U.S. Viral Vector and Plasmid DNA Manufacturing Market Size, Share, Trends, Industry Analysis Report

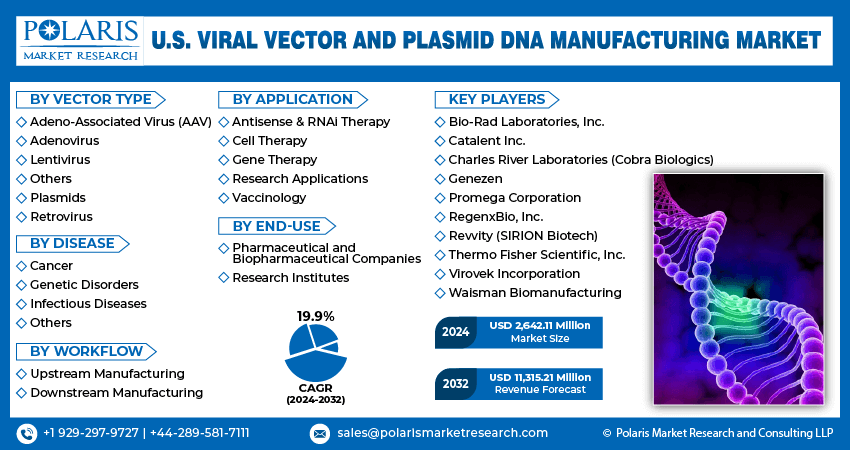

: By Vector Type, By Disease (Cancer, Genetic Disorders, Infectious Diseases, Others), By Workflow, By Application, By End-Use – Market Forecast, 2024 – 2032

