Test Chocolate Market Share, Size, Trends, Industry Analysis Report,

By Product (Artificial, Traditional); By Distribution Channel; By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Dec-2023

- Pages: 118

- Format: pdf

- Report ID: PM11007

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

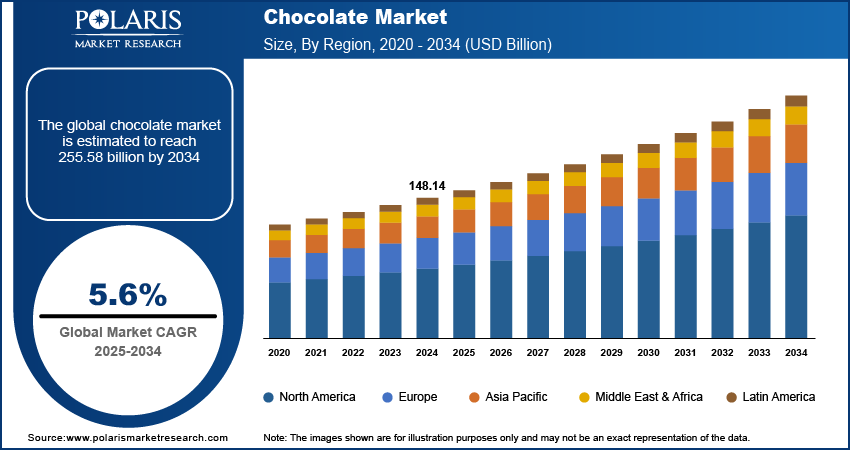

The global Chocolate market was valued at USD 140.47 billion in 2022 and is expected to grow at a CAGR of 5.6% during the forecast period.

The primary market driver is the increasing awareness among consumers of the health benefits associated with consuming high-quality chocolate. Additionally, the rising demand for vegan, organic, gluten-free, and sugar-free chocolates is expected to contribute to the product demand in the years to come.

To Understand More About this Research: Request a Free Sample Report

Furthermore, consumers opted for these treats during the pandemic to alleviate stress and enhance their mood, ensuring a consistent demand for chocolates. The increasing preference for bean and single-origin chocolates over bar chocolates is expected to encourage market participants to invest in this trend for enhanced profitability. The rising focus on the bean-to-bar concept has led to a substantial surge in demand for premium and specialty chocolate products. The ongoing trend of single-origin cocoa continues to drive new product development and innovation, foreseeably contributing to overall market growth in the future.

As indicated by health experts, moderate chocolate consumption is associated with an increase in serotonin, providing a calming effect on the brain and functioning as an antidepressant. The release of endorphins triggered by chocolate consumption contributes to a rapid improvement in mood. World Population Review data reveals that approximately 3.4%, or 251-310 million individuals globally, suffer from depression. Consequently, the growing prevalence of mental health conditions such as anxiety and depression is expected to drive product demand in the forecast period.

For Specific Research Requirements: Request for Customized Report

Furthermore, chocolate consumption is linked to a reduction in the release of the stress hormone cortisol. Regular inclusion of these elements in a daily diet can help alleviate health issues and reduce the reliance on medication. The ability of chocolate to promote relaxation and induce happiness is projected to contribute to increased chocolate sales in the coming years. The rising awareness of preventive healthcare is anticipated to further propel market growth during the forecasted timeframe.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the Chocolate Market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Industry Dynamics

Growth Drivers

- Utilization of high-quality or nutritious ingredients in chocolate items.

Responding to the increasing consumer demand for high-quality and health-conscious ingredients, market players consistently introduce premium chocolate products. Leading manufacturers are investing in new product development, releasing diverse variants such as innovative rice-based snacks, macadamia nuts, fruits, and chocolate truffles. Multinational companies like Ferrero and Mars (Dove) engage in surveys and case studies to develop exclusive product lines. Top-selling products in North America and Europe include premium fruits coated with chocolate, such as cranberry, blueberry, and pomegranate. These high-quality chocolates are easily accessible at convenience stores and specific international supermarkets.

Another category experiencing significant demand is sugar-free and dark chocolates, catering to consumers who lean towards less sweetness. Vegetable-based chocolate, offering choices like edamame-covered chocolate and wasabi-covered chocolate, has garnered popularity. Consumers in emerging economies favor salty chocolate snacks, such as potato chips and popcorn. These health-conscious trends and inventive chocolate products are anticipated to drive the global chocolate market in the forecast period.

Report Segmentation

The market is primarily segmented based on product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- The Traditional segment held the largest revenue share in 2022

This can be credited to cocoa's higher popularity, widespread availability, and penetration compared to carob, the raw material for artificial chocolate. The traditional segment, particularly the milk chocolate category, dominated the market, holding the largest share. Milk chocolate is rich in flavonoids, antioxidants known for eliminating free radicals from the bloodstream and enhancing blood flow. The global demand for milk chocolate has surged due to these benefits, coupled with an increase in consumer purchasing power.

