Natural Personal Care Ingredients Market Share, Size, Trends, Industry Analysis Report,

By Ingredient Type (Biosurfactants, Emollients, Natural Preservatives, Sugar Polymers, And Others); By Application; By Region.; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4774

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

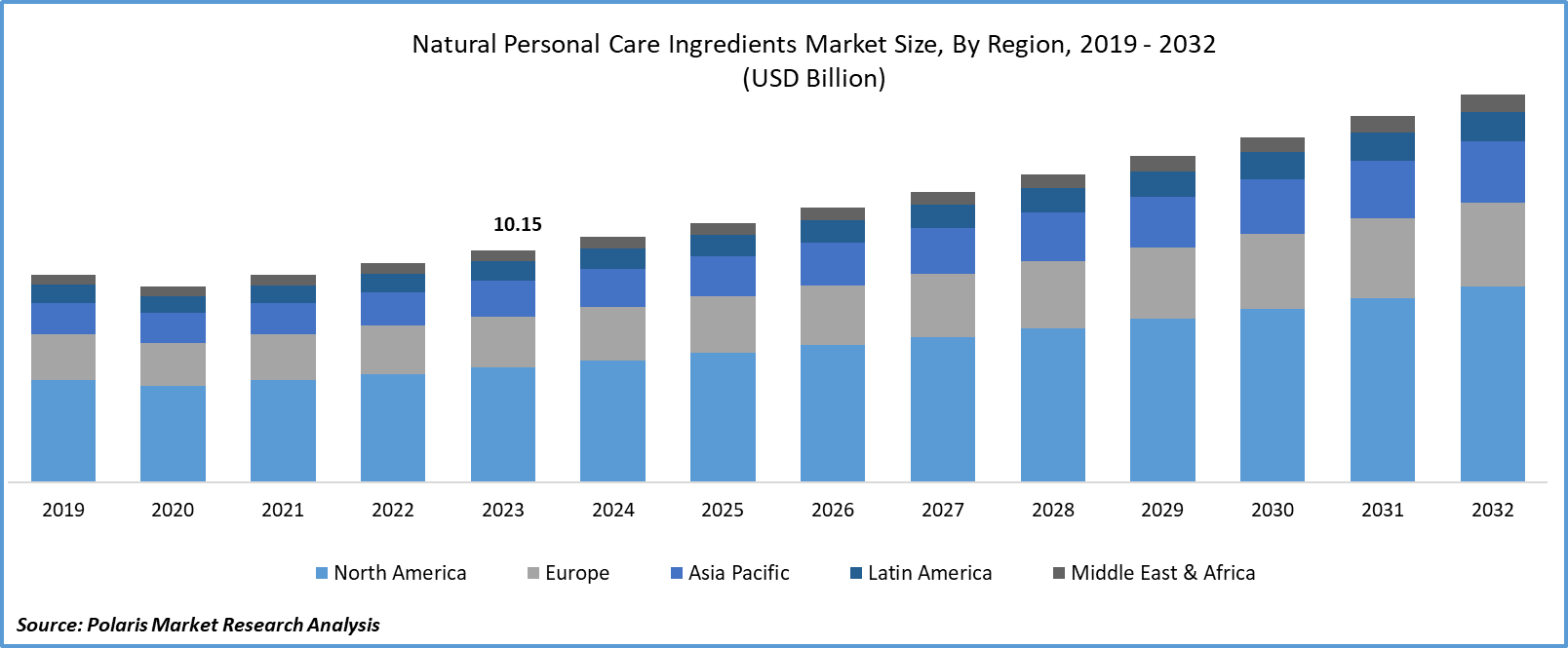

Global natural personal care ingredients market size was valued at USD 10.15 billion in 2023. The market is anticipated to grow from USD 10.73 billion in 2024 to USD 16.96 billion by 2032, exhibiting a CAGR of 5.9% during the forecast period

Industry Trend

The surge in eco-consciousness among individuals and organizations is driving the popularity of natural products. Ranging from body lotions to sun care items, these products are crafted from plant-based ingredients sourced under environmentally friendly conditions. Free from synthetic additives like parabens, phthalates, petrochemicals, and aluminum salts, they resonate with consumers aiming for personal wellness and ecological sustainability.

This shift towards organic alternatives reflects a broader societal move to minimize exposure to harmful chemicals and embrace sustainable practices. Major corporations are aligning with this ethos, prioritizing the development of eco-friendly offerings. Consequently, sales of organic goods are witnessing a notable uptick, buoyed by heightened consumer awareness of their benefits for health and the environment.

To Understand More About this Research: Request a Free Sample Report

The evolving perception of organic products, coupled with a growing demand for sustainability, is fueling their popularity. Suppliers and manufacturers are investing more in research and development within the organic realm, fostering growth in green chemistry and the broader green sector. According to a study by EcoFocus, an overwhelming 85% of consumers prioritize environmental considerations in their purchasing decisions. Furthermore, a significant portion favors green personal care and toiletry items over synthetic counterparts. Another survey by NSF International underscores this sentiment, revealing a preference for independently certified and tested organic products among the majority of consumers.