- Published Date:Aug-2024

- Pages: 117

- Format: PDF

- Report ID: PM5000

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

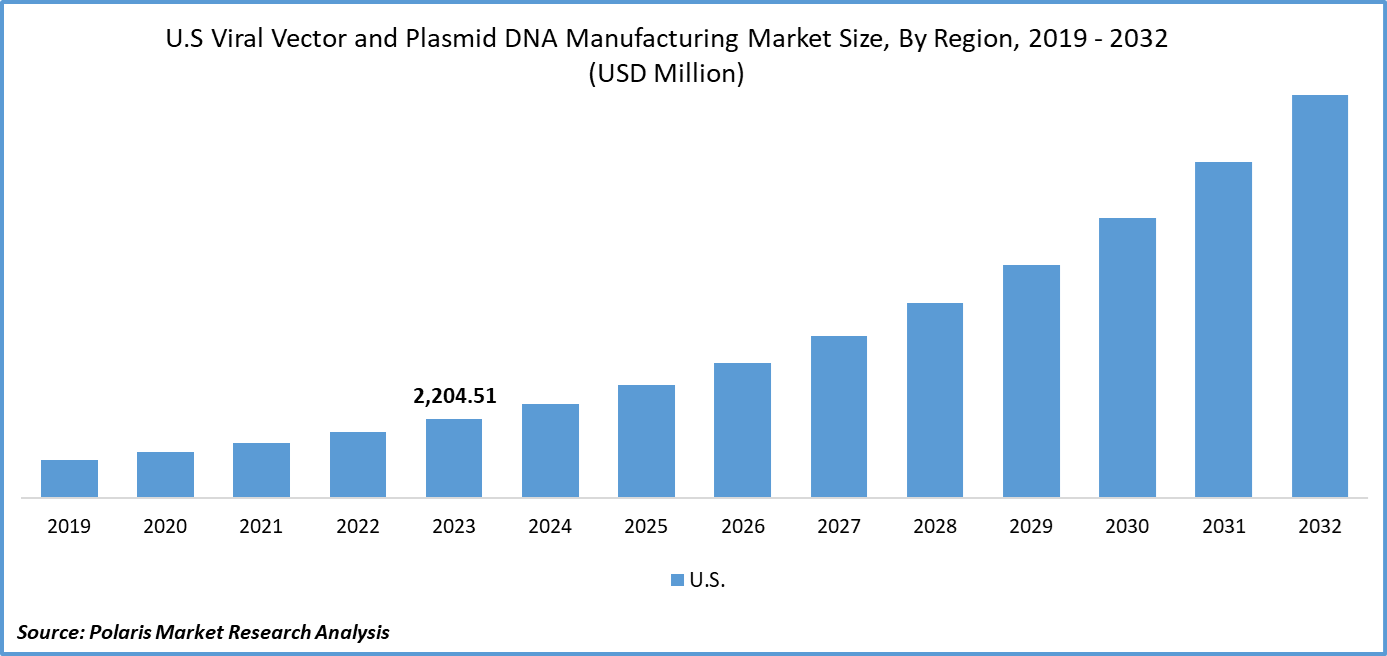

U.S. viral vector and plasmid DNA manufacturing market size was valued at USD 2,204.51 million in 2023. The U.S. viral vector and plasmid DNA manufacturing market industry is projected to grow from USD 2,642.11 million in 2024 to USD 11,315.21 million by 2032, exhibiting a compound annual growth rate (CAGR) of 19.9% during the forecast period (2024 - 2032). The viral vector and plasmid DNA manufacturing involves producing genetic materials used in gene therapies and vaccines. It includes creating viral vectors for gene delivery and plasmid DNA for therapeutic applications. The rise in genetic disorders and infectious diseases has necessitated the use of viral vectors for therapeutic purposes. The COVID-19 pandemic has accelerated the utilization of viral vectors in vaccine development, highlighting their effectiveness in fighting infectious diseases. This surge has resulted in a substantial expansion of the U.S. viral vector and plasmid DNA manufacturing market share.

Moreover, the market is witnessing growth due to increased government investments and a higher prevalence of targeted diseases such as spinal muscular atrophy. For instance, in 2020, according to the Spinal Muscular Atrophy Foundation, an estimated 10,000 to 25,000 individuals in the U.S. were affected by spinal muscular atrophy, significantly driving the demand for the U.S. viral vector and plasmid DNA manufacturing market.

To Understand More About this Research: Request a Free Sample Report

Additionally, the growing number of clinical trials and approved gene therapies has led to an increased demand for viral vectors. This demand is driving the expansion of manufacturing capacities and technological advancements in the production of viral vectors. Further, the increasing prevalence of cancer has driven the demand for advanced and effective cancer treatments, leading to a growing need for viral vectors and plasmid DNA. Consequently, there is an expected rise in the U.S. viral vectors and plasmid DNA manufacturing market share as research and development efforts prioritize the development of these essential components for cancer treatment.

U.S. Viral Vector and Plasmid DNA Manufacturing Market Trends

The Rising Demand for Gene and Cell Therapies is Driving Market Growth

The growing incidence of genetic disorders and cancer has led to a surge in demand for innovative treatments, particularly gene and cell therapies. These therapies heavily rely on viral vectors for efficient delivery of genetic material to target cells. Viral vectors play a crucial role in treating genetic disorders caused by specific gene mutations, such as cystic fibrosis, hemophilia, and muscular dystrophy, offering long-term benefits with potentially fewer side effects compared to traditional treatments. Moreover, the field of cancer treatment has seen remarkable progress with the advent of gene and cell therapies. CAR-T cell therapy has demonstrated significant success in treating specific types of cancer, including acute lymphoblastic leukemia (ALL) and non-Hodgkin lymphoma. Moreover, the landscape of partnership agreements for gene and cell therapies is constantly evolving, marked by strategic collaborations between biopharmaceutical companies, academics institutions, and technology firms. These collaborations play a critical role in advancing the development, manufacturing, and commercialization of these therapies.

For instance, in June 2024, Charles River Laboratories International, Inc. partnered with Captain T Cell for the production of plasmid DNA and retrovirus vectors. This collaboration is part of Charles River’s Cell and Gene Therapy (CGT) Accelerator Program. It aims to support Captain T Cell's initiative to manufacture a TCR-T cell therapy for solid tumor patients as part of a Phase I clinical trial. This collaboration is anticipated to significantly drive the U.S. viral vector and plasmid DNA manufacturing market.

