Global Voluntary Carbon Credit Market Size, Share, Trends, Industry Analysis Report

: Information By Project Type (Removal/Sequestration projects, Avoidance/Reduction projects), By End User, and By Region (North America, Europe, Asia-Pacific, and Rest Of The World) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 119

- Format: PDF

- Report ID: PM4990

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

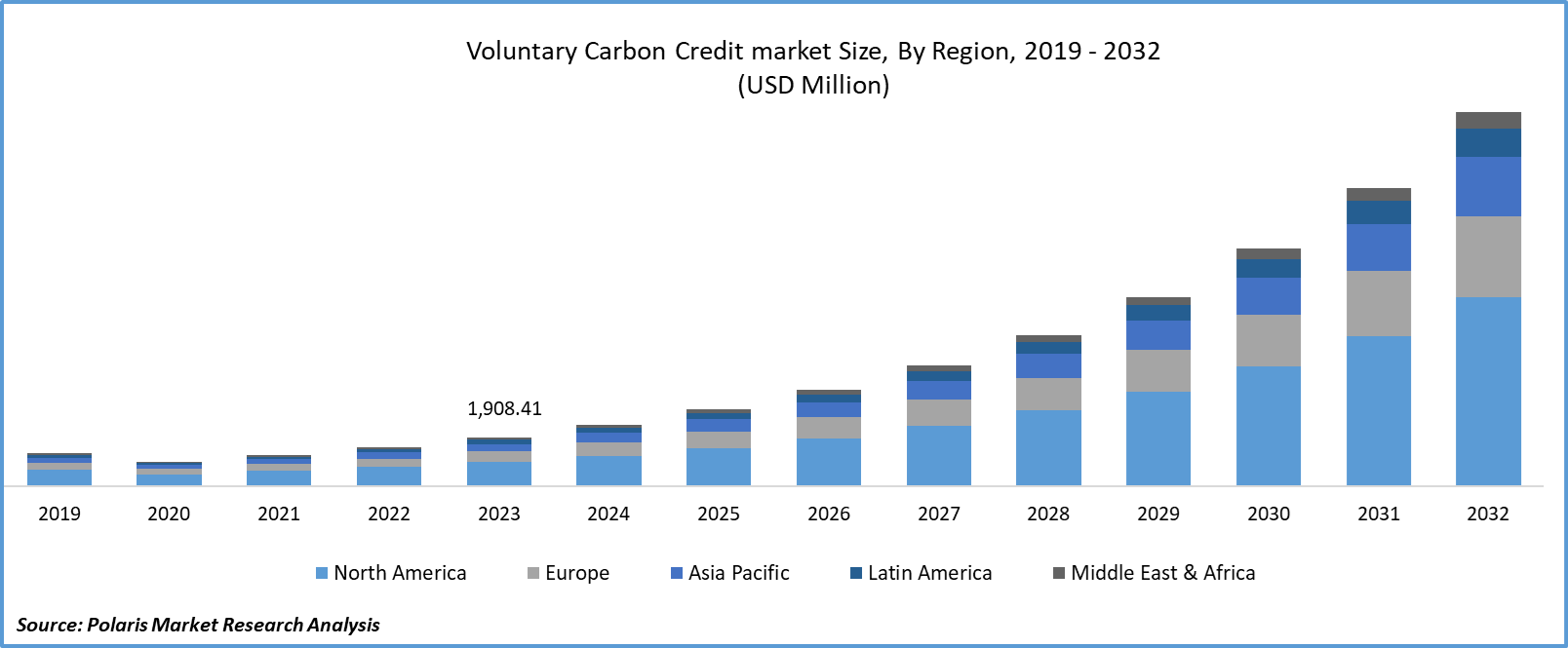

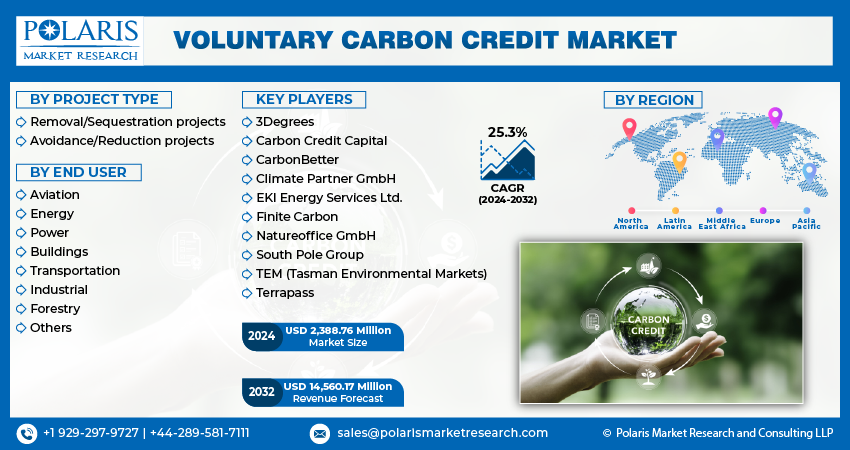

Global voluntary carbon credit market size was valued at USD 1,908.41 million in 2023. The voluntary carbon credit industry is projected to grow from USD 2,388.76 million in 2024 to USD 14,560.17 million by 2032, exhibiting a compound annual growth rate (CAGR) of 25.3% during the forecast period (2024 - 2032).

The voluntary carbon credit market is experiencing robust growth driven by several companies setting ambitious targets to achieve net-zero emissions. Purchasing carbon credits is a practical way to offset unavoidable emissions, thus boosting voluntary carbon credit market growth. Additionally, due to growing consumer preference for environmentally responsible products and brands, companies are responding by investing in carbon credits to enhance their green credentials.

Voluntary carbon credit allows businesses, organizations, and individuals to offset their carbon emissions by purchasing carbon credits from projects that reduce or remove greenhouse gases from the atmosphere. Unlike mandatory carbon markets, which governments regulate, the voluntary market operates on a discretionary basis, driven by the need to take proactive climate action and demonstrate environmental responsibility.

To Understand More About this Research: Request a Free Sample Report

The growing interest in a diverse range of projects beyond traditional reforestation and renewable energy, including carbon capture and storage (CCS), soil carbon sequestration, and blue carbon projects (coastal and marine ecosystems), is driving the market growthAlso, advancements in monitoring, reporting, and verification technologies enhance the accuracy and transparency of carbon credits, boosting voluntary carbon credit market.

Voluntary Carbon Credit Market Trends

Rising Technological Advancements are Driving the Market Growth

Market CAGR for voluntary carbon credits is being driven by technological advancements that enhance the accuracy and transparency of carbon credit projects, making it easier to verify and trust the carbon reductions claimed. The development of online marketplaces and exchanges facilitates the buying, selling, and trading of carbon credits, increasing market accessibility.