The landscape for new product launches in the natural personal care ingredients market is dynamic and ever-evolving. With increasing consumer demand for clean, sustainable, and eco-friendly products, there's a growing focus on natural ingredients derived from plants and other renewable sources. Key players in the market are constantly innovating to introduce new formulations and ingredients that meet these demands while maintaining efficacy and safety standards. This trend is driven by heightened awareness of the potential health and environmental benefits of using natural personal care products, prompting companies to invest in research and development to stay ahead in this competitive landscape.

- For instance, in March 2024, BASF Aroma Ingredients will expand its Isobionics portfolio with new natural flavors. Isobionics Natural beta-Caryophyllene 80 marks the newest entry in the portfolio, showcasing the brand's dedication to crafting natural flavors tailored to customer demands. This innovative offering will debut at the FlavourTalk Raw Materials Exhibition 2024, highlighting its commitment to advancing the natural flavor landscape.

As awareness grows about potential allergens in synthetic ingredients, the appeal of organic or naturally derived alternatives continues to rise. Moreover, the production of such products contributes to pollution reduction by optimizing natural resource usage through improved agricultural practices and manufacturing methods. As a result, natural personal care ingredients market is expected to grow at the fastest CAGR during the forecast period.

Key Takeaway

- North America dominated the largest market and contributed to more than 38% of the share in 2023.

- Asia Pacific market is expected to be the fastest-growing CAGR during the forecast period.

- By ingredient type, natural preservatives segment accounted for the largest market share in 2023.

- By the application category, the skin care segment is projected to grow at fastest CAGR during the projected period.

What are the market drivers driving the demand for the natural personal care ingredients market?

A rising trend towards Health and Wellness is expected to spur product demand.

The trend of health and wellness consciousness has gained significant momentum in recent years, with consumers becoming increasingly mindful of the products they use on their bodies and the impact these products have on their health and the environment. This heightened awareness has led to a growing demand for personal care products that not only address cosmetic needs but also contribute to overall well-being. Natural personal care ingredients have emerged as a favored choice among health-conscious consumers due to several key factors. Firstly, natural ingredients are perceived as safer alternatives to synthetic chemicals commonly found in traditional personal care products. Many consumers are concerned about the potential adverse effects of these synthetic chemicals, such as skin irritation, allergic reactions, and even long-term health risks. Natural ingredients, on the other hand, are viewed as gentler and less likely to cause harm, making them an appealing option for those seeking products that prioritize personal health and safety.

Moreover, natural personal care ingredients are often perceived as more beneficial for the environment compared to their synthetic counterparts. Conventional personal care products often contain ingredients derived from petrochemicals, which are non-renewable resources and can have negative environmental impacts during production and disposal. In contrast, natural ingredients are typically derived from renewable sources such as plants and minerals, making them more sustainable and eco-friendly. Additionally, natural ingredients are biodegradable, meaning they break down more easily in the environment, reducing pollution and minimizing ecological harm. The alignment of natural personal care ingredients with consumers' desire for cleaner lifestyles further drives their popularity. As individuals become increasingly conscious of their environmental footprint and seek to minimize their impact on the planet, they are drawn to products that are ethically sourced, sustainably produced, and free from harmful chemicals. Natural personal care products embody these values, offering consumers a way to support their health and well-being while also making environmentally responsible choices.

Which factor is restraining the demand for natural personal care ingredients?

Higher costs compared to synthetic alternatives are likely to impede the market growth.

While natural ingredients are often perceived as safer and more environmentally friendly, their production can be more labor-intensive and resource-intensive, due to higher manufacturing costs. As a result, natural personal care products tend to be priced at a premium compared to conventional products containing synthetic ingredients. This higher price point can act as a barrier for some consumers, particularly those with budget constraints or those who prioritize affordability over other factors. While there is a growing segment of consumers willing to pay a premium for natural and organic products, a significant portion of the market may be reluctant to invest in these products if they perceive them as too expensive.

Furthermore, limited availability and accessibility of natural personal care products in certain regions or retail channels can also restrain demand. While demand for natural products is growing globally, there may still be areas where these products are not widely available or where consumers have limited access to them.

Report Segmentation

The market is primarily segmented based on ingredient type, application, and region.

|

By Ingredient Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Ingredient Type Insights

Based on ingredient type analysis, the market is segmented into biosurfactants, emollients, natural preservatives, sugar polymers, and others. The natural Preservatives segment held the largest market share in 2023. A significant shift in consumer preferences towards natural and organic personal care products is driven by increasing awareness of the potential health risks associated with synthetic preservatives such as parabens and formaldehyde-releasing agents. As consumers seek safer and more sustainable alternatives, demand for natural preservatives has surged.

