Temperature Sensors Market Share, Size, Trends, Industry Analysis Report,

By Output (Analog, Digital); By Product Type; By Connectivity; By End-User; By Region; Segment Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4277

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

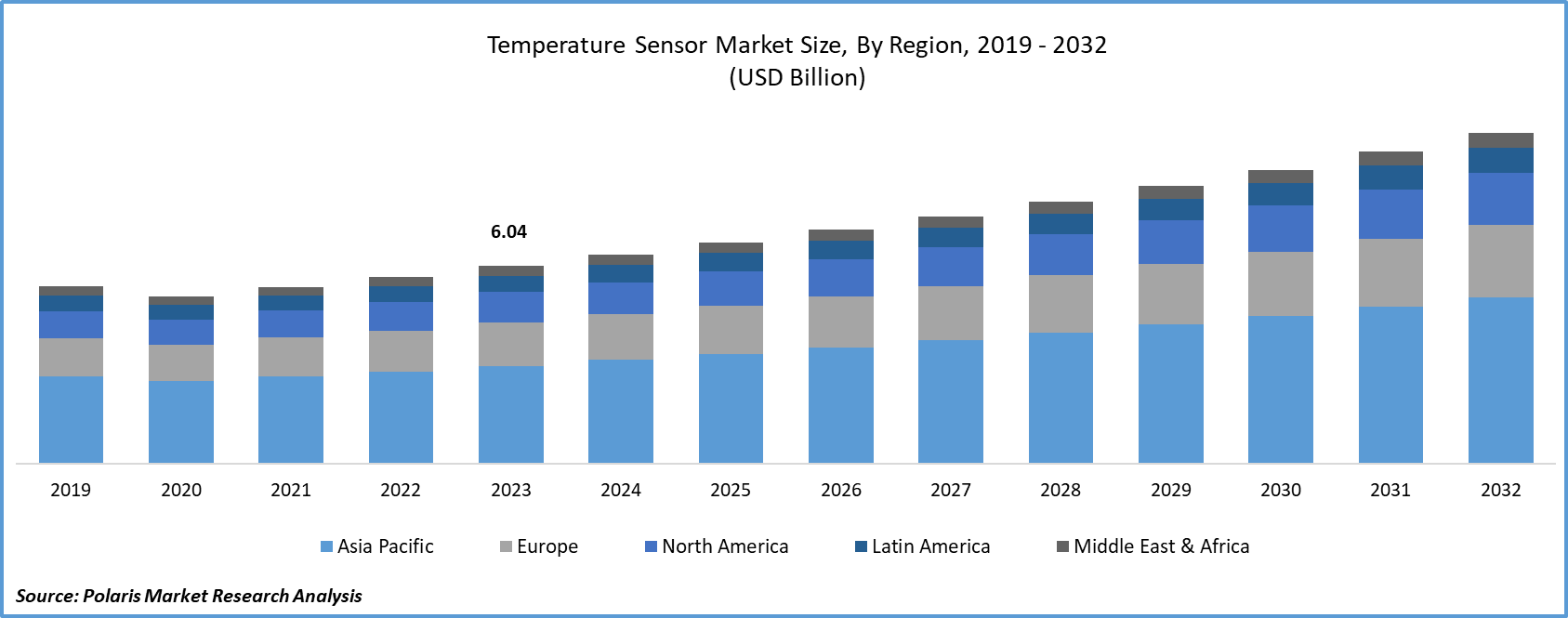

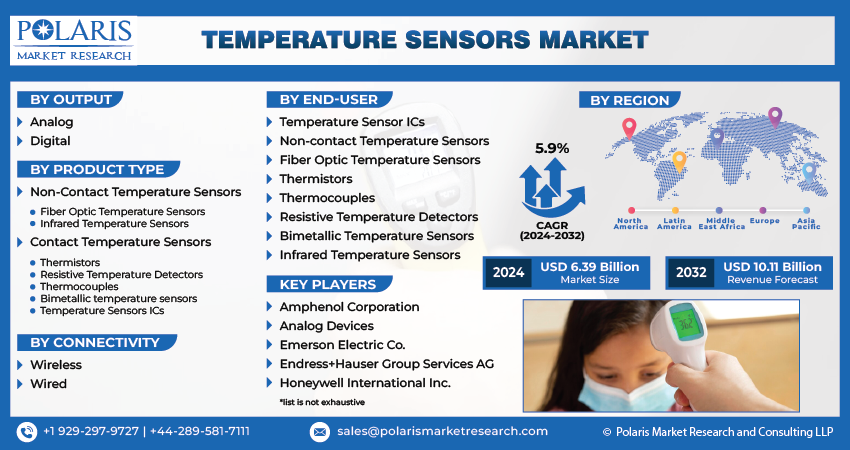

Temperature Sensors Market size was valued at USD 6.04 billion in 2023. The market is anticipated to grow from USD 6.39 billion in 2024 to USD 10.11 billion by 2032, exhibiting a CAGR of 5.9% during the forecast period

