Telecom Millimeter Wave Market Share, Size, Trends, Industry Analysis Report,

By Product; By Frequency Band (E-band, V-band); By Licensing Type; By End- User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 114

- Format: PDF

- Report ID: PM1450

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

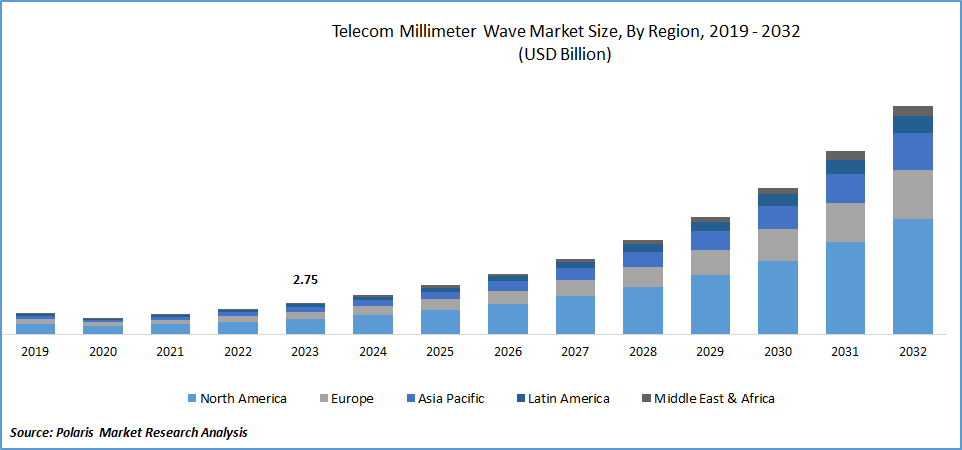

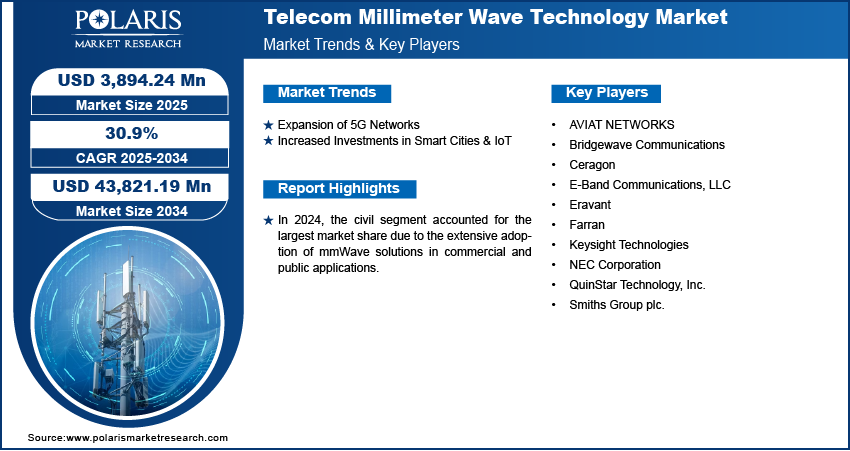

Telecom millimeter wave market size was valued at USD 2.75 billion in 2023. The market is anticipated to grow from USD 3.42 billion in 2024 to USD 19.92 billion by 2032, exhibiting the CAGR of 24.6% during the forecast period.

Telecom Millimeter Wave Market Overview

The telecom millimeter wave industry is growing due to the need for fast data transfer speeds, and the deployment of 5G technologies is driving substantial development. These are perfect for wireless backhaul and high-definition video streaming since they have a large bandwidth and minimal latency. As telecom operators engage in modernizing their network infrastructure to enable faster data speeds and handle the increasing number of connected devices, the industry is anticipated to continue growing at its current rate. Furthermore, the possibilities of MMW technology will be further enhanced by the development of cutting-edge technologies like Massive MIMO and beamforming. With encouraging development potential in the upcoming years, the telecom MMW technology industry has a generally optimistic view for the future.

To Understand More About this Research:Request a Free Sample Report

- For instance, in February 2024, Mavenir announced the deployment of an Open RAN network for Vodafone Idea to significantly reduce the cost of deployment by leveraging cloud-based technology well suited for 5G networks, providing low latency, high capacity, and unprecedented speeds.

Moreover, Telecom companies do not have a safe and dependable platform for working together. As new business models based on partnerships and the sharing economy arise, we can already envisage a plethora of applications that will be made possible by emerging technologies like block chain. By offering creative solutions, emerging technologies have the potential to enhance the regulatory environment for telecoms.