However, regulatory restrictions and consumer demand for transparency have prompted manufacturers to reformulate their products to eliminate or reduce the use of synthetic preservatives. This has created a growing need for natural alternatives that can effectively extend the shelf life of personal care products while meeting regulatory requirements and consumer expectations for safety and efficacy. Natural preservatives derived from botanical extracts, essential oils, and other plant-based sources are increasingly favored by consumers and manufacturers alike due to their perceived safety, efficacy, and compatibility with natural and organic formulations.

By Application Insights

Based on application analysis, the market has been segmented based on hair care, make-up, oral care, skin care, and others. The skin care segment is expected to witness the fastest-growing CAGR during the forecast period. Rising awareness among consumers regarding the importance of skincare and the potential health benefits of using natural and organic ingredients. Consumers are becoming increasingly conscious of the ingredients they apply to their skin, driven by concerns about the potential adverse effects of synthetic chemicals found in conventional skincare products. As a result, there is a growing demand for natural skincare products formulated with natural ingredients, such as botanical extracts, essential oils, and herbal infusions.

The skincare market is experiencing a shift towards clean beauty and green skincare, with consumers prioritizing products that are free from potentially harmful additives and produced in an environmentally responsible manner. Natural personal care ingredients align with these preferences, offering safer and more sustainable alternatives to synthetic chemicals commonly found in skincare formulations. This trend is driving manufacturers to reformulate their skincare products to incorporate natural ingredients and meet the growing consumer demand for clean, green, and sustainable skincare solutions. As a result, consumers have a wider selection of natural skincare products to choose from, further driving growth in this segment.

Regional Insights

North America

North America region accounted for the largest market share in 2023. North America has a well-established and mature personal care products market, with a strong consumer base that is increasingly shifting towards natural and organic alternatives. Consumers in North America are becoming more health-conscious and environmentally aware, due to a growing demand for natural personal care ingredients that are perceived as safer, healthier, and more environmentally friendly compared to synthetic counterparts. The regulatory environment in North America is conducive to the growth of the natural personal care ingredients market. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and Health Canada have implemented stricter guidelines and regulations governing the safety and labeling of personal care products, prompting manufacturers to reformulate their products with natural ingredients to comply with these regulations and meet consumer expectations for transparency and safety. The companies are responding to the growing consumer demand for natural and organic products by introducing new formulations and ingredients that cater to diverse skincare needs and preferences.

Asia Pacific

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. Rapid urbanization and westernization trends in many Asia Pacific countries are influencing consumer lifestyles and purchasing behaviors. As urban populations grow and lifestyles become more cosmopolitan, there's a greater demand for premium personal care products, including natural and organic options, to cater to the preferences of increasingly discerning consumers. This growth presents significant opportunities for manufacturers and suppliers of natural personal care ingredients to capitalize on the expanding market and meet the growing demand for natural and organic products.

Competitive Landscape

Intense competition, innovation, sustainability initiatives, regulatory compliance, and strategic partnerships characterize the natural personal care ingredients market. These factors shape the competitive landscape and drive companies to continuously evolve and differentiate their offerings to meet the demands of consumers seeking natural and sustainable personal care products. Many companies in the natural personal care ingredients market operate on a global scale, serving customers in various regions around the world. A global presence allows companies to access diverse markets, respond to changing consumer preferences, and capitalize on emerging trends.

Some of the major players operating in the global market include:

- Ashland Inc

- BASF SE

- Cargill, Incorporated

- Ciranda, Inc

- Croda International Plc

- Earth Supplied Products, LLC

- Evonik Industries AG

- Provital Group

- The Hain Celestial Group

- The Lubrizol Corporation

Recent Developments

- In March 2023, BASF Personal Care introduced Kerasylium, a pioneering plant-based substitute for animal keratin, at the in-cosmetics Global event. Kerasylium is a cutting-edge hair care ingredient meticulously crafted to restore damaged hair and provide protection against daily environmental stressors.

- In March 2023, Symrise unveiled a strategic investment in Synergio, a biotech firm specializing in crafting natural and sustainable solutions through cutting-edge plant-based technology for consumer goods. This move underscores Symrise's commitment to bolstering its leadership role in product protection within the personal care sector.

Report Coverage

The natural personal care ingredients market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis about various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, ingredient type, application, and futuristic growth opportunities.

Natural Personal Care Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.73 Billion |

|

Revenue forecast in 2032 |

USD 16.96 billion |

|

CAGR |

5.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Ingredient Type, By Application, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global natural personal care ingredients market size is expected to reach USD 16.96 billion by 2032

Key players in the market are Ashland, BASF SE, Cargill, Ciranda, Inc, Croda International Plc

North America contribute notably towards the global Natural Personal Care Ingredients Market

Natural personal care ingredients market exhibiting a CAGR of 5.9% during the forecast period

The Natural Personal Care Ingredients Market report covering key segments are ingredient type, application, and region.