Artificial chocolates are anticipated to exhibit a high CAGR throughout the forecast period. Carob confectionery, being caffeine-free, is well-suited for consumers intolerant to caffeine, with approximately 10% of the global population exhibiting hypersensitivity to caffeine, according to Caffeine Informer. Additionally, carob boasts a calcium composition nearly three times that of cocoa, making it particularly popular among individuals facing calcium deficiency and women.

Despite being imported, Nutella from Ferrero India maintains its dominance in the Indian chocolate spreads market, capturing approximately 85% of the market share. On a global scale, Ferrero aims to secure a leading position in the chocolate confectionery market, exemplified by the successful launch of Nutella biscuits in 2020, which achieved sales exceeding 45 million units.

By Distribution Channel Analysis

- The Online segment accounted for the highest market share during the forecast period

The online channel has witnessed increased adoption in recent years, driven by the growing internet penetration worldwide. Key factors contributing to the rise of online distribution channels include the expanding internet user base, the diverse range of available brands, and the convenience of making purchases from the comfort of one's home. Additionally, the features offered by online retailers, such as cash on delivery, discounts, and cashback options, are expected to further enhance the growth of online distribution channels.

Supermarkets and hypermarkets dominated the distribution channel segment, securing a substantial revenue share. The segment's growth is attributed to the increased availability of a wide range of brands and products in these stores. Additionally, consumers favor physical stores for immediate access to products and the ability to personally select items for an enhanced shopping experience. With rising consumer demand, manufacturers are establishing stores in malls, a trend expected to further boost chocolate sales in supermarkets and hypermarkets in the coming years.

Regional Insights

- Europe dominated the largest market in 2022

The chocolate market in the region is poised to achieve a substantial CAGR during the forecast period. Europe holds the position of being the world's largest manufacturer of chocolate, hosting confectionery production facilities for multinational giants such as Nestle S.A., Incorporated, Lindt & Sprüngli AG, Mondelez International, Inc., Mars, and Ferrero SA. These prominent confectionery companies significantly drive chocolate consumption in the European region. Additionally, the increasing consumer demand for natural ingredients in food applications for flavoring contributes to the surge in chocolate sales.

The growing popularity of specialty chocolate among Europeans is to boost demand further in the European market. Furthermore, innovations in new flavors and blends, particularly incorporating various types of nuts into chocolate, are anticipated to create substantial opportunities for manufacturers operating in the European chocolate market. The demand for organic cocoa products is witnessing significant growth among consumers, providing a lucrative market for chocolate suppliers to expand in this region. Germany plays a pivotal role as a major contributor to this market, boasting one of Europe's largest chocolate manufacturing industries. Moreover, a considerable portion of the chocolate produced in Germany is exported, solidifying its position as the world's largest exporter of chocolate.

Asia-Pacific emerges as the most attractive market for chocolate manufacturers, characterized by rapid expansions and innovations within the application industries of the region's emerging economies. China stands as a leading market in the region, holding the largest market share during the review period. Meanwhile, India is anticipated to exhibit an impressive growth rate during this period. The demand for cocoa powder is robust in countries like China, India, Japan, and the Philippines, contributing to the overall growth of the chocolate market in the region. The increased use of cocoa in snack foods and beverages further propels market growth in Asia-Pacific. Indonesia also plays a significant role in contributing to the growth of the chocolate market, with major cocoa companies such as Olam, Musim Mas, and Barry Callebaut having substantial acreage plantations in the country. Key players in the industry are undertaking various initiatives to foster market growth.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Arcor

- Barry Callebaut

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero Group

- Mars, Incorporated

- Meiji Holdings Co., Ltd.

- Mondelēz International, Inc.

- Nestlé

- The Australian Carob Co.

- The Hershey Company

Recent Developments

- In February 2022, Hershey's introduced a special edition chocolate bar named "Celebrate SHE" to honor and celebrate all women and girls. The unique feature of this limited edition is the prominent placement of 'SHE' at the center of the milk chocolate bar.

- In February 2022, Lindt Japan has launched new Sakura and Cream Lindor chocolate balls, available for purchase in Japan. These chocolates are crafted using white chocolate.

- In September 2021, Ferrero introduced a new variant of its products, 'Ferrero Rocher Tablets,' in collaboration with Lagardère for the travel-retail channel.

Chocolate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 147.62 billion |

|

Revenue forecast in 2032 |

USD 241.88 billion |

|

CAGR |

5.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

We provide our clients the option to personalize the Chocolate Market report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

Browse Our Top Selling Reports