revenue management systems capable of supporting complex billing requirements and ensuring compliance with industry standards.

Competitive Landscape

The competitive landscape for technology solutions in the U.S. healthcare payer market is characterized by intense rivalry among key players striving to innovate and differentiate themselves in a rapidly evolving industry. Established technology vendors, including software providers, data analytics firms, and telehealth platforms, compete alongside emerging startups and niche players, offering specialized solutions tailored to the unique needs of healthcare payers. Key competitive factors include the breadth and depth of product offerings, technological capabilities, scalability, interoperability, regulatory compliance, and pricing strategies. Market leaders continuously invest in research and development to stay at the forefront of technological advancements while also focusing on strategic partnerships, mergers, and acquisitions to expand their market presence and enhance their competitive position.

Some of the major players operating in the market include:

- Cognizant

- HealthEdge Software, Inc.

- Hyland Software, Inc.

- Medecision

- MedHOK, Inc

- Open Text Corporation

- Oracle

- OSP

- Pegasystems Inc.

- ZeOmega

- Zyter

Recent Developments

- In February 2024, CitiusTech, a healthcare technology services and solutions provider, introduced an innovative solution that caters to the quality, reliability, and trust requirements for Generative AI (Gen AI) solutions in healthcare organizations.

- In October 2023, MHK, a healthcare technology provider and part of the Hearst Health network, revealed that Prime Therapeutics LLC/Magellan Rx (Prime/MRx) has broadened its partnership with MHK by integrating additional features into the MarketProminence SaaS technology platform. The two organizations initially joined hands in 2020 with the adoption of the MHK CareProminence platform for managing Medicare pharmacies.

- In April 2023, Cognizant, a technology services company, announced the expansion of its partnership with Microsoft in the healthcare sector. This collaboration aims to provide healthcare payers and providers with access to advanced technology solutions that will streamline claims management, improve interoperability, and optimize business operations, resulting in better patient and member experiences.

Report Coverage

The technology solutions in the U.S. healthcare payer market research report emphasize key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, solution type, payer type, application, and futuristic growth opportunities.

Technology Solutions in The U.S. Healthcare Payer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.15 billion |

|

Revenue Forecast in 2032 |

USD 14.02 billion |

|

CAGR |

7.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Solution Type, By Payer Type, By Application |

|

Country Scope |

The U.S. |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Technology Solutions in The U.S. Healthcare Payer Market report covering key segments are solution type, payer type, and application.

Technology Solutions in the U.S. Healthcare Payer Market Size Worth USD 14.02 Billion by 2032

Technology solutions in the U.S. healthcare payer market exhibiting a CAGR of 7.0% during the forecast period

key driving factors in Technology Solutions in The U.S. Healthcare Payer Market are 1. Compliance with regulations drives the adoption of technology solutions in the U.S. healthcare payer market