Yoghurt Drink Market Share, Size, Trends, Industry Analysis Report,

By Packaging (Tetra Packs, Bottles); By Product; By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM2501

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

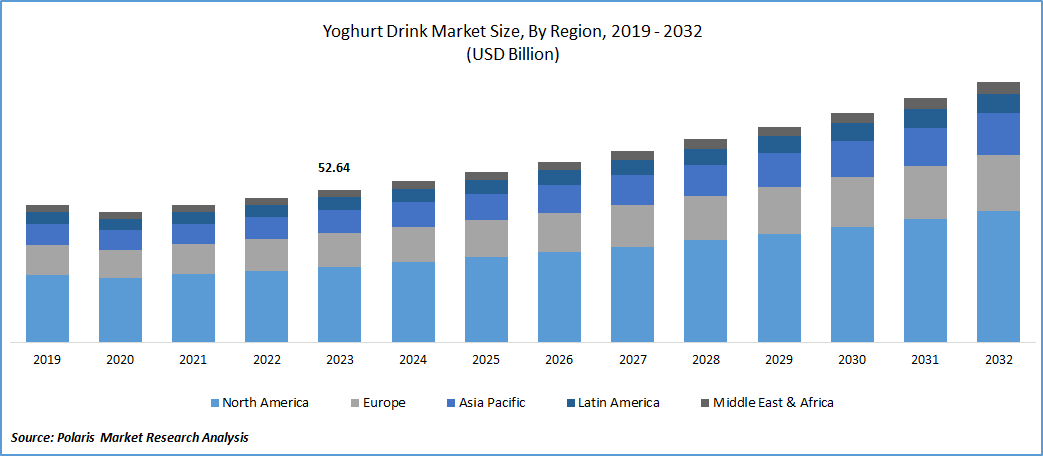

Yoghurt Drink Market size was valued at USD 52.64 billion in 2023. The market is anticipated to grow from USD 55.62 billion in 2024 to USD 89.76 billion by 2032, exhibiting a CAGR of 6.2% during the forecast period

Yoghurt Drink Market Overview

The market's expansion is driven by increasing consumer awareness of lifestyle disorders and the subsequent preference for healthy, probiotics-rich food products. The product, abundant in nutrients, contributes to improved health and a decreased risk of diseases like obesity. An article published in the Multidisciplinary Digital Publishing Institute (MDPI) in February 2022 noted that 70% of consumers favor drinkable yogurt due to its nutritious properties.

The onset of the pandemic triggered a surge in grocery stockpiling, especially in categories like dairy products and snacks, resulting in initial supply shortages in the market. Additionally, the stay-at-home orders imposed during the pandemic accelerated the renewed importance of yogurt, as consumers sought familiar, cost-effective, and nutritious products. According to a Dairyreporter.com article in February 2021, yogurt sales experienced a 4.1% increase during the lockdown phase. The heightened focus on adopting healthy eating habits in response to the virus spread initiated an upward trajectory for these products. Companies in North America and the Asia Pacific have actively promoted yogurt as an essential beverage for fostering good health, contributing to the expected expansion of the market.

To Understand More About this Research:Request a Free Sample Report

Furthermore, businesses are engaging in partnerships with dairy farms to ensure a streamlined supply of raw materials for manufacturing yogurt drinks.

- For instance, in January 2021, Oikos Pro, a subsidiary of Danone North America, introduced high-protein, functional yogurt cups and beverages, catering to a new consumption occasion and the growing trend of high-protein products. This initiative aimed to diversify the company's product line into health drinks, anticipated to positively impact the industry in the forecast period.

The increasing demand for probiotic foods and healthier snack options among health-conscious consumers, encompassing both adults and children, will further propel market growth. Numerous prominent brands are introducing products in this category as consumers increasingly adopt a healthier lifestyle.

Yoghurt Drink Market Dynamics

- Market Drivers

- Increasing health consciousness and the introduction of new flavors bolstering the growth of the Yoghurt Drink market.

Yogurt is a nutritionally dense food product, and individuals regularly incorporate yogurt and yogurt-based drinks into their diets for their health benefits. The increasing health awareness among people, driven by a desire for better well-being, is contributing to the growing demand for yogurt-based drinks in the market. Essential nutrients such as vitamins and zinc present in yogurt aid individuals in maintaining good health, resulting in high demand for yogurt drinks. This stands as a significant factor fueling the growth of the global yogurt drink market.

Furthermore, numerous prominent companies in the market offer yogurt-based drinks in a variety of flavors and textures, attracting a diverse consumer base. The preference for flavored yogurt drinks is widespread globally, surpassing the appeal of plain yogurt drinks. Consequently, major companies are actively focusing on developing new flavors to attract a broader customer base. These key factors collectively drive the growth of the global yogurt drink market.

Market Restraints

- The presence of alternative options likely to hamper the growth of the market.

The global yogurt drink market faces a significant challenge due to the availability of substitutes in the form of alternative probiotic beverages, smoothies, and plant-based milk options. With an expanding array of choices in the functional and healthy beverage segment, consumers are presented with various alternatives that may divert demand away from traditional yogurt drinks. The presence of these substitutes creates competition within the market, and yogurt drink manufacturers need to differentiate their products to maintain consumer interest and loyalty.

