Urban Air Mobility Market Share, Size, Trends, Industry Analysis Report,

By Solution (Platform, Infrastructure); By Operation; By Mobility Type; By Platform Architecture; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4377

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

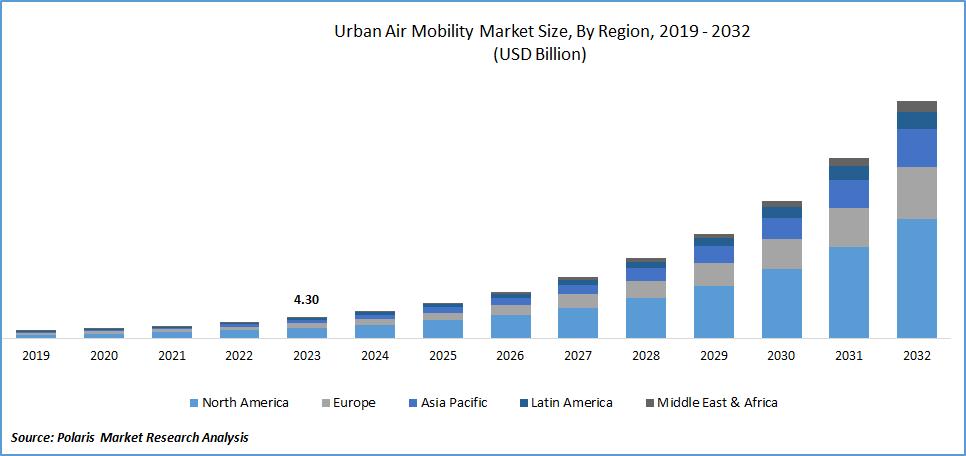

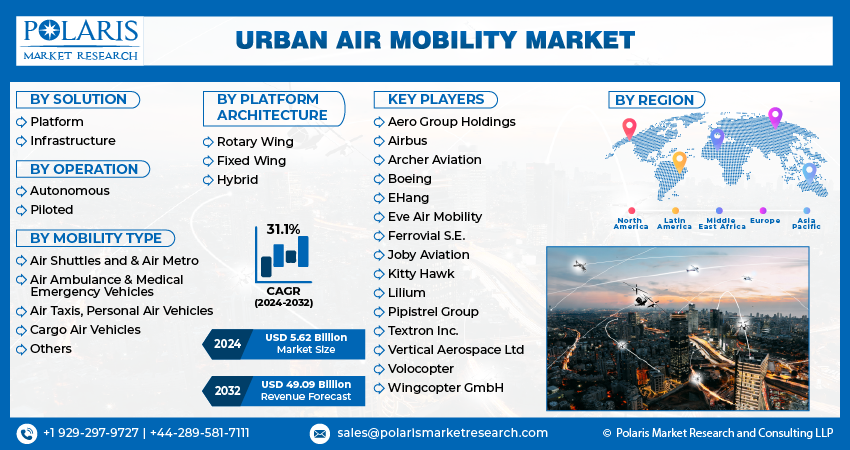

The global urban air mobility market was valued at USD 4.30 billion in 2023 and is expected to grow at a CAGR of 31.1% during the forecast period.

The Urban Air Mobility (UAM) market is driven by the increasing urbanization of cities, which is a result of increasing population density. Fast urbanization increases the difficulties associated with traffic congestion and necessitates creative solutions. UAM offers a solution for urban mobility with its electric Vertical Takeoff and Landing (eVTOL) aircraft. There is an increasing need for effective, time-saving transportation as more people move to cities in search of employment. In the midst of growing urbanization trends, UAM positions itself as a crucial component in the future of transportation, arising as a strategic reaction to the changing needs of urban residents.

Ongoing research and development initiatives fuel the growth of the urban air mobility market. Market players are introducing new solutions to cater to the growing consumer demand.

To Understand More About this Research: Request a Free Sample Report

- For instance, in January 2024, Hyundai unveiled its upcoming air taxi, the S-A2, designed to accommodate four passengers and scheduled for a 2028 debut. Featuring eight propellers, the S-A2 is set to undergo testing later this year. Hyundai asserts that despite its numerous propellers, the aircraft generates minimal noise, contributing to a quieter flight experience.