Interest is growing in offset credits from engineered reduction technologies such as carbon capture and storage (CCS), direct air capture (DAC), and BECCS (bioenergy with carbon capture and storage). These technologies are currently less common due to their complexity and higher cost, but they are increasingly seen as crucial by large companies aiming to meet ambitious climate goals. Carbon financing is evolving, and as these technologies expand, their role in the voluntary carbon market is expected to grow significantly.

Rising Demand for Carbon Offset Projects and Related Credits

The rising demand for carbon offset projects and related credits is a significant growth driver for the voluntary carbon credit market. This demand is driven by various factors, including corporate sustainability goals, consumer preferences, regulatory pressures, and the broader push to address climate change. Many companies are committing to ambitious sustainability targets, including achieving net-zero emissions by specific dates. Offsetting unavoidable emissions through the purchase of carbon credits is a crucial strategy for meeting these targets.

Corporations are increasingly aware that demonstrating environmental responsibility enhances their brand value and reputation. Investing in carbon offset projects allows them to showcase their commitment to sustainability, which attracts customers, investors, and partners. Some companies voluntarily exceed existing regulations to establish themselves as industry leaders in climate action. This proactive approach includes investing in high-quality carbon offset projects. Also, introducing new policy guidelines are aimed at fostering a robust and significant market growth.

For instance, in 2024, the US government released new policy guidelines for the voluntary carbon credit market. The new guidelines aim to enhance and advance the market by establishing standards that ensure the high integrity of voluntary carbon markets (VCMs). They were introduced in response to the surging demand for carbon offset projects and related credits, driven primarily by enterprises seeking net-zero goals and utilizing offsets to complete their emissions reduction endeavors or to balance unavoidable emissions.

Furthermore, the development of new and diverse carbon offset projects, such as blue carbon (coastal and marine ecosystems) and soil carbon sequestration, expands the range of options available for buyers. This variety attracts more participants to the market and drives the voluntary carbon credit market revenue.