Temperature Sensor Market Overview

The proliferation of temperature sensors utilizing IoT connectivity is anticipated to accelerate, driven by the increasing demand for COVID-19 testing and screening. Semtech and Polysense Technologies have partnered to create temperature monitoring devices designed for human body use, utilizing Semtech's LoRa LPWAN. These temperature sensors provide real-time data to frontline healthcare workers, facilitating quicker screening of individuals with elevated temperatures.

Major drivers of the temperature sensor market include the rising adoption of HVAC modules in the automotive industry and various industrial end-user applications. The growing demand for consumer electronics is also expected to contribute to market expansion. Additionally, increased global attention to security and surveillance, along with government initiatives promoting safety norms, is likely to foster the adoption of temperature sensors.

The widespread use of wireless temperature sensors in diverse industries is primarily attributed to their non-contact measurement features, allowing them to reach locations where physical deployment is challenging. In the oil and gas industry, temperature sensors find critical applications in various areas, including flare systems, wellhead tanks, chemical tanks, pipeline data collection, and compressors. Given the industry's nature, the use of temperature sensors is crucial for monitoring temperature changes and ensuring safe working conditions, especially in instances where installing wired devices inside pipes or tanks is inefficient due to high operating temperatures.

To Understand More About this Research: Request a Free Sample Report

Moreover, trends in the personal computing industry, such as faster processors, smaller system sizes, and the need to support more advanced applications, underscore the importance of monitoring and controlling heat. This trend, coupled with robust sales and advancements in desktop and portable computers, is expected to sustain the growth of temperature sensors.

The Temperature Sensors Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

The rising utilization within the automotive sector to uphold vehicle safety, enhance engine performance, and mitigate emissions is propelling market expansion. Leading industry players are employing diverse organic and inorganic strategies to innovate advanced products and solutions, specifically tailored for the automotive industry. These sensors assume a vital role in overseeing the hot exhaust gas flow and protecting temperature-sensitive components, like turbochargers, from overheating. Furthermore, government regulations enforcing safety and emission control standards for vehicles have prompted automotive companies to incorporate these sensors into their vehicles, leading to an increased demand in the automotive sector.

Temperature Sensor Market Dynamics

Market Drivers

- Increasing adoption of portable healthcare devices is projected to spur the product demand.

Temperature sensors play a crucial role in healthcare applications, including body temperature monitoring and medical equipment, contributing to the demand for these sensors. The rising elderly population and the increase in diseases will drive the demand for advanced portable healthcare devices. These devices, known for their precision in temperature measurement and monitoring, are incorporating thermal sensors. Medical devices equipped with built-in sensors are employed for monitoring body temperature in RF hyperthermia treatments and measuring patient surface temperature during fMRI, MRI, or other specialized electro-surgical procedures.

The growing utilization of these sensors in patient monitoring systems, digital temperature measurement systems, and life-support machines is contributing to the increased demand for such sensors in the healthcare sector. Furthermore, rapid technological advancements in healthcare and the desire for equipment miniaturization will enhance the revenue of the temperature sensor market.

Market Restraints

- The shrinking PC market are likely to impede the market growth.

Within personal computers, these sensors play a role in controlling and overseeing the CPU temperature, with laptops and desktops typically incorporating 3 to 5 temperature sensor ICs. Nevertheless, the sales of personal computers have experienced a decline in recent years, attributed to the growing preference for portable devices like tablets and smartphones. The necessity for these sensors in such portable devices varies. As a result, the increasing adoption of tablets and smartphones has had a negative impact on the distribution of these sensors.

Report Segmentation

The market is primarily segmented based on output, product type, connectivity, end-user, and region.

|

By Output |

By Product Type |

By Connectivity |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Temperature Sensor Market Segmental Analysis

By End-Users Analysis

- The Temperature Sensor ICs segment held the largest revenue share in 2023. The prevalence of this category is linked to the rising usage of temperature sensor ICs across diverse applications such as industrial, automotive, and consumer electronics. The escalating need for compact and cost-effective temperature sensing solutions is propelling the expansion of this segment. Infrared Temperature Sensors are anticipated to exhibit consistent growth, given their high accuracy, non-contact operation, and the growing demand for temperature sensing solutions in a variety of industrial and consumer applications.