The Growing Technological Advancements Drives Market Demand

The U.S. viral vector and plasmid DNA manufacturing market is experiencing rapid evolution by technological advancements and the introduction of new technologies. These developments are enhancing the efficiency, scalability, and quality of manufacturing processes, allowing for the production of high-quality vectors essential for gene and cell therapies. The launch of automated platforms is integrating various stages of viral vector production, such as cell culture and purification, into a unified automated system. These platforms aim to reduce manual intervention, enhance throughput, and improve reproducibility.

For instance, in May 2024, Charles River Laboratories launched Modular and Fast Track viral vector technology transfer frameworks, allowing accelerated method transfer to its Maryland-based viral vector center of excellence in nine months. This has contributed to an increase in the company's market share in U.S. viral vectors and plasmid DNA manufacturing.

U.S. Viral vector and plasmid DNA manufacturing Market Segment Insights

U.S. Viral Vector and Plasmid DNA Manufacturing Disease Insights:

The U.S. viral vector and plasmid DNA manufacturing market segmentation, based on disease, includes cancer, genetic disorders, infectious diseases, and others. In 2023, the cancer segment accounted for the largest market share. The recent approval of multiple gene therapies for cancer has significantly expedited the utilization of viral vector technologies in oncology. Regulatory authorities, such as the FDA, have sanctioned numerous gene therapies for cancer treatment, acknowledging their effectiveness and safety. These approvals bolster market expansion and also stimulate further advancements and innovation within the field of oncology.

Also, the growing incidence of cancer in the country is fueling the market demand. For instance, according to the U.S. Centers for Disease Control and Prevention, in 2021, the United States reported 1,777,566 new cases of cancer, with 439 new cases per 100,000 people. This increasing incidence is expected to experience the fastest growth of the U.S. viral vector and plasmid DNA manufacturing market share over the forecast period.

Furthermore, the progression toward personalized medicine in cancer treatment serves as another pivotal factor. Gene and cell therapies are personalized to individual patients based on their genetic makeup, providing more potent and targeted treatment alternatives. Viral vectors are instrumental in facilitating this personalized approach, thereby fueling demand in the cancer sector. Hence, this rising demand is increasing the U.S. viral vector and plasmid DNA manufacturing market share.

U.S. Viral Vector and Plasmid DNA Manufacturing End-Use Insights

The U.S. viral vector and plasmid DNA manufacturing market segmentation, based on end-use, includes pharmaceutical and biopharmaceutical companies and research institutes. The pharmaceutical and biopharmaceutical companies category is expected to be the fastest-growing market segment over the forecast period. The increasing incidence of genetic disorders and cancers has led to a rising demand for advanced treatments, particularly gene and cell therapies. Pharmaceutical and biopharmaceutical firms are heavily investing in the development of these therapies, which rely on viral vectors and plasmid DNA for genetic material delivery. The presence of a supportive regulatory environment has also contributed to the growth of this market segment. Simplified regulatory pathways reduce time-to-market, making it more appealing for pharmaceutical companies to develop and commercialize these therapies. Additionally, there is a notable surge in research and development (R&D) activities within pharmaceutical and biopharmaceutical companies, driven by the growing need for innovative treatments, biotechnological advancements, and the increasing focus on personalized medicine.

U.S. Viral Vector and Plasmid DNA Manufacturing Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the U.S. viral vector and plasmid DNA manufacturing market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the U.S. viral vector and plasmid DNA manufacturing industry must offer cost-effective items.

In recent years, the U.S. viral vector and plasmid DNA manufacturing industry has witnessed some technological advancements. Major players in the U.S. viral vector and plasmid DNA manufacturing market include Bio-Rad Laboratories, Inc., Catalent Inc., Charles River Laboratories (Cobra Biologics), Genezen, Promega Corporation, RegenxBio, Inc., Revvity (SIRION Biotech), Thermo Fisher Scientific, Inc., Virovek Incorporation, and Waisman Biomanufacturing.