Strong regulatory frameworks and government backing play a major role in driving the urban air mobility industry. Governments throughout the world are actively supporting and fostering the growth of UAM due to recognition of its revolutionary potential. Strategic policies and laws guarantee airworthiness requirements, safe operations, and integration into the current airspace. UAM infrastructure initiatives are further encouraged via partnerships and financial incentives. Support from the government creates an atmosphere that is favorable for industry participants, drawing investments and quickening the pace of technical progress.

Industry Dynamics

Growth Drivers

Traffic Congestion Alleviation and Environmental Sustainability

The urban air mobility market is propelled by the urgent need to alleviate urban traffic congestion. With cities grappling with increased population density and limited road infrastructure, UAM emerges as a transformative solution. eVTOL aircraft promise efficient, direct point-to-point transportation, circumventing ground-level gridlock. This congestion alleviation not only saves time for commuters but also enhances overall urban mobility. As traffic congestion worsens globally, the demand for UAM grows, positioning it as a key driver in reshaping urban transportation, fostering economic productivity, and offering a sustainable solution to the challenges posed by traditional road-based commuting.

The UAM market is further propelled as a powerful force for change by environmental sustainability. UAM contributes to international efforts to tackle climate change by providing a more environmentally friendly option to traditional transportation. In addition to lessening the environmental effect of urban transport, the use of eco-friendly technologies establishes UAM as a responsible and sustainable answer to future mobility requirements.

Report Segmentation

The market is primarily segmented based on solution, operation, mobility type, platform architecture, and region.

|

By Solution |

By Operation |

By Mobility Type |

By Platform Architecture |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Solution Analysis

The infrastructure segment is expected to experience significant growth during the forecast period

The infrastructure segment is expected to experience significant growth during the market forecast period. UAM infrastructure demands specialized vertiports and heliports with designated areas for eVTOL takeoff, landing, and passenger services. Charging stations require rapid interfaces for diverse eVTOL models, while maintenance stations are pivotal for fleet airworthiness. Advanced Air Traffic Management (ATM) systems integrate real-time monitoring and collision avoidance. Robust communication networks, both terrestrial and satellite-based, facilitate seamless data exchange. Integration with public transportation demands intermodal hubs and shared ticketing. Regulatory frameworks must cover airworthiness, pilot training, and evolving operational standards. Noise management involves strategic vertiport placement and noise reduction technologies. Community acceptance requires education initiatives, and environmental considerations emphasize sustainability. Insurance frameworks should address potential accidents and liability scenarios..

By Operation Analysis

The autonomous segment is expected to experience significant growth during the forecast period

The autonomous segment is expected to experience significant market growth during the forecast period. Autonomous urban air mobility integrates cutting-edge autonomous flight systems for unmanned or semi-autonomous aerial transportation in urban settings. Minimizing human intervention emphasizes automation, reducing reliance on human pilots. Rigorous safety protocols include collision avoidance and real-time monitoring. It enhances operational efficiency through route optimization and precise navigation. Regulatory complexities, spanning airspace integration and safety standards, necessitate collaboration with aviation authorities.

By Mobility Type Analysis

The air taxis segment is expected to experience significant growth during the forecast period

The air taxis segment is expected to experience significant market growth during the forecast period. Air taxis, integral to UAM, feature Vertical Takeoff and Landing (VTOL) capabilities, ensuring flexible access to urban and suburban areas. Leveraging electric propulsion for reduced emissions, they address mobility challenges by significantly cutting travel times in congested regions. Some models explore autonomous features pending regulatory approvals. Essential infrastructure, like vertiports, is being strategically developed. The market competition involves established players such as Joby Aviation, Lilium, and EHang, with partnerships with ride-sharing giants like Uber. Regulatory complexities are actively addressed to ensure safe integration, and industry focus includes customer-centric interfaces, public trust-building, and strategic collaborations to expedite development and commercialization.