However, COVID-19 affected telecom millimeter-wave technology by impacting the production process of semiconductors and electronics. The telecommunication industry is mostly driven by data consumption by users, dynamically driven by both businesses and people. The rising demand for uninterrupted and fast internet connectivity globally is driving the telecom millimeter-wave market.

Telecom Millimeter Wave Market Dynamics

Market Drivers

-

Rising consumer demand for advanced data transmission speed

The rising demand for the telecom millimeter wave market is due to large bandwidth, which can be modified to better data transfer speed. These quick and stable speeds make the experience better for real-time gaming and high-quality video streaming online, offering a greater resolution. For instance, in February 2024, ZTE and U Mobile signed a MOU to strengthen their collaboration in 5G Advanced technology, offering a speedier experience to support instances like remote surgery and high-definition video streaming, resulting in increased client and business application efficiency.

-

Rising adoption of 5G networks and wireless technology

The newest cellular technology, 5G, promises reduced latency, higher capacity, and quicker data rates. 5G will have a profound effect on our lives. We may anticipate a fresh surge of innovation in virtual reality, augmented reality, and driverless cars with higher internet speeds and reduced latency. Low latency and higher data throughput are more benefits of the 5G network. For instance, in June 2023, Vodafone, along with Artisness- an Italian start-up is working towards creating a 3D heart model of patients using AR and VR technology for cardiologists to view and interact for providing better expertise and effective interpretation of results.

Market Restraints

-

Adoption of energy efficient use of network

The telecom millimeter wave market faces constraints due to irresponsible network usage, such as video prefetching and auto-play, unwanted video ads, and streaming techniques that use all available bandwidth. Hence, reducing traffic loads in order to make efficient use of network policies will not only help network operators and content and application providers use less energy and emit fewer greenhouse gases, but it will also enable network providers to allocate and use investment more efficiently. For instance, in December 2023, Boston Company Group’s analysis, network improvement by deploying more energy efficient technologies such as 5G, North America successfully managed to reduce carbon emissions in 2022 as compared to Asia and the Middle East, which achieved moderate reductions.

Report Segmentation

The market is primarily segmented based on product, frequency band, licensing type, end-user, and region.

|

By Product |

By Frequency Band |

By Licensing Type |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Telecom Millimeter Wave Market Segmental Analysis

By Product Analysis

- Telecommunication equipment accounted for the highest market share due to the significant adoption of smartphone devices and the huge demand for larger bandwidth. This equipment is required to build the network infrastructure. For instance, some of the in-demand telecommunication equipment are SCS components, video panels, media converters, routers, and remote-control systems.

- The radar and satellite segment is anticipated to grow at the fastest CAGR owing to its wide applications in defense agencies. However, scanning systems have seen a rise in the need for non-intrusive security measures in public areas. They are also applicable in imaging and sensing systems, especially in defense.

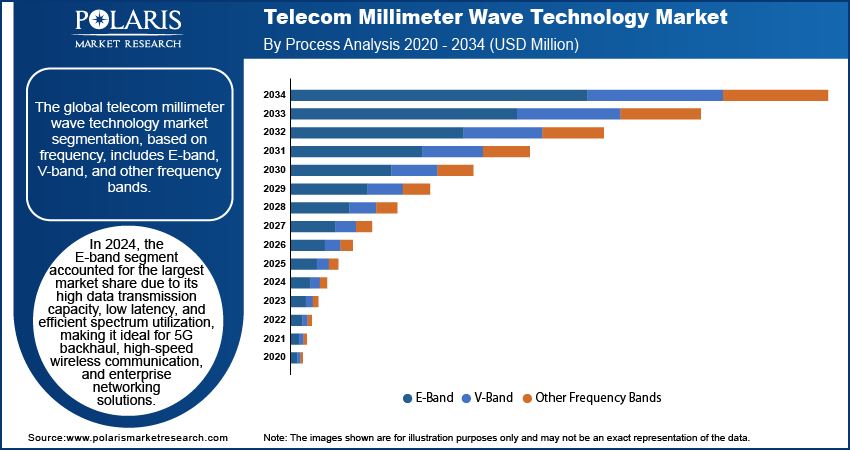

By Frequency Band Insights

- E-band frequencies dominated the market share and are expected to continue leading due to their increased use in telecommunications equipment. To enable data-intensive applications, they serve as backhaul for cellular networks, offering high-capacity, low-latency connections between base stations and core networks, providing a capacity span of 60-90 GHz frequencies.

- The V-band frequencies, which span 40 GHz to 70 GHz, are anticipated to expand due to their rising deployment in defense and military applications. Radar and satellite communications also make heavy use of the V-band frequencies. Aside from millimeter wave radar studies, the V band is not employed extensively.