- Thermocouples and Bimetallic Temperature Sensors are projected to exhibit consistent growth owing to their robustness, dependability, and extensive temperature measurement capabilities.

By Product Type Analysis

- The Non-Contact Temperature Sensors segment accounted for the highest market share during the forecast period. These sensors gauge the surface temperature of an object or body without establishing any physical contact between the sensor and the measured object. Primarily employed for small, mobile, and hard-to-reach objects or sources, non-contact temperature sensors encompass infrared and fiber optic temperature sensors. Notable companies providing non-contact temperature sensors include, TE Connectivity (Switzerland), OMEGA Engineering (US), Keyence Corporation (Japan), and Melexis (Belgium).

Temperature Sensor Market Regional Insights

- The Asia Pacific region dominated the global market with the largest market share in 2023

Asia Pacific has taken the lead in the adoption of temperature sensor products and solutions, driven by a consistent demand for cost-effective and highly efficient temperature sensors across various industries such as chemicals, consumer electronics, metals, oil and gas, automotive, energy and power, healthcare, and mining. The region's automotive sector, contributing to over 50% of the world's passenger car production, and the flourishing electrical and electronics industry further support the growth of the temperature sensor market.

China, as the largest consumer of electricity in the Asia Pacific, primarily due to rapid industrialization and a large population, is a significant contributor to the region's growth. The increasing demand from the energy and power sector, along with substantial investments in renewable energy resources, is expected to drive the demand for temperature sensors in China. The utilization of temperature sensors in transformer monitoring systems is also on the rise in the country, further fueling the demand for temperature sensors in the upcoming years.

North America will have fastest growing market share, driven by substantial investments from well-established manufacturers in the region dedicated to advancing and enhancing existing temperature sensor technologies. According to the American Automotive Policy Council, the automotive sector, comprising automakers and their suppliers, stands as America's largest manufacturing sector, contributing 3% to the nation's GDP. Notably, major players like FCA US, Ford, and General Motors have collectively announced investments close to USD 35 billion over the past five years, covering U.S. assembly, engine and transmission plants, R & D labs, headquarters, administrative offices, and associated infrastructure.

Companies in the region, such as Emerson Electric Co., provide thermocouple temperature sensors known for their resilience and durability in challenging process environments. Additionally, entities like Vernier Software and Technology offer thermocouple temperature sensors capable of measuring temperatures ranging from -200°C to 1400°C, including the measurement of flame temperatures reaching up to 1400°C or liquid nitrogen temperatures as low as -196°C.

Competitive Landscape

The Temperature Sensors market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Amphenol Corporation

- Analog Devices

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- Honeywell International Inc.

- Microchip Technology Inc.

- Siemens

- TE Connectivity

- Texas Instruments Incorporated

- WIKA Alexander Wiegand SE & Co. KG

Recent Developments

- In October 2023, Endress+Hauser Group Services AG and SICK are pursuing a strategic partnership focused on SICK's process automation business segment, as indicated by the signing of a joint memorandum of understanding.

- In April 2023, TE Connectivity collaborated with Preddio Technologies to deploy remote monitoring solutions for condition-based maintenance and operational productivity advantages.

- In July 2022, Siemens introduced enhanced CO2 control and monitoring features to the RDG200 thermostat. A specific model within the RDG200 thermostat series is equipped with integrated control features and a built-in CO2 sensor.

Report Coverage

The Temperature Sensor market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, output, product type, connectivity, end-user, and their futuristic growth opportunities.

Temperature Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.39 billion |

|

Revenue forecast in 2032 |

USD 10.11 billion |

|

CAGR |

5.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Output, By Product Type, By Connectivity, By End-user, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

The Temperature Sensors Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Browse Our Top Selling Reports

Optical Imaging Systems Market Size, Share 2024 Research Report

Pharmaceutical Grade Lactose Market Size, Share 2024 Research Report

Garbage Truck Bodies Market Size, Share 2024 Research Report

FAQ's

The global Temperature Sensor market size is expected to reach USD 10.11 billion by 2032

Key players in the market are Amphenol Corporation, Analog Devices, Emerson Electric Co., Endress+Hauser Group Services AG

Asia Pacific contribute notably towards the global Temperature Sensor Market

Temperature Sensors Market exhibiting the CAGR of 5.9% during the forecast period

The Temperature Sensor Market report covering key segments are output, product type, connectivity, end-user, and region.