Voluntary Carbon Credit Market Segment Insights

Voluntary Carbon Credit Project Type Insights:

The global voluntary carbon credit market segmentation, based on project type, includes removal/sequestration projects and avoidance/reduction projects. The avoidance/reduction projects segment is expected to witness the fastest market during the forecast period due to well-established methodologies and verification processes, making them more accessible and easier to implement. These projects have a longer track record and are widely recognized for their effectiveness in reducing emissions.

Many avoidance/reduction projects, such as renewable energy installations and energy efficiency improvements, often have lower upfront costs compared to advanced removal technologies. This cost efficiency enhances their attractiveness in the voluntary carbon credit market, driving adoption and contributing to sustainable development goals globally.

Voluntary Carbon Credit End User Insights:

The global voluntary carbon credit market segmentation, based on end user, includes aviation, energy, power, buildings, transportation, industrial, forestry, and others. The largest market share in 2023 was held by the power category, emphasizing the critical role of renewable energy in reducing greenhouse gas emissions. Projects such as wind, solar, and hydropower effectively replace fossil fuels, leading to significant carbon credits. Companies with ambitious sustainability goals, like transitioning to 100% renewable energy, find it essential to purchase these credits to meet their environmental targets and support global emission reduction initiatives.

Further, many corporations have set ambitious sustainability targets, including commitments to 100% renewable energy. Purchasing carbon credits from renewable energy projects helps companies meet these goals. For example, the RE100 initiative, where influential companies commit to use 100% renewable energy, has driven significant demand for renewable energy credits.

Voluntary Carbon Credit Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In 2023, North America accounted for the largest share in the voluntary carbon credit market due to well-developed financial markets and trading platforms facilitating the buying and selling of carbon credits. High levels of investment in renewable energy, carbon capture, and other emissions reduction technologies boost the supply and diversity of carbon credits available and strengthen the voluntary carbon credit industry landscape in North America.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

The U.S. voluntary carbon credit market has the largest market share due to high levels of investment in renewable energy, carbon capture, and other emissions reduction technologies, which boosts the supply and diversity of carbon credits available. The regulatory policies and incentives supporting carbon offset projects and emissions reductions contribute to a more active market.

In May 2024, the U.S. Department of the Treasury, a key player in the U.S. voluntary carbon credit market, issued a joint policy statement and principles on VCMs. These involve the buying and selling of credits representing one tonne of carbon reduced or removed from the atmosphere, conducted voluntarily by companies, NGOs, governments, and other entities. Beyond their role in advancing decarbonization efforts, VCMs offer potential economic opportunities both domestically and internationally. These include opportunities for farmers, ranchers, small suppliers, and through initiatives in developing nations. According to the report, voluntary carbon markets can create new revenue streams for farmers, ranchers, private forest owners, and rural communities while also stimulating investments in nature-based climate solutions within the agriculture and forestry sectors.

The Canada voluntary carbon credit market held a significant share in 2023. This is largely due to the efforts of organizations like the International Federation of Accountants (IFAC), CPA Canada, and the Institute for Sustainable Finance. These entities provide resources and guidelines that help market participants understand and engage in VCMs, increasing confidence and participation in the market.

For instance, in June 2024, the International Federation of Accountants (IFAC), CPA Canada, and the Institute for Sustainable Finance published a resource for professional accountants and market players, including capital providers, businesses, and the broader public, on the state of voluntary carbon markets (VCMs) and their future development. This report analyzes existing VCMs, corresponding standards, and the finest techniques to improve confidence in carbon markets and encourage investment in credible GHG reduction projects. It follows IOSCO's consultation report to promote the integrity and orderly functioning of VCMs, which now forms part of IOSCO's updated 2024 work plan. Such a dynamic market is poised to continue expanding as more stakeholders recognize the benefits and opportunities associated with carbon offsetting and drive the voluntary carbon credit market demand.

The Asia-Pacific voluntary carbon credit market is expected to grow at the fastest CAGR during the forecast period. Growing awareness and commitment to CSR initiatives are pushing businesses to invest in carbon offset projects. Moreover, China’s voluntary carbon credit market held the largest market share in 2023. The rapid industrialization and urbanization in China have led to increased emissions, requiring carbon offset strategies. Major infrastructure projects often seek carbon credits to mitigate their environmental impact. The Indian voluntary carbon credit market is expected to continue its steady growth during the forecast period due to advancements in carbon capture and storage (CCS) technologies, as well as renewable energy projects, which are increasing the availability and viability of carbon credits.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, and Others.