Moreover, the increasing popularity of homemade yogurt and smoothies represents another hurdle for established yogurt drink manufacturers. As more consumers opt for preparing these beverages at home, it not only provides them with customization options but also challenges the convenience offered by commercially available yogurt drinks. This growing trend in homemade alternatives may impact the market share of established brands and necessitate innovative strategies to retain market relevance. Overall, the market players need to adapt to changing consumer preferences and lifestyles to overcome these challenges and foster sustained growth in the yogurt drink industry.

Report Segmentation

The market is primarily segmented based on packaging, product, distribution channel, and region.

|

By Packaging |

By Product |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Yoghurt Drink Market Segmental Analysis

By Packaging Analysis

- The Tetra Packs segment held the largest revenue share in 2023. Amid substantial shifts in consumer lifestyles, a large portion of the global consumer base is choosing on-the-go products that provide convenience in both consumption and waste disposal. This trend is anticipated to play a role in the growth of this segment throughout the forecast period. For instance, in October 2019, Tetra Pak introduced a range of packaging for various yogurt products, encompassing stirred, set, drinking, concentrated, and ambient varieties. Furthermore, tetra packs are perceived as more environmentally friendly compared to plastic bottles, enhancing product visibility among consumers.

- Nevertheless, bottles are expected to exhibit the fastest CAGR in the forecast period. The shift in lifestyle choices has led a considerable number of individuals worldwide to choose on-the-go products, thereby contributing to the growth of this segment. Additionally, the provision of various sizes and shapes tailored to meet consumer preferences will further bolster the segment's growth. For example, Epigamia provides its yogurt smoothie in bottles of 180ml and 200ml.

By Product Analysis

- The Conventional segment accounted for the highest market share during the forecast period. The segment is poised to sustain its leading position in the forecast period, with the increasing prevalence of obesity emerging as a significant factor driving its growth. Conventional drinks within this segment are recognized for being enriched with calcium and phosphorus, contributing to enhanced bone health. For instance, in March 2020, Megmilk Snow, a dairy company based in Japan, launched a yogurt drink specifically formulated to alleviate allergy symptoms, with the proteins and vitamins in these beverages contributing to the detoxification of the body.

- Contrastingly, the vegan segment is anticipated to demonstrate the most rapid CAGR in the forecast period. The potential of vegan products to lower cholesterol levels, consequently diminishing the likelihood of digestion-related issues, is expected to propel the growth of this segment. As reported in a January 2020 article in Health Careers, 39% of consumers in the United States are incorporating more vegan food and drink options into their diets. Moreover, the availability of a diverse range of products in various flavors will further enhance the growth of this segment in the upcoming years.

Yoghurt Drink Market Regional Insights

-

The Asia Pacific region dominated the global market with the largest market share in 2023

The surge in demand for this product was attributed to increased consumer awareness about adopting a healthy dietary pattern. Moreover, consumers' willingness to invest in healthy snacks and beverages has empowered manufacturers to introduce innovations and a diverse range of beverages in the region. Ongoing innovations by leading manufacturers within this product segment are poised to contribute to its continued growth. A notable example is the launch of YO-MIX ViV by IFF in June 2021, presenting a solution for ambient yogurt and other fermented drinks with a specific focus on the Chinese market.

The introduction of complementary products is anticipated to contribute to increased sales. Central & South America is poised to emerge as the region with the highest growth rate. A surge in the consumption of dairy products, particularly in developed nations like Argentina and Brazil, is expected to be a key driver of regional demand. Additionally, yogurt is regarded as an ideal snack for children in the CSA region, prompting companies to concentrate on launching new products. For instance, in February 2019, Brainiac introduced a line of children's yogurt products, demonstrating the company's commitment to expanding its product portfolio and reaching a broader audience.

Competitive Landscape

The Yoghurt Drink market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Arla Foods Amba

- Benecol Ltd.

- Chobani, LLC

- Danone

- Fonterra Co-operative Group Ltd.

- General Mills Inc.

- Lactalis Group

- Meiji Holdings Co., Ltd.

- Nestlé

- Yakult Honsha Co., Ltd.

Recent Developments

- In February 2022, Starbucks introduced a plant-based vegan yogurt drink in Korea, branded as 'Pine Coco Green'.

- In February 2022, Chobani LLC has initiated the use of paper packaging for their yogurt and other dairy products, with the paper cups consisting of 80% paperboard and renewable materials.

Report Coverage

The Yoghurt Drink market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive packaging, product, distribution channel and futuristic growth opportunities.

Yoghurt Drink Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 55.62 billion |

|

Revenue Forecast in 2032 |

USD 89.76 billion |

|

CAGR |

6.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Packaging, By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

Yoghurt Drink Market Size Worth $ 89.76 Billion By 2032.

The top market players in Yogurt Drink Market include Abbott Laboratories, B. Braun Melsungen AG, Biosensors International Group (acquired by Blue Sail Medical Co., Ltd).

The Asia Pacific is region contribute notably towards the Yogurt Drink Market.

Yoghurt Drink Market exhibiting a CAGR of 6.2% during the forecast period.

Yogurt Drink Market report covering key segments are packaging, product, distribution channel, and region