By Licensing Type Insights

- The light licensing type dominated the market due to its ability to simplify and reduce spectrum management time. It provides flexible access by establishing a quicker, less expensive, and more effective licensing process. This has widely been used for low-interference frequency ranges.

- The Unlicensed type is anticipated to grow at the fastest CAGR due to the expansion of the Long-Term Evolution (LTE) wireless technology. LTE gives cellular network providers access to the unlicensed 5 GHz frequency range, enabling them to offload a portion of their data traffic. It can be allocated to or shared with anybody for non-exclusive use.

By Application Insights

- The telecommunication segment holds the largest market share due to its robust millimeter wave detection capability and reliable security features. These attributes effectively mitigate multipath effects and clutter echoes, ensuring efficient data transmission. The advanced detection capabilities and interference-free transmission position the telecommunication segment as a frontrunner in providing secure and high-quality communication services.

- The defence segment is anticipated to rise at the fastest CAGR owing to the adoption of technology-driven military solutions enabling unhindered and safe communication in the face of munitions, missile guidance systems, and hostile threats.

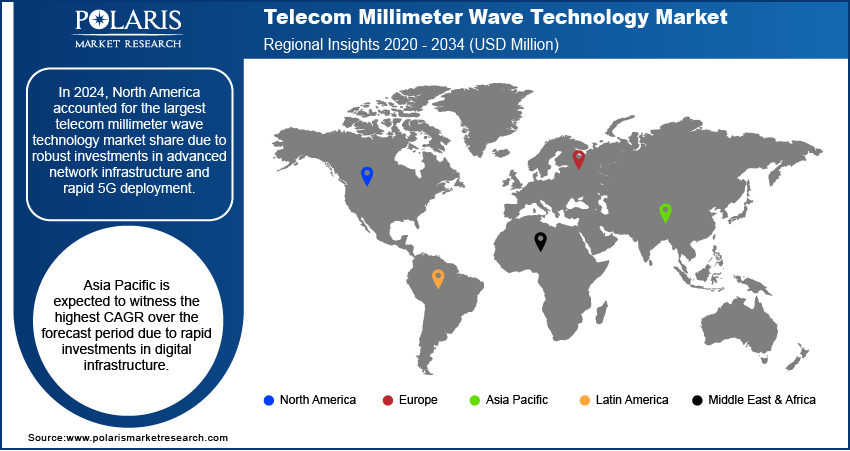

Telecom Millimeter Wave Market Regional Insights

The North America region dominated the global market with the largest market share

The North American region dominated the market with the highest market share owing to the rising urban population adopting modern technologies. Military technological advancements for civil purposes are driving the growth of this region due to its speed, ultra-wide bandwidth, and low latency of broadband communication, which greatly enhance the amount of information that can be transferred for military applications and real-time decision-making.

Asia Pacific region is expected to grow at the highest CAGR over the forecast period. This growth is attributed to the increasing usage of smartphones and telecommunication devices. The huge daily consumption of data is driving the growth of this region. The ever-increasing population of urban areas and disposable household income are increasing the demand for wave technologies.

Competitive Landscape

The telecom millimeter wave market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Aviat Network, Inc

- Bridgewave Communications, Inc

- E-band Communications LLC

- Farran Technology Ltd

- Keysight Technologies, Inc

- LightPointe Communications, Inc

- Millimeter Wave Products, Inc

- NEC Corporation

- Sage Millimeter, Inc

- Siklu Communication Ltd

- Smiths Group PLC

Recent Developments

- In March 2024, Tejas Network, a Tata Group unit, signed a MoU with Telecom Egypt to replicate its experience of implementing the rural broadband project Bharatnet and national knowledge network (NKN) projects in Egypt by developing in-house research and development.

- In February 2024, at Mobile World Congress (MWC) held in Spain, Dr. Mittal announced projects like BharatNet and 4G saturation, highlighting India's ability to resolve and close the digital gap and emphasize the use of AI to combat fake connections, ensuring safety and security.

Report Coverage

The telecom millimeter wave market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, frequency bands, licensing types, end-users, and their futuristic growth opportunities.

Telecom Millimeter Wave Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.42 billion |

|

Revenue forecast in 2032 |

USD 19.92 billion |

|

CAGR |

24.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Frequency Band, By Licensing Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Telecom Millimeter Wave Market report covering key segments are product, frequency band, licensing type, end-user, and region.

Telecom Millimeter Wave Market Size Worth $ 19.92 Billion By 2032

Telecom millimeter wave market exhibiting the CAGR of 24.6% during the forecast period.

North America is leading the global market

The key driving factors in Telecom Millimeter Wave Market are Rising consumer demand for advanced data transmission speed