Voluntary Carbon Credit Key Market Players & Competitive Insights

Leading market players include project developers, brokers, standards organizations, and buyers from various sectors. The voluntary carbon credit market is highly fragmented, with numerous small and large players involved in different aspects of the market. This fragmentation leads to a competitive landscape where innovation, development, credibility, and partnerships play critical roles. To expand and survive in a more competitive and rising market environment, the voluntary carbon credit industry must offer advancements in technology, such as blockchain for carbon trading transparency and improved carbon capture techniques.

Collaborations between corporates, NGOs, and governments are essential for scaling up carbon offset projects. Partnerships help pool resources, share expertise, and increase the global voluntary carbon credit industry reach. Major players in the voluntary carbon credit market include South Pole Group, 3Degrees, Finite Carbon, EKI Energy Services Ltd., CarbonBetter, Terrapass, Carbon Credit Capital, Natureoffice GmbH, Climate Partner GmbH, TEM (Tasman Environmental), etc.

Finite Carbon Corporation is a developer and supplier of forest carbon offsets that was founded in 2009. Since its establishment, the firm has developed high-integrity projects in voluntary and compliance markets, covering 4 million acres of forests across the mainland. In 2013, Finite Carbon registered and developed California’s first compliance offset project. Since then, the company has been responsible for developing and transacting over 100 million offsets, accounting for one-third of California’s compliance offset supply. Currently, Finite Carbon is developing a portfolio of voluntary improved forest management projects in North America. In May 2024, Finite Carbon launched a marketplace for carbon credit buyers in the voluntary carbon market.

Tasman Environmental (TEM) is a significant provider of carbon offsetting solutions in the Asia-Pacific region, operating in both voluntary and compliance markets. TEM is the provider of voluntary Australian carbon credits and offers comprehensive carbon offsetting solutions to support business goals. These solutions, which include corporate offset portfolios, digital sales and calculations, carbon project development and investment options, and a trading desk, have had a significant impact. Since 2014, TEM has financed over 300 carbon projects in 30 countries, reducing more than 11 million tonnes of carbon emissions and providing community and biodiversity benefits. In June 2021, TEM launched a voluntary carbon offset program for the Singapore Airlines Group.

Key companies in the voluntary carbon credit market include:

- 3Degrees

- Carbon Credit Capital

- CarbonBetter

- Climate Partner GmbH

- EKI Energy Services Ltd.

- Finite Carbon

- Natureoffice GmbH

- South Pole Group

- TEM (Tasman Environmental Markets)

- Terrapass

Voluntary Carbon Credit Industry Developments

December 2023: ClimatePartner and seven EU countries (Germany, Netherlands, France, Finland, Spain, Belgium, and Austria) published joint endorsements to enhance the voluntary carbon market's integrity. These recommendations ensure full transparency, high-quality carbon credits, and credible claims.

June 2023: 3Degrees announced that Verra, the global carbon standards body, has approved a groundbreaking methane release project at Skyridge Farms. The project not only captures methane but also introduces an innovative system that delivers numerous benefits to the farm. The newly approved carbon credit project is set to enhance the financial health of the company.

August 2021: South Pole partnered with Landcare NSW to develop and deliver nature-based climate transition alleviation and biodiversity projects in New South Wales. This innovative partnership aims to create lasting change through the development of carbon credit projects that provide real, tangible benefits.

Voluntary Carbon Credit Market Segmentation:

Voluntary Carbon Credit Project Type Outlook

- Removal/Sequestration projects

- Avoidance/Reduction projects

Voluntary Carbon Credit End User Outlook

- Aviation

- Energy

- Power

- Buildings

- Transportation

- Industrial

- Forestry

- Others

Voluntary Carbon Credit Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Voluntary Carbon Credit Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,908.41 million |

|

Market Size Value in 2024 |

USD 2,388.76 million |

|

Revenue Forecast in 2032 |

USD 14,560.17 million |

|

CAGR |

25.3% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global voluntary carbon credit market size was valued at USD 1,908.41 million in 2023 and is projected to grow to USD 14,560.17 million by 2032

The global market is projected to grow at a CAGR of 25.3% during the forecast period, 2024-2032

North America held the largest share of the global market.

The key players in the market are South Pole Group, 3Degrees, Finite Carbon, EKI Energy Services Ltd., CarbonBetter, Terrapass, Carbon Credit Capital, Natureoffice GmbH, Climate Partner GmbH, and TEM (Tasman Environmental).

The avoidance/reduction projects type is expected to witness the fastest CAGR during the forecast period

The power segment held the largest share in the global market