Thermo Fisher Scientific Inc. offers a range of life sciences solutions, specialized diagnostics, analytical instruments, laboratory products, and biopharmaceutical services across Europe, North America, Asia-Pacific, and globally. In July 2021, Thermo Fisher Scientific Inc., the global leader in scientific services, inaugurated cGMP plasmid DNA manufacturing facility in Carlsbad, Calif. This development equips the company to effectively address the escalating need for plasmid DNA-based therapeutics and critical mRNA-based vaccines.

Charles River Laboratories International, Inc. offers comprehensive drug discovery, non-clinical development, and safety testing services worldwide. The company operates through three main segments: discovery and safety assessment (DSA), research models and services (RMS), and manufacturing solutions. In June 2024, Charles River Laboratories partnered with the Gates Institute at the University of Colorado Anschutz Medical Campus for the strategic manufacturing of Lentiviral Vectors.

Key companies in the U.S. viral vector and plasmid DNA manufacturing market include

- Bio-Rad Laboratories, Inc.

- Catalent Inc.

- Charles River Laboratories (Cobra Biologics)

- Genezen

- Promega Corporation

- RegenxBio, Inc.

- Revvity (SIRION Biotech)

- Thermo Fisher Scientific, Inc.

- Virovek Incorporation

- Waisman Biomanufacturing

U.S. Viral Vector and Plasmid DNA Manufacturing Industry Developments

In January 2024, Charles River Laboratories International, Inc. launched its off-the-shelf Rep/Cap plasmid offering, which aims to simplify AAV-based gene therapy programs.

In August 2022, Thermo Fisher Scientific Inc. expanded its viral vector manufacturing facility in Plainville, Massachusetts. This expansion aims to bolster the capabilities for testing, development, and large-scale manufacturing of viral vectors, essentially facilitating the commercialization and advancement of gene therapy applications.

In May 2021, Bio-Rad Laboratories, Inc., a company in life science research and clinical diagnostics, launched two new products designed for the Droplet Digital PCR (ddPCR) platforms. The Vericheck ddPCR Mycoplasma Detection Kit and ddPCR Assays for AAV Viral Titerare are specifically developed to facilitate the advancement and production of safe and efficient cell and gene therapies.

U.S. Viral Vector and Plasmid DNA Manufacturing Market Segmentation

U.S. Viral Vector and Plasmid DNA Manufacturing Vector Type Outlook

- Adeno-Associated Virus (AAV)

- Adenovirus

- Lentivirus

- Others

- Plasmids

- Retrovirus

U.S. Viral Vector and Plasmid DNA Manufacturing Disease Outlook

- Cancer

- Genetic Disorders

- Infectious Diseases

- Others

U.S. Viral Vector and Plasmid DNA Manufacturing Workflow Outlook

- Upstream Manufacturing

- Vector Amplification & Expansion

- Vector Recovery/Harvesting

- Downstream Manufacturing

- Fill Finish

- Purification

U.S. Viral Vector and Plasmid DNA Manufacturing Application Outlook

- Antisense & RNAi Therapy

- Cell Therapy

- Gene Therapy

- Research Applications

- Vaccinology

U.S. Viral Vector and Plasmid DNA Manufacturing End-Use Outlook

- Pharmaceutical and Biopharmaceutical Companies

- Research Institutes

U.S. Viral Vector and Plasmid DNA Manufacturing Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 2,204.51 million |

|

Market Size Value in 2024 |

USD 2,642.11 million |

|

Revenue Forecast in 2032 |

USD 11,315.21 million |

|

CAGR |

19.9% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The U.S. viral vector and plasmid DNA manufacturing market size was valued at USD 2,204.51 million in 2023.• The U.S. viral vector and plasmid DNA manufacturing market size was valued at USD 2,204.51 million in 2023.

The market is projected to grow at a CAGR of 19.9% during the forecast period, 2024-2032.

The key players in the market are Bio-Rad Laboratories, Inc., Catalent Inc., Charles River Laboratories (Cobra Biologics), Genezen, Promega Corporation, RegenxBio, Inc., Revvity (SIRION Biotech), Thermo Fisher Scientific, Inc., Virovek Incorporation, and Waisman Biomanufacturing.

The cancer category dominated the market in 2023

The pharmaceutical and biopharmaceutical companies had the fastest growth in the market.