By Platform Architecture Analysis

The rotary wing segment accounted for significant market share in 2023

The rotary wing segment accounted for a significant market share in 2023. Rotary-wing UAM revolves around aircraft with Vertical Takeoff and Landing (VTOL) capabilities, notably helicopters. Its VTOL feature enhances accessibility to urban areas, utilizing existing helipads and minimizing ground infrastructure needs. Offering unprecedented route flexibility, rotary-wing UAM is adept at point-to-point transportation and navigating urban landscapes efficiently. Beyond conventional transport, its applications include emergency response and medical services, leveraging swift direct access. Noise mitigation strategies, advancements in electric propulsion, and collaboration with aviation authorities address regulatory and environmental considerations.

Regional Analysis

North America accounted for the largest market revenue share in 2023

North America accounted for the largest market revenue share in 2023. Significant investments are recorded in the sector, with aerospace companies and startups securing funding for the research and development of electric vertical takeoff and landing (eVTOL) aircraft. Regulatory bodies, notably the FAA, actively collaborate with industry stakeholders to establish guidelines for safe UAM integration into airspace. A competitive landscape has emerged with diverse market players like Uber Elevate, Joby Aviation, and Lilium. Technology advancements are focused on improving battery efficiency and autonomous capabilities. Infrastructure planning, including vertiports and air traffic management systems, plays a pivotal role in facilitating UAM deployment.

Asia-Pacific is expected to experience significant growth during the market forecast period. Asia-Pacific's UAM sector is witnessing a surge in investments, notably from China, Japan, and South Korea, fueling research in eVTOL technologies. Governments actively lead UAM initiatives, crafting comprehensive frameworks for safety, airspace integration, and operations. The diverse UAM market includes domestic and international players, fostering innovation from both established aerospace giants and nimble startups. Ongoing technological advancements focus on enhancing eVTOL efficiency and autonomy. Indigenous innovation hubs are emerging, contributing distinct perspectives. Cross-border collaborations and joint research initiatives define Asia-Pacific's UAM landscape.

Key Market Players & Competitive Insight

The market faces fierce rivalry, with companies leveraging cutting-edge technology, top-notch product offerings, and a robust brand reputation to propel market revenue expansion. Key players employ diverse tactics, including dedicated research and development, strategic mergers and acquisitions, and continuous technological advancements. These strategic maneuvers are aimed at broadening their product ranges and sustaining a competitive advantage. The market dynamic is shaped by constant innovation and a commitment to delivering high-quality solutions, underscoring the importance of strategic initiatives in ensuring sustained competitiveness.

Some of the major players operating in the global market include:

- Aero Group Holdings

- Airbus

- Archer Aviation

- Boeing

- EHang

- Eve Air Mobility

- Ferrovial S.E.

- Joby Aviation

- Kitty Hawk

- Lilium

- Pipistrel Group

- Textron Inc.

- Vertical Aerospace Ltd

- Volocopter

- Wingcopter GmbH

Recent Developments

- In September 2022, FlyBlade India and Eve Air Mobility revealed a strategic collaboration, encompassing a non-binding order for a potential 200 electric vertical takeoff and landing (eVTOL) vehicles. The partnership extends to services, support, and the utilization of Eve's Urban Air Traffic Management software solution.

- In November 2023, Eve Air Mobility marked a significant achievement in advancing Urban Air Mobility by partnering with the prominent private aviation firm Flexjet. Collaboratively, they performed an initial software simulation of Eve's state-of-the-art Urban Air Traffic Management solution. This endeavor involved validating and enhancing the software through user testing and collecting feedback on its interface and industry applicability.

- In November 2023, ANRA Technologies introduced its latest innovation, the Vertiport Management System (VMS), during the Dubai Air Show. This release signified a major achievement in overseeing the operations of vertical takeoff and landing urban air mobility aircraft at vertiport facilities.

Urban Air Mobility Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.62 billion |

|

Revenue forecast in 2032 |

USD 49.09 billion |

|

CAGR |

31.1% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Solution, By Operation, By Mobility Type, By Platform Architecture, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Urban Air Mobility Market report covering key segments are solution, operation, mobility type, platform architecture, and region.

The global urban air mobility market size is expected to reach USD 49.09 billion by 2032.

The global urban air mobility market is expected to grow at a CAGR of 31.1% during the forecast period.

North America regions is leading the global market.

Traffic Congestion Alleviation are the key driving factors in Urban Air Mobility Market.